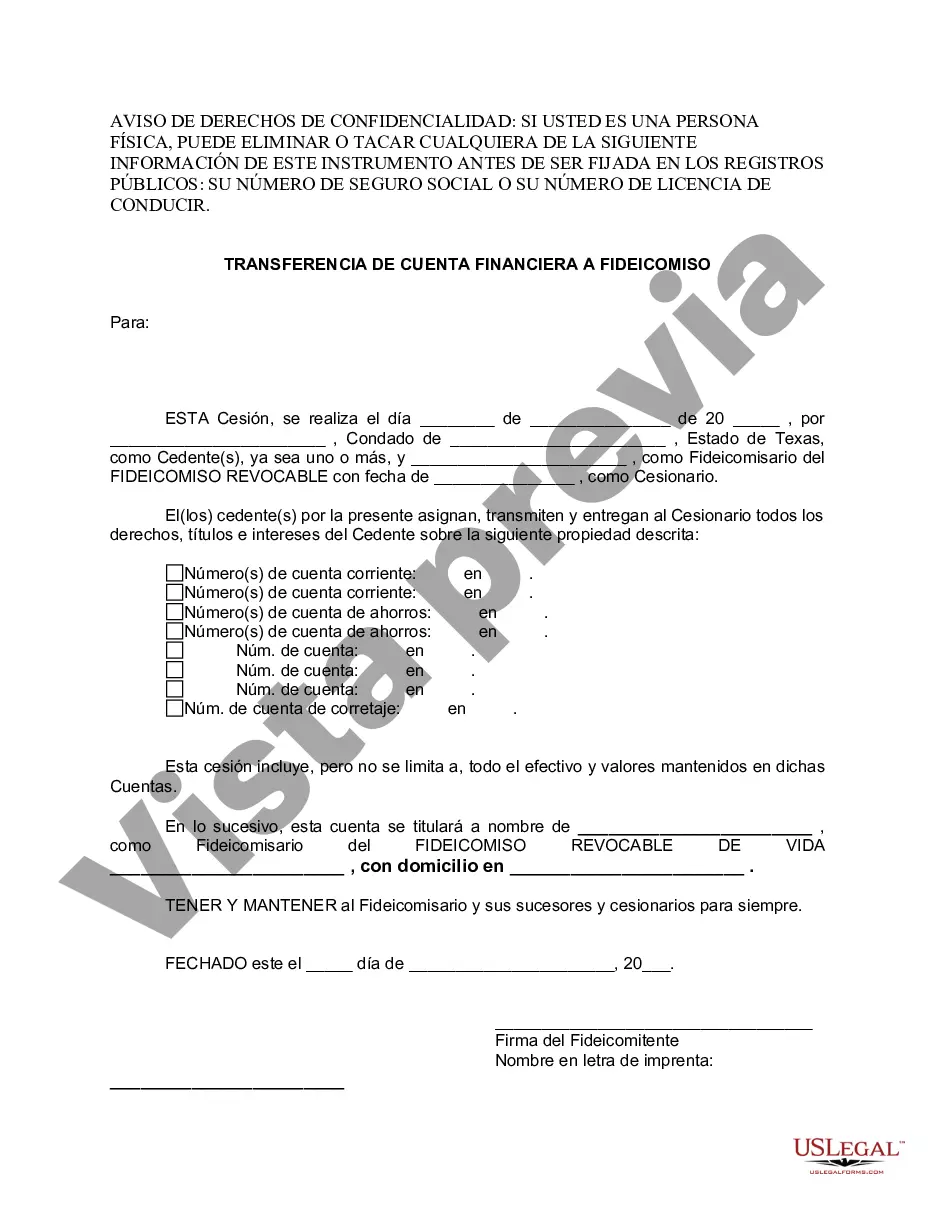

San Antonio Texas Financial Account Transfer to Living Trust refers to the process of transferring financial accounts owned by an individual or entity located in San Antonio, Texas, to a living trust. A living trust, also known as a revocable trust or inter vivos trust, is a legal entity established to hold and manage assets during the granter's lifetime and distribute them to beneficiaries according to the granter's instructions after their passing. The transfer of financial accounts to a living trust in San Antonio is an essential step in estate planning, helping individuals and families avoid probate, maintain privacy, and efficiently distribute their assets upon incapacity or death. By titling these accounts under the name of the living trust, they become assets of the trust and are subject to its terms and management. There are different types of San Antonio Texas Financial Account Transfers to a Living Trust, depending on the specific financial accounts being transferred. These may include: 1. Bank Accounts Transfer: This involves moving funds from individual bank accounts, such as savings accounts, checking accounts, money market accounts, or certificates of deposit (CDs), into the living trust's name. The trust becomes the account owner, allowing for seamless management and distribution. 2. Investment Accounts Transfer: This type of transfer includes brokerage accounts, stocks, bonds, mutual funds, and other investment assets. By re-registering the accounts under the living trust's name, the granter ensures these assets are protected and properly distributed according to their wishes. 3. Retirement Accounts Transfer: Retirement accounts, such as Individual Retirement Accounts (IRAs), 401(k)s, or other qualified plans, can also be transferred into a living trust through a process called "beneficiary designation." The living trust becomes the beneficiary, allowing for effective tax planning and control over the distribution of retirement assets. 4. Life Insurance Policies Transfer: Transferring life insurance policies into a living trust ensures the proceeds are managed and distributed according to the granter's instructions. The trust becomes the policyholder, and beneficiaries are designated within the trust document. 5. Real Estate Transfer: While not a financial account per se, transferring properties in San Antonio, Texas, into a living trust is a valuable component of overall financial account transfers. By re-titling properties under the trust's name, individuals gain protection, flexibility, and an efficient mechanism for managing and transferring real estate. It is important to consult with a qualified estate planning attorney or financial advisor in San Antonio, Texas, to properly execute Financial Account Transfers to a Living Trust. They can provide personalized guidance, assess tax implications, draft necessary legal documents, and ensure compliance with the applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Transferencia de cuenta financiera a fideicomiso en vida - Texas Financial Account Transfer to Living Trust

Description

How to fill out San Antonio Texas Transferencia De Cuenta Financiera A Fideicomiso En Vida?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for legal solutions that, usually, are extremely expensive. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of legal counsel. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the San Antonio Texas Financial Account Transfer to Living Trust or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is equally easy if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the San Antonio Texas Financial Account Transfer to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the San Antonio Texas Financial Account Transfer to Living Trust would work for you, you can choose the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!