Plano Texas Assignment to Living Trust: A Comprehensive Guide to Securing Your Assets Introduction: The Plano Texas Assignment to Living Trust is a legal document that plays a vital role in estate planning. This assignment allows individuals residing in Plano, Texas, to transfer their assets into a trust, maximizing control, privacy, and flexibility over the distribution of their property during their lifetime and after their demise. This detailed description aims to provide an overview of the Plano Texas Assignment to Living Trust, its benefits, and some notable types found in the region. What is a Living Trust? A living trust, also known as an inter vivos trust, is a legal document that enables individuals (trustees, granters) to transfer their assets to a separate legal entity, known as a trust. In a living trust, the granter appoints a trustee, who is responsible for managing and distributing the assets to the beneficiaries as specified in the trust agreement. Unlike a will, a living trust comes into effect immediately upon its creation and can be modified or revoked during the granter's lifetime. Benefits of Plano Texas Assignment to Living Trust: 1. Avoiding Probate: One of the key advantages of the Plano Texas Assignment to Living Trust is that it allows assets to bypass the probate process, saving time and money for both the granter and the beneficiaries. 2. Privacy: Unlike probate, which is a public process, the Plano Texas Assignment to Living Trust maintains privacy as the trust agreement does not become a matter of public record. 3. Incapacity Protection: The living trust includes provisions to appoint a successor trustee who can seamlessly take control of managing the granter's assets in case of their incapacity. 4. Flexibility and Control: Living trusts offer greater control over the distribution of assets, allowing granters to specify detailed instructions for how and when beneficiaries receive their shares. 5. Minimization of Estate Taxes: Certain types of Plano Texas Assignment to Living Trusts can be structured strategically to minimize estate taxes, benefiting both the granter and their beneficiaries. Types of Plano Texas Assignment to Living Trust: 1. Revocable Living Trust: This type of trust allows the granter to retain full control over the assets during their lifetime. It can be modified, amended, or revoked as per the granter's wishes. 2. Irrevocable Living Trust: In contrast to the revocable living trust, the granter relinquishes ownership and control over the assets transferred to the trust. Once established, it can only be modified or revoked with the consent of the beneficiaries. 3. Marital Trust: This trust type is commonly used by couples to provide financial security for the surviving spouse after the granter's death while preserving the remaining assets for the ultimate beneficiaries. 4. Testamentary Trust: Unlike the aforementioned living trusts, a testamentary trust is created through a will, which only becomes effective upon the granter's death. This trust is often established to provide for minor children or individuals with special needs. Conclusion: For Plano, Texas residents seeking a comprehensive estate planning solution, the Plano Texas Assignment to Living Trust offers numerous benefits over traditional will-based planning. With the ability to avoid probate, maintain privacy, and exercise greater control, a living trust provides peace of mind for both granters and beneficiaries. Understanding the different types of living trusts, such as revocable, irrevocable, marital, and testamentary trusts, can help individuals customize their trust to align with their unique circumstances and estate planning goals. Seek the guidance of a qualified estate planning attorney in Plano, Texas, to draft and establish a living trust that suits your specific needs.

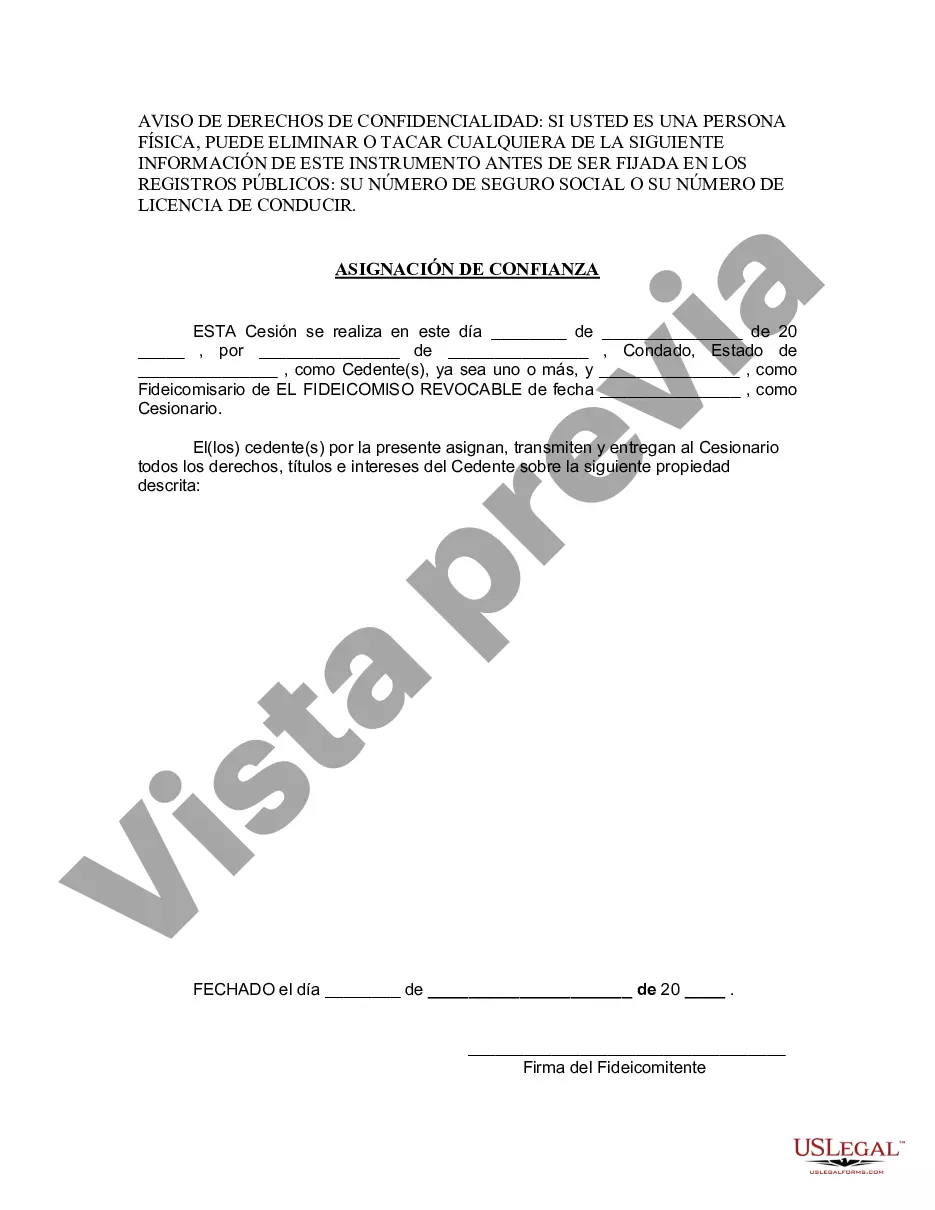

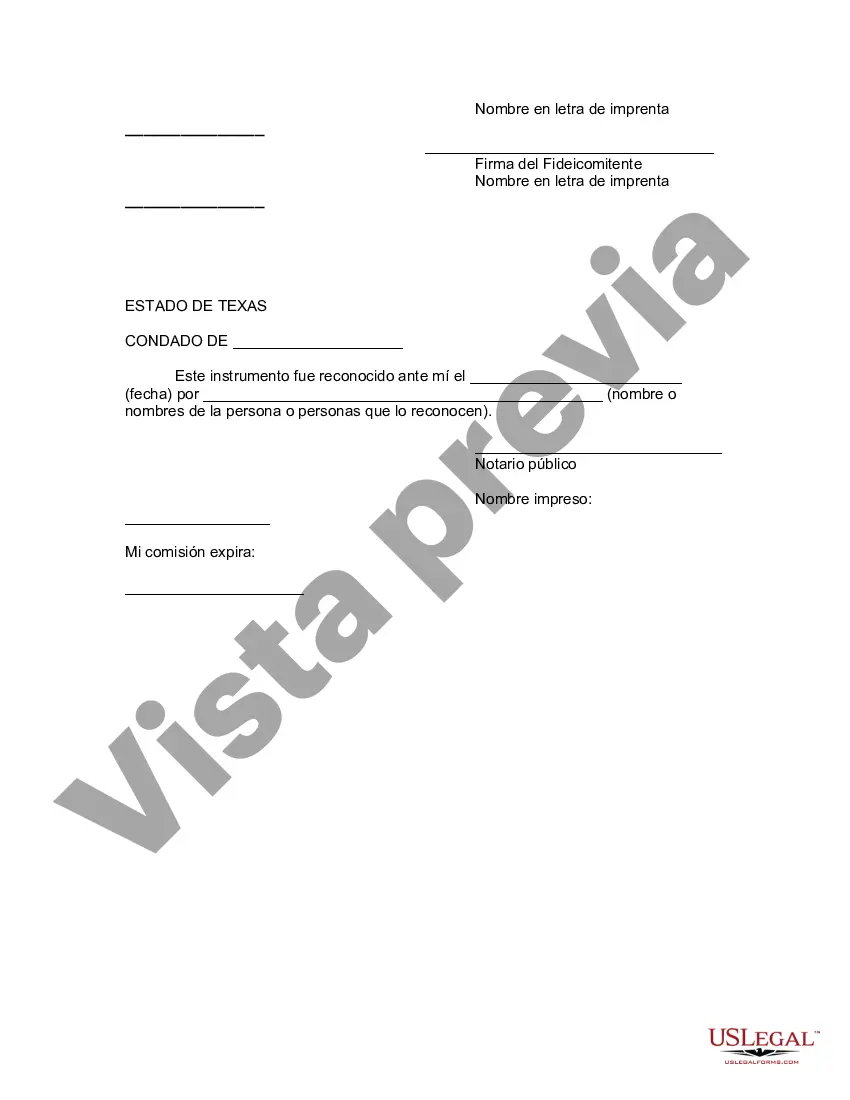

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Plano Texas Asignación a un fideicomiso en vida - Texas Assignment to Living Trust

State:

Texas

City:

Plano

Control #:

TX-E0178E

Format:

Word

Instant download

Description

Formulario para la asignación de varios bienes a un fideicomiso en vida.

Plano Texas Assignment to Living Trust: A Comprehensive Guide to Securing Your Assets Introduction: The Plano Texas Assignment to Living Trust is a legal document that plays a vital role in estate planning. This assignment allows individuals residing in Plano, Texas, to transfer their assets into a trust, maximizing control, privacy, and flexibility over the distribution of their property during their lifetime and after their demise. This detailed description aims to provide an overview of the Plano Texas Assignment to Living Trust, its benefits, and some notable types found in the region. What is a Living Trust? A living trust, also known as an inter vivos trust, is a legal document that enables individuals (trustees, granters) to transfer their assets to a separate legal entity, known as a trust. In a living trust, the granter appoints a trustee, who is responsible for managing and distributing the assets to the beneficiaries as specified in the trust agreement. Unlike a will, a living trust comes into effect immediately upon its creation and can be modified or revoked during the granter's lifetime. Benefits of Plano Texas Assignment to Living Trust: 1. Avoiding Probate: One of the key advantages of the Plano Texas Assignment to Living Trust is that it allows assets to bypass the probate process, saving time and money for both the granter and the beneficiaries. 2. Privacy: Unlike probate, which is a public process, the Plano Texas Assignment to Living Trust maintains privacy as the trust agreement does not become a matter of public record. 3. Incapacity Protection: The living trust includes provisions to appoint a successor trustee who can seamlessly take control of managing the granter's assets in case of their incapacity. 4. Flexibility and Control: Living trusts offer greater control over the distribution of assets, allowing granters to specify detailed instructions for how and when beneficiaries receive their shares. 5. Minimization of Estate Taxes: Certain types of Plano Texas Assignment to Living Trusts can be structured strategically to minimize estate taxes, benefiting both the granter and their beneficiaries. Types of Plano Texas Assignment to Living Trust: 1. Revocable Living Trust: This type of trust allows the granter to retain full control over the assets during their lifetime. It can be modified, amended, or revoked as per the granter's wishes. 2. Irrevocable Living Trust: In contrast to the revocable living trust, the granter relinquishes ownership and control over the assets transferred to the trust. Once established, it can only be modified or revoked with the consent of the beneficiaries. 3. Marital Trust: This trust type is commonly used by couples to provide financial security for the surviving spouse after the granter's death while preserving the remaining assets for the ultimate beneficiaries. 4. Testamentary Trust: Unlike the aforementioned living trusts, a testamentary trust is created through a will, which only becomes effective upon the granter's death. This trust is often established to provide for minor children or individuals with special needs. Conclusion: For Plano, Texas residents seeking a comprehensive estate planning solution, the Plano Texas Assignment to Living Trust offers numerous benefits over traditional will-based planning. With the ability to avoid probate, maintain privacy, and exercise greater control, a living trust provides peace of mind for both granters and beneficiaries. Understanding the different types of living trusts, such as revocable, irrevocable, marital, and testamentary trusts, can help individuals customize their trust to align with their unique circumstances and estate planning goals. Seek the guidance of a qualified estate planning attorney in Plano, Texas, to draft and establish a living trust that suits your specific needs.

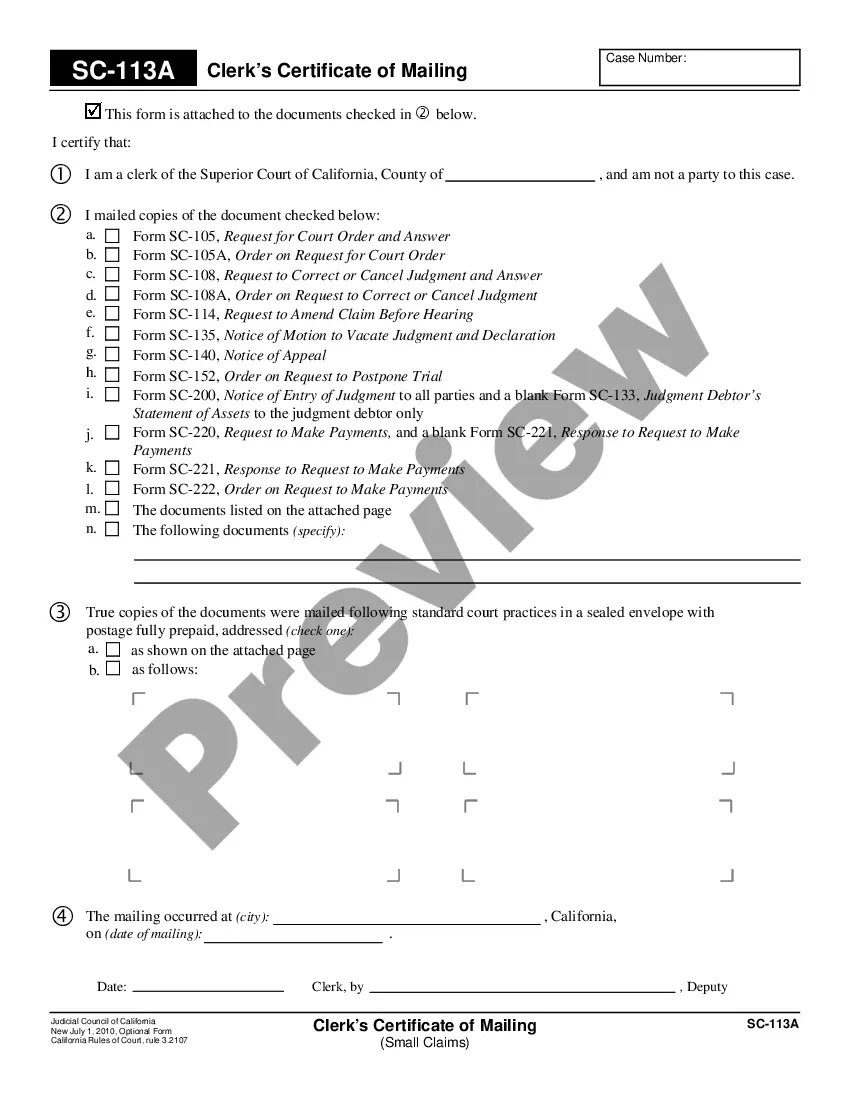

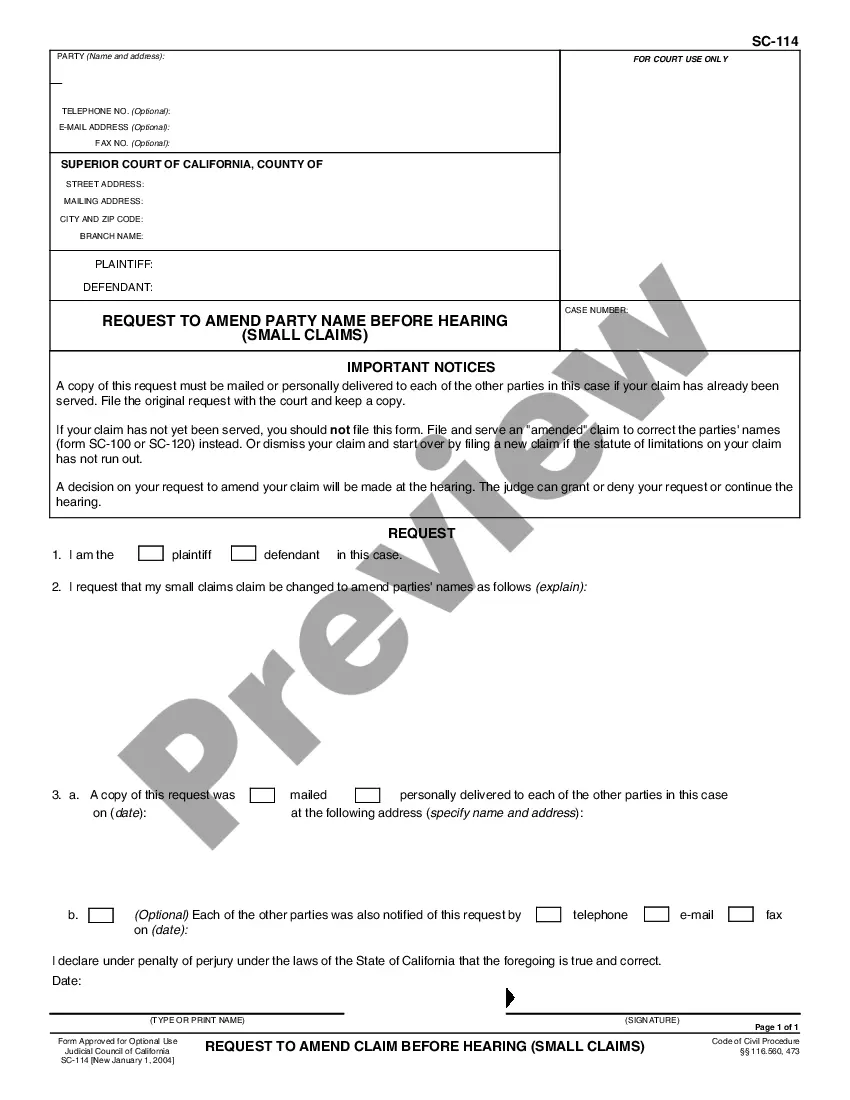

Free preview

How to fill out Plano Texas Asignación A Un Fideicomiso En Vida?

If you’ve already utilized our service before, log in to your account and save the Plano Texas Assignment to Living Trust on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Plano Texas Assignment to Living Trust. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!