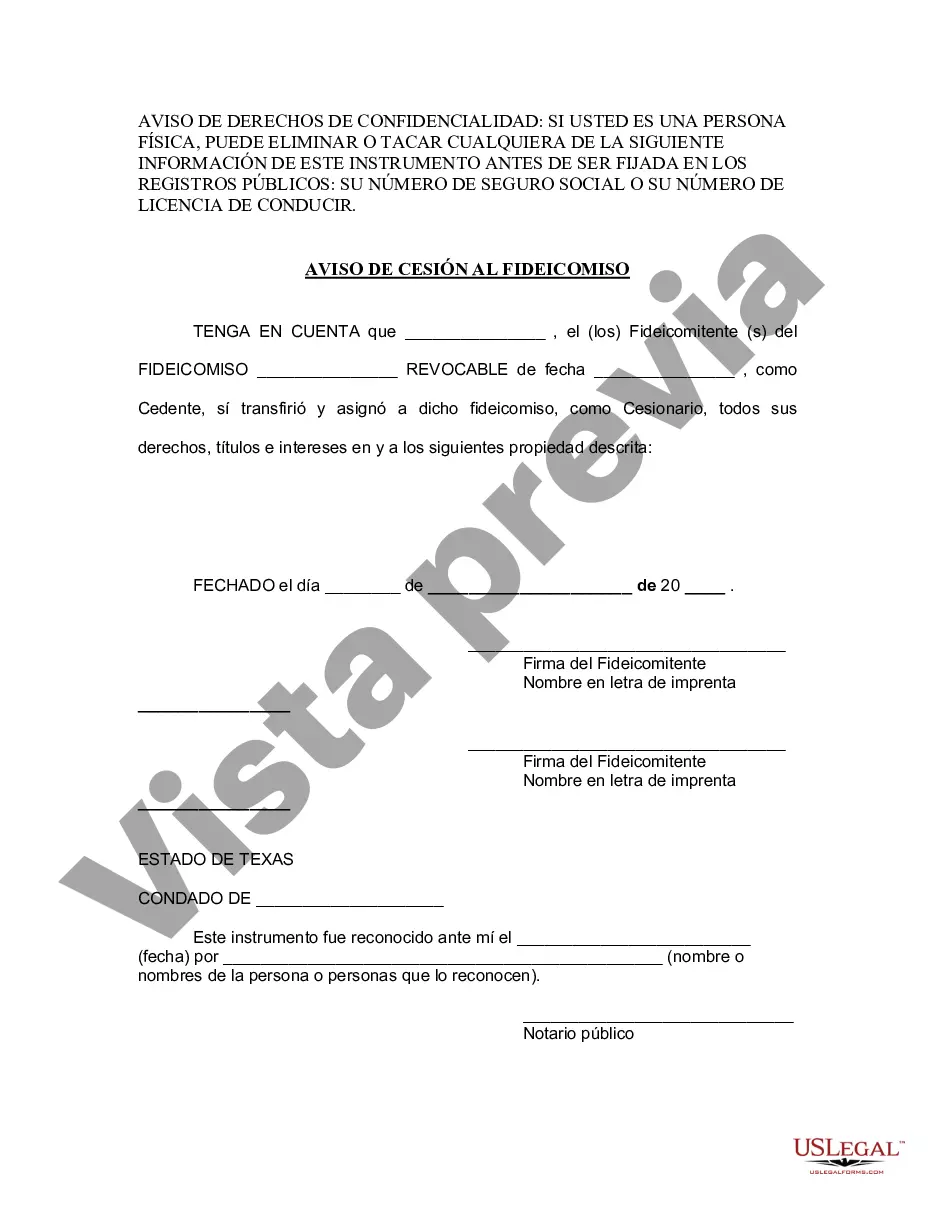

Title: Tarrant Texas Notice of Assignment to Living Trust — An Essential Overview Keywords: Tarrant Texas, Notice of Assignment, Living Trust, estate planning, asset protection, probate avoidance, legal document, revocable living trust, irrevocable living trust. Introduction: In Tarrant, Texas, a Notice of Assignment to Living Trust is a crucial legal document designed to facilitate smooth estate planning and asset distribution while providing various benefits such as privacy, probate avoidance, and asset protection. This detailed description will explore the nature of the notice, its significance, and different types of living trusts commonly utilized in Tarrant, Texas. 1. Understanding the Tarrant Texas Notice of Assignment to Living Trust: The Notice of Assignment to Living Trust is a legal document that signifies the transfer of assets from an individual or entity to a living trust, an estate planning instrument. The assignment ensures that assets are held in trust, allowing for flexibility, management, and distribution according to the granter's wishes during their lifetime and after their death. 2. Benefits of Utilizing a Living Trust in Tarrant, Texas: — Probate Avoidance: One significant advantage of creating a living trust is the ability to bypass the probate process, which can be time-consuming and costly. By assigning assets to a living trust, they can be distributed promptly and efficiently, saving beneficiaries from unnecessary delays and expenses. — Privacy: Unlike a will, which becomes a matter of public record during the probate process, a living trust allows for privacy and confidentiality as it is not subject to public scrutiny. This confidentiality can be crucial for individuals seeking to keep their estate matters private. — Asset Protection: Assets held in a living trust can be better protected from various factors, such as lawsuits, creditors, and potential beneficiaries' claims. This advantage is particularly significant for individuals with substantial estates or those in professions prone to litigation. 3. Types of Living Trusts in Tarrant, Texas: — Revocable Living Trust: This type of living trust is the most commonly utilized in Tarrant, Texas. It allows the granter to maintain control over the assets, modify or cancel the trust, and have the flexibility to make changes as their circumstances evolve. It becomes irrevocable upon the granter's death. — Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable trust cannot be easily modified or revoked by the granter. Once assets are assigned, they are effectively considered the property of the trust and no longer owned by the granter. Irrevocable trusts provide enhanced asset protection, tax planning advantages, and eligibility for certain government benefits. Conclusion: The Tarrant Texas Notice of Assignment to Living Trust is a crucial legal document that empowers individuals to plan and control the distribution of their assets during their lifetime and beyond. Utilizing a living trust, whether revocable or irrevocable, offers numerous benefits, including probate avoidance, privacy, and asset protection. Consulting with an experienced estate planning attorney in Tarrant, Texas, can ensure that the Notice of Assignment and the living trust are properly executed, fulfilling the granter's intentions for the seamless management and distribution of their assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Aviso de cesión a un fideicomiso en vida - Texas Notice of Assignment to Living Trust

Description

How to fill out Tarrant Texas Aviso De Cesión A Un Fideicomiso En Vida?

If you’ve already utilized our service before, log in to your account and save the Tarrant Texas Notice of Assignment to Living Trust on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make certain you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Tarrant Texas Notice of Assignment to Living Trust. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!

Form popularity

FAQ

Requisitos: Nombre y nacionalidad del fideicomitente. Nombre de la Institucion de credito (banco) que fungira como fiduciaria. Nombre y nacionalidad del fideicomisario y, si los hubiere, de los fideicomisarios en segundo lugar y de los fideicomisarios substitutos. Duracion del fideicomiso.

Ejemplo de que es un fideicomiso Por ejemplo, si un abuelo quiere dejar una herencia a su nieto sin necesidad de pasar por los padres, lo que hace el abuelo es contratar una empresa fiduciaria para que le administre los bienes a su nieto.

Es un producto financiero que ademas de ser parecido a un plan de ahorro, garantiza que el beneficiario, es decir tu hija o hijo, reciba el dinero acordado para continuar sus estudios en nivel superior aun cuando faltes.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Existen varias razones por las que los fideicomisos son una buena alternativa para asegurar la correcta administracion de tus bienes en el futuro: Proteges tus activos de las malas intenciones.Cuidas a tus seres queridos.Resguardas tus activos.Puedes definir un plan para que tus activos generen rentas.

Un fideicomiso es un contrato mediante el cual una persona (el fideicomitente) destina ciertos bienes a un fin determinado, encomendando la realizacion de ese fin a una institucion financiera (el fiduciario). Considerandose un fideicomiso publico el que ejecuta fondos publicos.

El costo de un fideicomiso preparado por un abogado puede ser aproximadamente entre $1,000 a $1,500 dolares si se trata de una sola persona, y de $1,200 a $2,500 dolares si se trata de una pareja. Estos precios pueden variar dependiendo del abogado y de las circunstancias.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Es un contrato basado principalmente en la confianza, en el cual una persona transfiere bienes o derechos a favor de un patrimonio autonomo, el cual es administrado por Interbank y dirigido a cumplir determinados objetivos.

Interesting Questions

More info

On it should be your Original Lender's name. Fill out the form to access a sample of Practical Guidance. If you reside in a state which provides its resident's title to its Deed of Trust, there will be a title search at the time of the registration of your Deed. If not, you may call our office, and we may be able to assist you. If you reside in any state that does not have a statewide procedure to enforce and enforce your Deed of Trust, please take a copy of your deed of trust to the Probate Office at the same address where you may have sold your Home. On the original document you will be given a bill on which you will be asked to sign and date. If you do not have an effective lien, you may want to have the Probate Officer perform a real estate transfer and assign the transfer to the Probate Officer for further processing.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.