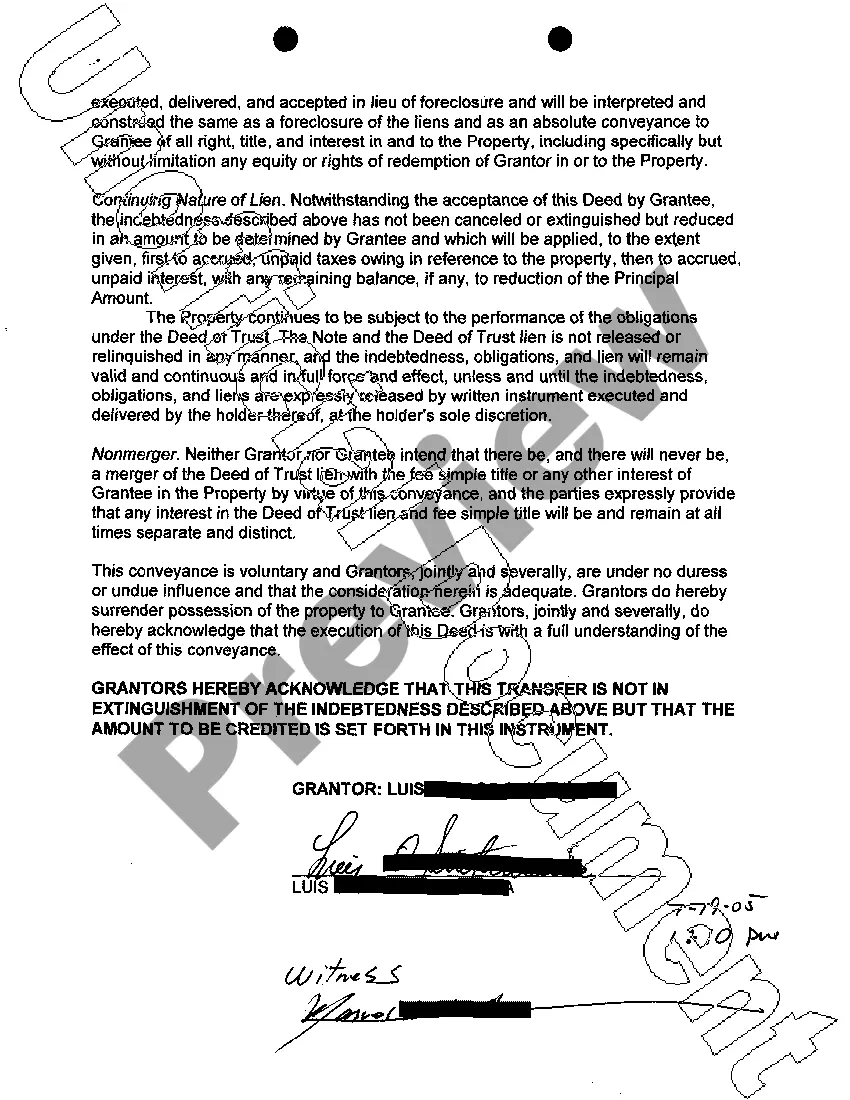

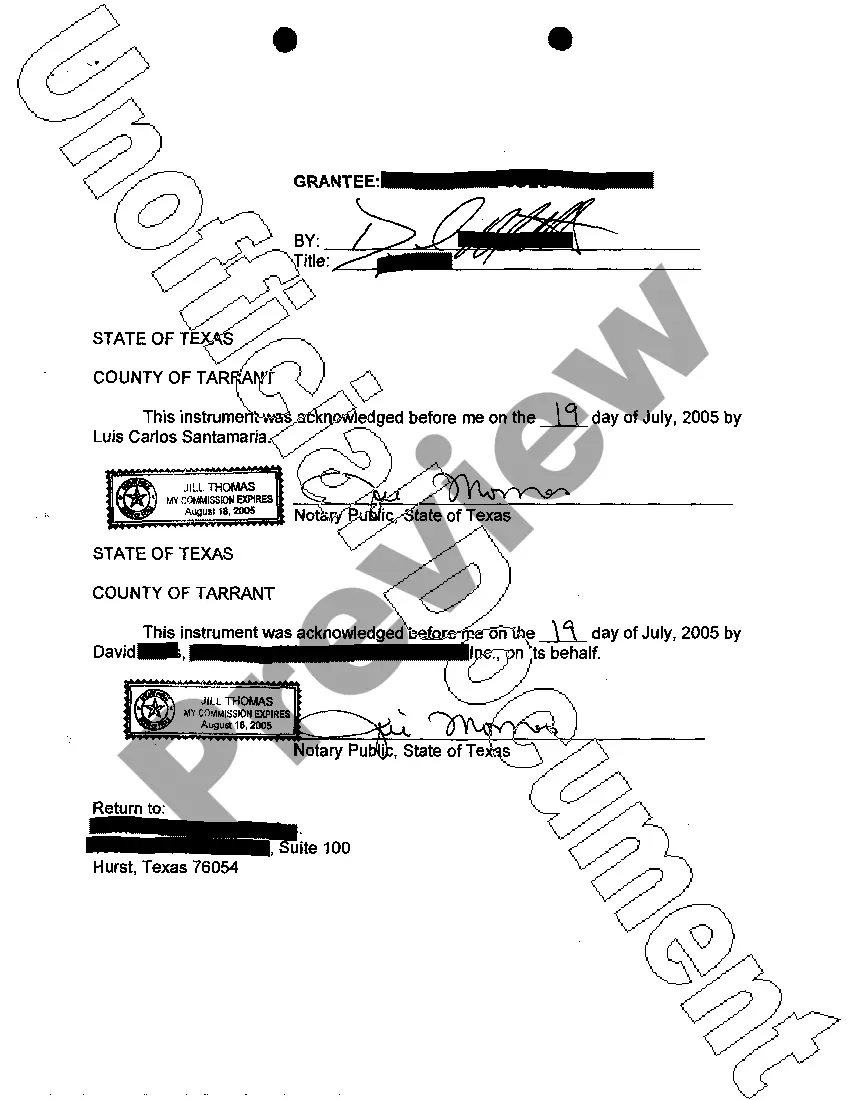

Waco Texas Deed in Lieu of Foreclosure is a legal process that allows homeowners in Waco, Texas, who are facing foreclosure, to voluntarily transfer ownership of their property to the mortgage lender. This option is often pursued when homeowners are unable to make their mortgage payments and are at risk of losing their home. By opting for a Deed in Lieu of Foreclosure, homeowners can avoid the time-consuming and costly foreclosure process. To initiate a Deed in Lieu of Foreclosure in Waco, Texas, homeowners must first communicate their intention to the mortgage lender. It is essential to engage in open and transparent discussions to explore this option. The lender will assess the homeowner's financial situation, including their ability to repay the mortgage, the property's value, and the outstanding loan balance. If the lender determines that a Deed in Lieu of Foreclosure is a viable solution, they will typically require the homeowner to provide certain documentation. Key documents that may be required during the Waco Texas Deed in Lieu of Foreclosure process include a hardship letter explaining the homeowner's financial difficulties, along with supporting documentation such as bank statements, pay stubs, tax returns, and any other relevant financial records. The lender may also perform a property appraisal to determine its current market value. In Waco, Texas, there are no specific types of Deed in Lieu of Foreclosure that differ from the general process. However, it is worth noting that the terms of the agreement may vary depending on the lender and the homeowner's unique circumstances. For example, some lenders may negotiate the forgiveness of any remaining debt after the property is transferred, while others may require the homeowner to repay a portion of the outstanding mortgage balance. It is crucial for homeowners in Waco, Texas, to understand the potential implications of opting for a Deed in Lieu of Foreclosure. While it can help them avoid the foreclosure process, it may have an impact on their credit score and potentially result in tax consequences. Consulting with a real estate attorney or financial advisor who specializes in foreclosure alternatives is strongly recommended to fully understand the implications and make an informed decision. In conclusion, a Waco Texas Deed in Lieu of Foreclosure offers homeowners an alternative option to mitigate the potential consequences of foreclosure. By voluntarily transferring ownership of the property to the lender, homeowners can avoid the time and expense associated with foreclosure. While there are no different types of Deed in Lieu of Foreclosure specific to Waco, Texas, the terms of the agreement may vary depending on the lender and the homeowner's unique circumstances. It is advisable to seek professional guidance when considering this foreclosure alternative.

Waco Texas Deed in Lieu of Foreclosure

Description

How to fill out Waco Texas Deed In Lieu Of Foreclosure?

Take advantage of the US Legal Forms and have immediate access to any form sample you require. Our beneficial platform with a large number of templates simplifies the way to find and obtain virtually any document sample you will need. You are able to save, complete, and certify the Waco Texas Deed in Lieu of Foreclosure in just a few minutes instead of surfing the Net for hours looking for a proper template.

Utilizing our catalog is a wonderful strategy to increase the safety of your document submissions. Our experienced legal professionals on a regular basis review all the documents to make certain that the forms are relevant for a particular state and compliant with new laws and regulations.

How can you get the Waco Texas Deed in Lieu of Foreclosure? If you have a profile, just log in to the account. The Download button will be enabled on all the samples you view. Moreover, you can find all the previously saved records in the My Forms menu.

If you don’t have an account yet, follow the instruction listed below:

- Find the template you require. Make sure that it is the template you were looking for: verify its title and description, and use the Preview function when it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the downloading process. Select Buy Now and select the pricing plan you like. Then, sign up for an account and process your order using a credit card or PayPal.

- Save the file. Indicate the format to get the Waco Texas Deed in Lieu of Foreclosure and modify and complete, or sign it for your needs.

US Legal Forms is probably the most considerable and reliable document libraries on the web. We are always ready to assist you in any legal process, even if it is just downloading the Waco Texas Deed in Lieu of Foreclosure.

Feel free to benefit from our platform and make your document experience as straightforward as possible!