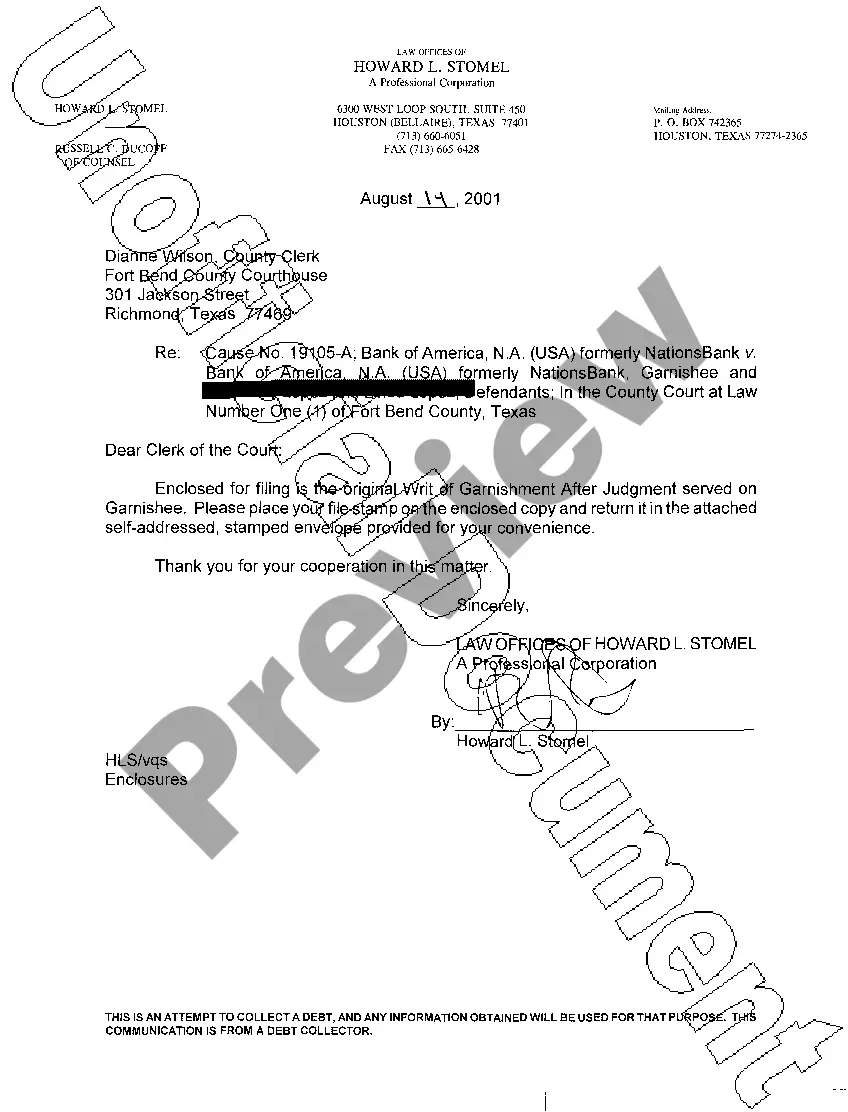

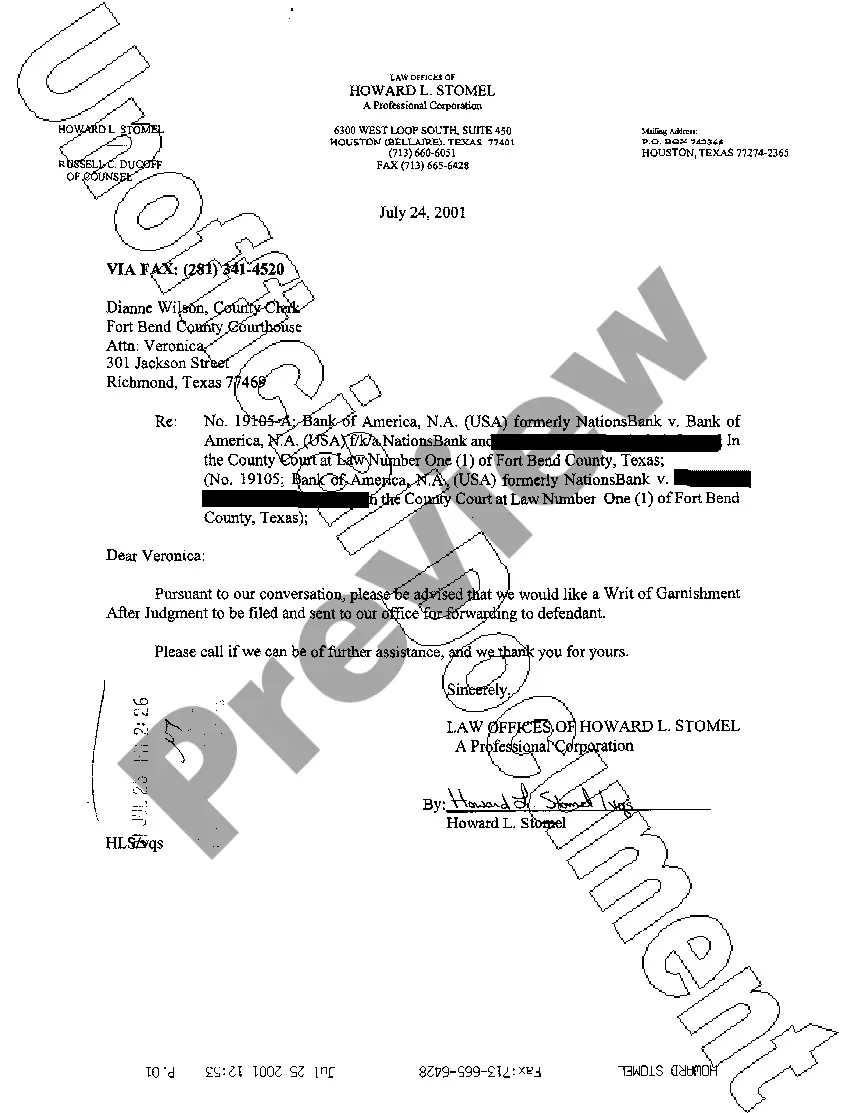

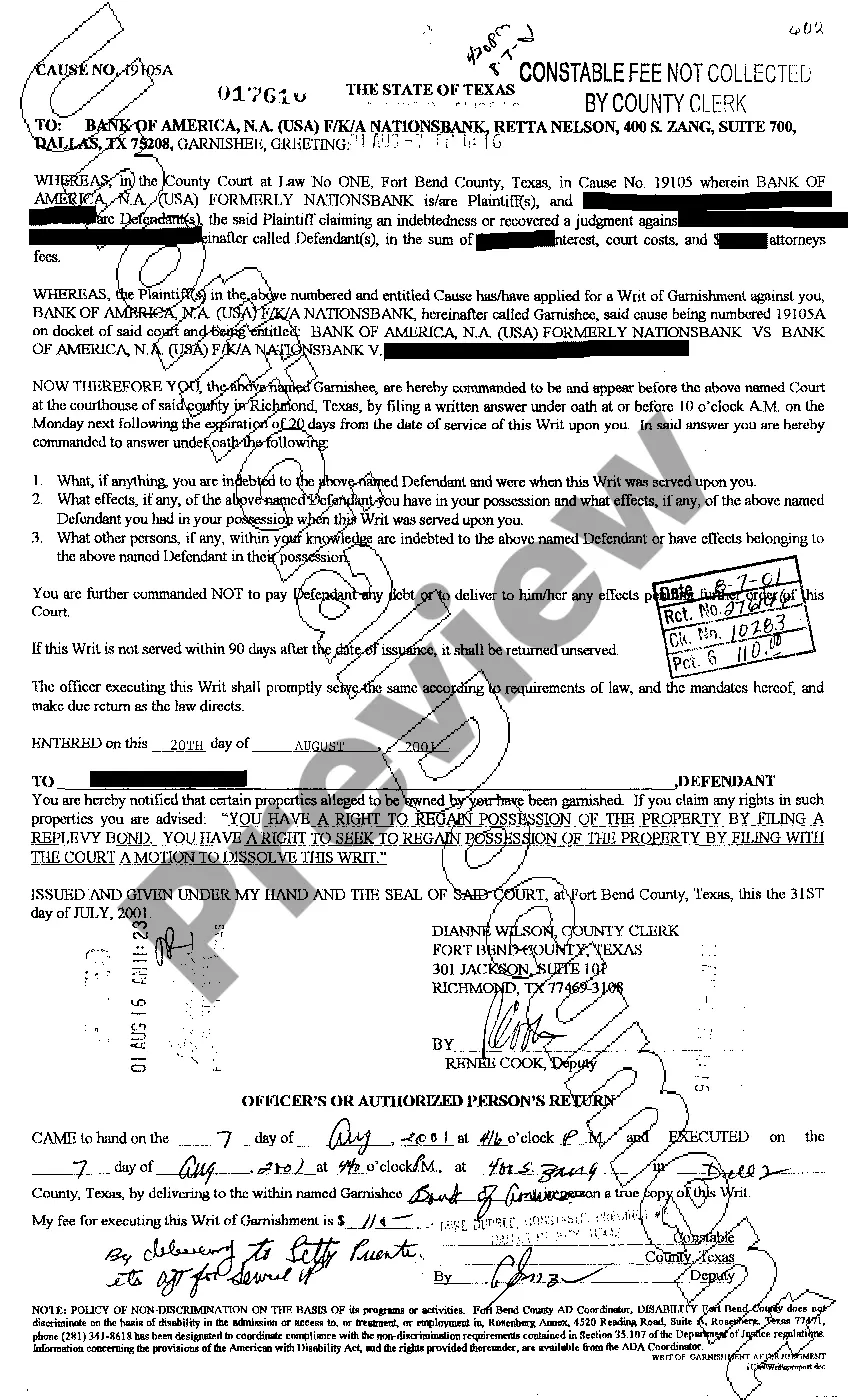

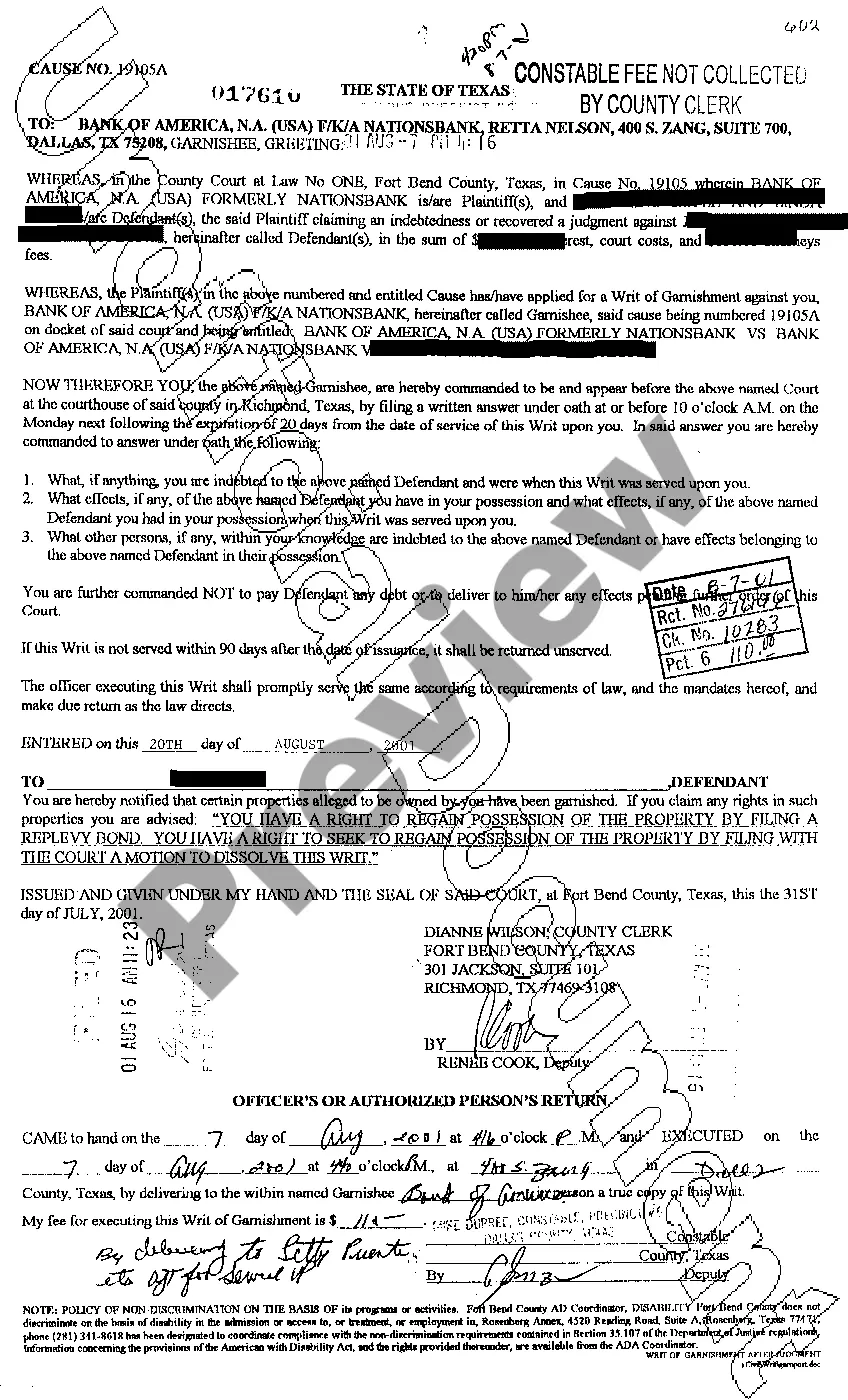

Pearland Texas Writ of Garnishment is a legal procedure used to collect debts owed by individuals or businesses in Pearland, Texas. It is typically initiated by a creditor (plaintiff) who has obtained a judgment against the debtor (defendant) and needs to recover the owed amount. The Pearland Texas Writ of Garnishment allows the creditor to seize a portion of the debtor's wages, bank accounts, or other assets in order to satisfy the debt. This means that the debtor's employer or financial institution is legally required to withhold a specific amount from the debtor's income or freeze their bank account until the debt is paid off. There are different types of Pearland Texas Writ of Garnishment, including: 1. Wage Garnishment: This type of garnishment allows the creditor to deduct a percentage of the debtor's wages directly from their employer. The employer is required to comply with the garnishment order and regularly send payments to the creditor until the debt is satisfied. 2. Bank Account Garnishment: With this type of garnishment, the creditor can freeze the debtor's bank account and withdraw funds to repay the debt. The financial institution must comply with the garnishment order and release the frozen funds to the creditor. 3. Property Garnishment: In some cases, the creditor can seize the debtor's property, such as vehicles or real estate, to satisfy the debt. The garnished property is typically sold at auction, and the proceeds go towards repaying the creditor. It is important to note that Pearland Texas Writ of Garnishment is subject to certain exemptions and limitations. For example, certain types of income, such as Social Security or retirement benefits, may be protected from garnishment. Additionally, there are limits on how much can be garnished from an individual's wages. If you receive a Pearland Texas Writ of Garnishment, it is crucial to seek legal advice to understand your rights and options. An attorney can help you navigate the garnishment process, explore possible exemptions, and potentially negotiate a settlement with the creditor.

Pearland Texas Writ of Garnishment

Description

How to fill out Pearland Texas Writ Of Garnishment?

Make use of the US Legal Forms and obtain immediate access to any form template you require. Our helpful website with a huge number of documents makes it easy to find and get virtually any document sample you want. You can download, complete, and certify the Pearland Texas Writ of Garnishment in a couple of minutes instead of browsing the web for several hours trying to find an appropriate template.

Using our library is an excellent strategy to improve the safety of your record filing. Our experienced lawyers regularly check all the records to ensure that the templates are appropriate for a particular state and compliant with new laws and polices.

How can you get the Pearland Texas Writ of Garnishment? If you already have a subscription, just log in to the account. The Download button will be enabled on all the samples you view. In addition, you can find all the previously saved files in the My Forms menu.

If you don’t have a profile yet, stick to the tips listed below:

- Open the page with the form you require. Make certain that it is the form you were hoping to find: examine its title and description, and use the Preview feature if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the downloading process. Click Buy Now and choose the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Export the document. Choose the format to get the Pearland Texas Writ of Garnishment and edit and complete, or sign it according to your requirements.

US Legal Forms is among the most considerable and trustworthy form libraries on the internet. We are always happy to assist you in virtually any legal procedure, even if it is just downloading the Pearland Texas Writ of Garnishment.

Feel free to benefit from our service and make your document experience as efficient as possible!