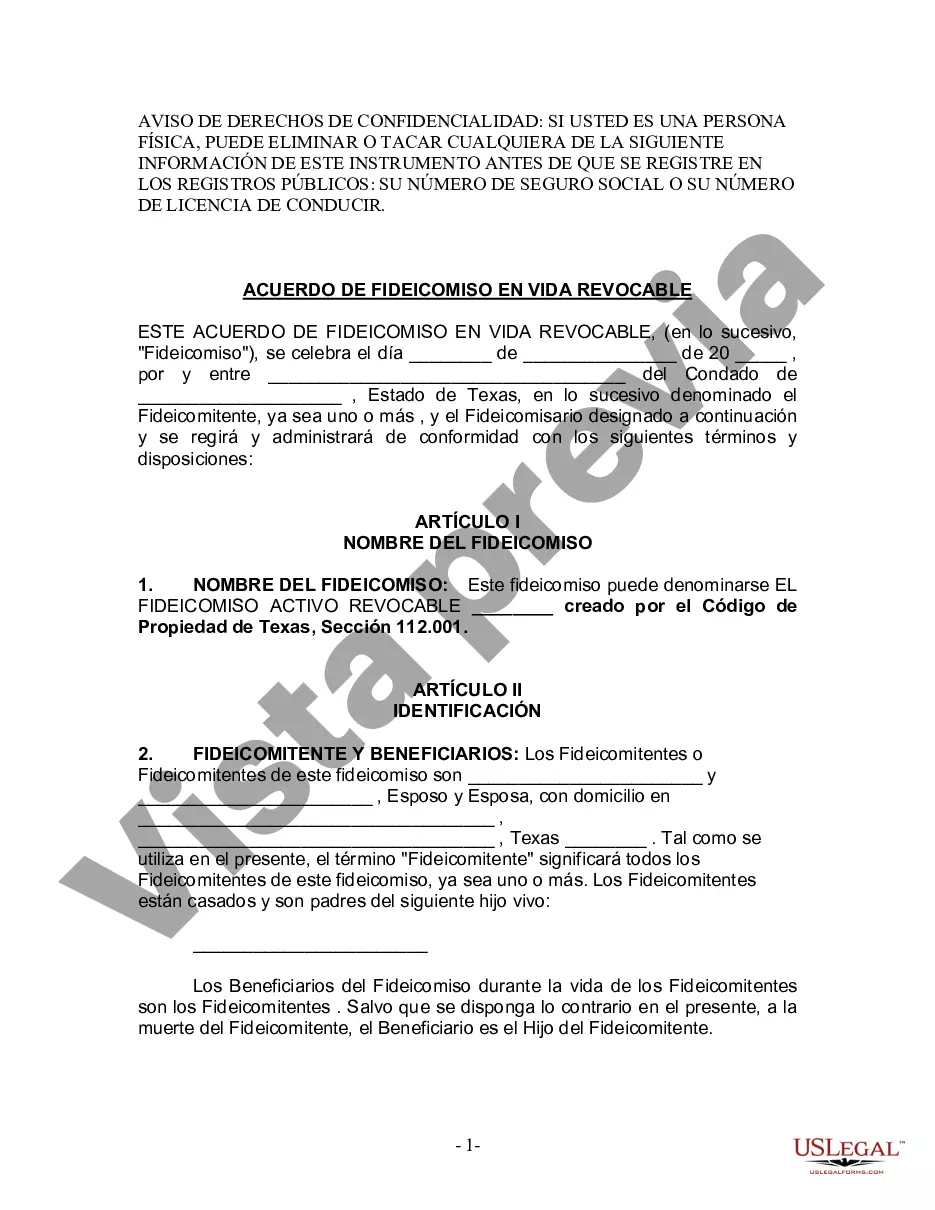

A Sugar Land Texas Living Trust for Husband and Wife with One Child is a legal arrangement designed to protect and manage the assets and property owned by a married couple in Sugar Land, Texas, for the benefit of their child. It offers numerous benefits such as asset protection, privacy, avoidance of probate, and potential tax advantages. One type of living trust for a married couple with one child is a Revocable Living Trust. This trust allows the couple to maintain control over their assets during their lifetime while naming their child as the beneficiary after their passing. The trust is revocable, meaning it can be modified or revoked at any time during their lifetime as circumstances change. Another type of living trust for a married couple with one child is an Irrevocable Living Trust. This trust, once established, cannot be modified or revoked without the consent of all parties involved. It provides enhanced asset protection and potential tax benefits but limits the couple's control over the assets. A Special Needs Trust is another type of living trust that may be beneficial for a married couple with one child who has special needs. It allows the parents to set aside funds for their child's care and support without jeopardizing their eligibility for government assistance programs. By establishing a living trust, the couple can ensure that their child's inheritance is managed responsibly and in accordance with their wishes. They can appoint a trustee, who can be a family member, friend, or a professional, to oversee the trust and distribute assets as stipulated in the trust document. This provides assurance that the child's financial future is safeguarded, even if both parents pass away. Furthermore, a Sugar Land Texas Living Trust for Husband and Wife with One Child provides privacy by avoiding the public probate process. Unlike a will, which becomes a public record upon death, a living trust allows the couple's assets to be transferred privately and efficiently to their child without court involvement. In conclusion, a Sugar Land Texas Living Trust for Husband and Wife with One Child is a comprehensive estate planning tool that offers asset protection, privacy, avoidance of probate, and potential tax advantages. Whether it is a Revocable Living Trust, Irrevocable Living Trust, or Special Needs Trust, these trusts provide married couples with peace of mind, knowing that their child's financial future is secure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sugar Land Texas Fideicomiso en vida para esposo y esposa con un hijo - Texas Living Trust for Husband and Wife with One Child

Description

How to fill out Sugar Land Texas Fideicomiso En Vida Para Esposo Y Esposa Con Un Hijo?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s almost impossible for someone without any legal background to create this sort of papers cfrom the ground up, mainly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes in handy. Our service offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also is a great asset for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you need the Sugar Land Texas Living Trust for Husband and Wife with One Child or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Sugar Land Texas Living Trust for Husband and Wife with One Child in minutes employing our trustworthy service. In case you are already a subscriber, you can go on and log in to your account to get the needed form.

However, if you are unfamiliar with our platform, ensure that you follow these steps prior to downloading the Sugar Land Texas Living Trust for Husband and Wife with One Child:

- Ensure the template you have found is suitable for your location because the regulations of one state or county do not work for another state or county.

- Preview the form and go through a brief outline (if available) of scenarios the document can be used for.

- If the one you selected doesn’t meet your requirements, you can start again and search for the necessary form.

- Click Buy now and pick the subscription plan that suits you the best.

- Access an account {using your credentials or create one from scratch.

- Select the payment gateway and proceed to download the Sugar Land Texas Living Trust for Husband and Wife with One Child as soon as the payment is through.

You’re good to go! Now you can go on and print out the form or fill it out online. In case you have any problems locating your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.