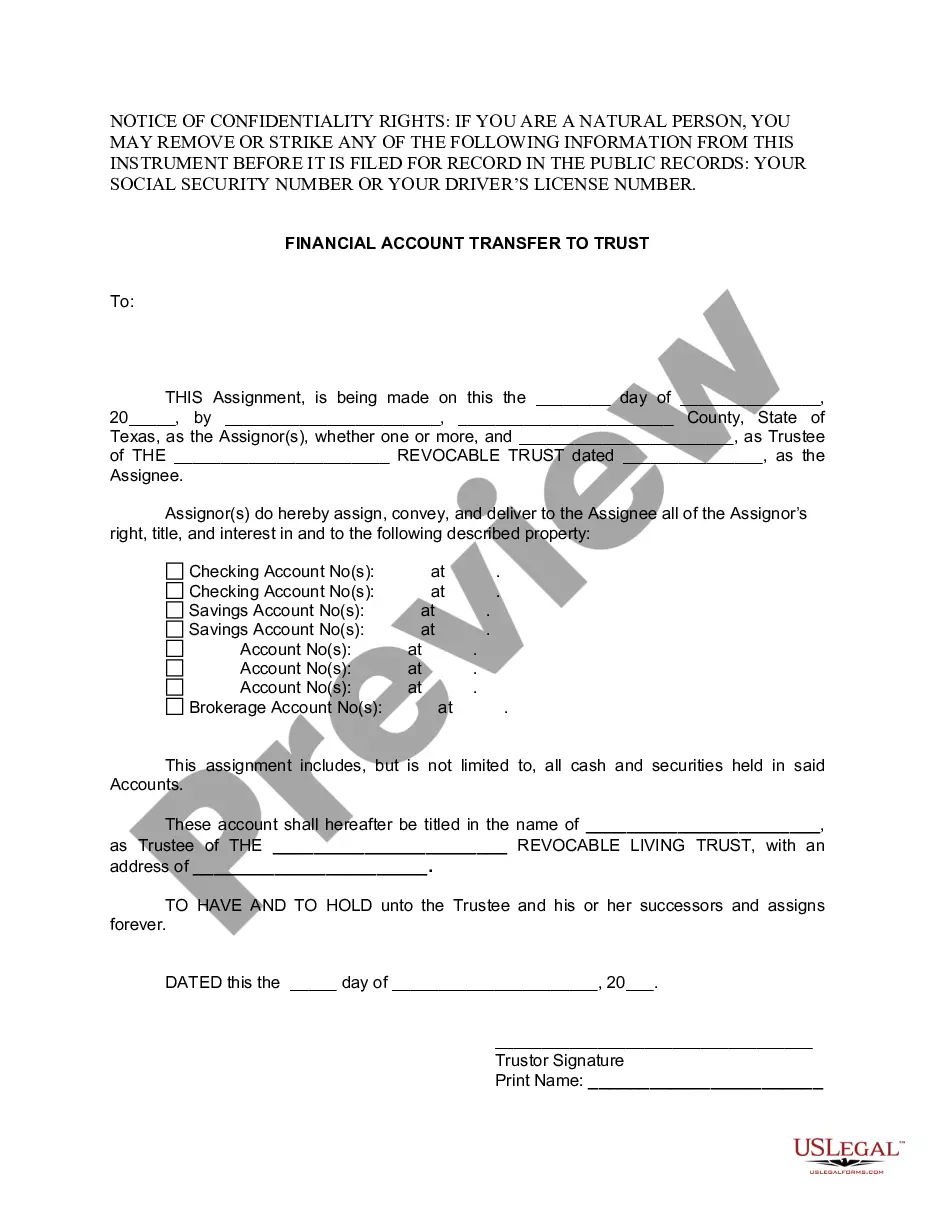

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Carrollton Texas Financial Account Transfer to Living Trust

Description

How to fill out Texas Financial Account Transfer To Living Trust?

Obtaining verified templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms collection.

It is a digital repository of over 85,000 legal documents catering to both personal and professional requirements, as well as various real-world scenarios.

All the paperwork is appropriately categorized by usage area and jurisdictional regions, making the search for the Carrollton Texas Financial Account Transfer to Living Trust as simple and straightforward as A B C.

Maintaining documents organized and in compliance with legal standards is crucial. Take advantage of the US Legal Forms library to always have essential document templates readily available for any requirement!

- Verify the Preview mode and document overview.

- Ensure you’ve selected the correct one that fulfills your needs and fully aligns with your regional jurisdiction regulations.

- Seek another template, if necessary.

- If you encounter any discrepancies, utilize the Search tab above to find the appropriate one.

- If it meets your criteria, proceed to the subsequent step.

Form popularity

FAQ

Transferring assets to a trust in Texas involves several steps to ensure everything is legally compliant. Start by identifying the assets you want to move into the trust, then prepare the necessary documentation to reflect the Carrollton Texas Financial Account Transfer to Living Trust. You'll need to change titles for real estate and update beneficiary designations for financial accounts. Working with professionals who specialize in asset transfers can simplify this process and provide peace of mind.

One significant downfall of having a trust is the potential for misunderstandings among family members. If not communicated clearly, intentions behind establishing a trust can lead to conflicts. Furthermore, once a trust is created, certain assets are no longer directly owned by the grantor, which can complicate access for spouses or heirs. Keeping these factors in mind, it's wise to discuss options like a Carrollton Texas Financial Account Transfer to Living Trust with a qualified professional.

The major disadvantage of a trust lies in the complexity it can introduce to estate management. Trusts require careful drafting and must adhere to legal requirements, or they might not function as intended. Additionally, once assets are transferred into a trust, it becomes more challenging to make changes without legal assistance. Therefore, it's important to consider these aspects when thinking about a Carrollton Texas Financial Account Transfer to Living Trust.

Creating a trust can be a wise decision for your parents as it helps manage and protect their assets. A Carrollton Texas Financial Account Transfer to Living Trust enables them to keep their estate out of probate, ensuring a smoother and faster transfer of assets. Additionally, this option can offer privacy and potentially reduce tax burdens. It's essential to consider their specific financial situation and discuss it with a legal expert to make informed choices.

Transferring your house to a living trust in Texas involves drafting a new deed that conveys ownership to the trust. After you complete the deed, file it with the county office to make the transfer official. It is advisable to work with a legal professional to navigate the specifics of your situation. This step is vital for ensuring a smooth Carrollton Texas Financial Account Transfer to Living Trust.

To transfer property to a living trust in Texas, you need to prepare a deed that names the trust as the new owner. It’s best to consult an attorney to ensure all legal requirements are met. Once the deed is completed, you will record it with the county clerk. This process is essential for a successful Carrollton Texas Financial Account Transfer to Living Trust.

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly define the terms. Without specific guidelines, beneficiaries may not understand how the funds should be used. This lack of clarity can lead to disputes among heirs. Ensuring a clear structure is important for effective Carrollton Texas Financial Account Transfer to Living Trust.

To transfer your checking account to your living trust, you need to contact your bank. Provide them with the trust documents and fill out the necessary forms. The bank may require a certification of trust, which simplifies the process. This Carrollton Texas Financial Account Transfer to Living Trust ensures that your funds are managed according to your wishes.