The "College Station Texas Acknowledgment for Proration of Ad Valor em Taxes" refers to a legal document used in the city of College Station, Texas, to acknowledge the proration of ad valor em taxes during a property transfer. Ad valor em taxes are property taxes based on the assessed value of a property, and proration refers to the pro-rated division of taxes between the buyer and seller based on the period of property ownership during the tax year. This acknowledgment document serves as a formal agreement between the buyer and seller, confirming their understanding and acceptance of the proration process for ad valor em taxes. It outlines the specific details related to the proration, such as the effective date, tax year, and the portion of taxes to be paid by each party. Keywords: College Station Texas, acknowledgment, proration, ad valor em taxes, property transfer, legal document, property taxes, assessed value, pro-rated division, buyer, seller, tax year, effective date, portion, payment. There may not be different types of College Station Texas Acknowledgment for Proration of Ad Valor em Taxes as it refers to a specific legal document applicable in College Station, Texas when prorating ad valor em taxes.

College Station Texas Acknowledgment for Proration of Ad Valorem Taxes

Description

How to fill out College Station Texas Acknowledgment For Proration Of Ad Valorem Taxes?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for a person with no law education to draft such paperwork from scratch, mainly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our service offers a huge library with over 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time using our DYI tpapers.

No matter if you need the College Station Texas Acknowledgment for Proration of Ad Valorem Taxes or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the College Station Texas Acknowledgment for Proration of Ad Valorem Taxes in minutes employing our trusted service. In case you are already a subscriber, you can proceed to log in to your account to download the needed form.

Nevertheless, in case you are a novice to our platform, ensure that you follow these steps before downloading the College Station Texas Acknowledgment for Proration of Ad Valorem Taxes:

- Be sure the template you have found is suitable for your location because the regulations of one state or area do not work for another state or area.

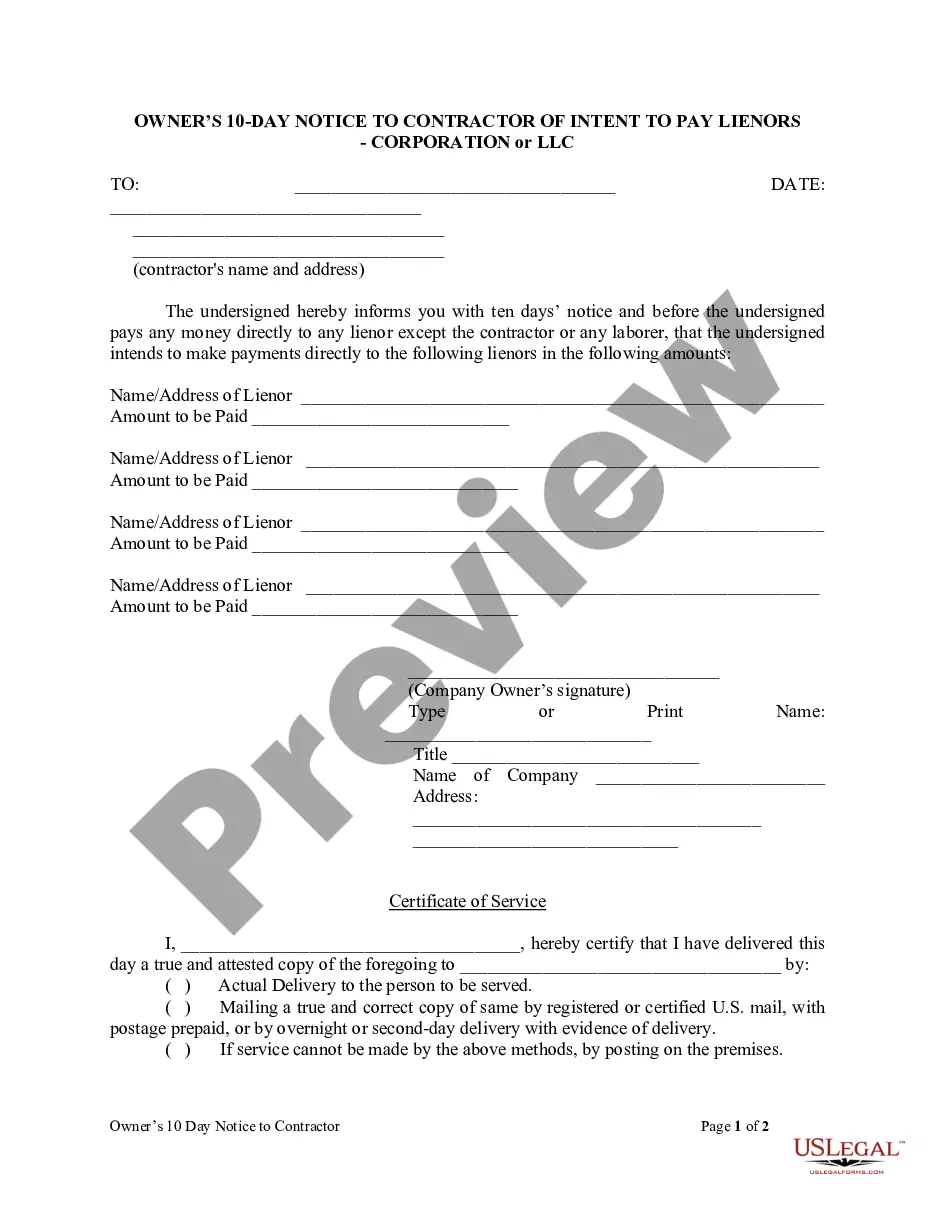

- Preview the form and go through a brief description (if provided) of scenarios the document can be used for.

- In case the form you selected doesn’t suit your needs, you can start over and search for the needed document.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your credentials or create one from scratch.

- Select the payment method and proceed to download the College Station Texas Acknowledgment for Proration of Ad Valorem Taxes as soon as the payment is done.

You’re good to go! Now you can proceed to print the form or fill it out online. If you have any problems locating your purchased documents, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.