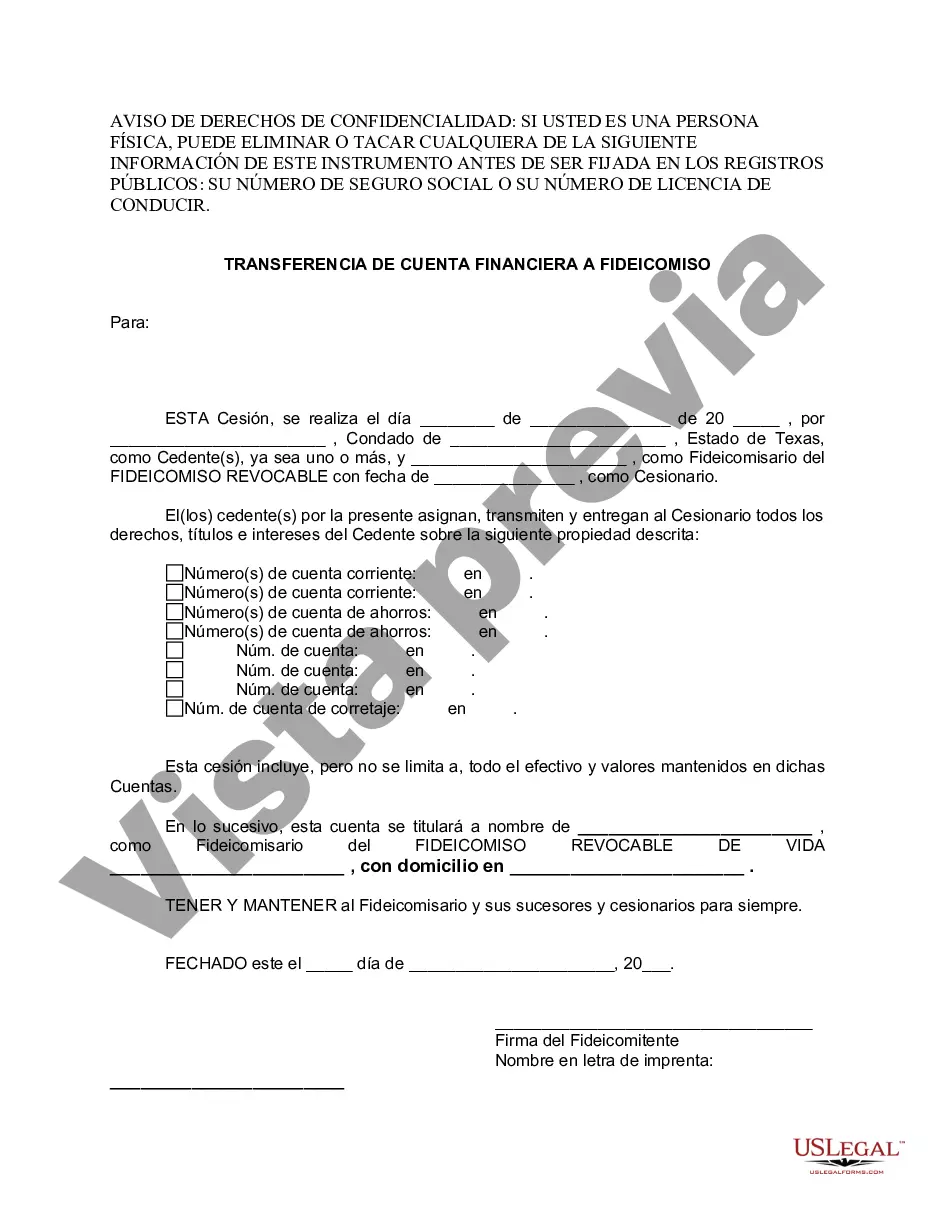

Dallas Texas Financial Account Transfer to Living Trust: A Comprehensive Guide In Dallas, Texas, individuals often seek to optimize their estate planning strategies by transferring their financial accounts to a living trust. This process ensures seamless management and distribution of their assets, while minimizing probate complications and maximizing privacy. Dallas' residents can choose from several types of financial account transfers to a living trust, namely: 1. Bank Account Transfer: By transferring their bank accounts, including savings, checking, and money market accounts, to a living trust, individuals can maintain control over their funds during their lifetime, while designating a successor trustee to manage these accounts upon their incapacity or death. 2. Investment Account Transfer: This type of transfer encompasses a broad range of investment instruments such as stocks, bonds, mutual funds, and other securities. When transferred to a living trust, individuals can maintain control over their investment decisions while ensuring a smooth transition in case of incapacity or death. 3. Retirement Account Transfer: Retirement accounts such as IRAs, 401(k)s, and pension plans can also be transferred to a living trust. This strategy allows individuals to name specific beneficiaries who will receive the funds directly, ensuring a seamless transfer of retirement assets and potentially minimizing tax implications. 4. Real Estate Account Transfer: For Dallas residents who own real estate properties, transferring ownership to a living trust offers a range of benefits. This type of transfer allows individuals to effectively manage their real estate holdings, avoid probate, and simplify the transfer of ownership to beneficiaries as outlined in the trust. During the process of a financial account transfer to a living trust in Dallas, Texas, individuals should consider the following steps: 1. Consultation with an Estate Planning Attorney: Seek the expertise of an experienced estate planning attorney in Dallas who specializes in living trusts and financial account transfers. They will guide you through the legal requirements, help you understand tax implications, and ensure your intentions are accurately reflected in the trust. 2. Creation of a Living Trust: Work with your attorney to establish a living trust and determine the terms and conditions that align with your financial goals and legacy objectives. This legal document should detail how your financial accounts should be managed and distributed to beneficiaries. 3. Asset Evaluation and Account Transfer: Compile a comprehensive list of all financial accounts that you wish to transfer to the living trust. With the assistance of your attorney, initiate the necessary paperwork and contact each financial institution to facilitate the proper transfer of ownership. 4. Update Beneficiary Designations: Review and update the beneficiary designations on all financial accounts being transferred to ensure they align with your living trust's terms. This step helps prevent potential conflicts between account designations and trust provisions. 5. Ongoing Management: Once the financial account transfer is complete, actively manage and monitor the assets held within your living trust. Regularly review the trust to ensure it reflects changes in your financial situation, family circumstances, or estate planning goals. By understanding the various types of financial account transfers available and carefully following the steps involved, Dallas residents can successfully transfer their financial accounts to a living trust. This process not only offers greater control over their assets but also provides peace of mind in knowing that their wishes will be honored during their lifetime and beyond. Seek professional guidance to tailor these strategies to your specific circumstances and ensure a seamless transition for your financial accounts in Dallas, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Transferencia de cuenta financiera a fideicomiso en vida - Texas Financial Account Transfer to Living Trust

Description

How to fill out Dallas Texas Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you are looking for a valid form, it’s extremely hard to find a more convenient service than the US Legal Forms website – probably the most considerable online libraries. Here you can get thousands of templates for business and personal purposes by categories and regions, or keywords. With our advanced search feature, finding the latest Dallas Texas Financial Account Transfer to Living Trust is as easy as 1-2-3. Moreover, the relevance of each and every file is confirmed by a team of professional lawyers that on a regular basis review the templates on our website and revise them based on the most recent state and county demands.

If you already know about our system and have a registered account, all you should do to get the Dallas Texas Financial Account Transfer to Living Trust is to log in to your user profile and click the Download option.

If you use US Legal Forms the very first time, just follow the instructions below:

- Make sure you have found the sample you want. Read its information and use the Preview function to see its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to get the appropriate record.

- Confirm your selection. Select the Buy now option. Following that, pick the preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Receive the template. Pick the format and save it on your device.

- Make changes. Fill out, edit, print, and sign the received Dallas Texas Financial Account Transfer to Living Trust.

Every single template you save in your user profile has no expiration date and is yours forever. You always have the ability to access them via the My Forms menu, so if you need to get an additional duplicate for editing or printing, you may return and download it once more at any time.

Make use of the US Legal Forms professional library to gain access to the Dallas Texas Financial Account Transfer to Living Trust you were seeking and thousands of other professional and state-specific templates on one platform!