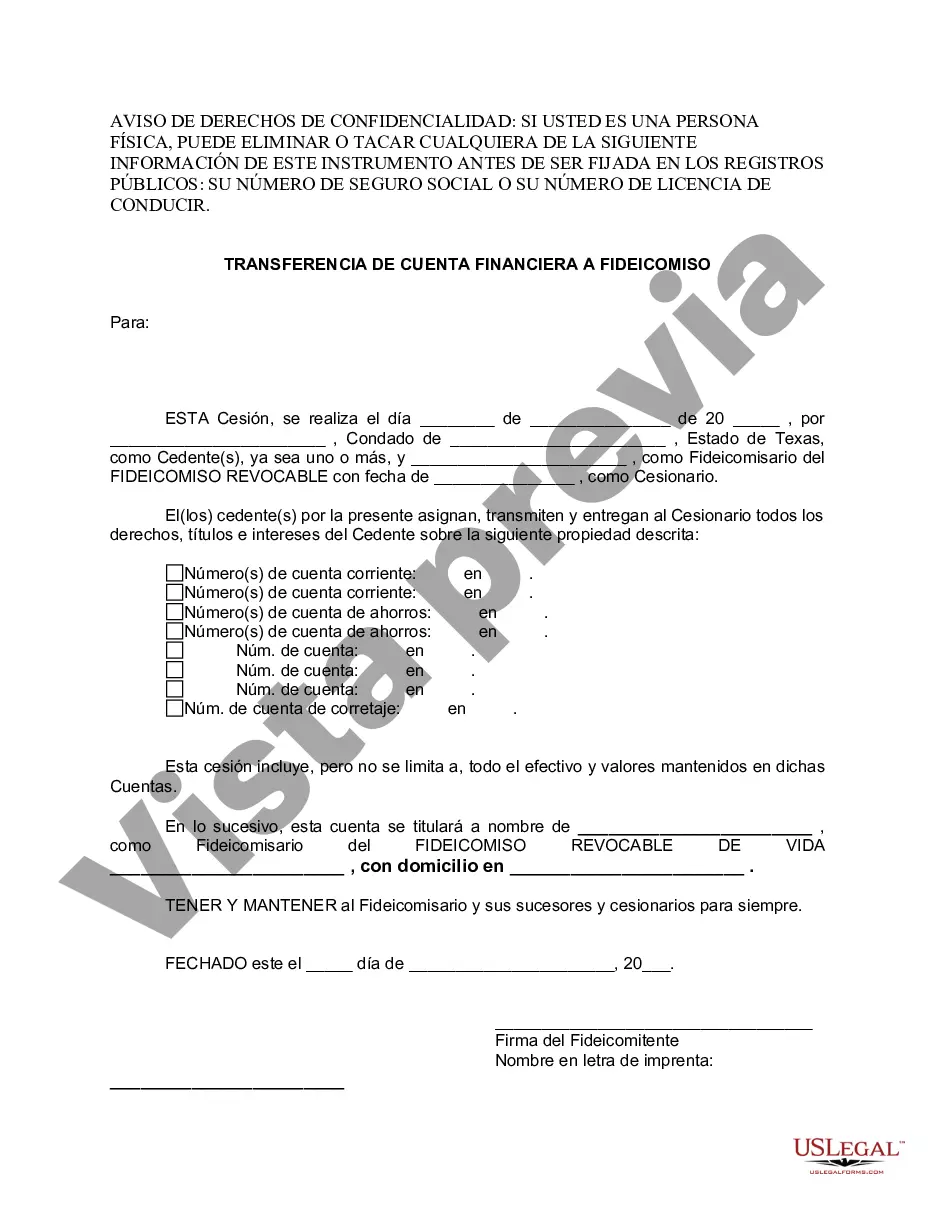

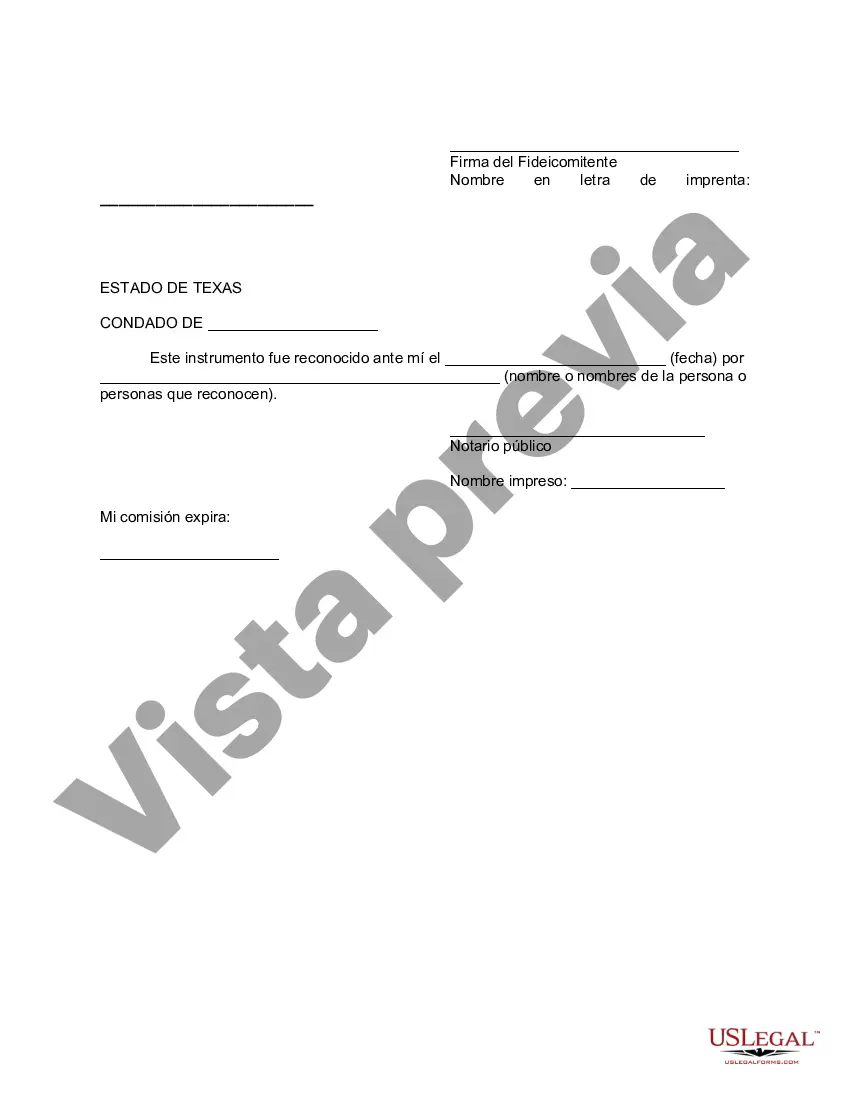

Sugar Land, Texas Financial Account Transfer to Living Trust: When it comes to protecting your financial assets and ensuring a smooth transfer of wealth to your beneficiaries, a vital estate planning tool to consider is the Living Trust. Living trusts are particularly beneficial in Sugar Land, Texas, as they allow individuals to avoid the probate process, streamline asset distribution, and maintain privacy. To provide a detailed description of Sugar Land, Texas Financial Account Transfer to Living Trust, let's delve into the process, benefits, and different types available: 1. Process of Financial Account Transfer to Living Trust: — Consultation: Seek the advice of an experienced estate planning attorney in Sugar Land to understand the intricacies of the process and determine whether a living trust aligns with your financial goals. — Creation of the Trust: Your attorney will assist you in drafting the necessary legal documents, including the trust agreement, that detail how your financial accounts and assets will be transferred and managed within the trust. — Funding the Trust: Once the trust is established, you will need to retitle your financial accounts to reflect ownership by the trust itself. This step may require notifying financial institutions and completing appropriate paperwork to effect the transfer. 2. Benefits of a Living Trust: — Avoidance of Probate: By transferring financial accounts to a living trust, your assets will bypass probate court, saving your loved one's time, money, and potential legal complications. — Privacy: Unlike a will, a living trust is not a public document. This means that the details of your financial accounts and who you choose as beneficiaries remain confidential. — Asset Protection: A properly structured living trust can shield your financial accounts from potential creditors, lawsuits, or other unforeseen circumstances. — Incapacity Planning: A living trust can provide provisions for the management of your financial accounts in the event of your incapacity, ensuring that your estate remains well-managed even if you are unable to handle it personally. 3. Types of Financial Account Transfer to Living Trust: — Bank Accounts: Savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs) can be readily transferred into a living trust. — Investment Accounts: Stocks, bonds, mutual funds, and other investment assets can be titled in the name of the trust, allowing for centralized management and administration. — Retirement Accounts: While not typically transferred to a living trust during your lifetime, you can name your trust as a beneficiary of retirement accounts, ensuring a smooth transition and potential tax planning benefits for your heirs. — Real Estate: In addition to financial accounts, real estate properties in Sugar Land, Texas, can also be transferred to a living trust, offering ease of management and circumventing the need for probate. In conclusion, Sugar Land, Texas Financial Account Transfer to Living Trust is a crucial step towards safeguarding your assets, maintaining privacy, and ensuring a streamlined distribution of wealth to your loved ones. By consulting with an estate planning attorney, you can navigate the intricacies of the process and tailor your living trust to align with your unique financial goals and circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sugar Land Texas Transferencia de cuenta financiera a fideicomiso en vida - Texas Financial Account Transfer to Living Trust

Description

How to fill out Sugar Land Texas Transferencia De Cuenta Financiera A Fideicomiso En Vida?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for attorney solutions that, usually, are extremely expensive. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of a lawyer. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Sugar Land Texas Financial Account Transfer to Living Trust or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Sugar Land Texas Financial Account Transfer to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Sugar Land Texas Financial Account Transfer to Living Trust would work for you, you can select the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!