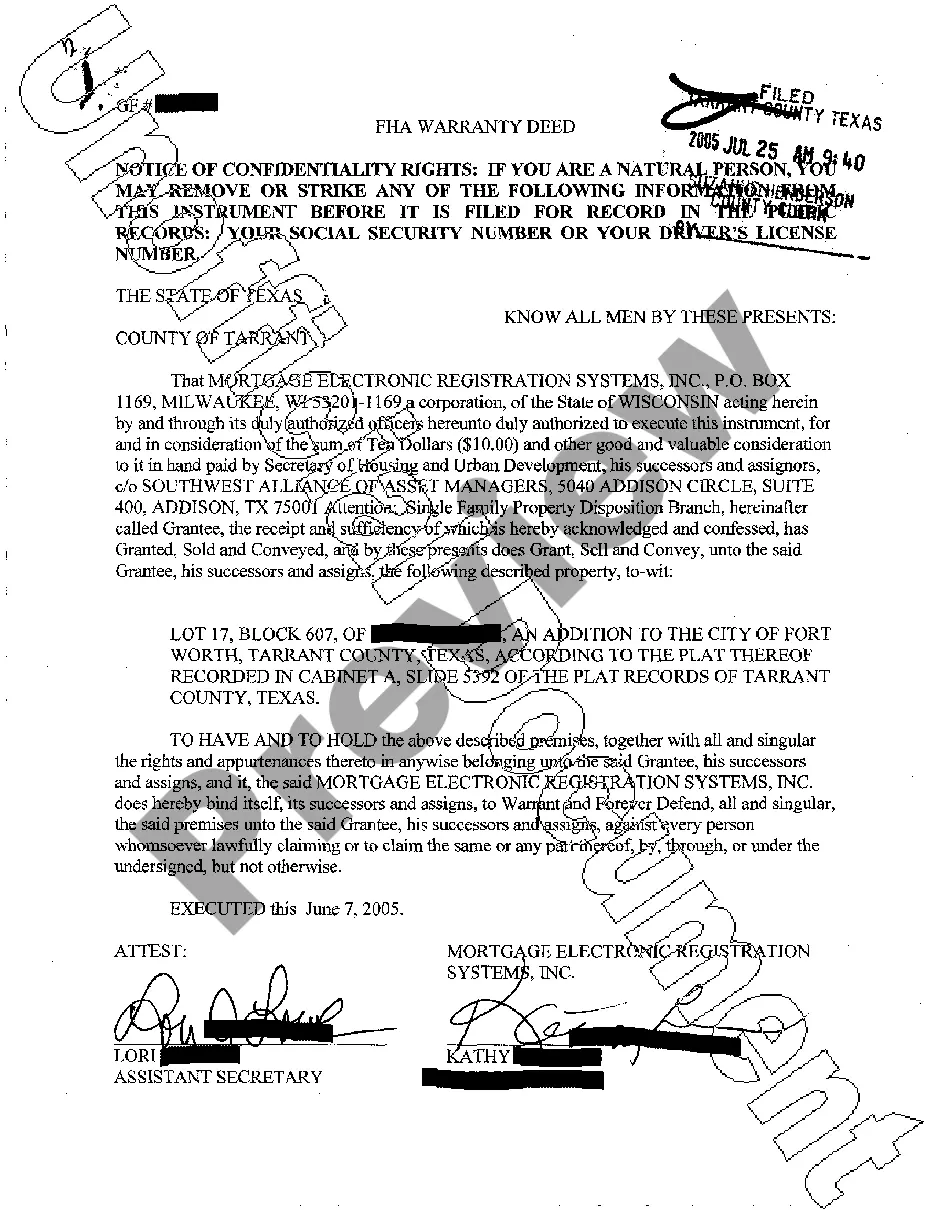

College Station Texas FHA Warranty Deed: A Comprehensive Guide If you are a resident of College Station, Texas, and looking to buy or sell a property, understanding the various types of deeds is crucial. One such important deed is the College Station Texas FHA Warranty Deed, which provides certain assurances and guarantees to both the buyer and the seller. In this guide, we will delve into the details of this deed, its purpose, and any different types you might encounter. A warranty deed is a legal document used to transfer real estate ownership from one party to another, with explicit promises and covenants guaranteeing that the property is free from any existing liens or title defects. In the case of College Station, Texas, an FHA warranty deed not only offers standard protections but also complies with the guidelines set by the Federal Housing Administration (FHA). The FHA, a division of the Department of Housing and Urban Development (HUD), aims to facilitate affordable housing options for Americans and reduce risks for lenders. By obtaining an FHA warranty deed, the property can qualify for FHA financing, opening up opportunities for potential buyers who might not meet traditional lending criteria. When it comes to different types of College Station Texas FHA Warranty Deeds, specific names may vary depending on the circumstances or parties involved. However, they generally fall into two main categories: 1. General Warranty Deed: This type of deed provides the broadest form of protection for the buyer. In College Station, Texas, a general warranty deed under the FHA ensures that the seller guarantees the title against any claims, even those arising before their ownership. This means that the buyer can seek remedy from the seller if any defect or claim arises, subject to certain limitations and conditions. 2. Special Warranty Deed: Also referred to as a limited warranty deed, this type of deed offers a narrower range of protection compared to a general warranty deed. Under an FHA special warranty deed in College Station, Texas, the seller guarantees the title only against claims that might have occurred during their ownership. It does not extend to claims arising from previous owners or outside their period of ownership. When engaging in any real estate transaction, it is essential to consult with legal professionals or a title company to gain a thorough understanding of the specific type of warranty deed being utilized and the protections it affords. Additionally, the involvement of an FHA loan brings an additional layer of complexity, thus necessitating the guidance of experts well-versed in FHA guidelines and procedures. In conclusion, a College Station Texas FHA Warranty Deed is a specialized form of warranty deed that meets the criteria set forth by the Federal Housing Administration. By complying with the FHA guidelines, this type of deed makes properties eligible for FHA financing, expanding access to potential buyers. Understanding the different categories of warranty deeds, such as general warranty and special warranty deeds, helps both parties assess the degree of protection they can expect during the real estate transaction process.

College Station Texas FHA Warranty Deed

Description

How to fill out College Station Texas FHA Warranty Deed?

If you are looking for a valid form, it’s extremely hard to find a better platform than the US Legal Forms website – one of the most extensive libraries on the web. Here you can get a large number of templates for organization and personal purposes by types and states, or key phrases. With the advanced search option, getting the newest College Station Texas FHA Warranty Deed is as elementary as 1-2-3. In addition, the relevance of each and every record is proved by a team of expert lawyers that on a regular basis check the templates on our platform and revise them based on the newest state and county laws.

If you already know about our platform and have an account, all you should do to get the College Station Texas FHA Warranty Deed is to log in to your profile and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have discovered the form you need. Check its information and utilize the Preview option to see its content. If it doesn’t meet your needs, utilize the Search field at the top of the screen to discover the needed document.

- Affirm your decision. Click the Buy now option. After that, pick your preferred pricing plan and provide credentials to register an account.

- Process the purchase. Use your credit card or PayPal account to complete the registration procedure.

- Obtain the template. Choose the file format and download it on your device.

- Make adjustments. Fill out, edit, print, and sign the acquired College Station Texas FHA Warranty Deed.

Every template you add to your profile does not have an expiration date and is yours permanently. You always have the ability to gain access to them using the My Forms menu, so if you want to get an additional duplicate for editing or printing, you may come back and export it once more at any moment.

Take advantage of the US Legal Forms extensive library to get access to the College Station Texas FHA Warranty Deed you were seeking and a large number of other professional and state-specific templates on a single website!