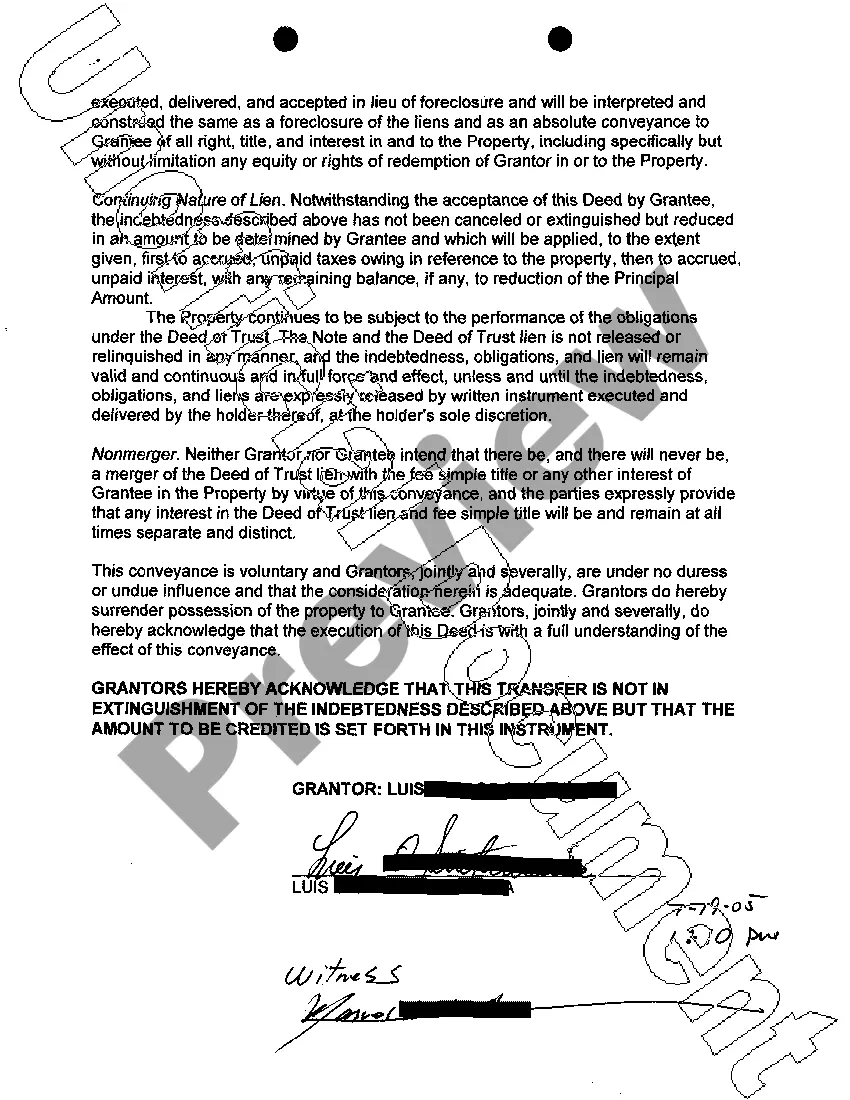

Abilene Texas Deed in Lieu of Foreclosure is a legal arrangement between a homeowner and a lender that allows the homeowner to transfer ownership of their property to the lender in exchange for releasing them from their mortgage obligations. This alternative to foreclosure can be a viable option for homeowners in Abilene, Texas who are facing financial hardship and are unable to keep up with their mortgage payments. Keywords: Abilene Texas, Deed in Lieu of Foreclosure, foreclosure, homeowner, lender, mortgage obligations, alternative, financial hardship, mortgage payments. There are two different types of Abilene Texas Deed in Lieu of Foreclosure: 1. Traditional Deed in Lieu of Foreclosure: This type involves the homeowner voluntarily surrendering the property to the lender. The homeowner signs a deed transferring ownership rights to the lender, and in return, the lender agrees to release the homeowner from any further obligation to repay the mortgage debt. This option can help homeowners avoid the negative consequences of foreclosure and the impact it can have on their credit score. 2. Cash for Keys: In this type of Abilene Texas Deed in Lieu of Foreclosure, the lender offers the homeowner a financial incentive to voluntarily vacate the property. The lender provides a cash payment to the homeowner in exchange for their cooperation and willingness to hand over the property without the need for formal foreclosure proceedings. Cash for Keys can provide homeowners with financial assistance to help them transition to a new living arrangement and avoid the lengthy foreclosure process. Both types of Abilene Texas Deed in Lieu of Foreclosure options require the homeowner to be in communication and negotiation with their lender. It is essential for homeowners to consult with legal professionals or housing counselors who can guide them through the process and ensure they understand the implications of entering into a Deed in Lieu of Foreclosure agreement. By exploring these alternatives, homeowners in Abilene, Texas can potentially find a solution that minimizes the financial and emotional impact of foreclosure and provides a fresh start towards financial stability and housing security.

Abilene Texas Deed in Lieu of Foreclosure

Description

How to fill out Abilene Texas Deed In Lieu Of Foreclosure?

Make use of the US Legal Forms and have immediate access to any form template you need. Our helpful platform with a huge number of templates makes it simple to find and get almost any document sample you require. You can download, fill, and sign the Abilene Texas Deed in Lieu of Foreclosure in a few minutes instead of surfing the Net for many hours seeking an appropriate template.

Using our collection is an excellent way to increase the safety of your form submissions. Our professional attorneys regularly check all the records to ensure that the templates are relevant for a particular state and compliant with new acts and polices.

How do you get the Abilene Texas Deed in Lieu of Foreclosure? If you have a subscription, just log in to the account. The Download button will be enabled on all the documents you view. Additionally, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, follow the tips listed below:

- Find the form you need. Make certain that it is the form you were seeking: check its title and description, and utilize the Preview function when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the downloading procedure. Click Buy Now and select the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Download the file. Pick the format to obtain the Abilene Texas Deed in Lieu of Foreclosure and modify and fill, or sign it according to your requirements.

US Legal Forms is one of the most significant and reliable template libraries on the web. We are always ready to help you in any legal case, even if it is just downloading the Abilene Texas Deed in Lieu of Foreclosure.

Feel free to take advantage of our form catalog and make your document experience as efficient as possible!