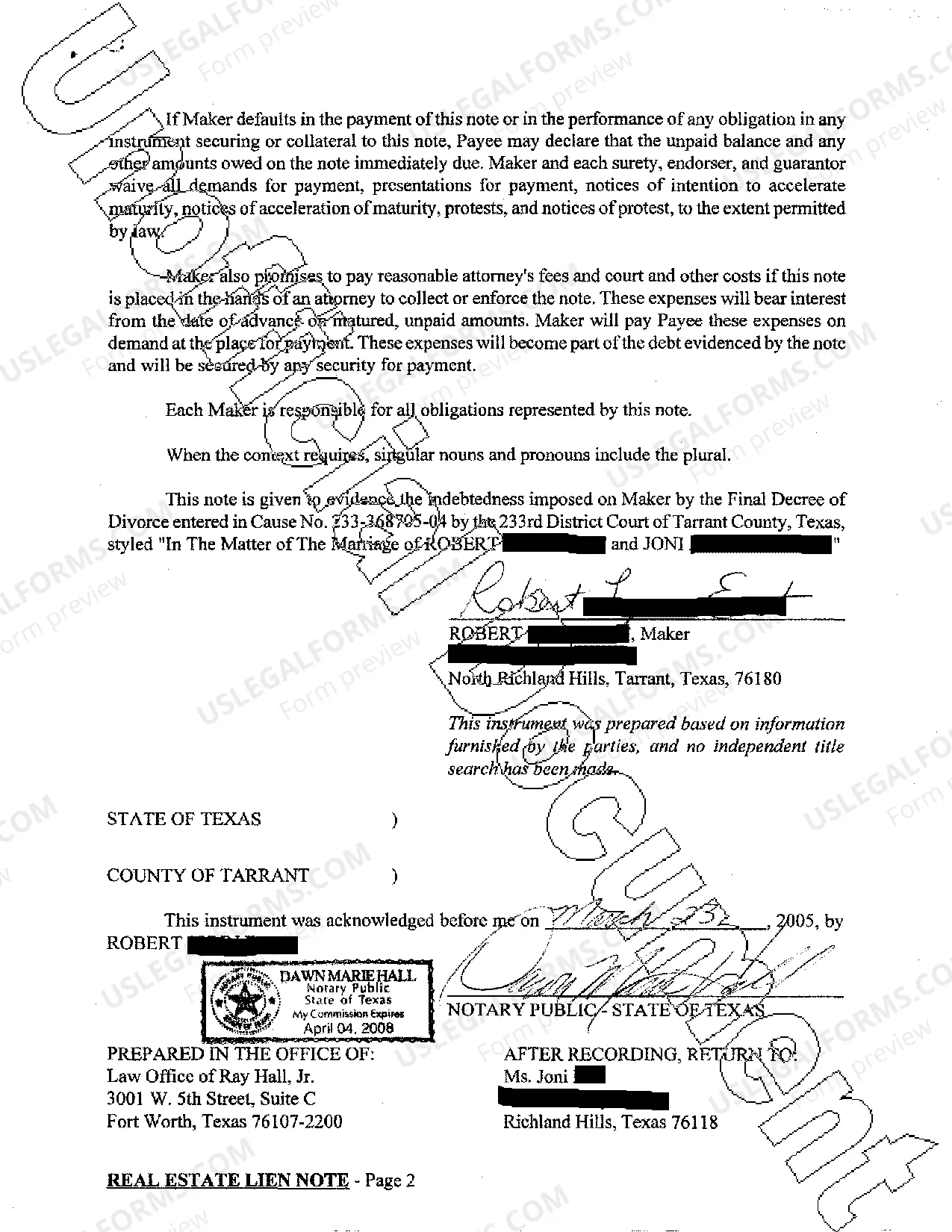

College Station Texas Real Estate Lien Note refers to legal documents that serve as evidence of debt on a property in College Station, Texas. It represents a claim against the property as a security for the repayment of a loan or some other form of financial obligation. A College Stations Texas Real Estate Lien Note typically includes essential details such as the borrower's information, the lender's information, the loan amount, the interest rate, the repayment terms, and the property's description. These notes are recorded in the public records and provide notice to other parties that there is an outstanding debt associated with the property. There are different types of College Station Texas Real Estate Lien Notes, including: 1. Mortgage Lien Note: This is the most common type of lien note and is used when a borrower obtains a loan from a lender to purchase a property. The property acts as collateral, and if the borrower fails to repay the loan, the lender can foreclose on the property. 2. Deed of Trust Lien Note: Similar to a mortgage lien note, a deed of trust lien note is used in Texas instead of a mortgage. It involves three parties: the borrower, the lender, and a trustee who holds the legal title to the property until the loan is fully repaid. 3. Mechanics Lien Note: This type of lien note is used when a contractor or supplier is not paid for work done or materials provided on a property. The mechanics lien note allows them to claim a lien on the property until they receive payment. 4. Property Tax Lien Note: If a property owner fails to pay their property taxes, the local government can place a tax lien on the property. The property tax lien note serves as a record of the outstanding debt and the right of the government to collect it through foreclosure if necessary. 5. Judgment Lien Note: When a court awards a monetary judgment to a creditor, they can place a judgment lien on the debtor's property. The judgment lien note records the amount owed and gives the creditor the right to satisfy the debt from the proceeds if the property is sold. It's important for buyers, sellers, and lenders to have a clear understanding of College Station Texas Real Estate Lien Notes as they play a significant role in property transactions and financial obligations. Consulting with a real estate attorney or professional is recommended to fully comprehend the implications and potential risks associated with these lien notes.

College Station Texas Real Estate Lien Note

Description

How to fill out College Station Texas Real Estate Lien Note?

We always strive to reduce or avoid legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for attorney solutions that, usually, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of an attorney. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the College Station Texas Real Estate Lien Note or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the College Station Texas Real Estate Lien Note complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the College Station Texas Real Estate Lien Note is proper for your case, you can select the subscription option and proceed to payment.

- Then you can download the form in any available format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!