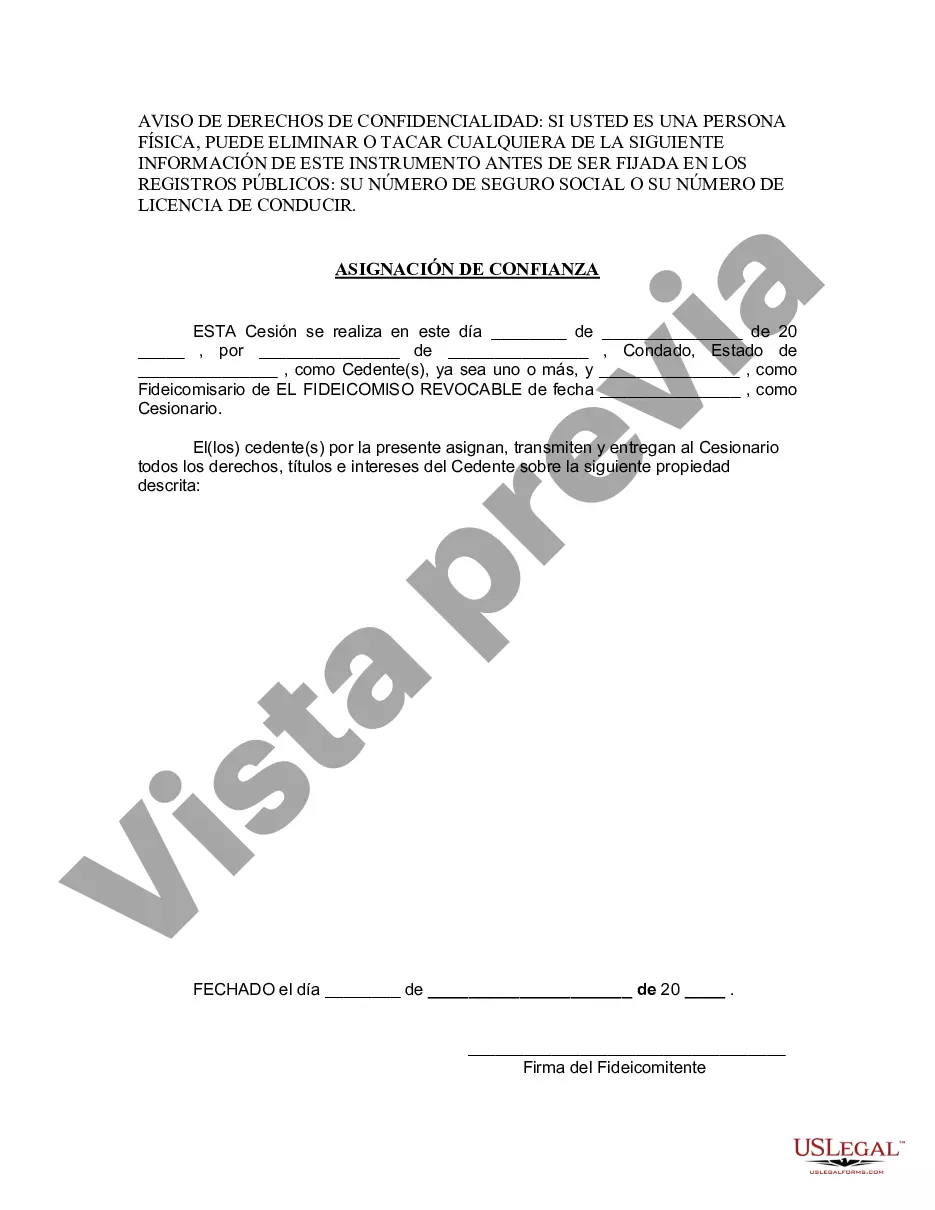

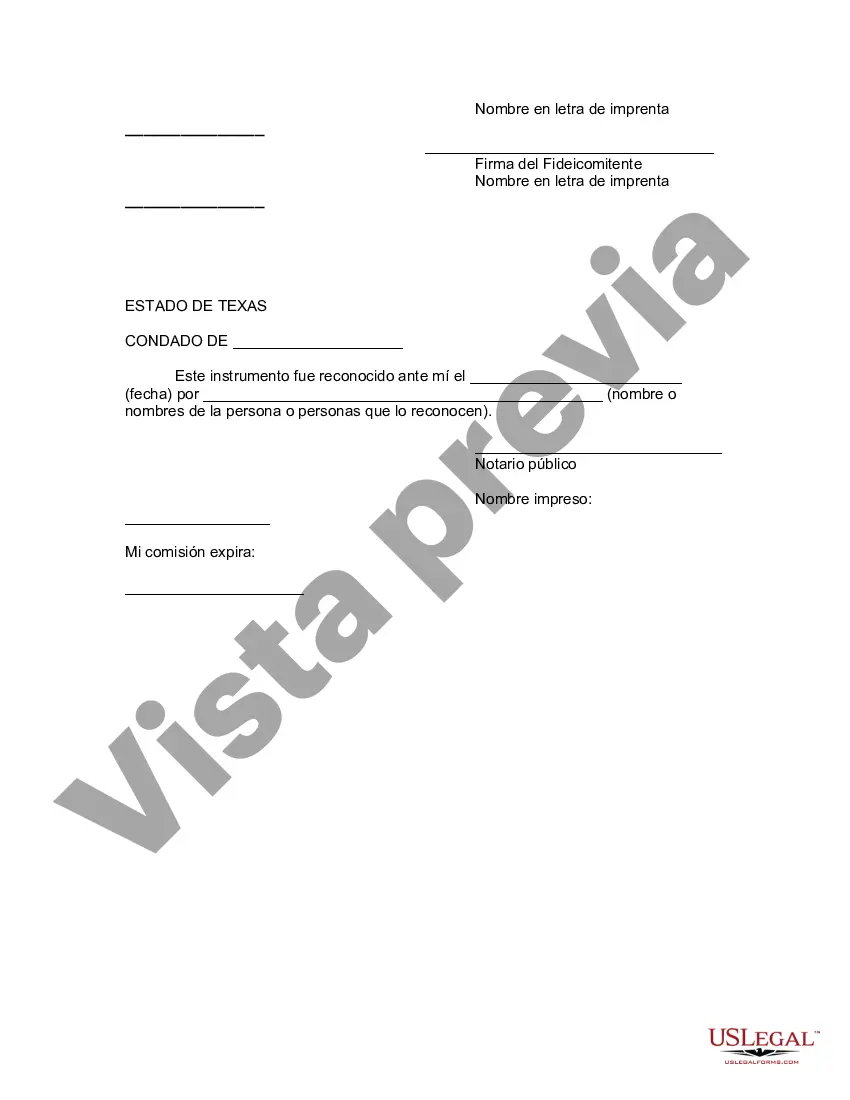

Laredo, Texas Assignment to Living Trust: A Comprehensive Guide to Securing Your Assets In Laredo, Texas, residents have the opportunity to protect their assets and ensure the smooth transfer of their estate through a legal arrangement called the Assignment to Living Trust. This powerful tool allows individuals to assign their assets, such as properties, bank accounts, and investments, into a trust while still maintaining control and benefitting from them during their lifetime. Let's explore this topic in detail and shed light on the different types of Laredo, Texas Assignment to Living Trust available. What is an Assignment to Living Trust? An Assignment to Living Trust, commonly known as a living trust or revocable trust, is a legal document that enables individuals to transfer their assets into a trust, managed by a trustee, for the purpose of estate planning and avoiding probate. Unlike a will, which takes effect only after death, a living trust becomes effective from the moment it is created, providing a seamless transition of assets while granting greater control over distribution. Key Benefits of Laredo, Texas Assignment to Living Trust: 1. Probate Avoidance: One of the primary advantages of establishing a living trust in Laredo, Texas, is avoiding probate. Through this process, assets held in a trust can bypass the lengthy and potentially expensive probate proceedings, offering privacy and efficiency to your loved ones during the estate distribution process. 2. Flexibility and Control: The Assignment to Living Trust allows the settler (the person creating the trust) to retain control over their assets during their lifetime. They can manage, modify, or even revoke the trust as long as they are mentally competent. This feature makes it a versatile tool for financial planning and adaptation to life circumstances. 3. Incapacity Planning: In case of mental or physical incapacitation, the living trust provides a mechanism for the seamless management of assets by a successor trustee designated by the settler. This ensures the continuity of financial affairs without the need for court intervention, conservatorship, or guardianship proceedings. 4. Privacy Protection: Unlike a will, which becomes a public document upon probate, the living trust maintains utmost privacy. This way, the details of your estate and distribution are kept confidential, shielding your family from potential public scrutiny or external interference. Types of Laredo, Texas Assignment to Living Trust: 1. Individual Living Trust: This is the most common type of living trust, where a single person creates a trust for the management and distribution of their assets upon death or incapacitation. 2. Joint Living Trust: A joint living trust is designed for married or committed couples who wish to combine their assets into one trust. This type of trust provides seamless asset management and distribution for both partners during their lifetimes and after. 3. Testamentary Trust: Although technically not a living trust, it's worth mentioning that Laredo, Texas residents can also create a testamentary trust within their will. This trust only takes effect after the settler's death and allows for the continued management and distribution of assets following their wishes. Creating an Assignment to Living Trust in Laredo, Texas is an astute decision to protect your assets, streamline probate, and ensure a hassle-free transfer of wealth to your loved ones. Consider consulting with an experienced estate planning attorney who can guide you through the process, tailor the trust to your unique circumstances, and secure your financial future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Laredo Texas Asignación a un fideicomiso en vida - Texas Assignment to Living Trust

Description

How to fill out Laredo Texas Asignación A Un Fideicomiso En Vida?

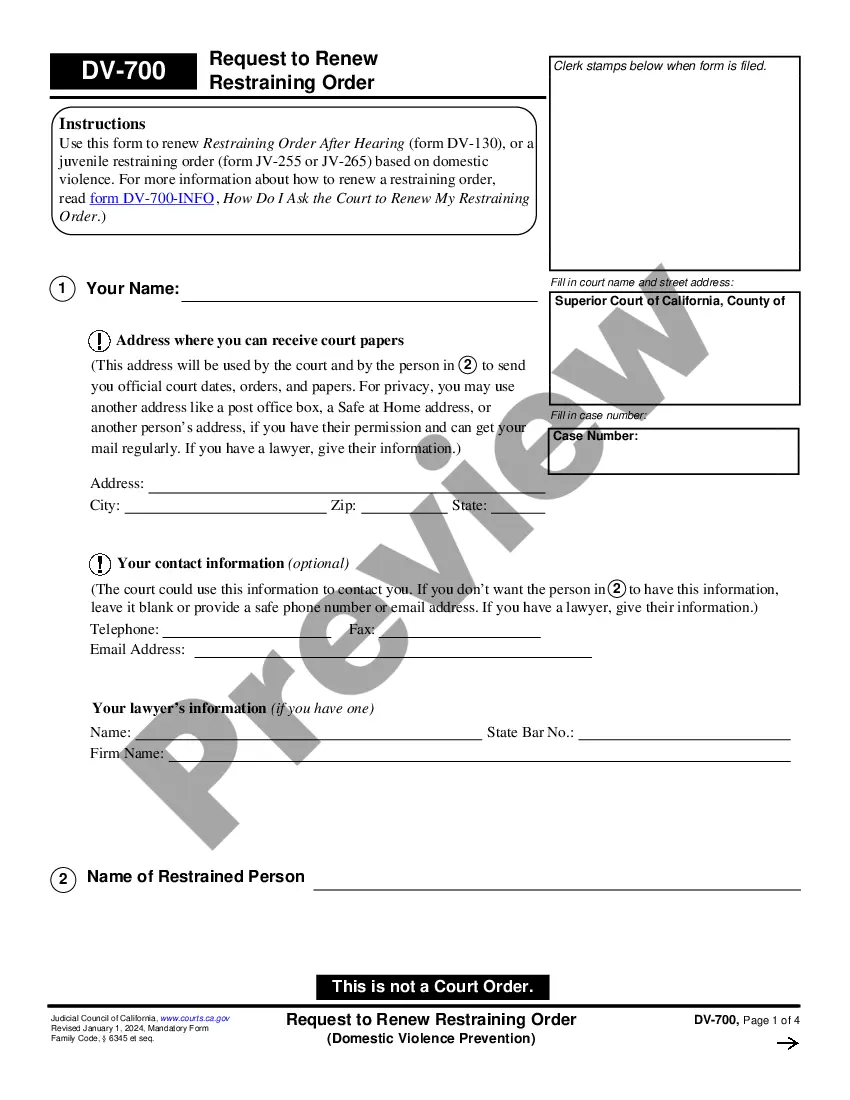

Do you need a reliable and inexpensive legal forms supplier to get the Laredo Texas Assignment to Living Trust? US Legal Forms is your go-to solution.

No matter if you need a basic arrangement to set rules for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of specific state and area.

To download the document, you need to log in account, find the needed form, and click the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Laredo Texas Assignment to Living Trust conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to find out who and what the document is good for.

- Start the search over if the form isn’t suitable for your specific scenario.

Now you can create your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the Laredo Texas Assignment to Living Trust in any provided format. You can return to the website when you need and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending hours learning about legal paperwork online once and for all.