Corpus Christi Texas Asignación a un fideicomiso en vida - Texas Assignment to Living Trust

State:

Texas

City:

Corpus Christi

Control #:

TX-E0178E

Format:

Word

Instant download

Description

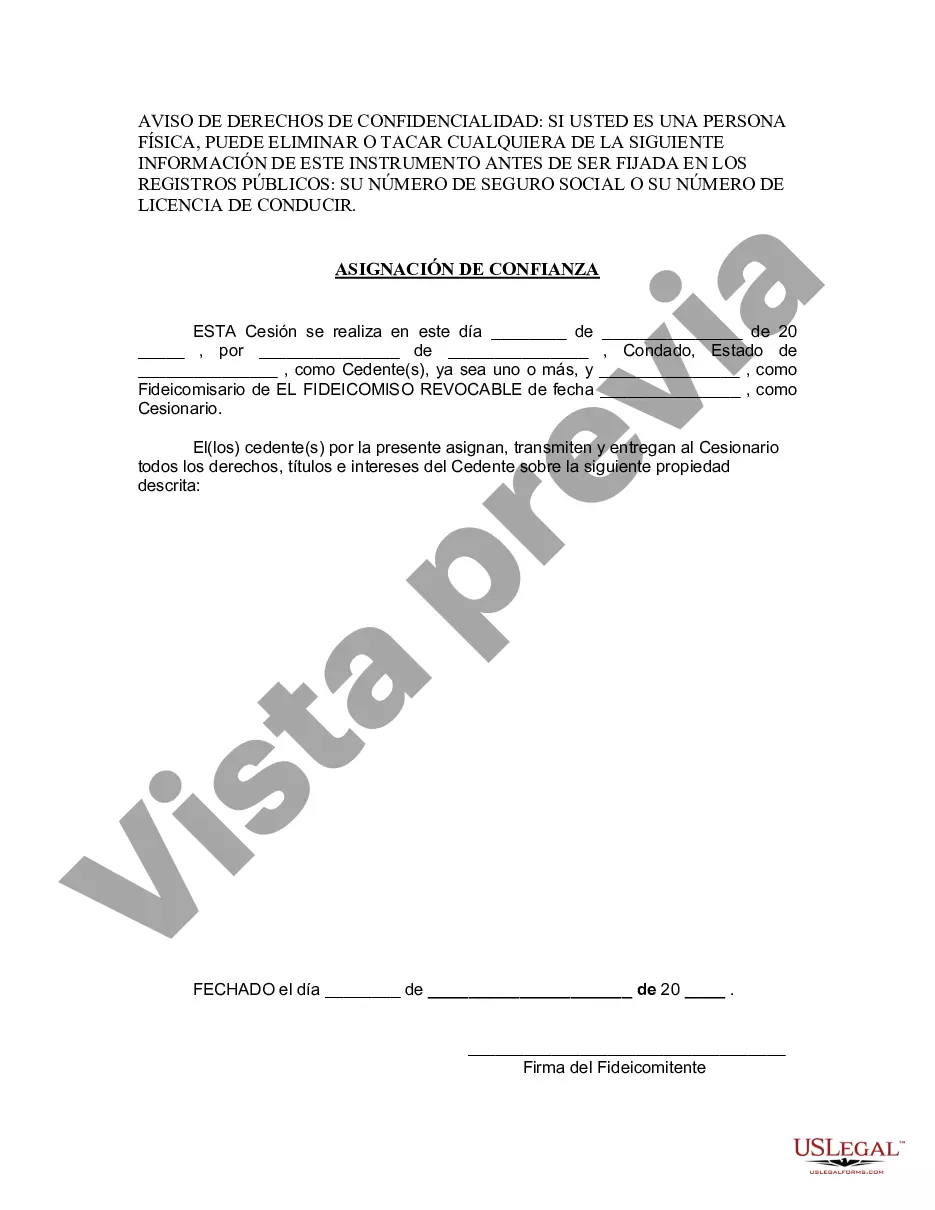

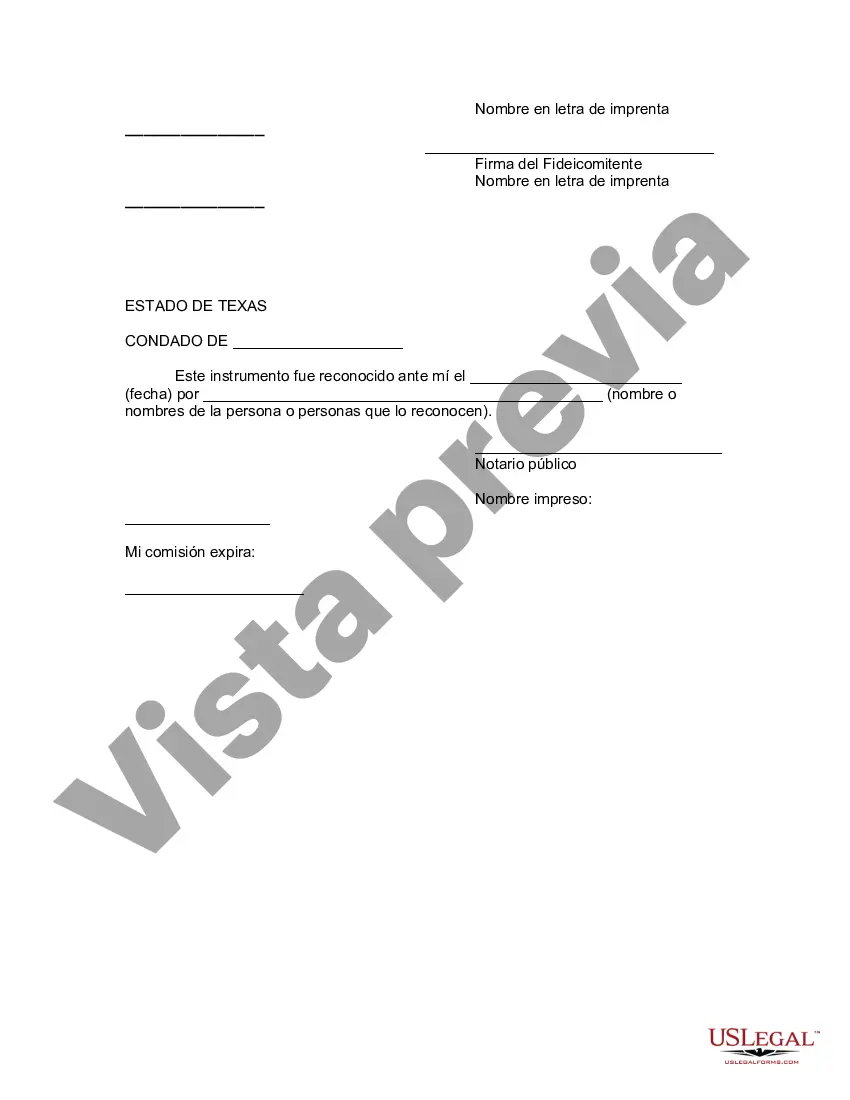

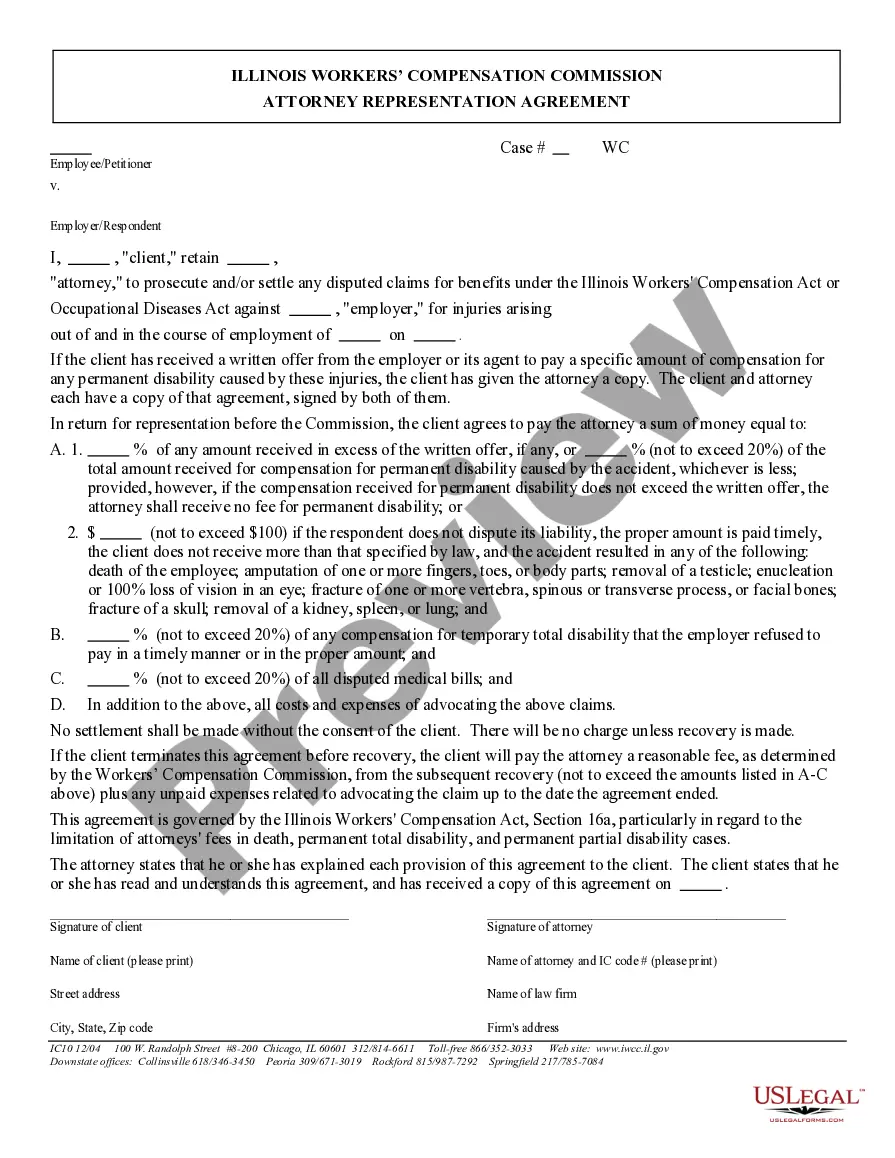

Formulario para la asignación de varios bienes a un fideicomiso en vida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.

Free preview

How to fill out Texas Asignación A Un Fideicomiso En Vida?

If you are seeking a pertinent form, it’s incredibly challenging to select a superior service than the US Legal Forms website – likely the most extensive online libraries.

Here you can obtain thousands of templates for commercial and personal purposes categorized by types and regions, or keywords.

With the excellent search function, finding the latest Corpus Christi Texas Assignment to Living Trust is as simple as 1-2-3.

Complete the transaction. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the template. Specify the file format and download it to your device.

- Furthermore, the significance of each document is validated by a team of professional attorneys who consistently evaluate the templates on our platform and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to acquire the Corpus Christi Texas Assignment to Living Trust is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, just adhere to the instructions below.

- Ensure you have located the form you desire. Review its details and utilize the Preview option (if available) to inspect its content. If it doesn’t fulfill your requirements, use the Search field near the top of the screen to find the suitable document.

- Confirm your selection. Hit the Buy now option. After that, select your desired pricing plan and submit details to create an account.