A Beaumont Texas Living Trust for Husband and Wife with One Child is a legal arrangement that enables a married couple to protect and manage their assets during their lifetime and after their passing. This type of living trust is specifically designed for couples who have one child and aims to provide security, avoid probate, and ensure efficient asset distribution. The two main types of Beaumont Texas Living Trust for Husband and Wife with One Child are Revocable Living Trusts and Irrevocable Living Trusts. 1. Revocable Living Trust: This type of trust allows the couple to maintain control over their assets and make changes or revoke the trust at any time. With a revocable living trust, the couple can transfer their assets into the trust, manage them during their lifetime, and designate their child as the beneficiary upon their passing. This trust is flexible and can be altered to accommodate any potential changes in circumstances. 2. Irrevocable Living Trust: In contrast to a revocable trust, an irrevocable living trust cannot be modified or revoked once it is established. This type of trust provides a greater level of asset protection by removing the assets from the couple's estate. By transferring their assets into an irrevocable living trust, the couple effectively relinquishes control over those assets. The trust is managed by a trustee, who distributes the assets according to the couple's wishes upon their passing. Regardless of the type of Living Trust chosen, there are several key benefits in having a Beaumont Texas Living Trust for Husband and Wife with One Child. Firstly, it enables the couple to avoid the probate process, which can be time-consuming, expensive, and public. By transferring assets into the trust, they can pass them directly to their child upon their passing, bypassing the need for court involvement and probate proceedings. Additionally, a living trust provides privacy since it does not become public record like a will does during the probate process. This aspect allows the couple to keep their financial affairs confidential and is particularly beneficial for those who value their privacy. Furthermore, by creating a living trust, the couple can ensure that their child's future is adequately protected. They can set specific instructions and conditions regarding the distribution of assets to their child. For instance, they may choose to delay the distribution until the child reaches a certain age, achieves specific milestones, or receives certain educational qualifications. In conclusion, a Beaumont Texas Living Trust for Husband and Wife with One Child is a valuable estate planning tool that offers asset protection, privacy, and control over asset distribution. Whether couples opt for a Revocable Living Trust or an Irrevocable Living Trust, this legal arrangement ensures that their child's future is safeguarded and simplifies the process of asset transfer after the couple's passing.

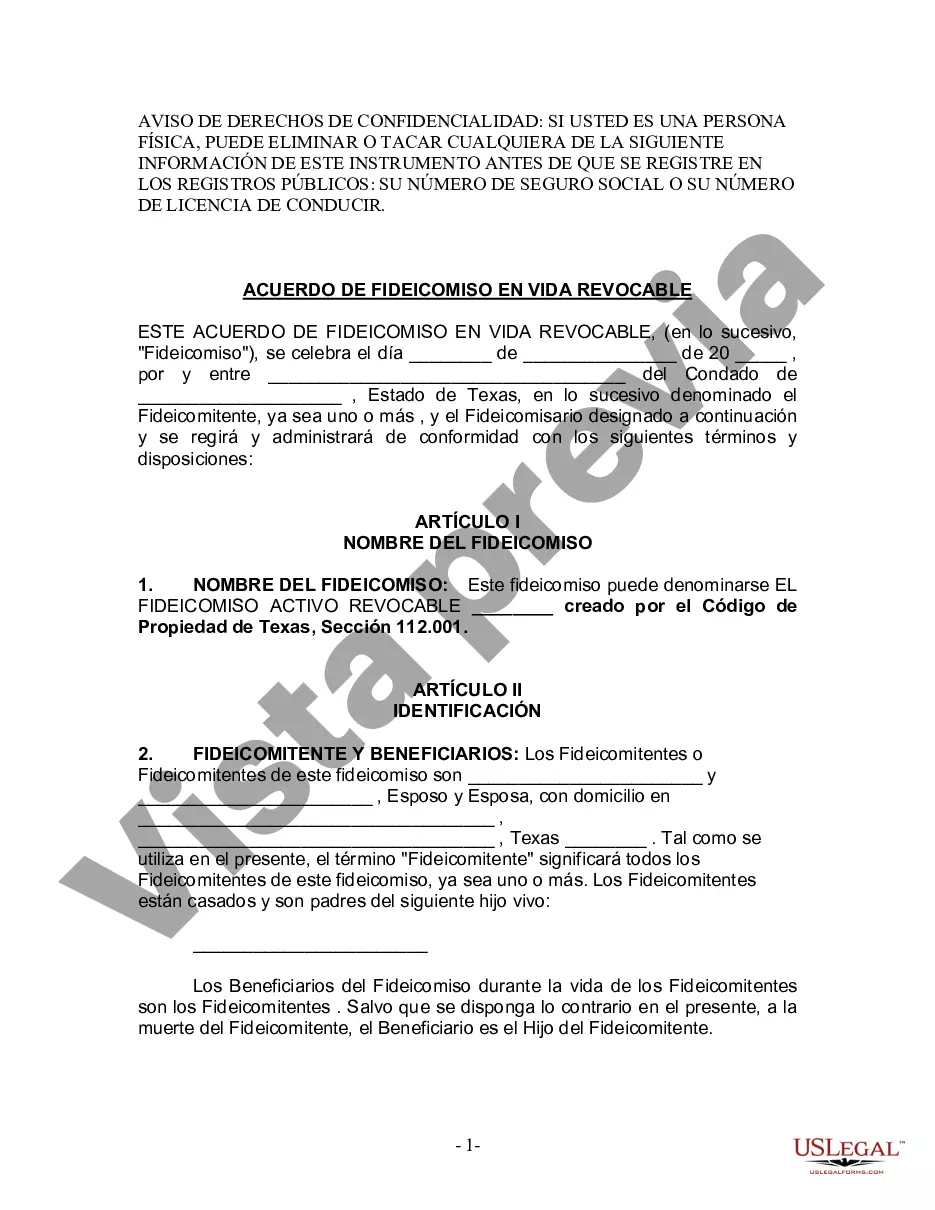

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Beaumont Texas Fideicomiso en vida para esposo y esposa con un hijo - Texas Living Trust for Husband and Wife with One Child

Description

How to fill out Beaumont Texas Fideicomiso En Vida Para Esposo Y Esposa Con Un Hijo?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Beaumont Texas Living Trust for Husband and Wife with One Child? US Legal Forms is your go-to solution.

Whether you require a simple arrangement to set rules for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of specific state and county.

To download the document, you need to log in account, locate the required form, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Beaumont Texas Living Trust for Husband and Wife with One Child conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to learn who and what the document is good for.

- Start the search over in case the form isn’t suitable for your legal situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Beaumont Texas Living Trust for Husband and Wife with One Child in any available file format. You can return to the website at any time and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending hours learning about legal papers online for good.