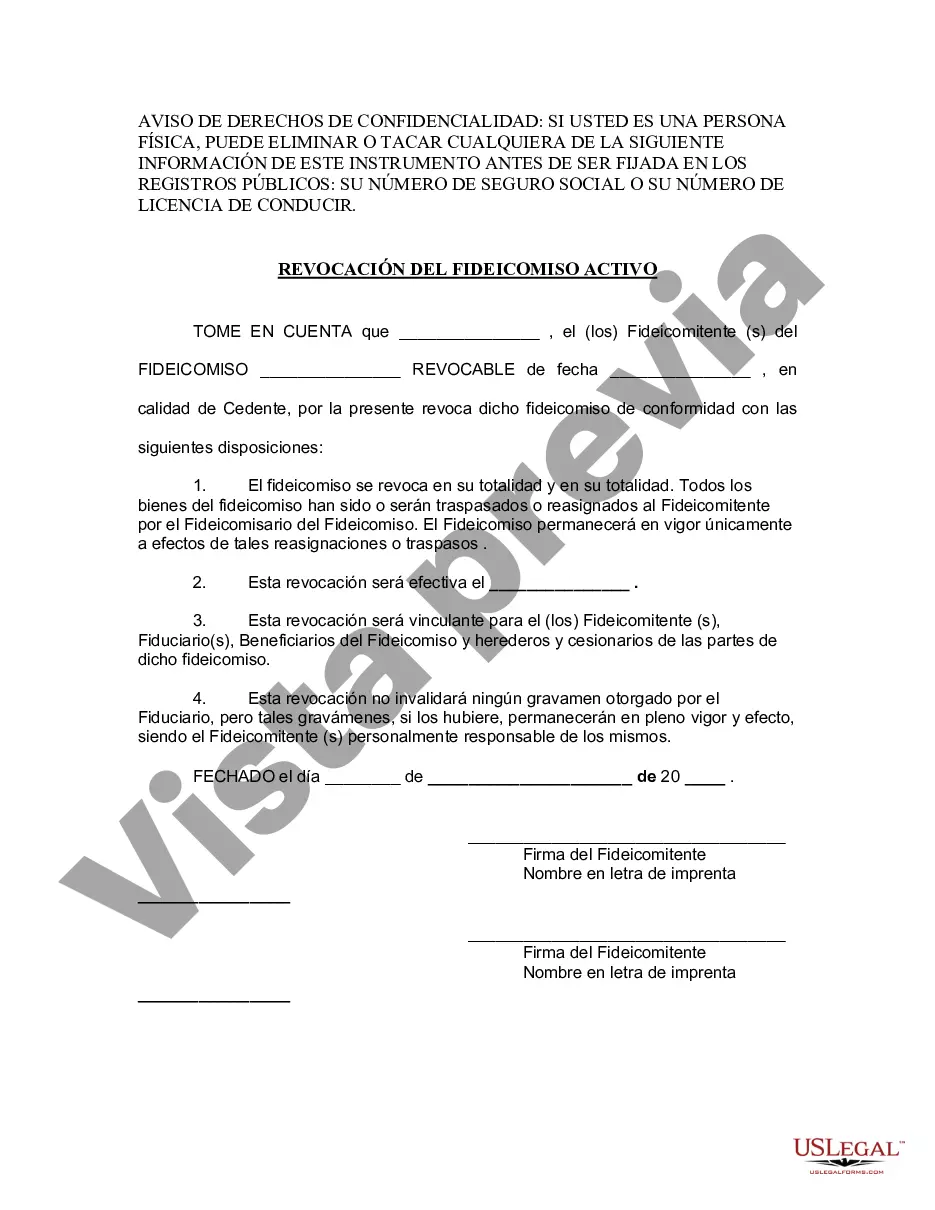

Collin Texas Revocation of Living Trust is a legal process that allows an individual residing in Collin County, Texas, to cancel or dissolve their existing living trust. A living trust is a common estate planning tool utilized to safeguard an individual's assets during their lifetime and ensure a smooth asset transfer to beneficiaries upon their death. However, there are instances where someone may wish to revoke or terminate their living trust due to various reasons such as changes in personal circumstances, a desire to modify the terms or provisions, or the need to establish an alternative estate planning structure. The revocation process involves several key steps to be followed in accordance with Texas state laws and Collin County regulations. Firstly, it is crucial to review the terms and conditions of the living trust document. This document typically outlines the procedures for revoking the trust and may include specific requirements regarding the revocation process. Seeking professional legal advice from an experienced Collin Texas estate planning attorney is highly recommended ensuring compliance with all legal obligations and to acquire guidance tailored to the specific situation. Once the revocation decision is made, the trust or (the person who originally established the living trust) must prepare a written revocation document that explicitly expresses their intent to revoke the trust. This written document must be properly executed and signed in the presence of witnesses to ensure it meets the legal requirements. Furthermore, it is crucial to notify all pertinent parties involved in the living trust, including beneficiaries, trustees, and any affected financial institutions, about the revocation. In Collin Texas, there aren't necessarily different types of revocation methods for living trusts. The general revocation process described above applies to all living trusts established in Collin County. However, it is important to note that there might be additional legal options or considerations depending on the specific circumstances, such as situations involving joint living trusts, revocable vs. irrevocable living trusts, or the establishment of a new trust to replace the revoked one. As such, consulting with a knowledgeable Collin Texas estate planning attorney becomes crucial to ensure the precise fulfillment of legal requirements and secure the individual's interests. In summary, Collin Texas Revocation of Living Trust is the legal procedure undertaken to nullify an existing living trust in Collin County, Texas. It allows for changes in estate planning, modification of provisions, or the replacement of the trust with an alternative structure. Reviewing the living trust document, preparing a written revocation document, properly executing it, and notifying relevant parties are key steps in the revocation process. Seeking professional legal advice from a Collin Texas estate planning attorney is highly recommended navigating the revocation process and understand any specific considerations applicable to the situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Revocación de fideicomiso en vida - Texas Revocation of Living Trust

State:

Texas

County:

Collin

Control #:

TX-E0178G

Format:

Word

Instant download

Description

Formulario para revocar un fideicomiso en vida.

Collin Texas Revocation of Living Trust is a legal process that allows an individual residing in Collin County, Texas, to cancel or dissolve their existing living trust. A living trust is a common estate planning tool utilized to safeguard an individual's assets during their lifetime and ensure a smooth asset transfer to beneficiaries upon their death. However, there are instances where someone may wish to revoke or terminate their living trust due to various reasons such as changes in personal circumstances, a desire to modify the terms or provisions, or the need to establish an alternative estate planning structure. The revocation process involves several key steps to be followed in accordance with Texas state laws and Collin County regulations. Firstly, it is crucial to review the terms and conditions of the living trust document. This document typically outlines the procedures for revoking the trust and may include specific requirements regarding the revocation process. Seeking professional legal advice from an experienced Collin Texas estate planning attorney is highly recommended ensuring compliance with all legal obligations and to acquire guidance tailored to the specific situation. Once the revocation decision is made, the trust or (the person who originally established the living trust) must prepare a written revocation document that explicitly expresses their intent to revoke the trust. This written document must be properly executed and signed in the presence of witnesses to ensure it meets the legal requirements. Furthermore, it is crucial to notify all pertinent parties involved in the living trust, including beneficiaries, trustees, and any affected financial institutions, about the revocation. In Collin Texas, there aren't necessarily different types of revocation methods for living trusts. The general revocation process described above applies to all living trusts established in Collin County. However, it is important to note that there might be additional legal options or considerations depending on the specific circumstances, such as situations involving joint living trusts, revocable vs. irrevocable living trusts, or the establishment of a new trust to replace the revoked one. As such, consulting with a knowledgeable Collin Texas estate planning attorney becomes crucial to ensure the precise fulfillment of legal requirements and secure the individual's interests. In summary, Collin Texas Revocation of Living Trust is the legal procedure undertaken to nullify an existing living trust in Collin County, Texas. It allows for changes in estate planning, modification of provisions, or the replacement of the trust with an alternative structure. Reviewing the living trust document, preparing a written revocation document, properly executing it, and notifying relevant parties are key steps in the revocation process. Seeking professional legal advice from a Collin Texas estate planning attorney is highly recommended navigating the revocation process and understand any specific considerations applicable to the situation.

Free preview

How to fill out Collin Texas Revocación De Fideicomiso En Vida?

If you’ve already used our service before, log in to your account and save the Collin Texas Revocation of Living Trust on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Ensure you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Collin Texas Revocation of Living Trust. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!