League City Texas Living Trust for Husband and Wife with One Child: A Comprehensive Guide A Living Trust is a legal document that allows individuals to plan and manage their assets during their lifetime and distribute them after their death. By creating a Living Trust, individuals can ensure their assets are protected, avoid the probate process, and provide for their loved ones according to their wishes. In League City, Texas, specific Living Trust options are available for husband and wife with one child, tailored to their unique needs. There are primarily two types of Living Trusts that suit the requirements of a husband and wife with one child in League City, Texas — Revocable and Irrevocable Living Trusts. Below, we will delve into each type and explain their respective benefits. 1. Revocable Living Trust: A Revocable Living Trust, also known as a Family Living Trust or a Revocable Inter Vivos Trust, is a flexible trust designed to address the needs of a husband and wife with one child in League City, Texas. Some key features and benefits include: a. Asset Protection: Assets placed into a Revocable Living Trust are shielded from probate, ensuring their quick and efficient transfer to beneficiaries. This protection is beneficial for the child's future inheritances. b. Flexibility: As the name suggests, this type of trust is "revocable," meaning that the creators (husband and wife) retain the ability to modify or terminate the trust at any time during their lives. This flexibility allows for adjustments to accommodate changing circumstances. c. Managing Assets: The trust creators serve as trustees and retain control over their assets during their lifetime. They can manage, buy, sell, or transfer assets without any restrictions. d. Incapacity Planning: A Revocable Living Trust includes provisions for potential incapacity, ensuring a seamless transition of managing the couple's assets if one or both parents become unable to do so. 2. Irrevocable Living Trust: While a Revocable Living Trust offers flexibility, an Irrevocable Living Trust, as the name suggests, cannot be altered or revoked once established. Here are some key aspects of this trust type: a. Estate Tax Planning: An Irrevocable Living Trust is particularly useful for individuals concerned about reducing estate taxes. By placing assets into this trust, they are effectively removed from the creator's taxable estate, potentially reducing tax liability for the surviving spouse and child. b. Creditor Protection: Assets transferred into an Irrevocable Living Trust are generally protected from creditors, safeguarding the child's eventual inheritance. c. Medicaid Planning: If long-term care costs are a concern, an Irrevocable Living Trust can be utilized to protect assets from being considered when evaluating Medicaid eligibility. Both types of Living Trusts can offer significant advantages for a husband and wife with one child in League City, Texas. It is recommended to consult with an experienced estate planning attorney to determine which trust type and its specific provisions best suit the family's needs and goals. Remember, important factors to consider when setting up a Living Trust include the nature and value of assets, desired level of control, tax implications, and the family's long-term objectives. With professional guidance, families can establish a League City Texas Living Trust that safeguards their wealth, protects their child's future, and ensures their wishes are carried out efficiently and effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.League City Texas Fideicomiso en vida para esposo y esposa con un hijo - Texas Living Trust for Husband and Wife with One Child

Description

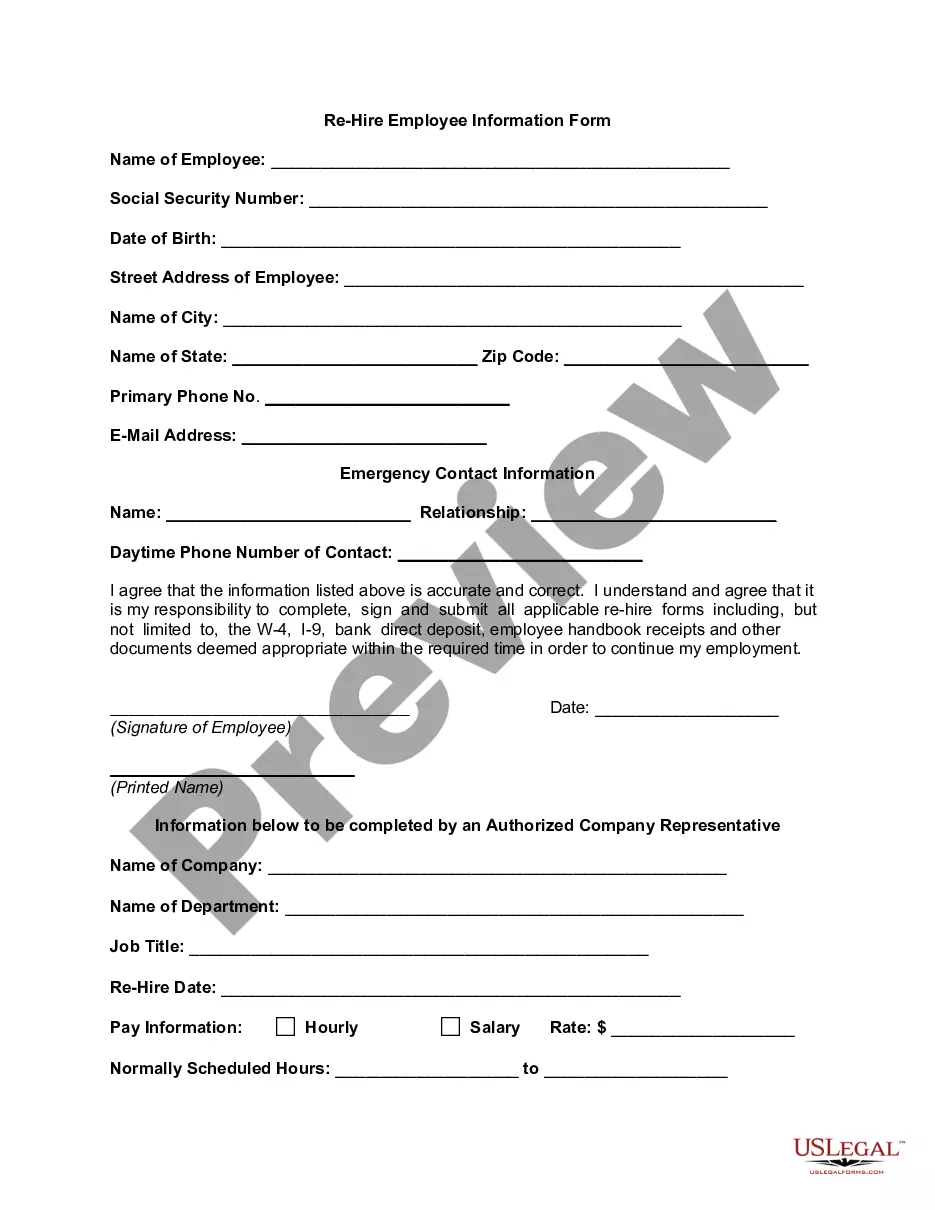

How to fill out League City Texas Fideicomiso En Vida Para Esposo Y Esposa Con Un Hijo?

Take advantage of the US Legal Forms and have immediate access to any form you want. Our beneficial platform with thousands of document templates makes it simple to find and obtain virtually any document sample you require. You can download, complete, and sign the League City Texas Living Trust for Husband and Wife with One Child in a few minutes instead of browsing the web for several hours looking for a proper template.

Using our collection is an excellent way to improve the safety of your form submissions. Our professional legal professionals on a regular basis check all the documents to make sure that the templates are relevant for a particular state and compliant with new laws and regulations.

How can you get the League City Texas Living Trust for Husband and Wife with One Child? If you already have a subscription, just log in to the account. The Download option will appear on all the documents you view. Moreover, you can find all the earlier saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the instruction listed below:

- Find the form you require. Make certain that it is the form you were hoping to find: examine its headline and description, and take take advantage of the Preview feature when it is available. Otherwise, use the Search field to look for the appropriate one.

- Start the downloading process. Click Buy Now and select the pricing plan you like. Then, create an account and pay for your order with a credit card or PayPal.

- Save the file. Select the format to get the League City Texas Living Trust for Husband and Wife with One Child and revise and complete, or sign it according to your requirements.

US Legal Forms is among the most extensive and trustworthy form libraries on the web. Our company is always happy to help you in virtually any legal procedure, even if it is just downloading the League City Texas Living Trust for Husband and Wife with One Child.

Feel free to take advantage of our form catalog and make your document experience as convenient as possible!