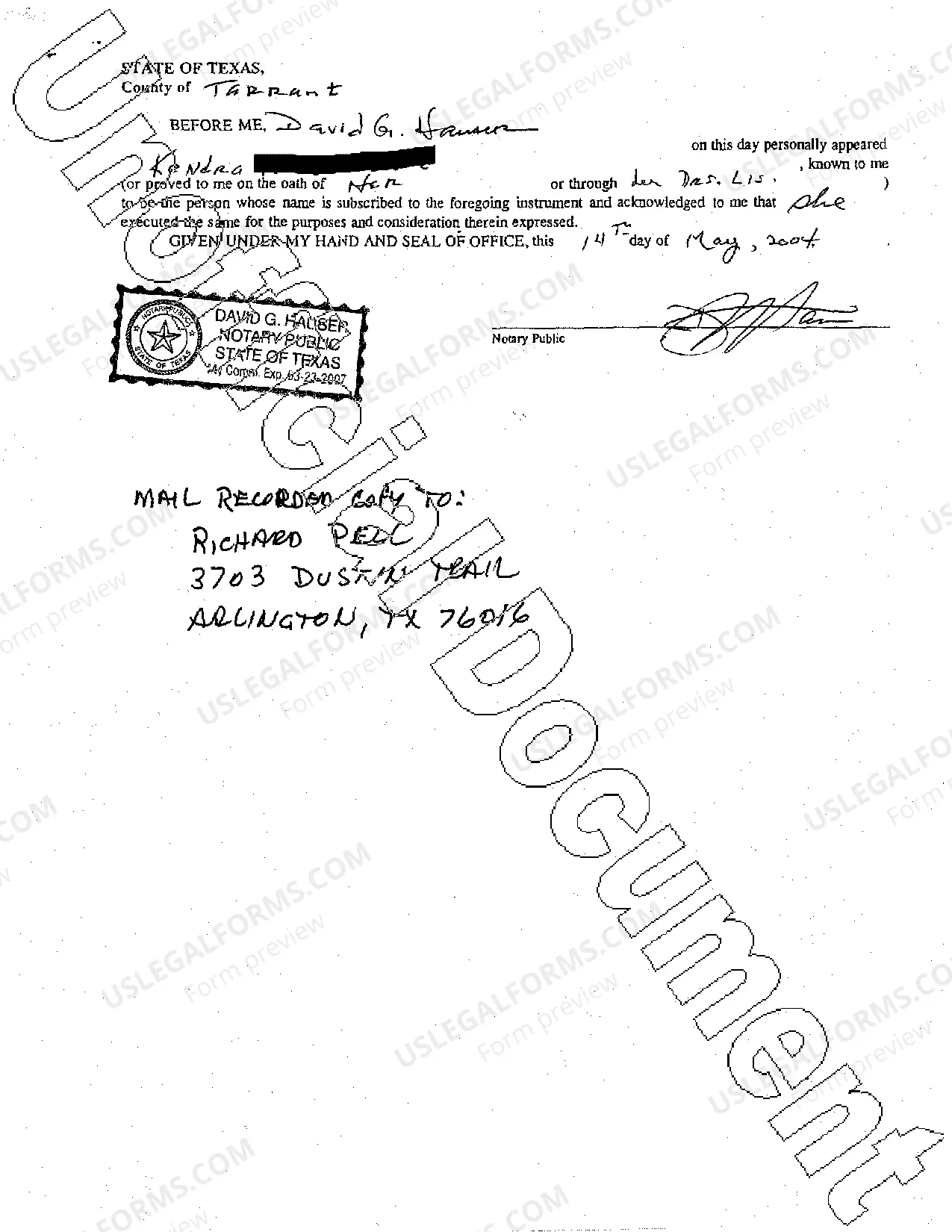

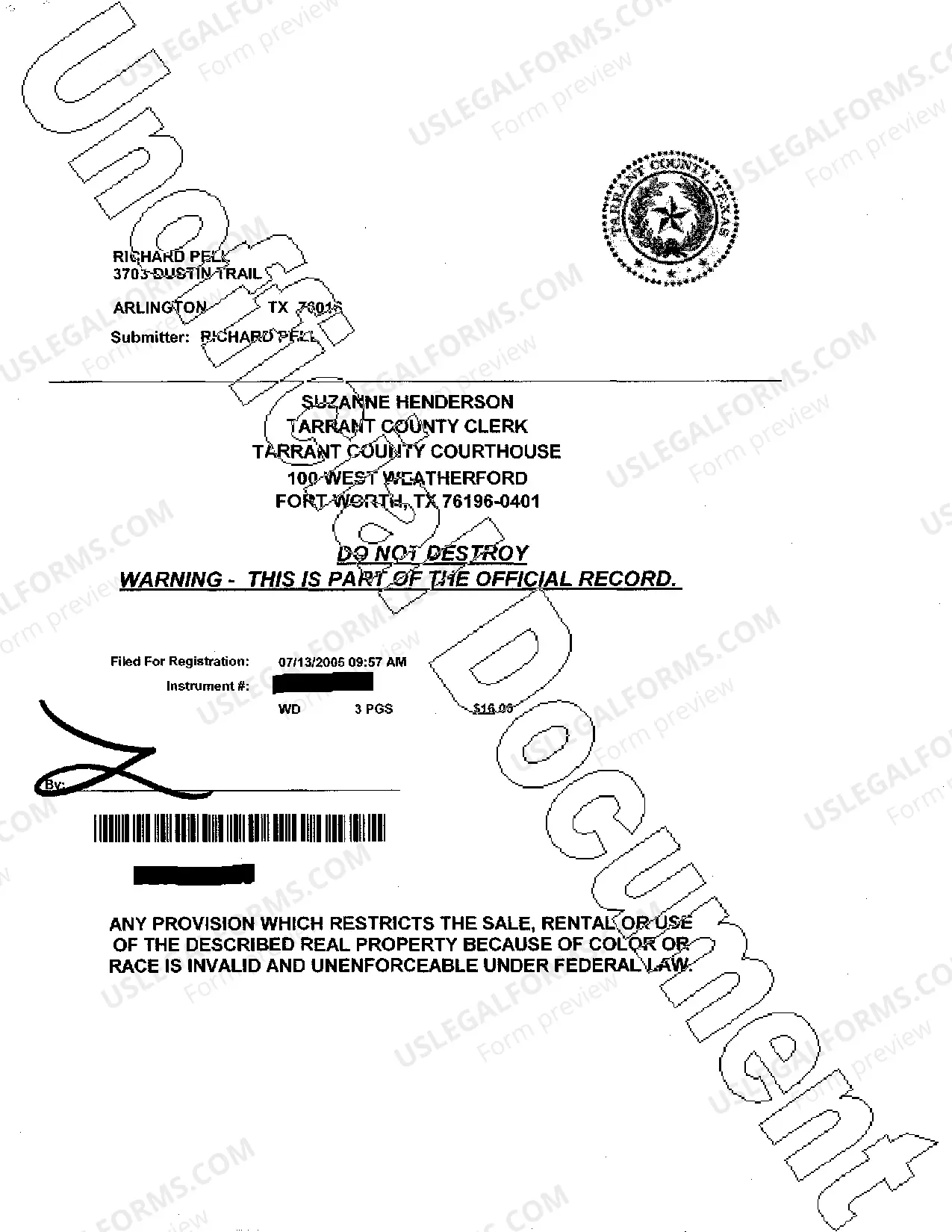

Sugar Land Texas Mortgage refers to the process of securing a home loan for individuals or families in Sugar Land, Texas. Sugar Land, a vibrant city located in Fort Bend County, offers an array of housing options, ranging from luxurious homes in gated communities to charming townhouses and apartments. As home prices in Sugar Land continue to rise, obtaining a mortgage becomes essential for most homebuyers. There are several types of mortgages available in Sugar Land, including: 1. Conventional Mortgage: This is the most common type of mortgage, offering fixed or adjustable interest rates. It requires a down payment and is typically suited for individuals with good credit scores and stable incomes. 2. FHA Loan: Backed by the Federal Housing Administration, this type of mortgage is accessible to borrowers with lower credit scores and allows for a lower down payment, making it ideal for first-time homebuyers. 3. VA Loan: Designed exclusively for veterans, active-duty military personnel, and their families, VA loans offer favorable terms and typically require now down payment. 4. Jumbo Loan: When purchasing a high-value home in Sugar Land, borrowers may require a jumbo loan, which exceeds the conventional loan limits set by Fannie Mae and Freddie Mac. 5. USDA Loan: Ideal for individuals seeking homes in rural areas of Sugar Land, USDA loans offer low mortgage rates and no down payment, provided the borrower meets income and property eligibility criteria. Obtaining a Sugar Land Texas Mortgage involves several steps. Firstly, potential homebuyers should assess their financial situation, including credit scores, income stability, and debt levels. Next, they should research and compare different mortgage lenders in Sugar Land, considering factors such as interest rates, closing costs, and customer reviews. After selecting a lender, borrowers will need to complete a mortgage application, providing personal and financial information. The lender will then assess the application and determine the loan amount for which the borrower qualifies. If approved, borrowers move to the underwriting process, during which the lender verifies the provided information and evaluates the property's value. Upon successfully completing the underwriting process, the borrower will be issued a loan commitment letter, outlining the terms and conditions of the mortgage. Closing is the final step, during which legal documents are signed, and funds are disbursed to complete the purchase. Overall, Sugar Land Texas Mortgage options offer flexibility and assistance to individuals or families aspiring to own a home in this vibrant city. By exploring the various types of mortgages available and working with a trusted lender, prospective homebuyers can make informed decisions and achieve their goal of homeownership in Sugar Land, Texas.

Sugar Land Texas Mortgage

Description

How to fill out Sugar Land Texas Mortgage?

We always strive to reduce or prevent legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for legal solutions that, usually, are extremely expensive. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of legal counsel. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Sugar Land Texas Mortgage or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is equally effortless if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Sugar Land Texas Mortgage complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Sugar Land Texas Mortgage is proper for your case, you can pick the subscription option and proceed to payment.

- Then you can download the document in any available file format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!