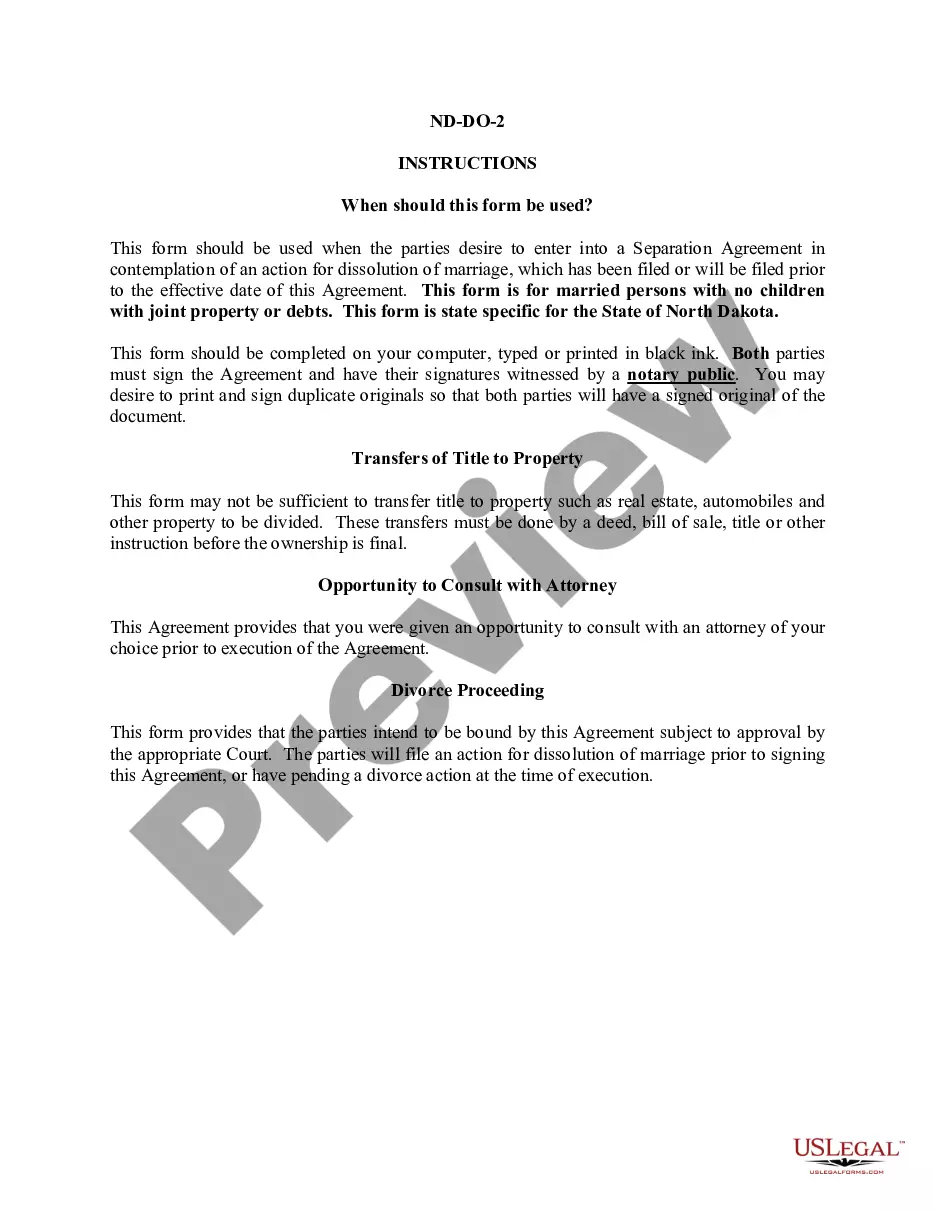

A living trust in Grand Prairie, Texas, is a legal document that allows individuals to transfer their assets to a trust during their lifetime and specify how the assets should be managed and distributed after their death. This assignment to a living trust enables individuals to ensure their assets are protected and distributed according to their wishes, while also avoiding the probate process. There are various types of Grand Prairie, Texas assignments to living trusts, including: 1. Revocable Living Trust: This is the most common type of living trust in which the trust creator retains the flexibility to modify or revoke the trust during their lifetime. The assets in the trust are managed by the trustee, who can be the trust creator or another designated individual. 2. Irrevocable Living Trust: In this type of living trust, the terms and conditions cannot be changed or revoked once the trust is established. Assets transferred to an irrevocable living trust may be protected from estate taxes, creditor claims, and other liabilities. 3. Testamentary Living Trust: This trust is created within a Last Will and Testament and only takes effect after the individual's death. It allows individuals to provide detailed instructions on how their assets should be managed and distributed after they pass away. 4. Special Needs Living Trust: This type of living trust is specifically designed to provide for the ongoing care of a loved one with special needs. It ensures that the individual's assets are managed appropriately to enhance their quality of life without jeopardizing government benefits like Medicaid or Supplemental Security Income (SSI). 5. Charitable Living Trust: Individuals who wish to leave a portion of their assets to a charitable organization may opt for this type of living trust. It allows them to support a cause they care about while potentially obtaining certain tax advantages. When establishing a Grand Prairie, Texas assignment to a living trust, individuals should consult with an experienced estate planning attorney who can guide them through the process. The attorney will help ensure that the trust is created and funded correctly, minimize tax implications, and ensure the chosen beneficiaries receive their intended inheritances. By considering a living trust assignment, individuals can have peace of mind knowing their assets will be handled according to their wishes, even after they pass away.

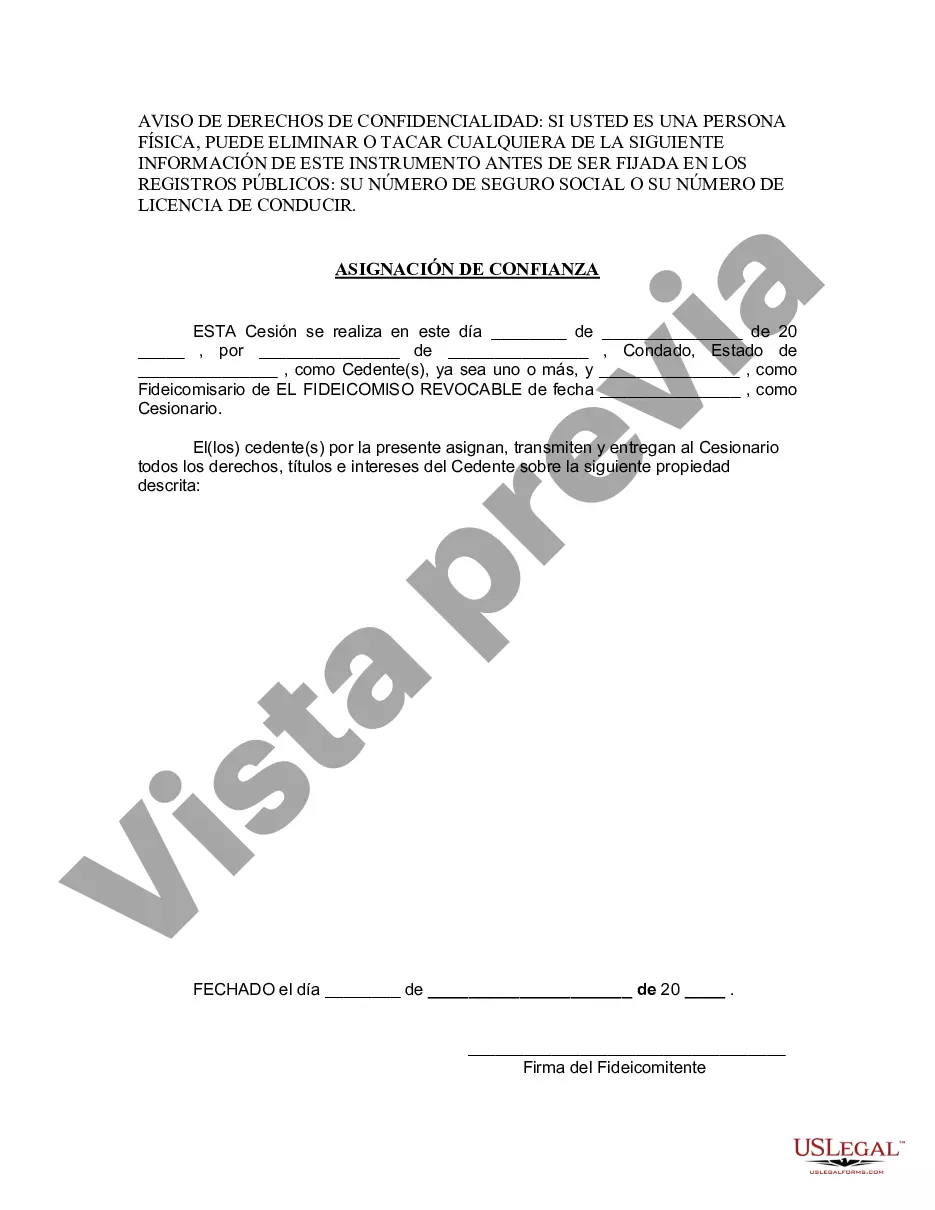

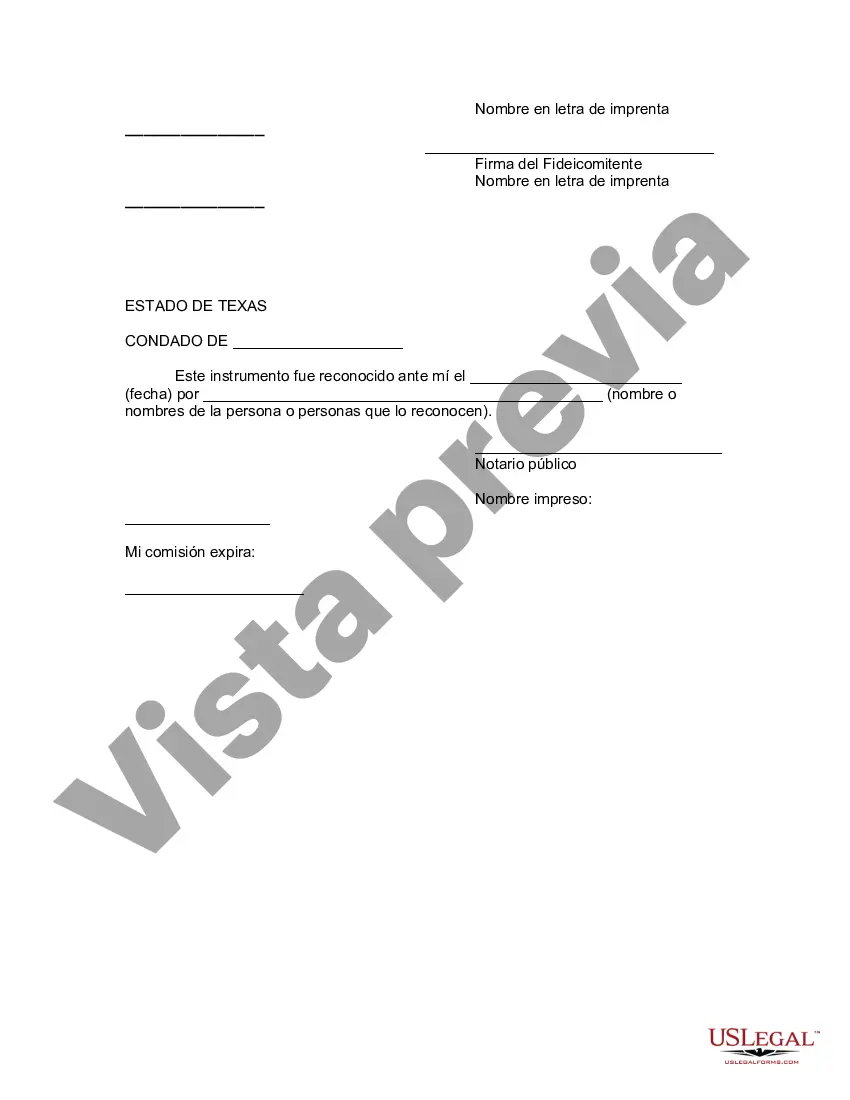

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Grand Prairie Texas Asignación a un fideicomiso en vida - Texas Assignment to Living Trust

State:

Texas

City:

Grand Prairie

Control #:

TX-E0178E

Format:

Word

Instant download

Description

Formulario para la asignación de varios bienes a un fideicomiso en vida.

Free preview

How to fill out Grand Prairie Texas Asignación A Un Fideicomiso En Vida?

Take advantage of the US Legal Forms and gain immediate access to any form template you need.

Our advantageous platform, featuring a vast array of document templates, streamlines the process of locating and acquiring nearly any document sample you require.

You can export, complete, and sign the Grand Prairie Texas Assignment to Living Trust within minutes instead of spending hours online trying to find a suitable template.

Using our catalog is an excellent way to enhance the security of your form submissions.

If you haven’t registered for an account yet, follow the instructions below.

Feel free to utilize our platform fully and make your document experience as seamless as possible!

- Our experienced attorneys frequently review all documents to guarantee that the forms are appropriate for a specific state and adhere to new laws and regulations.

- How can you acquire the Grand Prairie Texas Assignment to Living Trust.

- If you already have an account, simply Log In to your profile.

- The Download button will be visible on every document you view.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

Interesting Questions

More info

Read the selection and choose the best answer to each question. Then fill in the answer on your answer document.She brought home a form which read Assignment of Property to Revocable Trust is this it? Also, if I use Quicken Willmaker which form do I use? Team directly responsible for the inmates living in the unit. Completing the questionnaire takes approximately 15 minutes. In this story, a woman and her child leave Mexico to live in the United States. When they arrive in the U.S., they have very difficult … Grade 1. Teachers didn't assign much work for them to complete, the Dallas ISD mother said. "I don't think the schools were prepared," Gutierrez said.