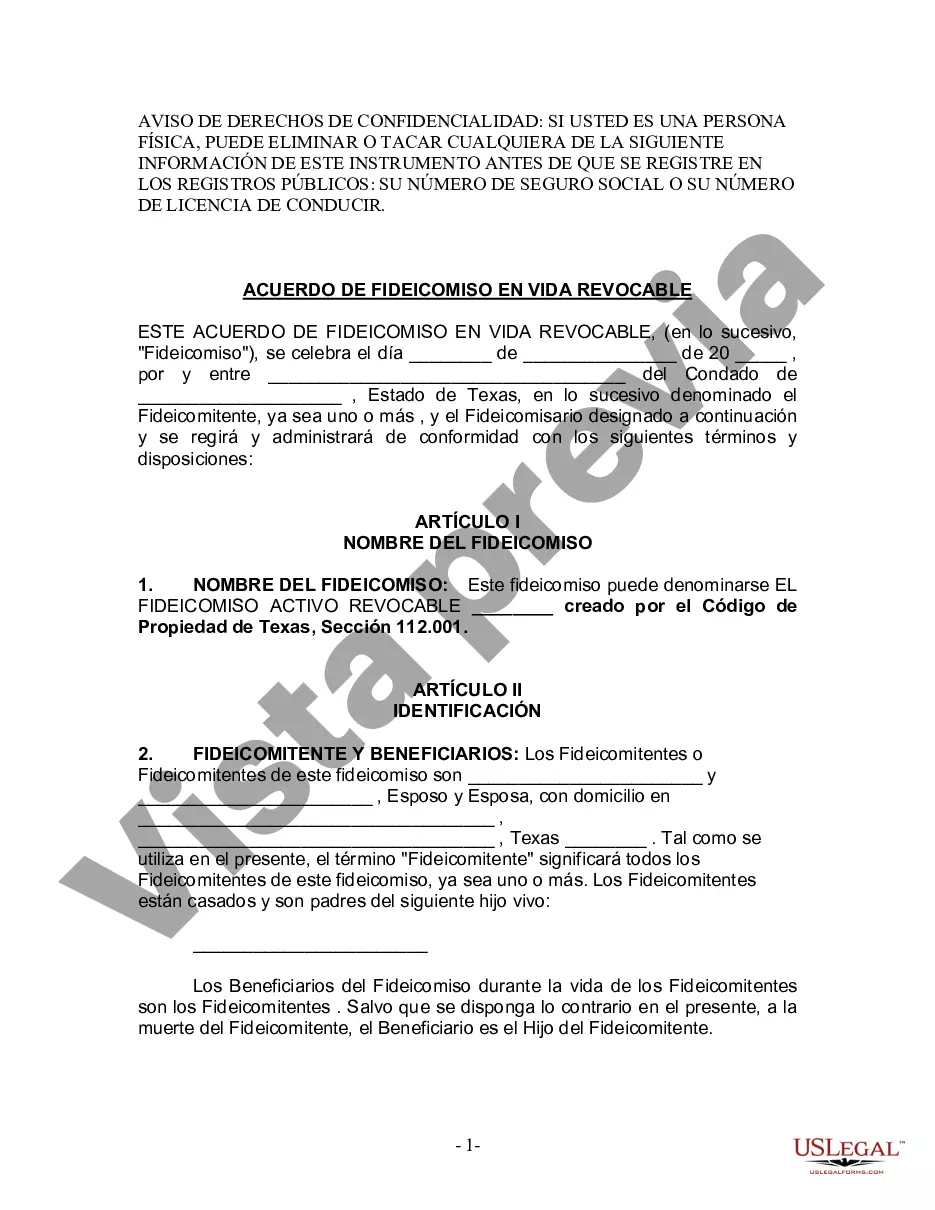

A San Angelo Texas Living Trust for Husband and Wife with One Child is a legal arrangement that allows married couples to protect and manage their assets while planning for the future. It is designed to ensure that their property and possessions are distributed according to their wishes after their passing, while minimizing the impact of estate taxes and avoiding probate. One popular type of living trust for couples with one child is the Revocable Living Trust. This trust allows couples to maintain control over their assets during their lifetime and make changes or amendments as needed. With a revocable living trust, the spouses can serve as the trustees and beneficiaries, retaining the ability to manage and use their property as they see fit. It provides flexibility and control over the trust's assets while avoiding probate and allowing for easy transfer of assets to the surviving spouse or child. Another type of living trust for couples with one child is the Irrevocable Living Trust. Unlike the revocable trust, an irrevocable living trust cannot be changed or revoked once it is created. However, it offers certain advantages such as asset protection and potential tax benefits. With an irrevocable trust, the couples transfer their assets into the trust, removing them from their estate for estate tax purposes. This type of trust is commonly used for individuals with substantial wealth or complex estate planning needs. A San Angelo Texas Living Trust for Husband and Wife with One Child allows couples to designate a successor trustee who will manage the trust assets in case the original trustees become incapacitated or pass away. It also sets forth instructions on how the assets should be distributed to the surviving spouse and the child upon the death of both parents. This ensures that the child is provided for and that the assets are protected and used according to the parents' wishes. Creating a living trust for husband and wife with one child in San Angelo, Texas requires careful consideration of the specific needs and goals of the family. Consulting an experienced estate planning attorney is recommended to ensure that all legal requirements are met and to customize the trust to fit the family's unique circumstances. By establishing a living trust, couples can have peace of mind knowing that their assets are protected and their child's future is secure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Angelo Texas Fideicomiso en vida para esposo y esposa con un hijo - Texas Living Trust for Husband and Wife with One Child

Description

How to fill out San Angelo Texas Fideicomiso En Vida Para Esposo Y Esposa Con Un Hijo?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone with no law education to draft such paperwork from scratch, mainly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms can save the day. Our platform offers a massive library with more than 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you require the San Angelo Texas Living Trust for Husband and Wife with One Child or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the San Angelo Texas Living Trust for Husband and Wife with One Child quickly using our trustworthy platform. If you are already a subscriber, you can proceed to log in to your account to download the needed form.

However, in case you are new to our platform, ensure that you follow these steps before obtaining the San Angelo Texas Living Trust for Husband and Wife with One Child:

- Ensure the template you have chosen is specific to your location considering that the rules of one state or area do not work for another state or area.

- Preview the form and go through a quick outline (if available) of scenarios the document can be used for.

- In case the one you selected doesn’t suit your needs, you can start over and search for the necessary form.

- Click Buy now and pick the subscription plan that suits you the best.

- with your credentials or create one from scratch.

- Pick the payment gateway and proceed to download the San Angelo Texas Living Trust for Husband and Wife with One Child once the payment is done.

You’re all set! Now you can proceed to print out the form or fill it out online. Should you have any issues locating your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.