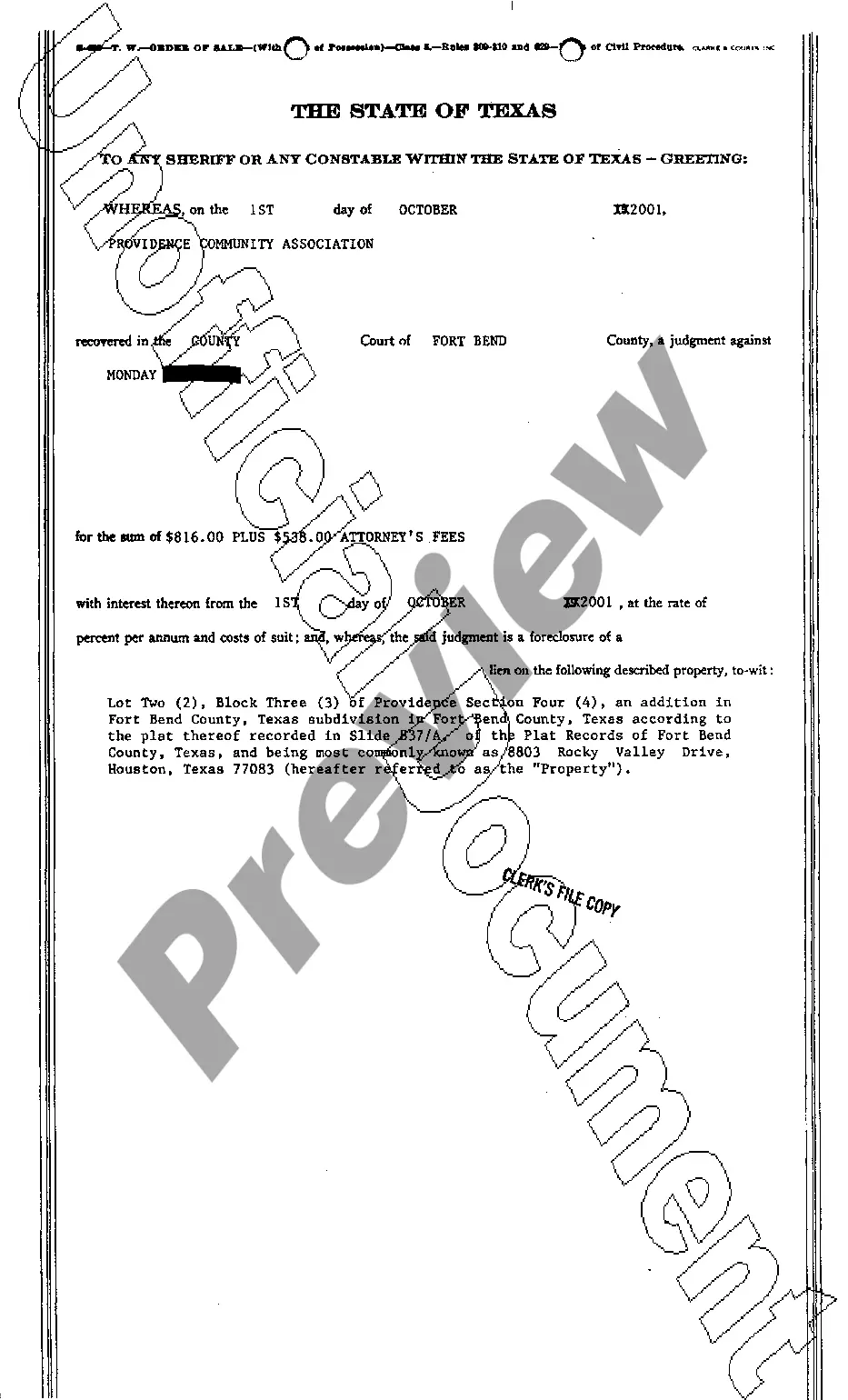

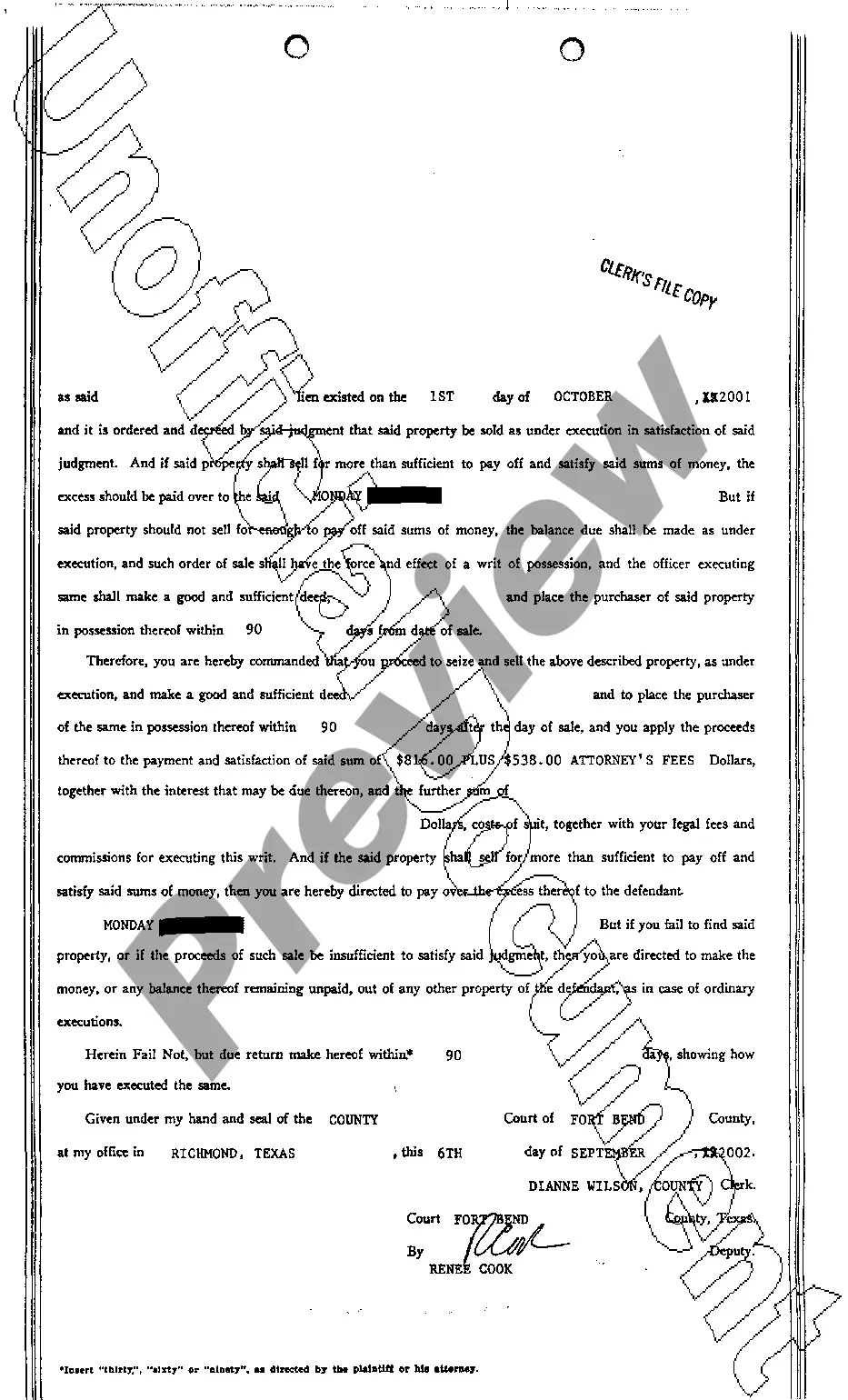

Fort Worth Texas Order of Sale refers to a legal process that enables the sale of a property to satisfy a debt or judgment. It is a specific type of legal proceeding initiated by a creditor, usually a mortgage lender or a taxing authority, to recover the unpaid amount owed by the debtor. The Order of Sale is typically used in situations where the debtor has defaulted on a loan, failed to pay property taxes, or violated specific contractual obligations. By obtaining an Order of Sale from a court, the creditor gains the authority to sell the property in question and recover the outstanding debt. The process typically begins with the creditor filing a lawsuit against the debtor, outlining the reasons for the legal action and requesting a judgment for the unpaid debt. Once a judgment is obtained, the creditor may apply for an Order of Sale, which specifies the terms and conditions of the sale, including the minimum bid amount, the timeline, and requirements for public notices and advertising. In Fort Worth, Texas, there are different types of Order of Sales depending on the nature of the debt or judgment. Some common types include: 1. Foreclosure Order of Sale: Initiated by a mortgage lender, this type of order allows for the sale of a property due to the borrower's failure to make mortgage payments. Foreclosure Order of Sales are typically sold at public auctions, either on the steps of the county courthouse or through a designated auctioneer. 2. Tax Sale Order of Sale: Issued by the taxing authorities, such as the county tax assessor's office, this type of order allows the sale of a property to recover unpaid property taxes. Tax Sale Order of Sales often occur through public auctions, with interested buyers bidding on the property. 3. Judgment Order of Sale: Obtained by a creditor who has successfully sued and received a judgment against the debtor, this type of order authorizes the sale of the debtor's property to satisfy the debt. The proceeds from the sale are then used to repay the creditor. It is important to note that the Fort Worth Texas Order of Sale process follows specific legal procedures and timelines, ensuring transparency and fairness for all parties involved. Interested parties, such as potential buyers or other lien holders, are typically given the opportunity to participate in the sale process by submitting bids or asserting their rights, further ensuring a fair and competitive sale.

Fort Worth Texas Order of Sale

Description

How to fill out Fort Worth Texas Order Of Sale?

If you are looking for a valid form, it’s difficult to choose a better service than the US Legal Forms website – probably the most comprehensive libraries on the web. Here you can get a huge number of document samples for business and personal purposes by categories and states, or key phrases. Using our advanced search function, finding the newest Fort Worth Texas Order of Sale is as easy as 1-2-3. Additionally, the relevance of each file is proved by a team of expert attorneys that regularly check the templates on our platform and update them according to the most recent state and county regulations.

If you already know about our system and have an account, all you should do to get the Fort Worth Texas Order of Sale is to log in to your account and click the Download button.

If you make use of US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have discovered the form you want. Read its explanation and use the Preview feature (if available) to check its content. If it doesn’t meet your needs, utilize the Search field near the top of the screen to find the appropriate file.

- Affirm your decision. Choose the Buy now button. Following that, choose your preferred pricing plan and provide credentials to register an account.

- Make the purchase. Utilize your bank card or PayPal account to complete the registration procedure.

- Receive the form. Select the format and download it on your device.

- Make modifications. Fill out, revise, print, and sign the received Fort Worth Texas Order of Sale.

Each form you add to your account has no expiry date and is yours permanently. It is possible to access them via the My Forms menu, so if you want to get an additional copy for modifying or creating a hard copy, feel free to return and save it once again anytime.

Take advantage of the US Legal Forms professional library to gain access to the Fort Worth Texas Order of Sale you were seeking and a huge number of other professional and state-specific templates in one place!