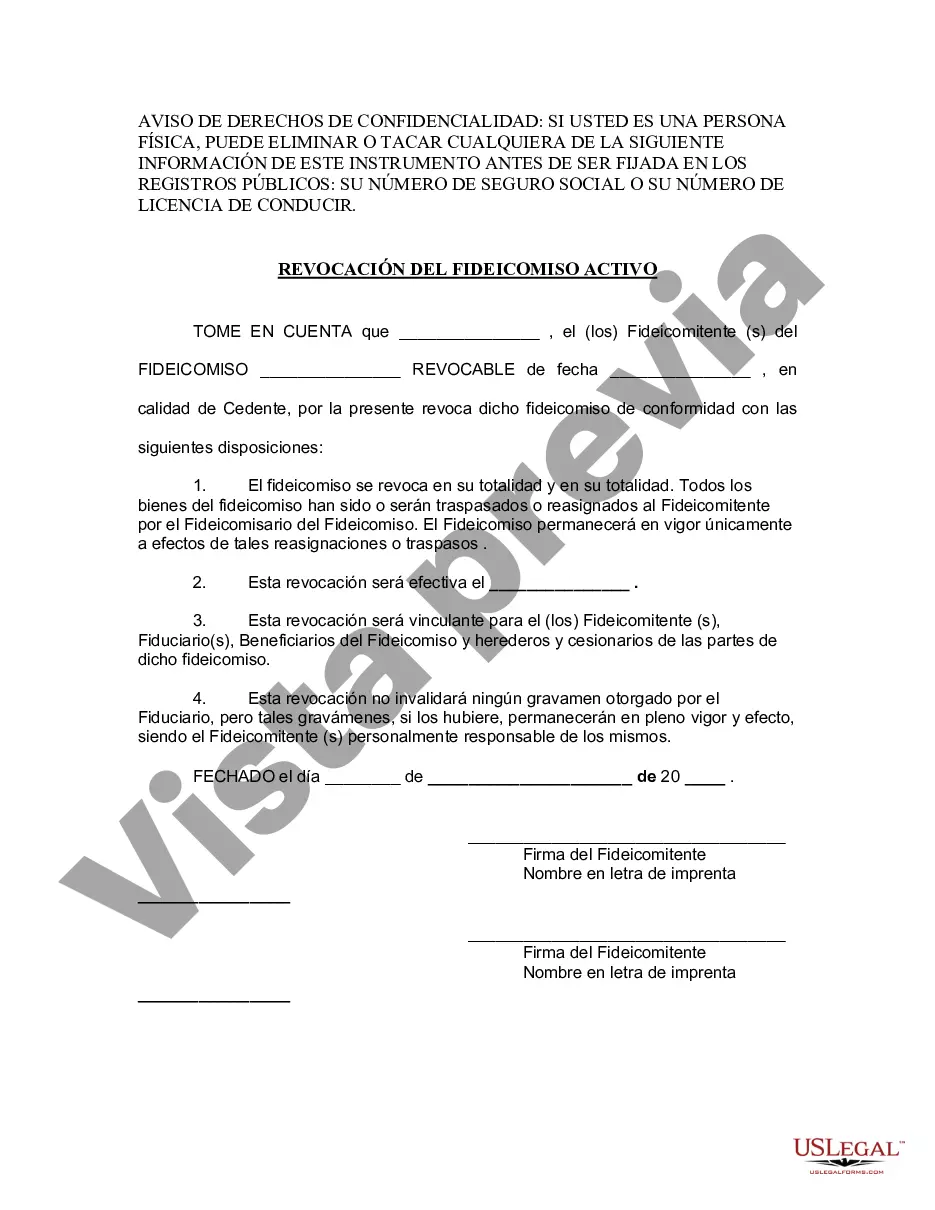

Harris Texas Revocation of Living Trust: Detailed Overview and Types A "Harris Texas Revocation of Living Trust" refers to the legal process followed to cancel or nullify a previously established living trust in Harris County, Texas. A living trust is a popular estate planning tool that allows individuals to transfer ownership of their assets and properties to a trust during their lifetime, ensuring distribution and management according to their wishes upon incapacitation or death. However, situations may arise where the trust creator, also known as the granter or settler, decides to revoke the trust due to changing circumstances, altered estate planning goals, or other personal reasons. To officially revoke a living trust in Harris County, Texas, specific steps must be taken in compliance with state laws. Firstly, it is crucial to draft a formal revocation document, often referred to as a "Harris Texas Revocation of Living Trust" or "Revocation Agreement." This legal document explicitly states the settler's intent to dissolve the trust and renders it void. The revocation agreement should include essential details such as the name and identification of the trust, the date of the original trust's creation, and the settler's complete name and contact information. When generating content for a Harris Texas Revocation of Living Trust, relevant keywords to include might be: 1. Revocation of Living Trust: Explaining the concept and process involved in revoking a living trust in Harris, Texas. Emphasize the importance of proper legal documentation for ensuring the trust's cancellation. 2. Harris County Trust Dissolution: Shining a light on the revocation process specifically in Harris County, Texas, highlighting any county-specific requirements or procedures that may need to be followed. 3. Texas Living Trust Laws: Discussing the relevant state laws and regulations in Texas governing the revocation of living trusts, including any prerequisites or legal formalities to follow. 4. Harris Texas Revocation Agreement: Exploring the key elements and information that should be included in a revocation agreement, emphasizing its role in making the revocation legally valid. Types of Harris Texas Revocation of Living Trust: While the fundamental process of revoking a living trust remains consistent, there are a few different types of revocation methods that can be employed in Harris County, Texas. These methods include: 1. Express Revocation of Living Trust: This type of revocation occurs when the settler explicitly states their intent to revoke the trust in a written document, such as a revocation agreement or an amendment to the trust instrument. 2. Implied Revocation of Living Trust: Implied revocation happens when the settler takes actions inconsistent with the continued existence of the living trust, such as transferring trust assets to their individual name or creating a new incompatible trust. 3. Operation of Law Revocation: This type of revocation arises when changes in the legal landscape or circumstances render the living trust void automatically, without the necessity for explicit action taken by the settler. These changes may include marriage, divorce, death, or changes in tax laws affecting the trust. Understanding the different revocation methods can help ensure that individuals seeking to dissolve their living trust in Harris County, Texas, choose the most suitable approach aligned with their circumstances and legal requirements. Consulting with a qualified attorney specializing in trusts and estates is advisable to navigate the intricacies of the revocation process and guarantee compliance with relevant laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Revocación de fideicomiso en vida - Texas Revocation of Living Trust

Description

How to fill out Harris Texas Revocación De Fideicomiso En Vida?

If you are looking for a valid form template, it’s difficult to find a better service than the US Legal Forms website – probably the most extensive libraries on the internet. With this library, you can find a large number of form samples for business and individual purposes by types and states, or key phrases. With our high-quality search function, getting the latest Harris Texas Revocation of Living Trust is as easy as 1-2-3. Moreover, the relevance of every document is verified by a team of expert lawyers that on a regular basis check the templates on our platform and revise them in accordance with the latest state and county requirements.

If you already know about our platform and have an account, all you should do to receive the Harris Texas Revocation of Living Trust is to log in to your account and click the Download button.

If you make use of US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have opened the sample you want. Read its information and use the Preview feature (if available) to check its content. If it doesn’t meet your needs, use the Search option near the top of the screen to discover the needed record.

- Affirm your selection. Select the Buy now button. Following that, select your preferred pricing plan and provide credentials to register an account.

- Make the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Select the file format and download it on your device.

- Make adjustments. Fill out, edit, print, and sign the acquired Harris Texas Revocation of Living Trust.

Each and every template you save in your account has no expiry date and is yours permanently. You always have the ability to access them via the My Forms menu, so if you want to get an additional copy for enhancing or creating a hard copy, you can return and download it again at any time.

Make use of the US Legal Forms extensive catalogue to get access to the Harris Texas Revocation of Living Trust you were looking for and a large number of other professional and state-specific samples in one place!