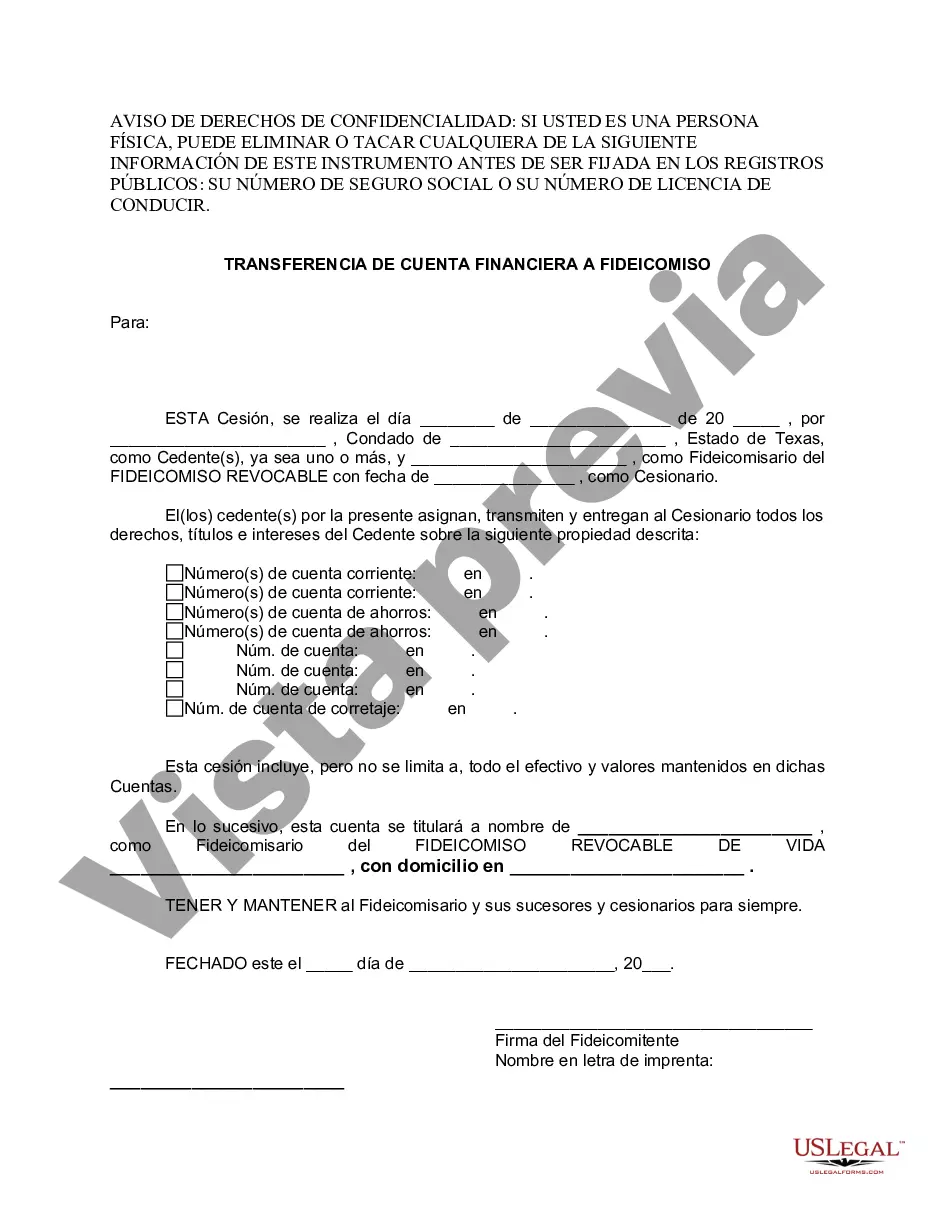

College Station Texas Financial Account Transfer to Living Trust: A Comprehensive Guide In College Station, Texas, individuals have the opportunity to safeguard their financial assets by transferring their accounts to a living trust. This process allows them to efficiently manage their finances and plan for the future, ensuring that their assets are protected and distributed according to their wishes. Whether you're an individual or a business, understanding the various types of financial account transfers available in College Station is crucial. Let's delve into the details of College Station Texas Financial Account Transfer to Living Trust, including different types and key steps involved. Types of College Station Texas Financial Account Transfer to Living Trust: 1. Bank Accounts: This type of transfer encompasses savings accounts, checking accounts, money market accounts, and certificates of deposit. Transferring these accounts to a living trust allows the account holder (granter) to maintain control over their funds while avoiding probate upon their passing. 2. Investment Accounts: Individuals who hold stocks, bonds, mutual funds, or other investment instruments can transfer these assets into their living trust. By doing so, they ensure seamless management and distribution of these accounts, with the added advantage of potential tax benefits. 3. Retirement Accounts: Retirement accounts such as 401(k), 403(b), individual retirement accounts (IRAs), and pensions can also be transferred to a living trust. This offers the flexibility to designate beneficiaries and control how these assets are distributed while preserving tax-deferred or tax-exempt retirement savings. Key Steps Involved in a College Station Texas Financial Account Transfer to Living Trust: 1. Consultation: Seek professional guidance from an estate planning attorney or financial advisor in College Station. They will evaluate your specific financial situation, discuss your goals, and recommend an appropriate living trust structure to meet your needs. 2. Establishing a Living Trust: Prepare the necessary legal documents to establish your living trust. This involves appointing a trustee (either yourself or a trusted individual/entity) who will be responsible for managing the trust's assets and carrying out your instructions. 3. Funding the Trust: Initiate the process of transferring your financial accounts to the living trust. Work with your attorneys, financial institutions, and relevant institutions to complete the paperwork required for each specific type of account transfer. 4. Updating Account Beneficiaries: Ensure that the beneficiary designations on your financial accounts align with the provisions of your living trust. This step is crucial to avoid potential conflicts between the trust provisions and outdated beneficiary designations. 5. Continuous Review: Regularly review and update your living trust to reflect any changes in your financial situation, goals, or family circumstances. This ensures that your trust remains up-to-date and aligned with your intentions. By undertaking a College Station Texas Financial Account Transfer to Living Trust, individuals gain peace of mind knowing that their financial affairs are organized and secure. It simplifies the asset distribution process while protecting their interests and minimizing potential estate taxes or probate costs. Consult with estate planning professionals in College Station today to explore the best options available to you and safeguard your financial stability for the future.

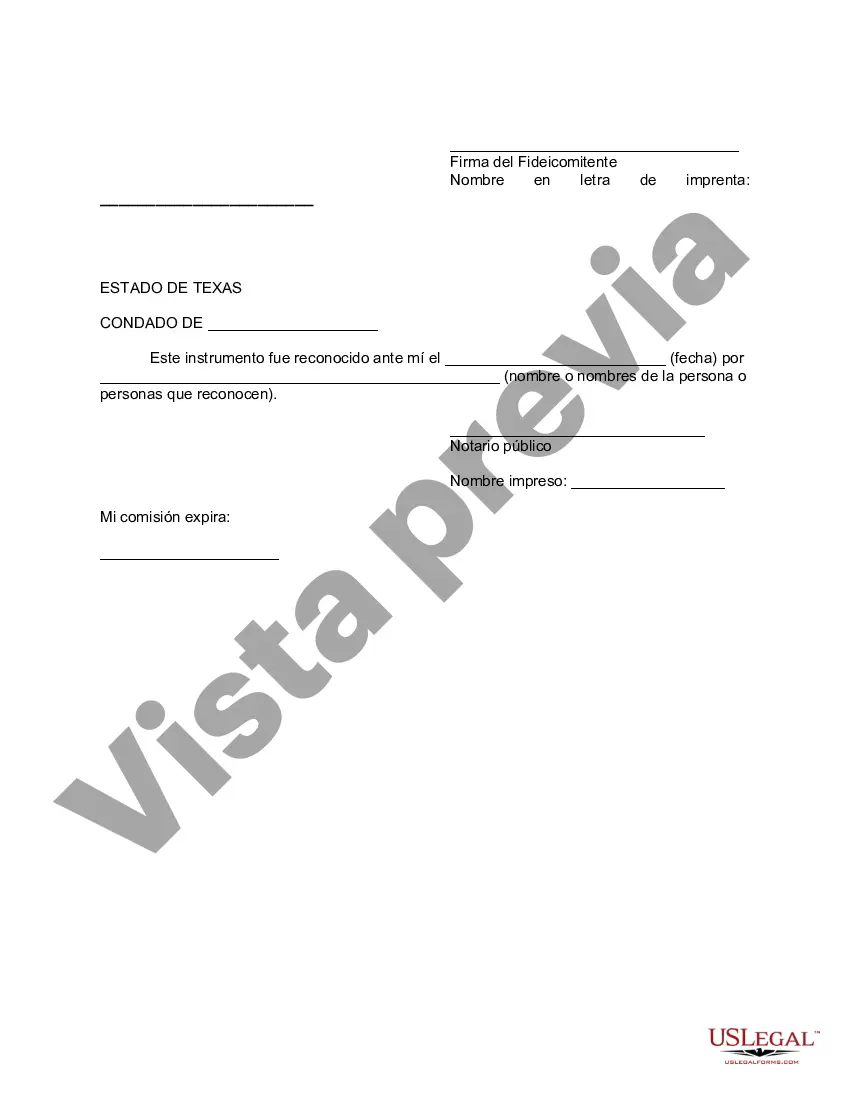

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.College Station Texas Transferencia de cuenta financiera a fideicomiso en vida - Texas Financial Account Transfer to Living Trust

Description

How to fill out College Station Texas Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Take advantage of the US Legal Forms and have immediate access to any form sample you require. Our beneficial website with a large number of templates simplifies the way to find and get almost any document sample you will need. You can download, complete, and sign the College Station Texas Financial Account Transfer to Living Trust in a matter of minutes instead of browsing the web for hours seeking the right template.

Utilizing our library is a wonderful strategy to increase the safety of your document filing. Our experienced attorneys regularly check all the documents to ensure that the templates are appropriate for a particular state and compliant with new laws and regulations.

How can you obtain the College Station Texas Financial Account Transfer to Living Trust? If you have a profile, just log in to the account. The Download button will appear on all the samples you look at. Furthermore, you can get all the earlier saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions below:

- Find the form you require. Make certain that it is the form you were hoping to find: examine its headline and description, and make use of the Preview feature if it is available. Otherwise, use the Search field to look for the needed one.

- Start the downloading procedure. Select Buy Now and choose the pricing plan you prefer. Then, create an account and process your order using a credit card or PayPal.

- Download the document. Choose the format to get the College Station Texas Financial Account Transfer to Living Trust and edit and complete, or sign it for your needs.

US Legal Forms is among the most considerable and reliable template libraries on the web. We are always ready to help you in any legal procedure, even if it is just downloading the College Station Texas Financial Account Transfer to Living Trust.

Feel free to benefit from our platform and make your document experience as efficient as possible!