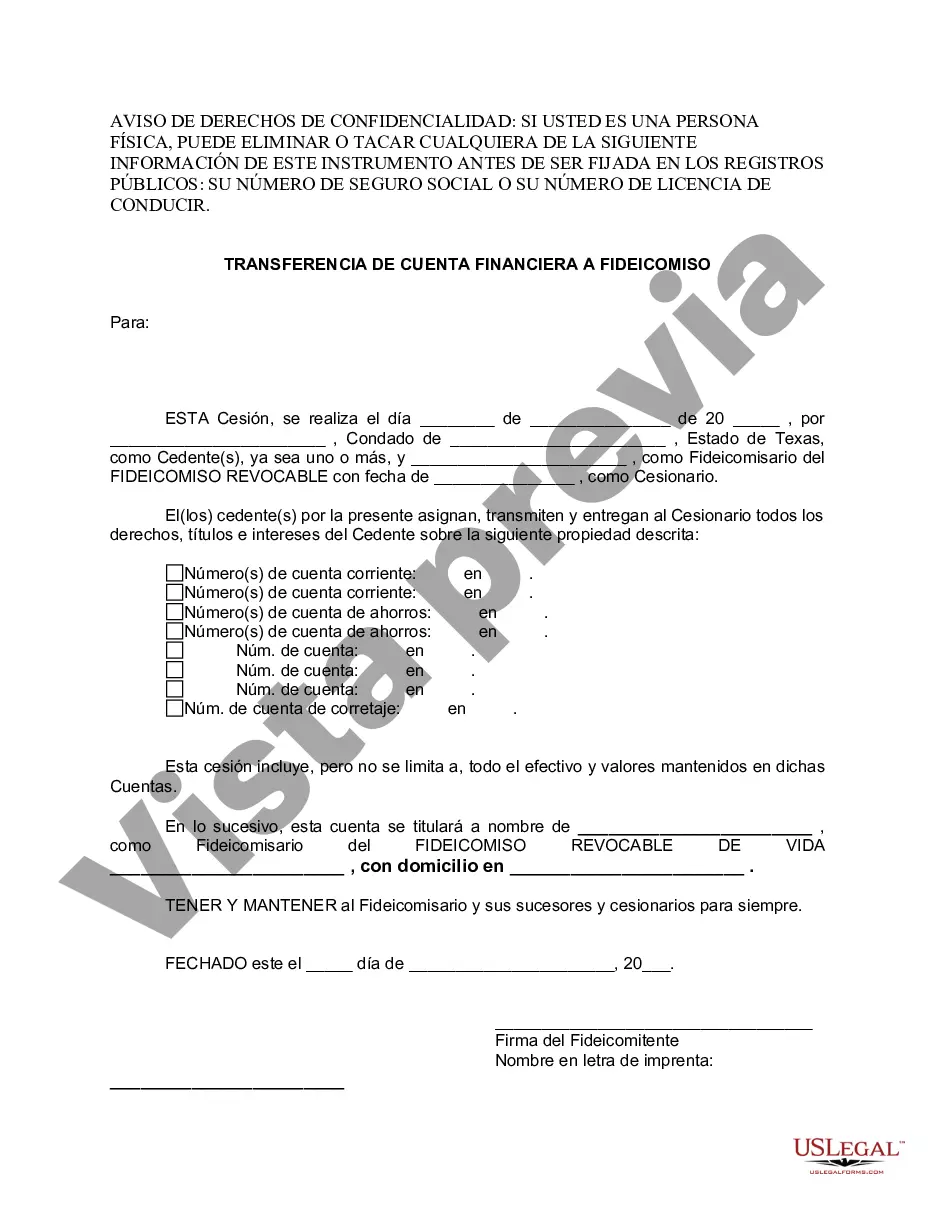

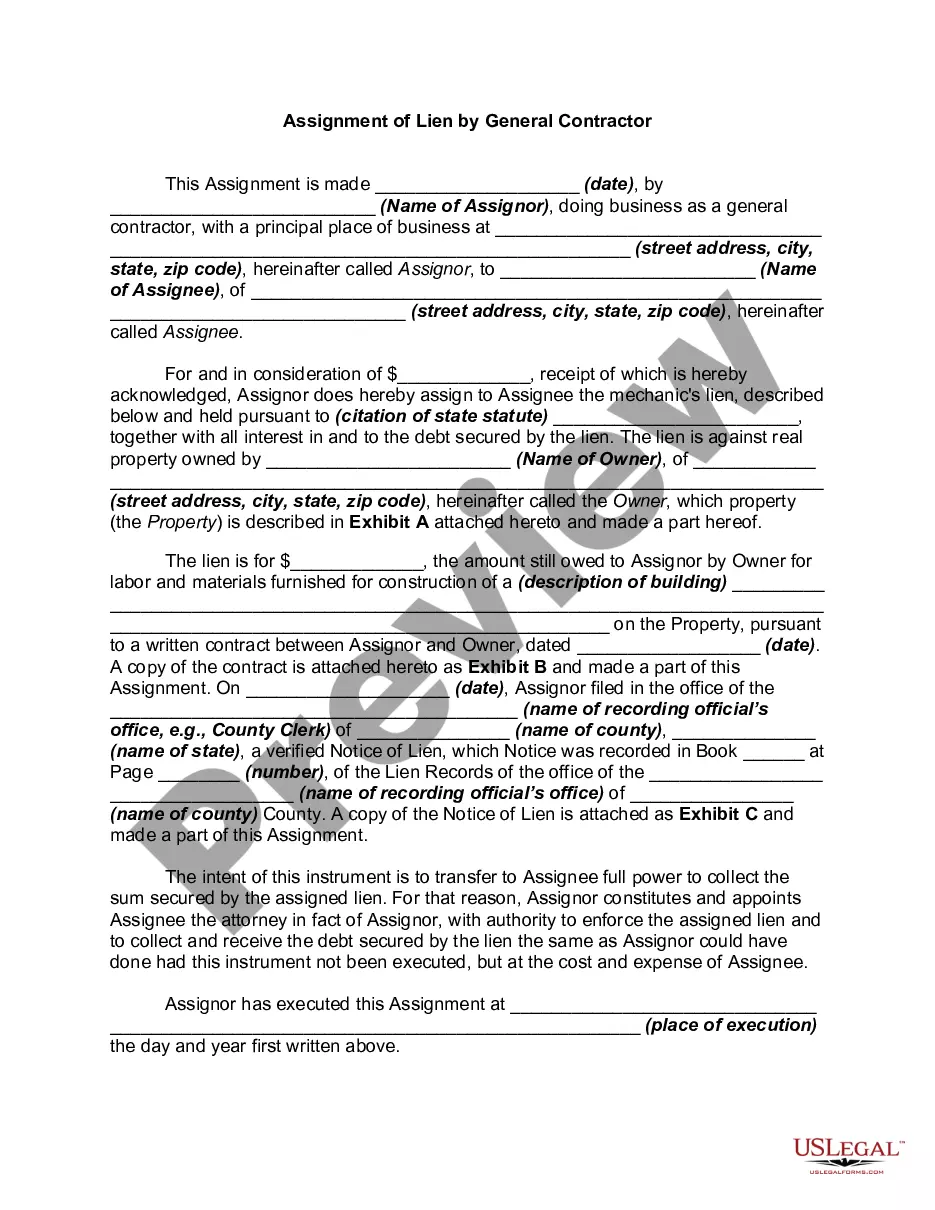

Austin Texas Financial Account Transfer to Living Trust refers to the process of transferring one's financial accounts, such as bank accounts, stocks, bonds, and mutual funds, to a living trust established in the state of Texas. This legal procedure allows individuals to manage and distribute their assets during their lifetime and also provides provisions for after their death. The living trust is a legal document that enables individuals to retain control over their assets while specifying how the assets should be managed and distributed according to their wishes. By transferring financial accounts to a living trust, individuals can avoid probate, which is the legal process of administering a person's estate after they pass away. This can save time, costs, and potential disputes among beneficiaries. There are various types of Austin Texas Financial Account Transfers to Living Trust: 1. Bank Account Transfer to Living Trust: This type of transfer involves moving funds from personal savings accounts, checking accounts, certificates of deposit (CDs), and money market accounts to the living trust. It ensures that these funds are managed and distributed as per the creator's instructions. 2. Stock and Bond Transfer to Living Trust: This involves moving ownership of stocks, corporate bonds, government bonds, and other securities to the living trust. By doing so, the creator can ensure that the trust will hold and distribute these investments without going through probate. 3. Mutual Fund Transfer to Living Trust: This particular transfer involves moving ownership of mutual fund shares to the living trust. It enables the trust to hold and manage the mutual funds according to the creator's directives, allowing for efficient management and potential tax benefits. 4. Retirement Account Transfer to Living Trust: Although retirement accounts, such as individual retirement accounts (IRAs) and 401(k) plans, cannot be directly transferred to a living trust, they can be designated as beneficiaries of the trust. This approach allows the retirement accounts to flow seamlessly into the living trust upon the account holder's passing, providing continued asset management and distribution. In Austin, Texas, the process of transferring financial accounts to a living trust involves working closely with an estate planning attorney or a financial advisor who specializes in trusts and probate. The specific steps may include drafting and executing the living trust document, completing relevant account transfer forms, and notifying the financial institutions and companies of the account transfer. It is crucial to ensure that all necessary legal requirements are met to establish the validity and effectiveness of the living trust. Overall, Austin Texas Financial Account Transfer to Living Trust is a crucial estate planning strategy, providing individuals with control, flexibility, and efficiency in managing and distributing their financial accounts, while potentially avoiding probate and ensuring a smoother transition of assets to their beneficiaries.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Austin Texas Transferencia de cuenta financiera a fideicomiso en vida - Texas Financial Account Transfer to Living Trust

State:

Texas

City:

Austin

Control #:

TX-E0178C

Format:

Word

Instant download

Description

Formulario para transferir cuentas financieras a un fideicomiso en vida.

Austin Texas Financial Account Transfer to Living Trust refers to the process of transferring one's financial accounts, such as bank accounts, stocks, bonds, and mutual funds, to a living trust established in the state of Texas. This legal procedure allows individuals to manage and distribute their assets during their lifetime and also provides provisions for after their death. The living trust is a legal document that enables individuals to retain control over their assets while specifying how the assets should be managed and distributed according to their wishes. By transferring financial accounts to a living trust, individuals can avoid probate, which is the legal process of administering a person's estate after they pass away. This can save time, costs, and potential disputes among beneficiaries. There are various types of Austin Texas Financial Account Transfers to Living Trust: 1. Bank Account Transfer to Living Trust: This type of transfer involves moving funds from personal savings accounts, checking accounts, certificates of deposit (CDs), and money market accounts to the living trust. It ensures that these funds are managed and distributed as per the creator's instructions. 2. Stock and Bond Transfer to Living Trust: This involves moving ownership of stocks, corporate bonds, government bonds, and other securities to the living trust. By doing so, the creator can ensure that the trust will hold and distribute these investments without going through probate. 3. Mutual Fund Transfer to Living Trust: This particular transfer involves moving ownership of mutual fund shares to the living trust. It enables the trust to hold and manage the mutual funds according to the creator's directives, allowing for efficient management and potential tax benefits. 4. Retirement Account Transfer to Living Trust: Although retirement accounts, such as individual retirement accounts (IRAs) and 401(k) plans, cannot be directly transferred to a living trust, they can be designated as beneficiaries of the trust. This approach allows the retirement accounts to flow seamlessly into the living trust upon the account holder's passing, providing continued asset management and distribution. In Austin, Texas, the process of transferring financial accounts to a living trust involves working closely with an estate planning attorney or a financial advisor who specializes in trusts and probate. The specific steps may include drafting and executing the living trust document, completing relevant account transfer forms, and notifying the financial institutions and companies of the account transfer. It is crucial to ensure that all necessary legal requirements are met to establish the validity and effectiveness of the living trust. Overall, Austin Texas Financial Account Transfer to Living Trust is a crucial estate planning strategy, providing individuals with control, flexibility, and efficiency in managing and distributing their financial accounts, while potentially avoiding probate and ensuring a smoother transition of assets to their beneficiaries.

Free preview

How to fill out Austin Texas Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Locating verified templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms repository.

This is an online assortment of over 85,000 legal documents catering to both personal and professional requirements for all real-life scenarios.

All the papers are systematically categorized by areas of application and jurisdiction, making it as fast and simple as ABC to find the Austin Texas Financial Account Transfer to Living Trust.

Maintain paperwork organized and compliant with legal standards is of utmost significance. Utilize the US Legal Forms library to consistently have crucial document templates for any requirements conveniently available to you!

- Visit the Preview mode and document description.

- Ensure you've selected the appropriate one that fulfills your requirements and fully aligns with your local regulatory needs.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the correct version. If it meets your criteria, proceed to the subsequent step.

- Purchase the document.