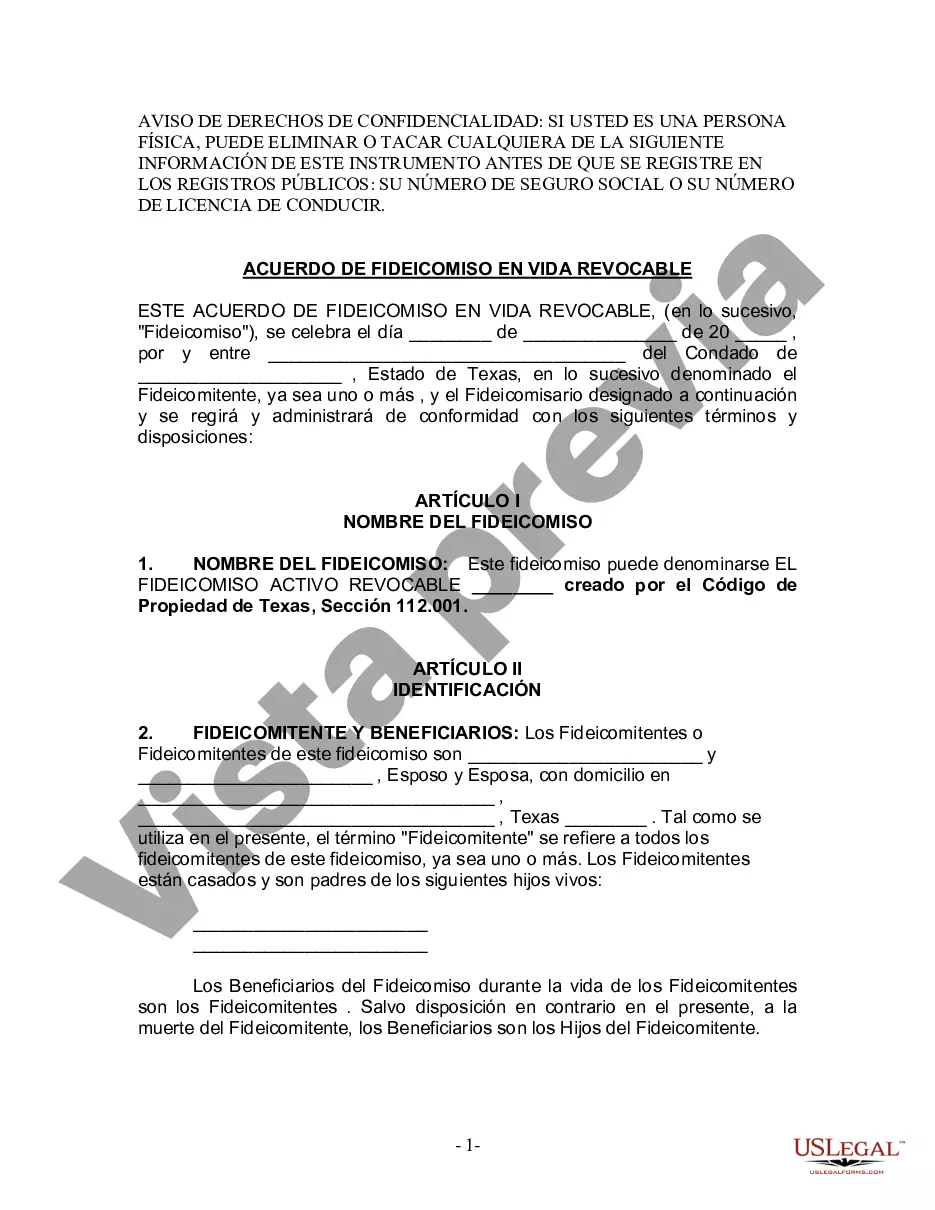

A Harris Texas Living Trust for Husband and Wife with Minor and/or Adult Children is a legal document that provides the framework for managing and distributing assets and property owned by a couple residing in Harris County, Texas. It is designed to ensure the smooth transfer of assets to beneficiaries while allowing the creators (husband and wife) to maintain control and flexibility over their estate during their lifetimes. Keywords: Harris Texas Living Trust, Husband and Wife, Minor and/or Adult Children, assets, property, beneficiaries, estate, control, flexibility. There are different types of Harris Texas Living Trusts for Husband and Wife with Minor and/or Adult Children including: 1. Revocable Living Trust: A revocable living trust is one that can be altered or revoked by the creators (husband and wife) during their lifetimes. It provides them with the flexibility to make changes to the trust's provisions, add or remove assets, and even terminate the trust if desired. This type of trust enables efficient management and distribution of the couple's assets, especially in cases where minor or adult children are involved. 2. Irrevocable Living Trust: An irrevocable living trust, as the name suggests, cannot be altered or revoked once it is established. Once assets are transferred into this trust, the creators relinquish control over these assets. However, this type of trust offers certain benefits, such as potential tax advantages and protection against potential creditors. It may be suitable for individuals who are more concerned with asset protection rather than flexibility. 3. Testamentary Trust: A testamentary trust is a type of trust that is included in a person's will and takes effect upon their death. In the case of a Harris Texas Living Trust for Husband and Wife with Minor and/or Adult Children, this trust could be established to ensure the proper management and distribution of assets to the couple's minor or adult children after their passing. The trust could also specify the terms regarding when and how the assets should be distributed to these beneficiaries. Conclusion: A Harris Texas Living Trust for Husband and Wife with Minor and/or Adult Children is a flexible estate planning tool that allows couples to protect and distribute their assets according to their specific wishes, while providing for their minor or adult children. Whether through a revocable or irrevocable living trust, or a testamentary trust established within a will, this legal document ensures that the couple's estate is managed efficiently and in line with their intentions. Consulting with a qualified estate planning attorney is crucial to establish the most suitable type of living trust based on individual circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Fideicomiso en vida para esposo y esposa con hijos menores o adultos - Texas Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Harris Texas Fideicomiso En Vida Para Esposo Y Esposa Con Hijos Menores O Adultos?

If you are searching for a valid form, it’s extremely hard to choose a better service than the US Legal Forms website – one of the most considerable libraries on the web. Here you can get a huge number of form samples for company and individual purposes by types and regions, or keywords. Using our high-quality search option, getting the latest Harris Texas Living Trust for Husband and Wife with Minor and or Adult Children is as easy as 1-2-3. In addition, the relevance of every document is confirmed by a team of skilled attorneys that regularly review the templates on our website and update them in accordance with the latest state and county requirements.

If you already know about our platform and have an account, all you should do to get the Harris Texas Living Trust for Husband and Wife with Minor and or Adult Children is to log in to your profile and click the Download option.

If you make use of US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have found the form you require. Read its explanation and utilize the Preview feature (if available) to explore its content. If it doesn’t suit your needs, utilize the Search option near the top of the screen to discover the proper record.

- Confirm your selection. Select the Buy now option. Next, choose your preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Use your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Choose the format and save it on your device.

- Make changes. Fill out, edit, print, and sign the received Harris Texas Living Trust for Husband and Wife with Minor and or Adult Children.

Every form you save in your profile has no expiration date and is yours forever. You always have the ability to gain access to them using the My Forms menu, so if you need to have an extra duplicate for enhancing or creating a hard copy, feel free to return and download it once again at any time.

Make use of the US Legal Forms professional library to get access to the Harris Texas Living Trust for Husband and Wife with Minor and or Adult Children you were seeking and a huge number of other professional and state-specific samples on a single platform!