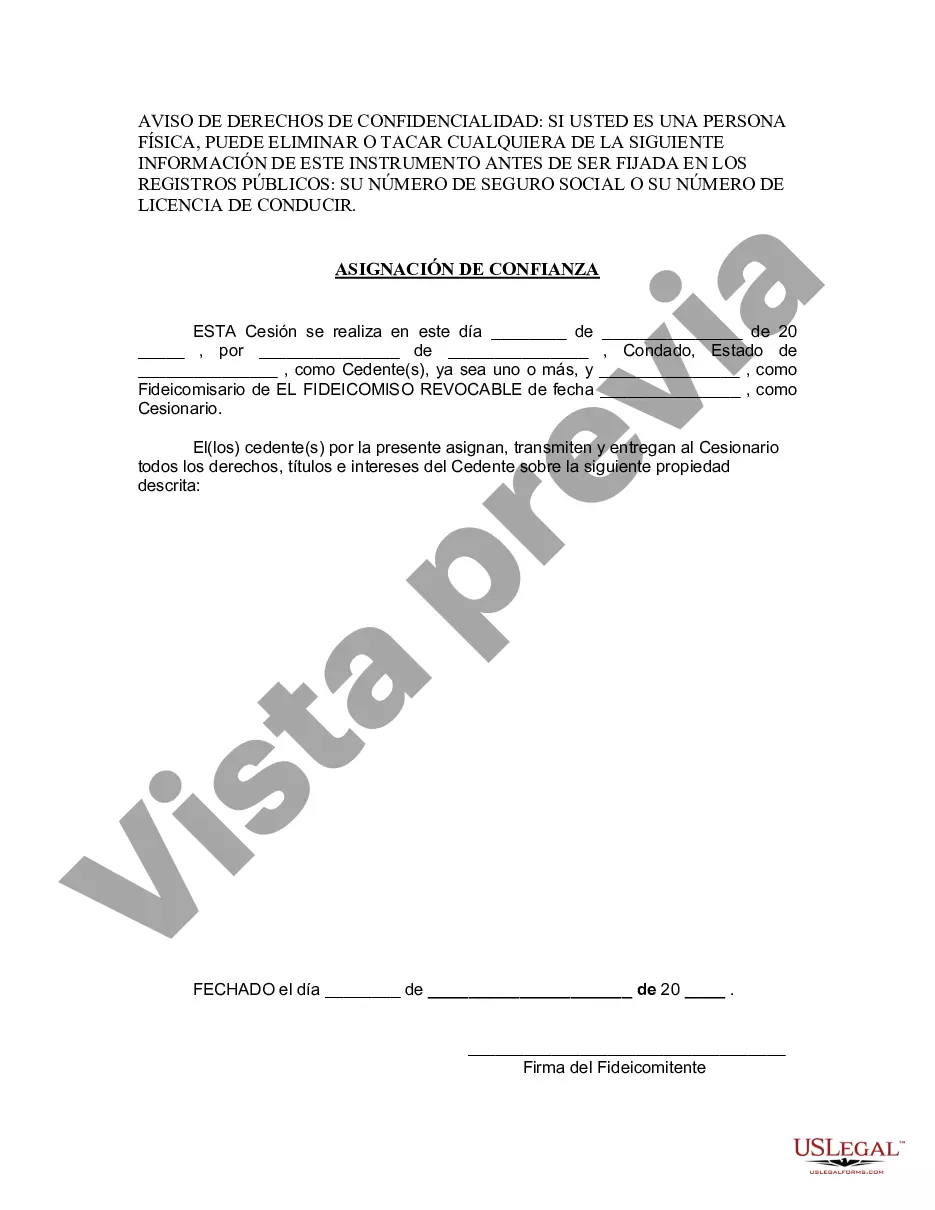

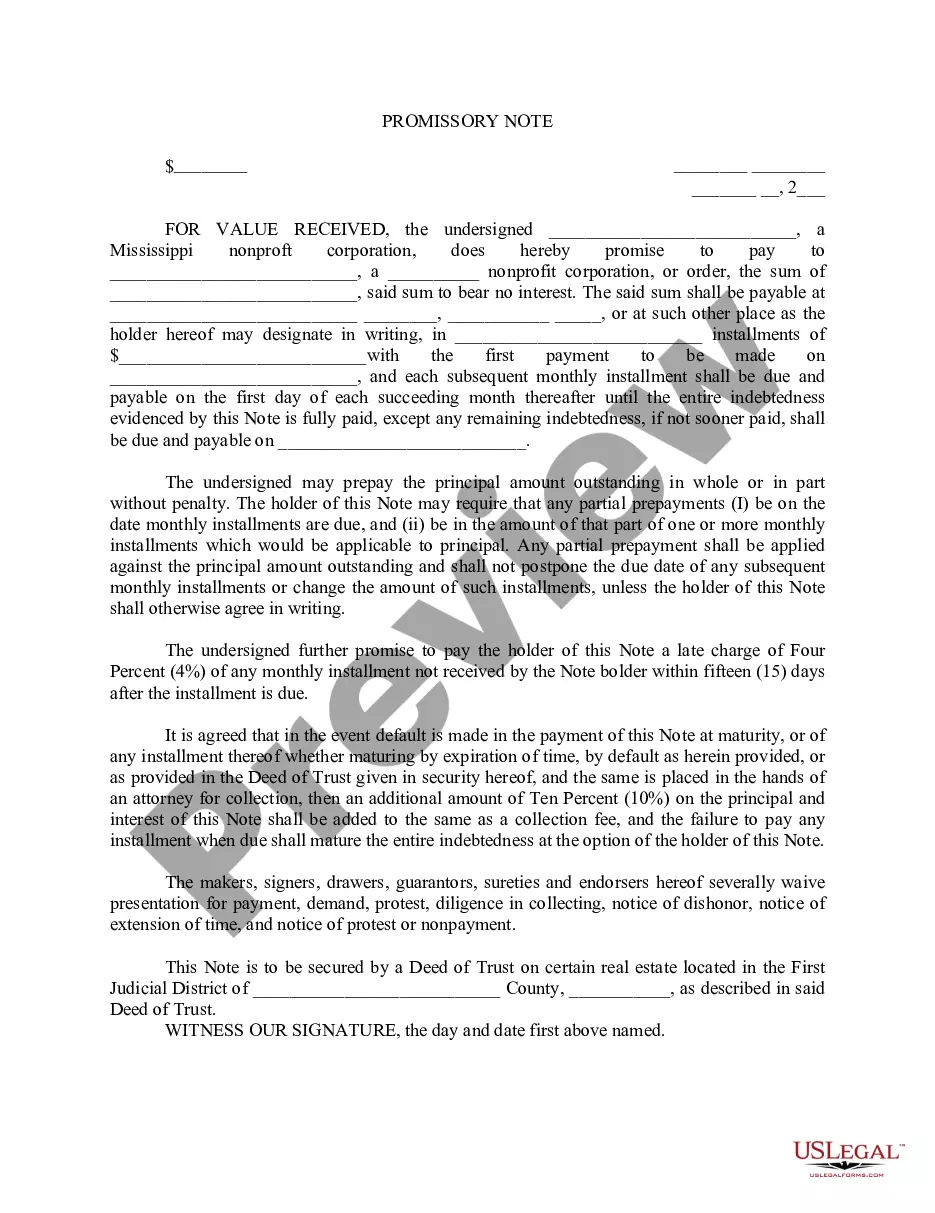

A living trust is a legal document that allows an individual to transfer their assets into a trust during their lifetime. In Wichita Falls, Texas, an Assignment to Living Trust refers to the process of transferring property ownership from an individual to a trust established for their benefit. This assignment ensures that the assets held in the trust will be managed and distributed according to the wishes of the trust creator, also known as the granter or settler. The process of assigning assets to a living trust in Wichita Falls involves drafting a trust document, designating a trustee, identifying the trust beneficiaries, and transferring the ownership of assets from the granter to the trust. This transfer typically requires executing various legal documents, such as deeds for real estate, assignments for personal property, and specific language in financial accounts or insurance policies. There are different types of living trusts that residents of Wichita Falls, Texas, may consider: 1. Revocable Living Trust: This is the most common type of living trust, allowing the granter to retain control and make changes to the trust during their lifetime. In the case of a revocable living trust, the granter can amend, modify, or even revoke the trust entirely as long as they are mentally capable. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be changed or revoked once it has been established. This type of trust provides more asset protection from creditors and can be used for estate tax planning as the assets are technically no longer considered part of the granter's estate. 3. Testamentary Trust: This type of trust is created through a will and does not take effect until the granter's death. It allows the granter to have control over the distribution of assets after their passing. In Wichita Falls, Texas, assets assigned to a testamentary trust go through the probate process before being distributed. 4. Special Needs Trust: This type of trust is designed to provide financial support and assistance to individuals with special needs or disabilities. It allows the granter to leave assets to a loved one without jeopardizing their eligibility for government benefits such as Medicaid or Supplemental Security Income (SSI). It is advisable for individuals in Wichita Falls, Texas, considering an Assignment to Living Trust to consult with an experienced attorney specializing in estate planning to understand the legal requirements and tax implications specific to their situation. Creating a living trust can help ensure the seamless management and distribution of assets, provide privacy, and potentially avoid the need for probate, saving time and costs for loved ones after the granter's passing.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wichita Falls Texas Asignación a un fideicomiso en vida - Texas Assignment to Living Trust

Description

How to fill out Wichita Falls Texas Asignación A Un Fideicomiso En Vida?

We always strive to reduce or avoid legal issues when dealing with nuanced law-related or financial affairs. To do so, we apply for legal solutions that, as a rule, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of a lawyer. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Wichita Falls Texas Assignment to Living Trust or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is equally easy if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Wichita Falls Texas Assignment to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Wichita Falls Texas Assignment to Living Trust is suitable for you, you can select the subscription option and proceed to payment.

- Then you can download the document in any available format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!