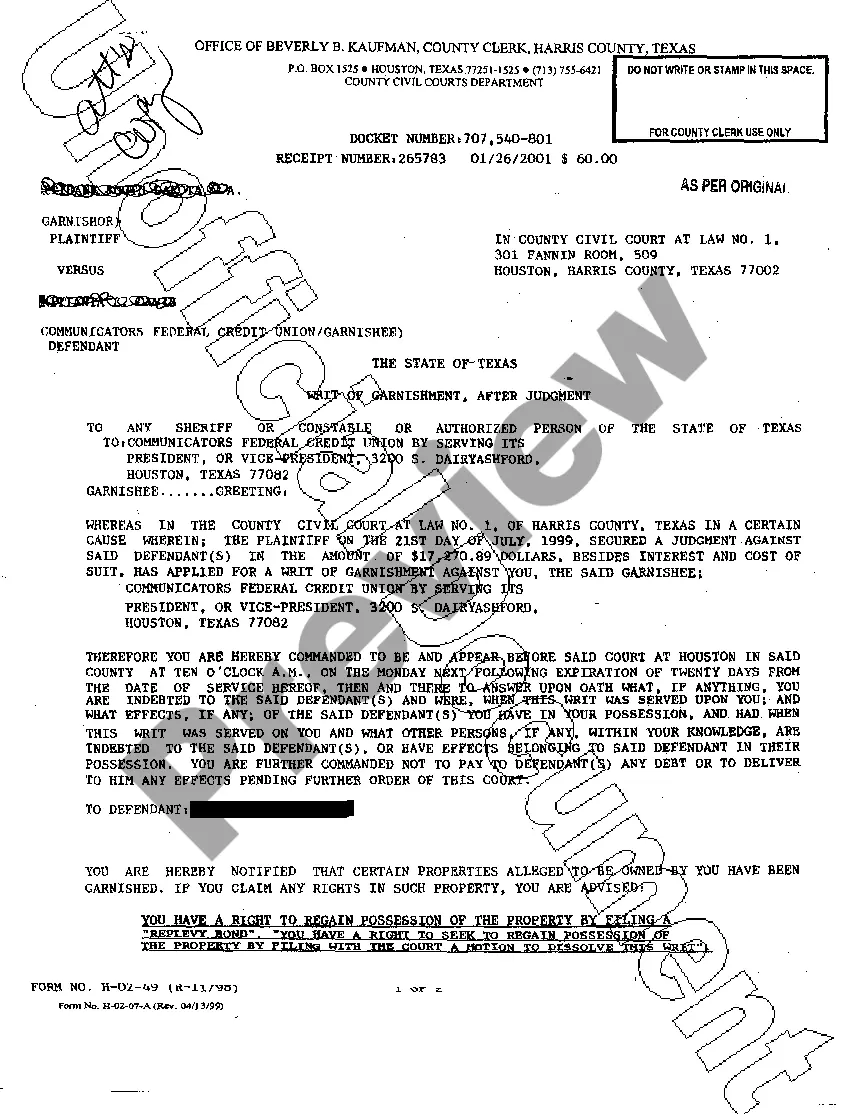

Writ of Garnishment is a legal process in Houston, Texas that allows a creditor to collect the debt owed to them by obtaining a court order to seize a portion of the debtor's wages or assets. It is commonly used when an individual or business fails to pay their debts, and the creditor seeks legal remedies to recover the owed amount. In Houston, Texas, there are primarily two types of Writ of Garnishment that can be pursued by creditors: 1. Writ of Garnishment for Wages: This type of writ allows a creditor to request the court to withhold a portion of the debtor's earnings directly from their employer. The employer is legally obligated to deduct the specified amount from the employee's wages and remit it to the creditor until the debt is satisfied. However, there are certain limitations on the amount that can be garnished, as stated by federal and state laws. 2. Writ of Garnishment for Assets: In cases where a debtor does not have wages to garnish or the creditor wishes to recover the debt from other sources, they can file a Writ of Garnishment for Assets. This allows the creditor to seize and liquidate the debtor's non-exempt assets, such as bank accounts, property, or vehicles, to satisfy the owed debt. To initiate the Writ of Garnishment process, the creditor must file a lawsuit against the debtor and secure a judgment in their favor. Once the court grants the judgment, the creditor can then apply for a Writ of Garnishment. The writ is then served to the employer or the financial institution where the debtor holds their assets, commanding them to withhold the specified amount or surrender the assets to the creditor. It is important to note that there are legal protections in place for debtors in Houston, Texas. Certain types of income, such as social security benefits, unemployment compensation, or retirement pensions, may be exempt from garnishment. Additionally, the debtor has the right to seek exemptions for their assets, as per the exemptions allowed by law. In conclusion, the Houston Texas Writ of Garnishment is a legal tool available to creditors to recover outstanding debts from debtors. It can take the form of Writ of Garnishment for Wages, allowing the creditor to garnish a portion of the debtor's earnings, or Writ of Garnishment for Assets, allowing the seizure and sale of non-exempt assets to satisfy the debt. However, it is advisable for both creditors and debtors to seek professional legal advice to understand their rights and responsibilities throughout this process.

Houston Texas Writ of Garnishment

Description

How to fill out Houston Texas Writ Of Garnishment?

Are you looking for a trustworthy and inexpensive legal forms provider to buy the Houston Texas Writ of Garnishment? US Legal Forms is your go-to choice.

No matter if you require a simple agreement to set regulations for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of separate state and area.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Houston Texas Writ of Garnishment conforms to the laws of your state and local area.

- Go through the form’s details (if available) to learn who and what the form is good for.

- Start the search over if the template isn’t suitable for your specific scenario.

Now you can create your account. Then choose the subscription plan and proceed to payment. Once the payment is done, download the Houston Texas Writ of Garnishment in any available format. You can get back to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting hours researching legal paperwork online for good.