Travis Texas Financial Account Transfer to Living Trust is a process that involves transferring various types of financial accounts to a living trust set up by an individual or a couple. Living trusts are commonly used estate planning tools that help individuals manage and distribute their assets after their passing, in a way that avoids probate. By transferring financial accounts to a living trust, individuals can ensure a seamless transition of assets, maintain privacy, and potentially reduce estate taxes. There are several types of financial accounts that can be transferred to a living trust in Travis, Texas. Some common examples include: 1. Bank Accounts: This includes checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). By transferring these accounts to a living trust, individuals can designate multiple beneficiaries and ensure the smooth transfer of funds upon their passing. 2. Investment Accounts: This category encompasses brokerage accounts, stocks, bonds, mutual funds, and other investment instruments. Transferring investment accounts to a living trust can help protect these assets, provide flexibility in asset management, and streamline the distribution process. 3. Real Estate: While not directly considered a financial account, real estate properties can also be transferred to a living trust. By doing so, homeowners can ensure that their property is managed and distributed according to their wishes without going through probate. 4. Retirement Accounts: Retirement accounts such as IRA (Individual Retirement Account) or 401(k) plans can be transferred to a living trust, although the rules and tax implications surrounding these transfers can be complex. Seeking advice from a financial advisor or estate planning attorney is crucial when dealing with retirement accounts. 5. Life Insurance Policies: Although life insurance policies cannot be directly transferred to a living trust, they can be designated as assets to the trust. This allows for efficient management and distribution of the insurance proceeds. It is important to note that the process of transferring financial accounts to a living trust may require specific legal documents, such as an "Assignment of Assets" or "Transfer on Death" forms, depending on the type of account. Seeking professional guidance from an attorney who specializes in estate planning is highly recommended ensuring all legal requirements are met. Overall, Travis Texas Financial Account Transfer to Living Trust provides individuals with a comprehensive and efficient way to manage their assets during their lifetime and ensure a seamless transfer to their beneficiaries upon their passing. Proper estate planning and consultation with professionals can ensure a smooth transition and maximize the benefits of a living trust for individuals and their loved ones in Travis, Texas.

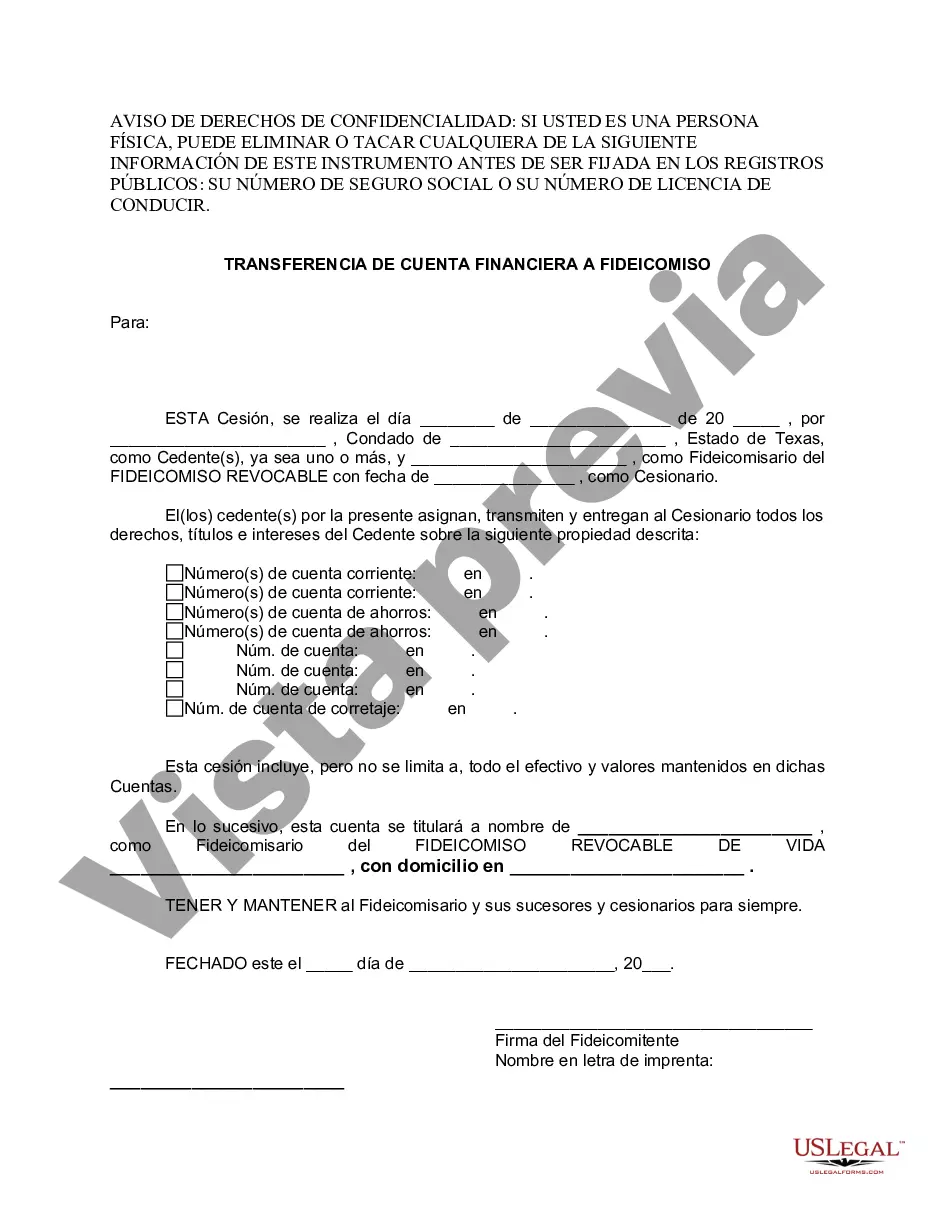

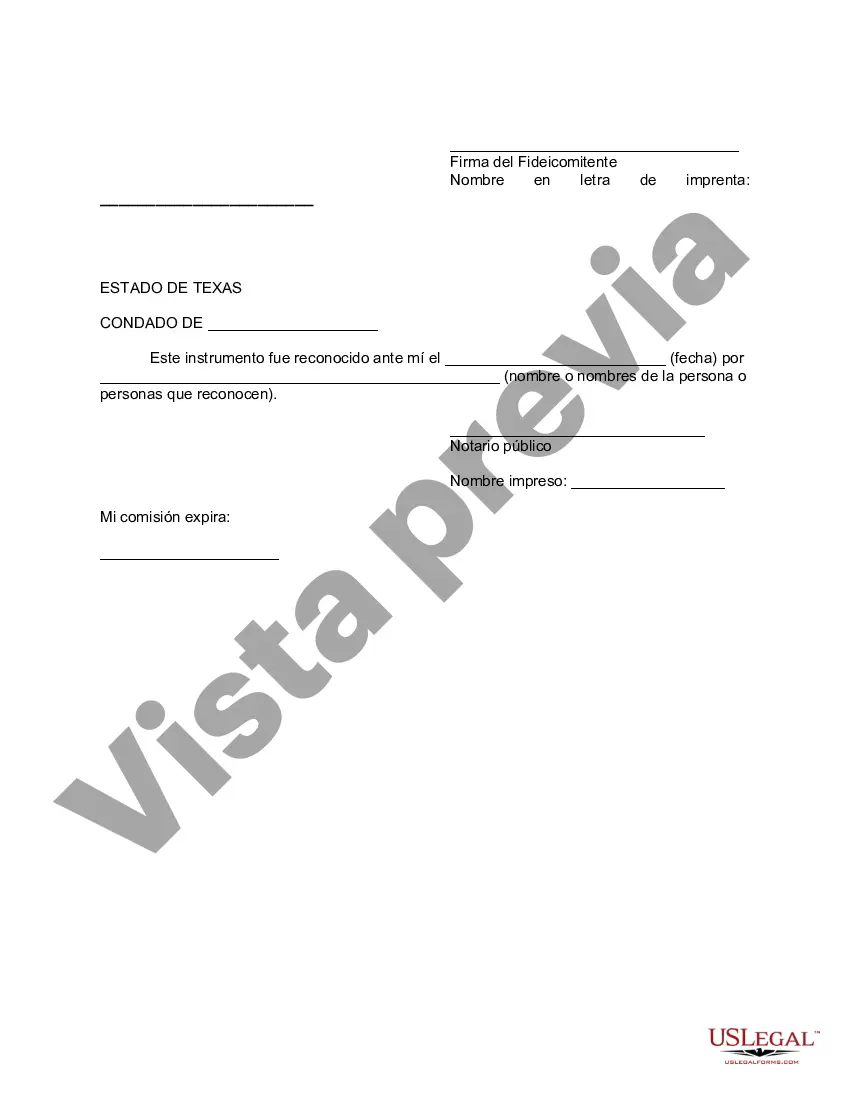

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Transferencia de cuenta financiera a fideicomiso en vida - Texas Financial Account Transfer to Living Trust

State:

Texas

County:

Travis

Control #:

TX-E0178C

Format:

Word

Instant download

Description

Formulario para transferir cuentas financieras a un fideicomiso en vida.

Travis Texas Financial Account Transfer to Living Trust is a process that involves transferring various types of financial accounts to a living trust set up by an individual or a couple. Living trusts are commonly used estate planning tools that help individuals manage and distribute their assets after their passing, in a way that avoids probate. By transferring financial accounts to a living trust, individuals can ensure a seamless transition of assets, maintain privacy, and potentially reduce estate taxes. There are several types of financial accounts that can be transferred to a living trust in Travis, Texas. Some common examples include: 1. Bank Accounts: This includes checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). By transferring these accounts to a living trust, individuals can designate multiple beneficiaries and ensure the smooth transfer of funds upon their passing. 2. Investment Accounts: This category encompasses brokerage accounts, stocks, bonds, mutual funds, and other investment instruments. Transferring investment accounts to a living trust can help protect these assets, provide flexibility in asset management, and streamline the distribution process. 3. Real Estate: While not directly considered a financial account, real estate properties can also be transferred to a living trust. By doing so, homeowners can ensure that their property is managed and distributed according to their wishes without going through probate. 4. Retirement Accounts: Retirement accounts such as IRA (Individual Retirement Account) or 401(k) plans can be transferred to a living trust, although the rules and tax implications surrounding these transfers can be complex. Seeking advice from a financial advisor or estate planning attorney is crucial when dealing with retirement accounts. 5. Life Insurance Policies: Although life insurance policies cannot be directly transferred to a living trust, they can be designated as assets to the trust. This allows for efficient management and distribution of the insurance proceeds. It is important to note that the process of transferring financial accounts to a living trust may require specific legal documents, such as an "Assignment of Assets" or "Transfer on Death" forms, depending on the type of account. Seeking professional guidance from an attorney who specializes in estate planning is highly recommended ensuring all legal requirements are met. Overall, Travis Texas Financial Account Transfer to Living Trust provides individuals with a comprehensive and efficient way to manage their assets during their lifetime and ensure a seamless transfer to their beneficiaries upon their passing. Proper estate planning and consultation with professionals can ensure a smooth transition and maximize the benefits of a living trust for individuals and their loved ones in Travis, Texas.

Free preview

How to fill out Travis Texas Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you’ve already used our service before, log in to your account and save the Travis Texas Financial Account Transfer to Living Trust on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Travis Texas Financial Account Transfer to Living Trust. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!