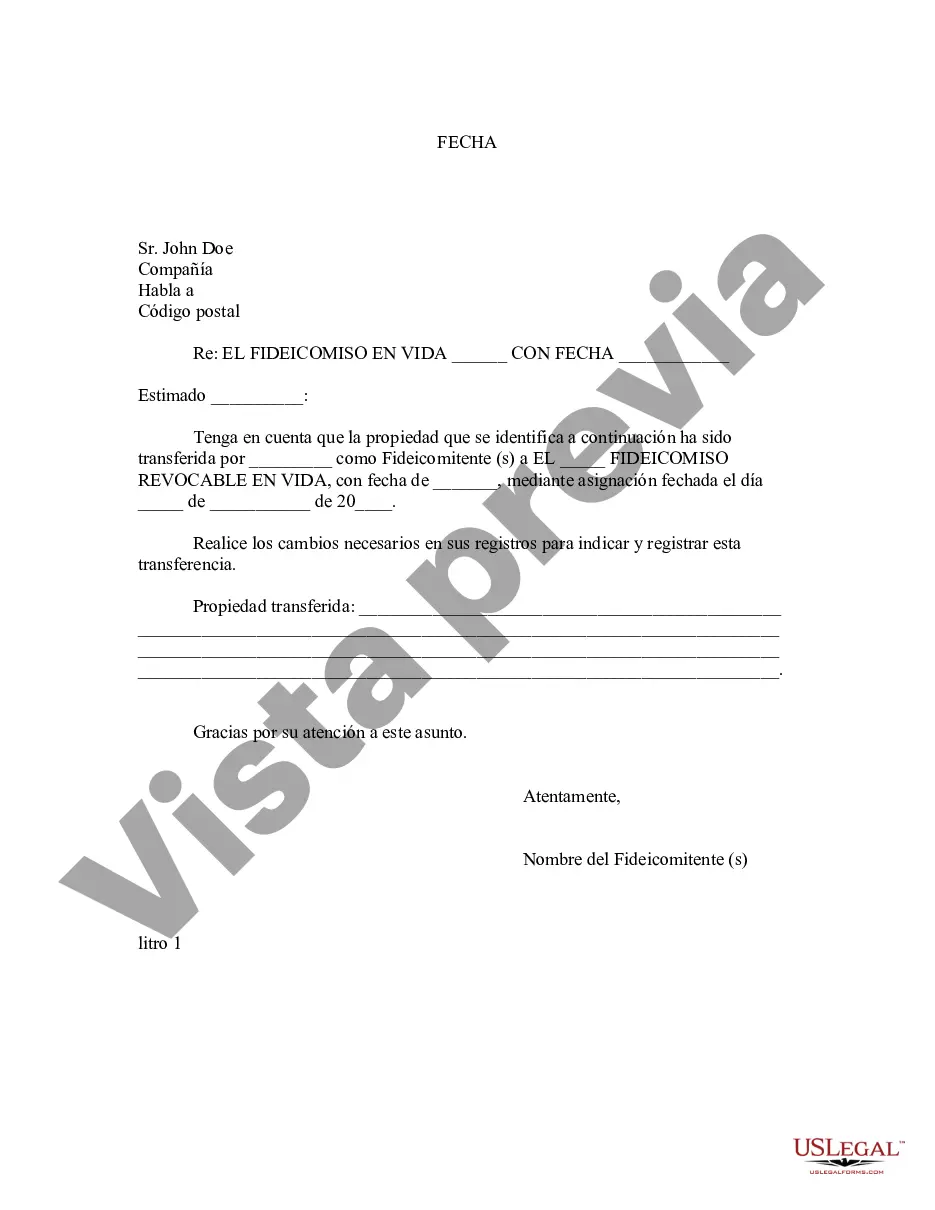

Title: Comprehensive Guide: Laredo Texas Letter to Lien holder to Notify of Trust Introduction: In Laredo, Texas, individuals seeking to notify lien holders of trust arrangements must draft a formal letter to ensure proper documentation. This detailed guide provides an in-depth understanding of what this letter entails and how it can be customized as per specific requirements. We explore various types of Laredo Texas Letters to Lien holder to Notify of Trust, addressing key aspects and incorporating relevant keywords throughout. Types of Laredo Texas Letters to Lien holder to Notify of Trust: 1. Revocable Living Trust: A Laredo Texas Letter to Lien holder to Notify of Trust serves as an essential communication tool when establishing a revocable living trust. This type of trust allows individuals to manage their assets during their lifetime while providing flexibility to revoke or modify the trust as needed. 2. Irrevocable Trust: When individuals create an irrevocable trust, they relinquish ownership and control over assets held within the trust. The Laredo Texas Letter to Lien holder to Notify of Trust in this context emphasizes informing lien holders about the legal transfer of assets and the trustee's authority. 3. Testamentary Trust: A testamentary trust is established through a will, and its terms go into effect upon the testator's death. The Laredo Texas Letter to Lien holder to Notify of Trust for a testamentary trust should outline the trustee's responsibilities and duties, ensuring lien holders receive necessary information to adjust accounts accordingly. 4. Special Needs Trust: Laredo Texas Letter to Lien holder to Notify of Trust becomes crucial while forming a special needs trust. This trust arrangement is designed to secure financial resources for beneficiaries with disabilities while preserving their eligibility for government benefits. The letter should highlight key provisions and restrictions, acknowledging lien holders' role in managing trust-related finances. 5. Charitable Remainder Trust: Charitable remainder trusts involve designating a charity as the ultimate beneficiary while allowing the settler (trust creator) or other named beneficiaries to receive income during their lifetime. The Laredo Texas Letter to Lien holder to Notify of Trust in this context informs lien holders about the trust's charitable nature and outlines provisions for income distribution. Key Components of Laredo Texas Letter to Lien holder to Notify of Trust: 1. Clear Trust Identification: Start the letter by explicitly stating the type of trust being established or modified (e.g., revocable living trust, irrevocable trust). 2. Trustee Information: Include the name, contact details, and role of the trustee responsible for managing the trust assets and communicating with lien holders. 3. Lien holder Details: Provide complete information about the financial institution or lien holder, including their name, contact details, and any account or policy number(s) relevant to the trust. 4. Effective Date and Duration: Specify the date when the trust becomes effective and, if applicable, the date of termination or modification. 5. Description of Assets: Provide a comprehensive list or description of the specific assets being transferred or held within the trust, ensuring lien holders are aware of changes in ownership or control. 6. Extra Instructions: Include any additional instructions or specific requirements for lien holders, such as modifying account titles or reissuing checks under the trustee's name. Conclusion: Understanding the various types and nuances of Laredo Texas Letters to Lien holder to Notify of Trust is crucial for ensuring smooth communication and proper management of trust assets. By customizing these letters using the relevant keywords and addressing specific trust arrangements, individuals can effectively notify lien holders while complying with legal requirements in Laredo, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Laredo Texas Carta al acreedor prendario para notificar el fideicomiso - Texas Letter to Lienholder to Notify of Trust

Description

How to fill out Laredo Texas Carta Al Acreedor Prendario Para Notificar El Fideicomiso?

Are you looking for a reliable and inexpensive legal forms provider to get the Laredo Texas Letter to Lienholder to Notify of Trust? US Legal Forms is your go-to choice.

Whether you require a basic agreement to set regulations for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of separate state and area.

To download the form, you need to log in account, locate the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Laredo Texas Letter to Lienholder to Notify of Trust conforms to the laws of your state and local area.

- Read the form’s details (if available) to find out who and what the form is good for.

- Restart the search if the template isn’t good for your legal scenario.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Laredo Texas Letter to Lienholder to Notify of Trust in any available format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time learning about legal paperwork online for good.