Title: Dallas Texas Assignment to Living Trust: A Comprehensive Overview Exploring Types, Benefits, and Process Introduction: Dallas, Texas Assignment to Living Trust is a crucial aspect of estate planning, allowing individuals to secure their assets and provide for their loved ones efficiently. In this article, we delve into the various aspects of Dallas Texas Assignment to Living Trust, including its definition, types, associated benefits, and the process involved. What is Dallas Texas Assignment to Living Trust? Dallas Texas Assignment to Living Trust refers to the legal process of transferring assets or property ownership from an individual to a trust while living, with the intention to distribute those assets to beneficiaries upon the granter's passing. The trust is created, funded, and managed by the granter, who designates a trustee responsible for administering the assets according to the trust's instructions. Types of Dallas Texas Assignment to Living Trusts: 1. Revocable Living Trust: This type of trust allows the granter to retain control over the assets during their lifetime. It can be modified, revoked, or amended as per the granter's wishes, providing ample flexibility. The assets held under a revocable living trust bypass probate upon the granter's death, ensuring a quicker and more private distribution to beneficiaries. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be dissolved or modified without the consent of its beneficiaries. Once assets are transferred to this trust, the granter relinquishes ownership and control. However, irrevocable living trusts provide significant asset protection, estate tax advantages, and protect assets from creditor claims. Benefits of Dallas Texas Assignment to Living Trust: 1. Avoiding Probate: By transferring assets to a living trust, individuals can bypass the potentially lengthy and costly probate process, ensuring swift distribution to beneficiaries. 2. Privacy: Unlike probate, which is a public process, assets within a living trust remain private, preserving confidentiality. 3. Incapacity Planning: Living trusts include incapacity provisions, allowing a successor trustee to step in and manage assets in case of the granter's incapacitation, preventing the need for court-appointed guardianship. 4. Minimize Estate Taxes: Proper planning within the living trust structure can help minimize or eliminate estate taxes, ensuring more of the estate is preserved for beneficiaries. 5. Asset Protection: Irrevocable living trusts offer an additional layer of protection against creditors and lawsuits that may arise during the granter's lifetime. Process of Dallas Texas Assignment to Living Trust: 1. Consultation: Seek professional legal counsel experienced in estate planning, who will help create a customized living trust based on your unique circumstances and goals. 2. Asset Evaluation: Determine which assets will be placed within the living trust, such as real estate, bank accounts, investments, life insurance policies, and more. 3. Trust Formation: Create the trust agreement, naming the trustee, beneficiaries, and instructions for asset management and distribution. 4. Funding: Transfer assets into the trust by changing titles and beneficiaries, updating relevant documentation. 5. Trust Administration: The designated trustee manages and distributes assets according to the trust's terms during the granter's lifetime and upon their passing. Conclusion: Dallas Texas Assignment to Living Trust is an essential estate planning tool that offers a range of benefits, including probate avoidance, privacy, incapacity planning, and asset protection. By understanding the different types of living trusts and engaging in a well-structured process with professional legal guidance, individuals can secure their assets, streamline the distribution process, and provide for their loved ones seamlessly in the future.

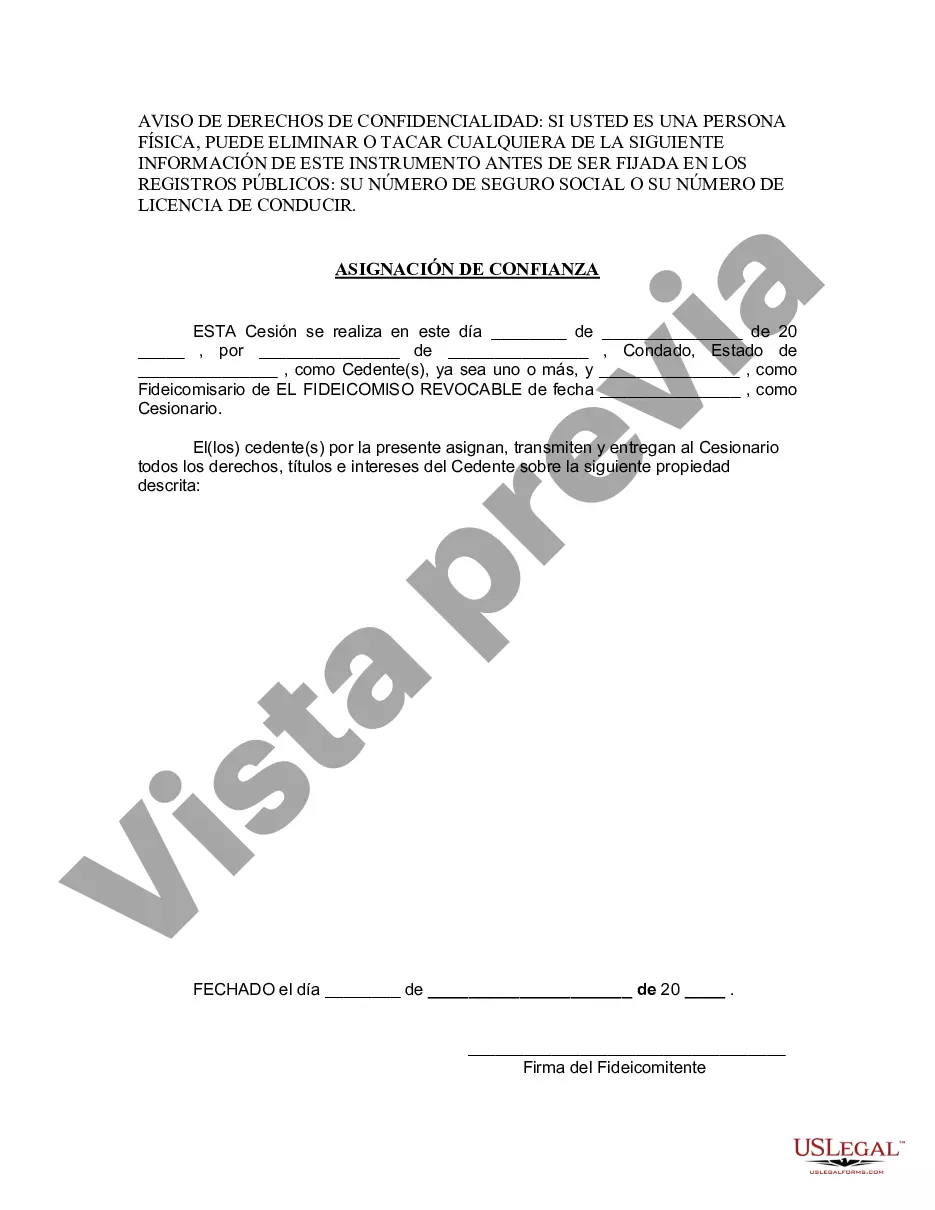

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Asignación a un fideicomiso en vida - Texas Assignment to Living Trust

Description

How to fill out Dallas Texas Asignación A Un Fideicomiso En Vida?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal services that, as a rule, are very expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of an attorney. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Dallas Texas Assignment to Living Trust or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Dallas Texas Assignment to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Dallas Texas Assignment to Living Trust is suitable for your case, you can select the subscription option and proceed to payment.

- Then you can download the document in any suitable format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!