Are you looking for a way to protect your assets and ensure financial security for your family in Round Rock, Texas? A living trust might be the right solution for you. Specifically designed for husband and wife with one child, a Round Rock Texas Living Trust offers a comprehensive estate planning tool that will safeguard your loved ones' future. Let's dive into the details and explore the different types available. A living trust, also known as a revocable trust, is a legal document that allows you to transfer ownership of your assets into a trust while you are still alive. As the trust creators, or granters, you maintain full control over your assets and have the ability to make changes or terminate the trust at any time. This ensures flexibility and adaptability to your changing circumstances. By establishing a living trust in Round Rock, Texas, for a husband and wife with one child, you can provide numerous benefits to your family. One key advantage is the avoidance of probate, which is the legal process that validates a will and distributes assets after death. Probate can be a time-consuming and costly process, but a living trust bypasses it altogether, saving your family time and money. Furthermore, a living trust offers enhanced privacy since it is not a public document like a will. Unlike probate, the details of a living trust remain confidential, shielding your family's financial affairs from prying eyes. Additionally, a Round Rock Texas Living Trust provides for the seamless management of your assets in the event of incapacitation. If either spouse becomes unable to handle financial affairs due to illness or injury, the designated successor trustee can step in and manage the trust assets according to your specific instructions. This ensures that your family's financial needs are met without the need for court-appointed conservatorship. Now, let's discuss the different types of Round Rock Texas Living Trusts for husband and wife with one child: 1. Traditional Joint Living Trust: In this arrangement, both spouses are named as granters and trustees, allowing both to have full control and access to the trust assets. Upon the death of one spouse, the surviving spouse retains control and can amend or revoke the trust as needed. 2. AB Trust (Marital and Bypass Trust): An AB Trust, also known as a Marital and Bypass Trust or a Spousal and Family Trust, is designed to maximize estate tax savings. Upon the death of the first spouse, the trust divides into two separate trusts: the Marital Trust and the Bypass Trust. The Marital Trust provides income to the surviving spouse, while the Bypass Trust protects the assets from estate taxes and preserves them for the child. 3. Family Pot Trust: This type of living trust allows both spouses to contribute their individual assets into a single trust, creating a "pot" of combined assets. The trust provides for the surviving spouse's financial needs and distributes any remaining assets to the child upon the death of the second spouse. In conclusion, a Round Rock Texas Living Trust for husband and wife with one child offers a comprehensive and customizable estate planning solution. Whether you choose a traditional joint trust, an AB Trust, or a family pot trust, establishing a living trust ensures that your loved ones are protected, minimizes the complexities of probate, and provides financial security for your family's future. Contact an experienced estate planning attorney in Round Rock, Texas, to create a tailored living trust that suits your specific needs.

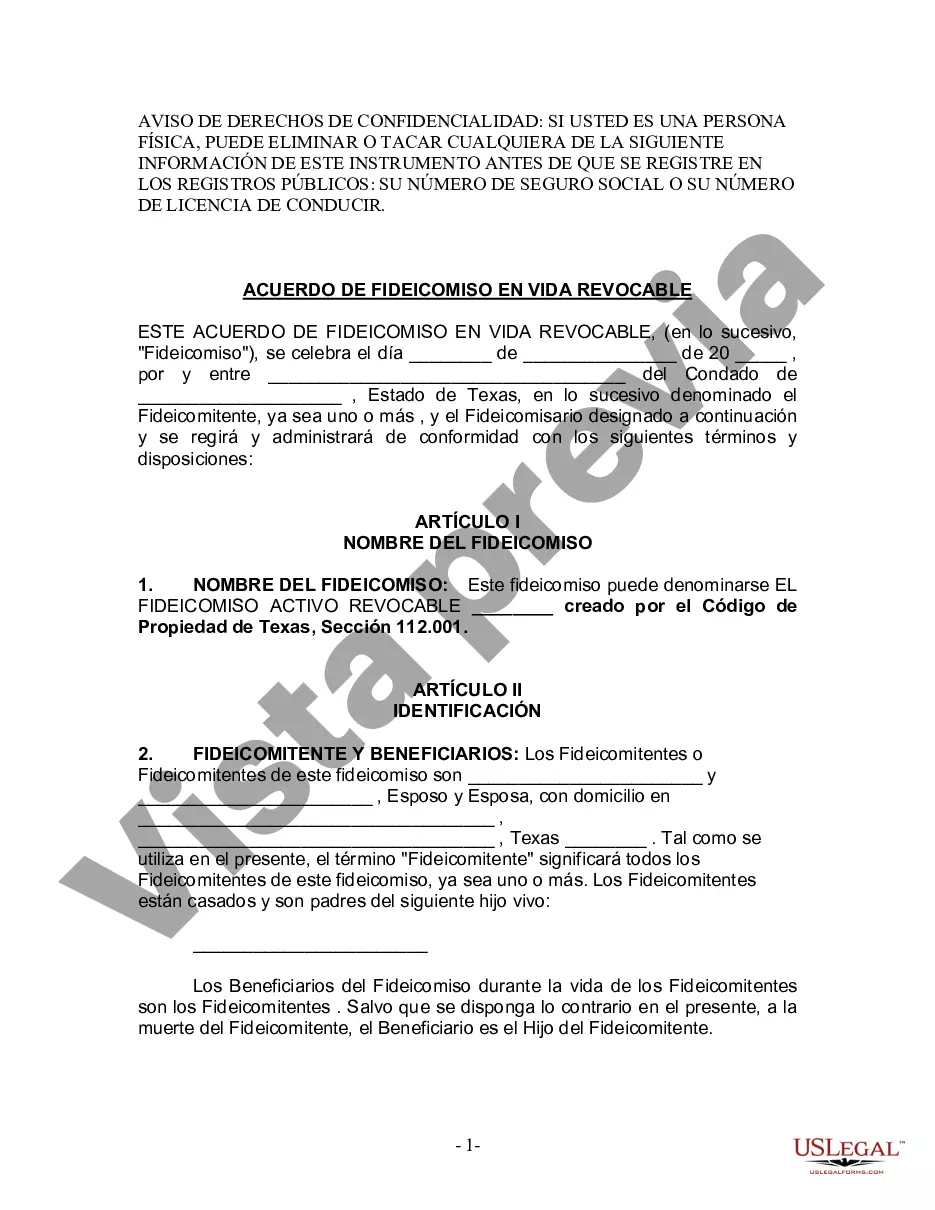

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Round Rock Texas Fideicomiso en vida para esposo y esposa con un hijo - Texas Living Trust for Husband and Wife with One Child

Description

How to fill out Round Rock Texas Fideicomiso En Vida Para Esposo Y Esposa Con Un Hijo?

If you are searching for a relevant form template, it’s difficult to find a better place than the US Legal Forms site – probably the most comprehensive libraries on the web. With this library, you can get a large number of document samples for business and individual purposes by types and states, or key phrases. With our advanced search function, getting the newest Round Rock Texas Living Trust for Husband and Wife with One Child is as elementary as 1-2-3. Additionally, the relevance of every record is verified by a group of professional lawyers that regularly review the templates on our platform and revise them according to the newest state and county demands.

If you already know about our system and have a registered account, all you need to receive the Round Rock Texas Living Trust for Husband and Wife with One Child is to log in to your profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have chosen the form you need. Look at its explanation and use the Preview feature (if available) to explore its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to discover the proper file.

- Confirm your choice. Click the Buy now option. Next, select your preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your bank card or PayPal account to finish the registration procedure.

- Receive the template. Choose the file format and save it to your system.

- Make adjustments. Fill out, revise, print, and sign the obtained Round Rock Texas Living Trust for Husband and Wife with One Child.

Every template you save in your profile has no expiry date and is yours forever. You can easily gain access to them using the My Forms menu, so if you want to get an additional version for modifying or printing, you can come back and download it once more whenever you want.

Make use of the US Legal Forms professional catalogue to get access to the Round Rock Texas Living Trust for Husband and Wife with One Child you were seeking and a large number of other professional and state-specific samples on a single website!