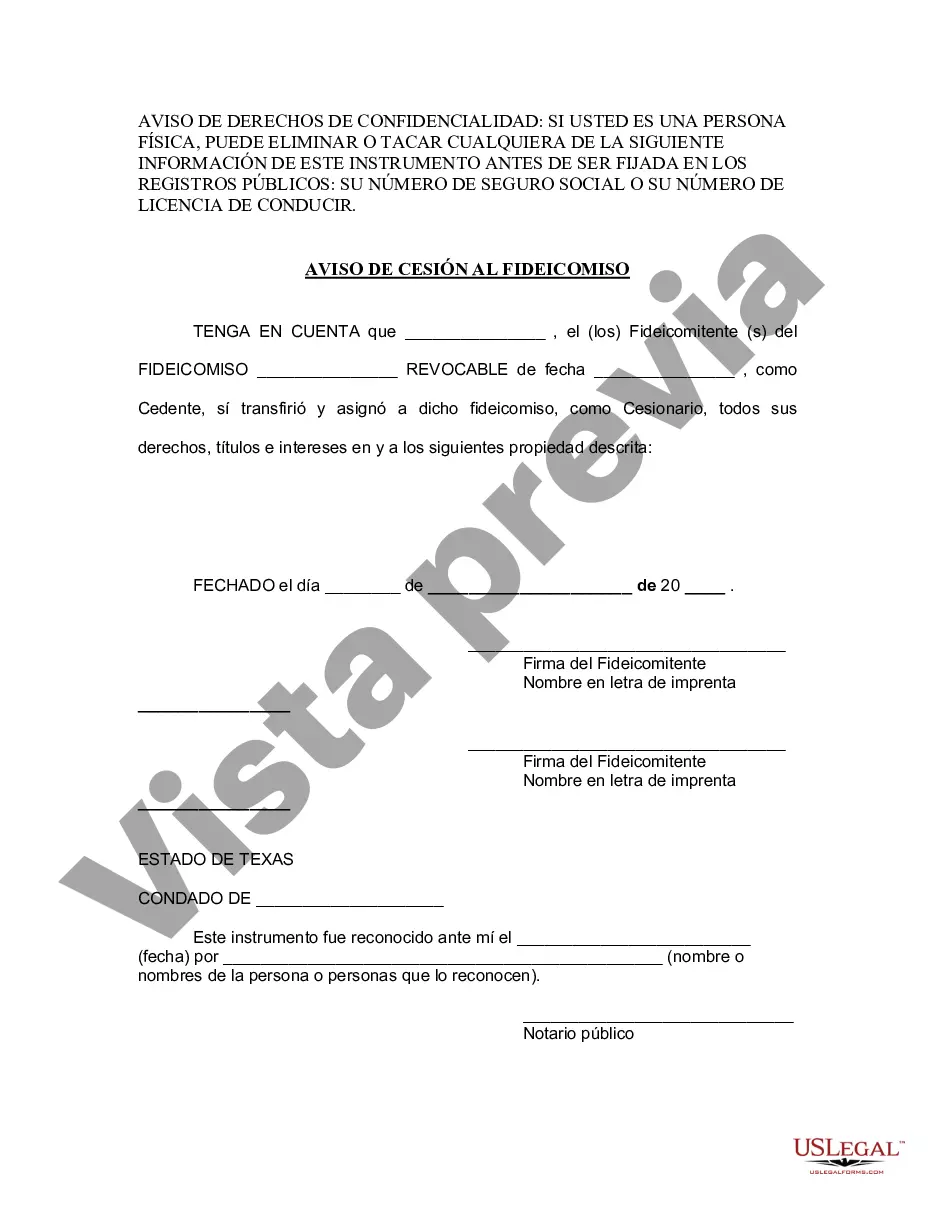

A Notice of Assignment to Living Trust is an essential legal document filed in the state of Wichita Falls, Texas, that signifies the transfer of assets from an individual to a living trust. This notice serves as official documentation to inform concerned parties, such as financial institutions, creditors, and interested individuals, about the assignment of assets to the living trust. It is a crucial step in the estate planning process, as it ensures a smooth transition of assets and protects the privacy of the trust and its beneficiaries. There are several types of Notice of Assignment to Living Trust that individuals in Wichita Falls, Texas, may encounter, each serving a specific purpose. Understanding these variations can be beneficial when creating and managing a living trust: 1. Basic Notice of Assignment to Living Trust: This is the most commonly used type of notice, indicating the transfer of general personal assets to a living trust. It includes a comprehensive list of assets being assigned, such as bank accounts, investments, real estate, jewelry, vehicles, and other tangible or intangible properties. 2. Notice of Assignment to Living Trust for Real Estate: When assigning real estate properties, such as residential houses, commercial buildings, or vacant land, a specialized notice is used. This document includes detailed information about the property, including its address, legal description, and any encumbrances or liens that may exist. 3. Notice of Assignment to Living Trust for Financial Accounts: Financial institutions require a specific notice when transferring assets such as checking accounts, savings accounts, certificates of deposit (CDs), and brokerage accounts to a living trust. It outlines the account details, including the financial institution's name, account number, and any beneficiaries associated with the account. 4. Notice of Assignment to Living Trust for Intellectual Property: For individuals with intellectual property assets like copyrights, trademarks, patents, or royalties, a specialized notice is utilized. This notice provides relevant information about the intellectual property, including registration details, ownership documentation, and any licensing agreements. 5. Notice of Assignment to Living Trust for Business Interests: If an individual's assets include ownership in a business, whether it's a sole proprietorship, partnership, or corporation, a specialized notice is necessary. This document describes the nature of the business, the ownership structure, and any related agreements or contracts. It is crucial to consult with an experienced estate planning attorney in Wichita Falls, Texas, when preparing a Notice of Assignment to Living Trust. They can provide guidance tailored to your specific needs and ensure compliance with local laws and regulations. By properly executing a Notice of Assignment to Living Trust, individuals can protect their assets and streamline the distribution process, ultimately achieving their estate planning goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wichita Falls Texas Aviso de cesión a un fideicomiso en vida - Texas Notice of Assignment to Living Trust

Description

How to fill out Wichita Falls Texas Aviso De Cesión A Un Fideicomiso En Vida?

If you are looking for a relevant form, it’s impossible to find a more convenient platform than the US Legal Forms site – one of the most considerable libraries on the internet. Here you can get thousands of form samples for organization and individual purposes by categories and states, or key phrases. With the high-quality search feature, finding the newest Wichita Falls Texas Notice of Assignment to Living Trust is as elementary as 1-2-3. In addition, the relevance of every document is confirmed by a group of expert attorneys that regularly check the templates on our platform and update them based on the newest state and county laws.

If you already know about our system and have a registered account, all you should do to receive the Wichita Falls Texas Notice of Assignment to Living Trust is to log in to your account and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have opened the form you want. Check its explanation and make use of the Preview function (if available) to see its content. If it doesn’t meet your needs, use the Search field near the top of the screen to find the proper record.

- Confirm your selection. Choose the Buy now option. Next, select the preferred pricing plan and provide credentials to register an account.

- Make the purchase. Make use of your credit card or PayPal account to complete the registration procedure.

- Receive the template. Select the file format and download it to your system.

- Make modifications. Fill out, edit, print, and sign the obtained Wichita Falls Texas Notice of Assignment to Living Trust.

Every single template you save in your account has no expiration date and is yours forever. It is possible to access them via the My Forms menu, so if you want to receive an extra copy for modifying or creating a hard copy, you can return and export it again at any time.

Make use of the US Legal Forms extensive collection to gain access to the Wichita Falls Texas Notice of Assignment to Living Trust you were seeking and thousands of other professional and state-specific templates on a single website!