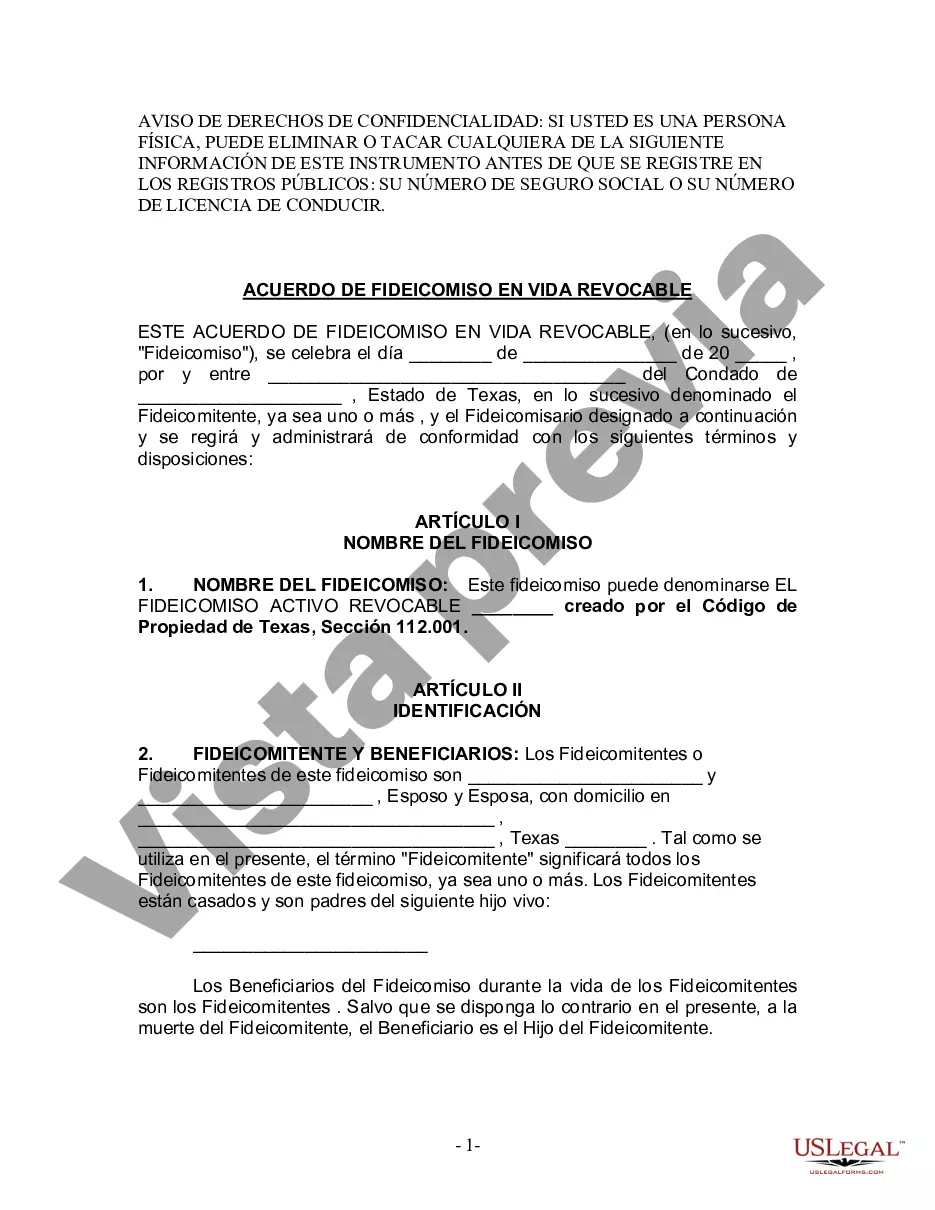

A Travis Texas Living Trust for Husband and Wife with One Child is a legal document that serves as an estate planning tool specifically designed for married couples with one child residing in Travis County, Texas. This trust allows the couple to protect their assets, plan for their child's future, and efficiently distribute their estate upon their passing. Here are some important aspects and variations of this type of living trust: 1. Definition: A Travis Texas Living Trust for Husband and Wife with One Child establishes a revocable trust where the couple serves as the granters, trustees, and primary beneficiaries during their lifetime, and their child becomes the beneficiary upon their demise. 2. Asset Protection: This living trust allows the couple to protect their assets from probate, which is the court-supervised process of distributing assets after death. By avoiding probate, the couple can minimize costs, maintain privacy, and ensure a smoother transfer of assets to their child. 3. Administration: The couple, as trustees, will be responsible for managing the trust and its assets during their lifetime. They can freely buy, sell, and transfer assets within the trust without external approval or court intervention, providing them with flexibility and control over their estate. 4. Avoidance of Potential Challenges: By establishing a living trust, the couple can prevent potential challenges and conflicts that may arise from the distribution of their estate. As the trust becomes irrevocable upon the death of both spouses, the child inherits the assets according to the predetermined instructions, minimizing the possibility of disputes. 5. Guardianship and Support: The trust allows the couple to designate a guardian to care for their child in the event of their simultaneous passing. They can also include instructions regarding financial support for the child from the trust's assets until a certain age or predetermined milestones, assuring the child's well-being. Variations of Travis Texas Living Trust for Husband and Wife with One Child: 1. Testamentary Trust: This type of trust is included as a provision within the couple's wills and only becomes effective after both spouses pass away. It can offer similar benefits as a living trust, such as avoiding probate, protecting assets, and ensuring proper distribution. 2. Special Needs Trust: If the child has special needs or disabilities, a special needs trust can be established to provide ongoing financial support without negatively impacting their eligibility for government assistance programs. 3. Charitable Remainder Trust: This type of trust offers the couple the opportunity to leave a portion of their assets to a charitable organization while still receiving income from those assets during their lifetime. Overall, a Travis Texas Living Trust for Husband and Wife with One Child provides numerous benefits, including asset protection, efficient estate distribution, avoidance of probate, and the ability to customize plans to suit the unique needs of the family. It is advisable to consult with an experienced attorney to ensure the trust is properly established and tailored to the specific requirements of the couple and their child.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Fideicomiso en vida para esposo y esposa con un hijo - Texas Living Trust for Husband and Wife with One Child

Description

How to fill out Travis Texas Fideicomiso En Vida Para Esposo Y Esposa Con Un Hijo?

No matter the social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person with no law background to create such papers cfrom the ground up, mostly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms can save the day. Our platform offers a huge library with more than 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you want the Travis Texas Living Trust for Husband and Wife with One Child or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Travis Texas Living Trust for Husband and Wife with One Child quickly employing our trustworthy platform. If you are presently a subscriber, you can proceed to log in to your account to get the needed form.

Nevertheless, in case you are unfamiliar with our library, ensure that you follow these steps prior to downloading the Travis Texas Living Trust for Husband and Wife with One Child:

- Ensure the template you have found is specific to your location because the regulations of one state or area do not work for another state or area.

- Review the document and read a short outline (if provided) of cases the document can be used for.

- If the one you chosen doesn’t suit your needs, you can start over and search for the suitable document.

- Click Buy now and choose the subscription plan that suits you the best.

- Access an account {using your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Travis Texas Living Trust for Husband and Wife with One Child once the payment is through.

You’re good to go! Now you can proceed to print the document or fill it out online. Should you have any problems locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.