Harris County, Texas Financial Account Transfer to Living Trust: A Comprehensive Overview Are you a resident of Harris County, Texas, planning for the future and looking to secure your financial assets through a living trust? The Harris Texas Financial Account Transfer to Living Trust provides a valuable solution. In this detailed description, we will explore the various aspects of this process, outlining the key steps involved and discussing the different types of transfers available. A living trust, also known as an inter vivos trust, is a legal arrangement that enables individuals to transfer their financial assets and properties into a trust during their lifetime. The purpose of creating a living trust is to ensure the seamless management and distribution of assets upon the trust or's incapacitation or death. By establishing such a trust, you can gain greater control over your assets, minimize probate procedures, and provide for your beneficiaries without the need for court intervention. When it comes to the financial account transfer to a living trust in Harris County, Texas, there are several types of transfers to consider: 1. Bank Account Transfer: This involves transferring various types of financial accounts, including savings, checking, and money market accounts, into the living trust. By doing so, the assets held in these accounts will be placed under the trust's management, allowing for smoother administration and potential tax advantages. 2. Investment Account Transfer: This type of transfer involves re-titling brokerage accounts, stock portfolios, bonds, and other investment assets into the living trust. By transferring these accounts, you ensure that your designated successor trustee or trustees can effectively manage and distribute these assets in accordance with your wishes. 3. Retirement Account Transfer: Harris Texas Financial Account Transfer to Living Trust also covers the transfer of retirement accounts, such as IRAs (Individual Retirement Accounts) and 401(k)s, into the trust. This transfer requires careful consideration and compliance with specific regulations, as some tax implications may arise. It is advisable to consult with a knowledgeable financial advisor or attorney specializing in estate planning to navigate this process successfully. 4. Real Estate Property Transfer: In addition to financial accounts, this type of living trust transfer encompasses the transfer of residential and commercial real estate properties located within Harris County. By transferring your real estate assets into the trust, you can streamline their administration, potentially reduce estate taxes, and ensure efficient distribution to your intended beneficiaries. To initiate the Harris Texas Financial Account Transfer to Living Trust, you should consider the following steps: 1. Seek Professional Guidance: Engaging the services of an experienced estate planning attorney who specializes in living trusts and asset transfers is strongly recommended. They will guide you through the process, ensuring that your assets are properly titled and legally transferred to the trust. 2. Create and Fund Your Living Trust: Work with your attorney to establish the living trust document that outlines your wishes and appoints a trustee to administer the trust. Next, transfer ownership of your financial accounts and assets into the trust by updating the titles accordingly. 3. Notify Financial Institutions: Inform the respective financial institutions and banks about the living trust creation and provide them with the necessary legal documents, including the trust agreement and any required transfer forms. They will guide you through their specific procedures for account transfers and may request additional documentation. 4. Review and Update Beneficiary Designations: Ensure that all beneficiary designations on your financial accounts align with the living trust provisions. This step is crucial to guarantee that your assets flow seamlessly to your desired beneficiaries upon your passing. By following these steps and completing the appropriate transfers, you can take full advantage of the Harris Texas Financial Account Transfer to Living Trust, effectively streamlining the management and distribution of your assets, while also providing for the individual needs of your beneficiaries. Note: It is crucial to consult with legal and financial professionals to tailor the living trust and financial account transfers to your specific circumstances and objectives. The information provided in this description is intended as a general overview and does not constitute legal or financial advice.

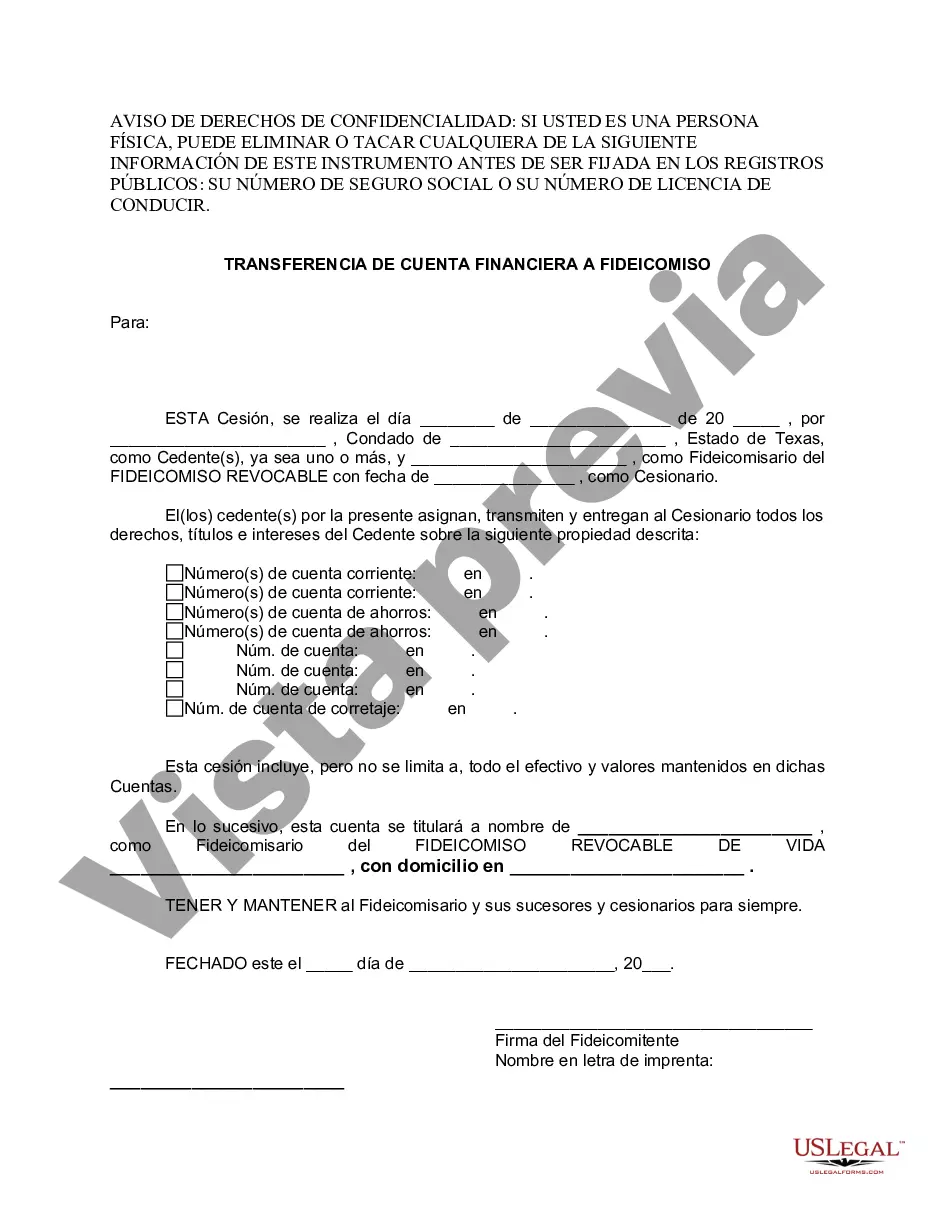

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Transferencia de cuenta financiera a fideicomiso en vida - Texas Financial Account Transfer to Living Trust

State:

Texas

County:

Harris

Control #:

TX-E0178C

Format:

Word

Instant download

Description

Formulario para transferir cuentas financieras a un fideicomiso en vida.

Harris County, Texas Financial Account Transfer to Living Trust: A Comprehensive Overview Are you a resident of Harris County, Texas, planning for the future and looking to secure your financial assets through a living trust? The Harris Texas Financial Account Transfer to Living Trust provides a valuable solution. In this detailed description, we will explore the various aspects of this process, outlining the key steps involved and discussing the different types of transfers available. A living trust, also known as an inter vivos trust, is a legal arrangement that enables individuals to transfer their financial assets and properties into a trust during their lifetime. The purpose of creating a living trust is to ensure the seamless management and distribution of assets upon the trust or's incapacitation or death. By establishing such a trust, you can gain greater control over your assets, minimize probate procedures, and provide for your beneficiaries without the need for court intervention. When it comes to the financial account transfer to a living trust in Harris County, Texas, there are several types of transfers to consider: 1. Bank Account Transfer: This involves transferring various types of financial accounts, including savings, checking, and money market accounts, into the living trust. By doing so, the assets held in these accounts will be placed under the trust's management, allowing for smoother administration and potential tax advantages. 2. Investment Account Transfer: This type of transfer involves re-titling brokerage accounts, stock portfolios, bonds, and other investment assets into the living trust. By transferring these accounts, you ensure that your designated successor trustee or trustees can effectively manage and distribute these assets in accordance with your wishes. 3. Retirement Account Transfer: Harris Texas Financial Account Transfer to Living Trust also covers the transfer of retirement accounts, such as IRAs (Individual Retirement Accounts) and 401(k)s, into the trust. This transfer requires careful consideration and compliance with specific regulations, as some tax implications may arise. It is advisable to consult with a knowledgeable financial advisor or attorney specializing in estate planning to navigate this process successfully. 4. Real Estate Property Transfer: In addition to financial accounts, this type of living trust transfer encompasses the transfer of residential and commercial real estate properties located within Harris County. By transferring your real estate assets into the trust, you can streamline their administration, potentially reduce estate taxes, and ensure efficient distribution to your intended beneficiaries. To initiate the Harris Texas Financial Account Transfer to Living Trust, you should consider the following steps: 1. Seek Professional Guidance: Engaging the services of an experienced estate planning attorney who specializes in living trusts and asset transfers is strongly recommended. They will guide you through the process, ensuring that your assets are properly titled and legally transferred to the trust. 2. Create and Fund Your Living Trust: Work with your attorney to establish the living trust document that outlines your wishes and appoints a trustee to administer the trust. Next, transfer ownership of your financial accounts and assets into the trust by updating the titles accordingly. 3. Notify Financial Institutions: Inform the respective financial institutions and banks about the living trust creation and provide them with the necessary legal documents, including the trust agreement and any required transfer forms. They will guide you through their specific procedures for account transfers and may request additional documentation. 4. Review and Update Beneficiary Designations: Ensure that all beneficiary designations on your financial accounts align with the living trust provisions. This step is crucial to guarantee that your assets flow seamlessly to your desired beneficiaries upon your passing. By following these steps and completing the appropriate transfers, you can take full advantage of the Harris Texas Financial Account Transfer to Living Trust, effectively streamlining the management and distribution of your assets, while also providing for the individual needs of your beneficiaries. Note: It is crucial to consult with legal and financial professionals to tailor the living trust and financial account transfers to your specific circumstances and objectives. The information provided in this description is intended as a general overview and does not constitute legal or financial advice.

Free preview

How to fill out Harris Texas Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you’ve already used our service before, log in to your account and save the Harris Texas Financial Account Transfer to Living Trust on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Harris Texas Financial Account Transfer to Living Trust. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!