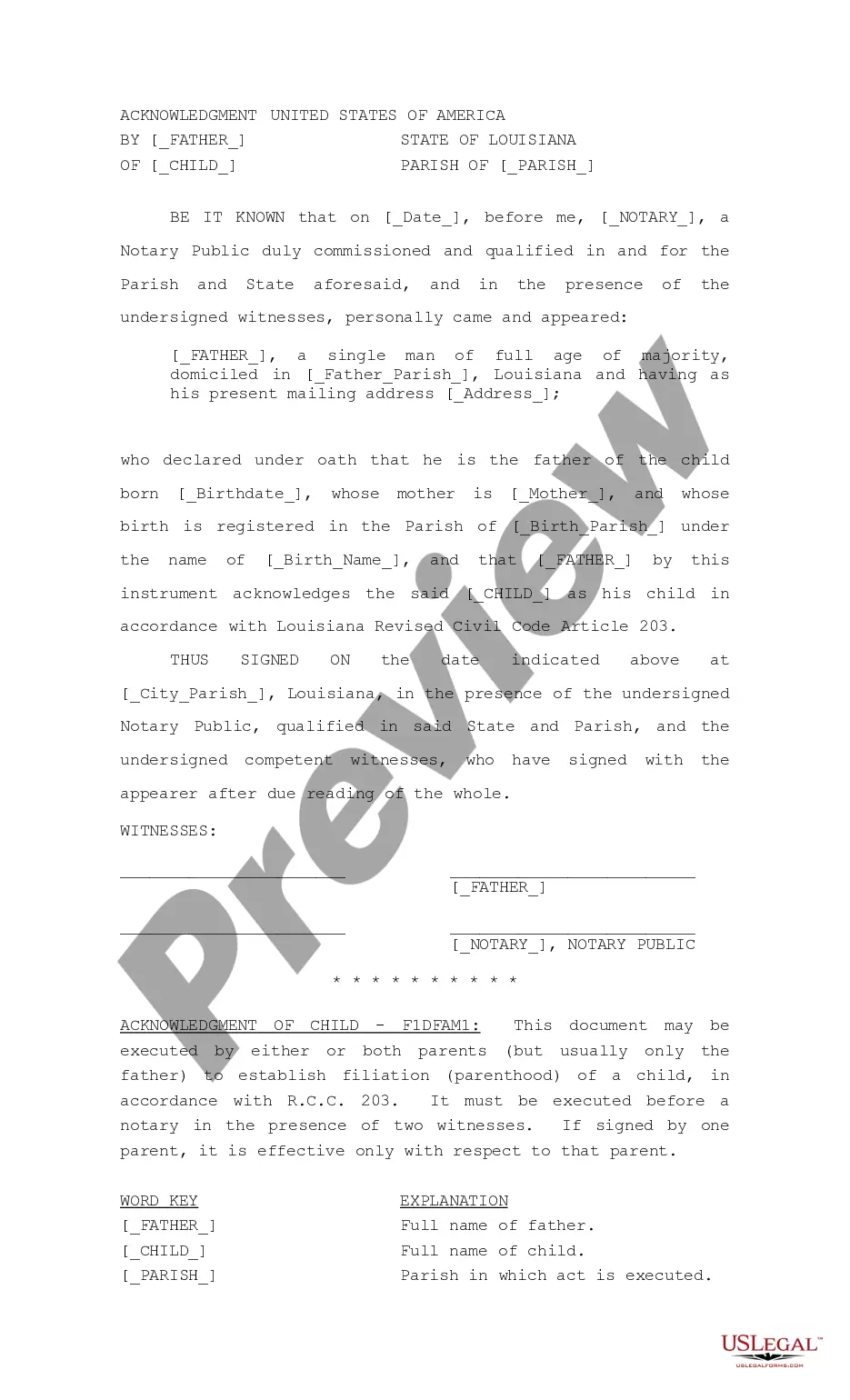

This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

San Antonio Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children

Description

How to fill out Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children?

If you are in search of a legitimate form template, it’s hard to discover a more suitable location than the US Legal Forms site – one of the most extensive collections on the internet.

With this collection, you can locate a vast array of templates for commercial and personal needs by categories and regions, or keywords.

Using our premium search feature, obtaining the latest San Antonio Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children is as simple as 1-2-3.

Verify your choice. Click on the Buy now button. Afterwards, select your desired subscription plan and enter your information to register for an account.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

- Furthermore, the applicability of each document is validated by a team of expert attorneys that frequently assess the templates on our platform and refresh them in line with the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to acquire the San Antonio Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure you have selected the form you need.

- Review its details and utilize the Preview feature to investigate its content.

Form popularity

FAQ

Non-Probate Assets Property owned by ?joint tenants with rights of survivorship?; ?Pay on Death? (POD) or ?Transfer on Death? (TOD) accounts; Life insurance policies; Retirements accounts; Trust assets; and. Life estate or TOD real property.

How Long Can A Trust Last In Texas? Thankfully, that is all behind us. The new law sets the maximum trust period for 300 years. The 300- year period starts running on the effective date of the trust.

When a trust is set up correctly, there is no need to go through probate. Whoever you have named as the beneficiary of the trust will automatically become the owner of the assets. The court doesn't need to oversee transfer of ownership for the assets, which are placed into the trust.

When a person dies and leaves property that has not been transferred to another person by way of a Trust, joint ownership with a right of survivorship, or direct payments to Beneficiaries (such as from insurance policies or retirement accounts), property in Texas will be distributed through probate.

Texas appellate courts have held, ?in the context of a distribution of trust income under an irrevocable trust during the marriage, income distributions are community property only if the recipient has a present possessory right to part of the corpus, even if the recipient has chosen not to exercise that right?.?

Creating a living trust in Texas is a matter of personal choice, but many people find the benefits worthwhile. Your trust keeps your personal business out of the public eye. Wills must go through probate and become public record. A trust is not probated and does not become public record.

Living Trusts In Texas, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Your spouse retains their half of the community property, 1/3 of your separate personal property, a ? interest in your separate real property for their lifetime and the right to use the real property for their lifetime. Your children receive everything else, including your half interest in the community property.

Regardless of whether the assets in a trust are considered community property in a divorce, under the current state of the law in Texas, if a spouse receives income from an irrevocable trust, the income may be considered community property, even if the trust was created prior to the marriage.

Marital Property If you establish a trust during the marriage and place assets earned during the marriage in that trust, the courts will dissolve the trust and declare the assets community property to be divided in the divorce.