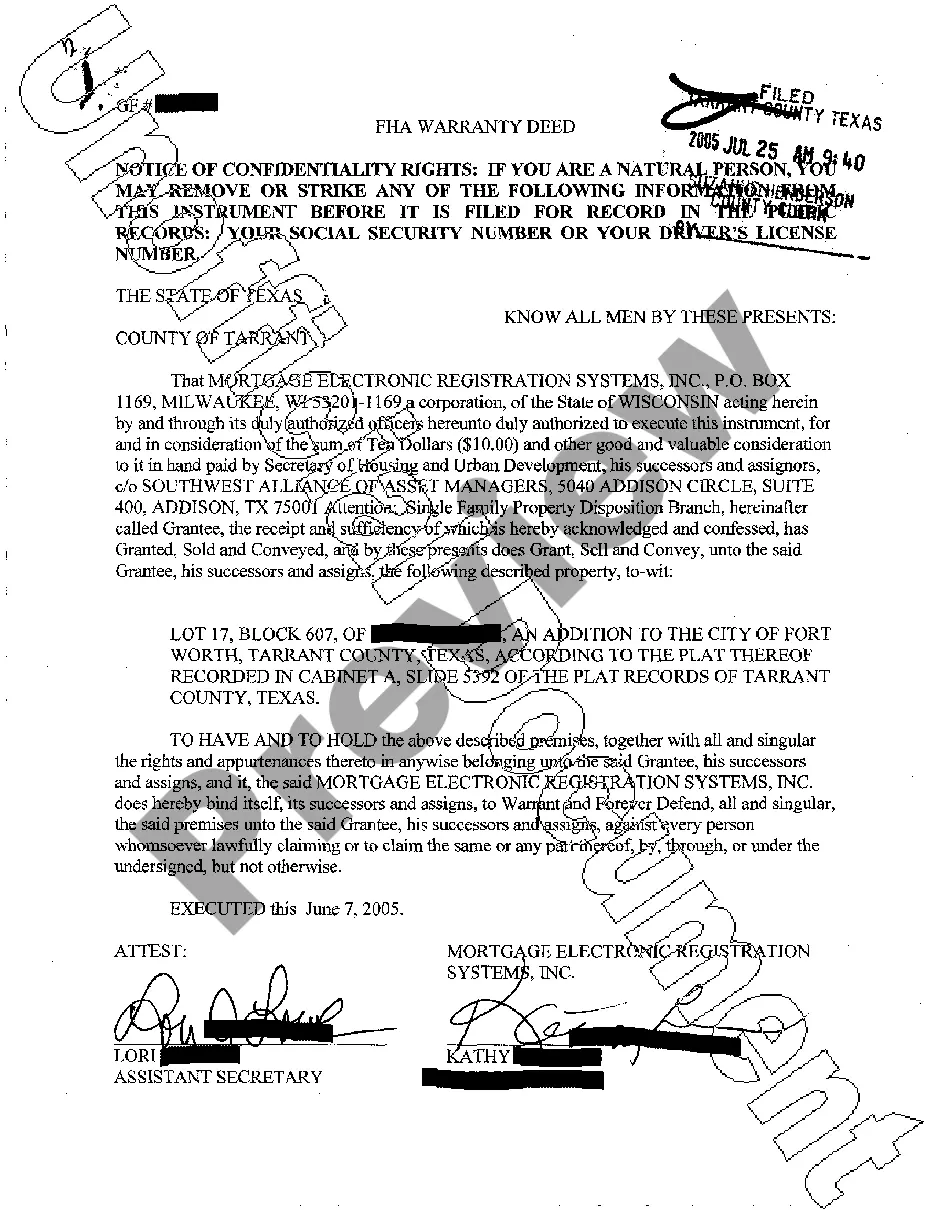

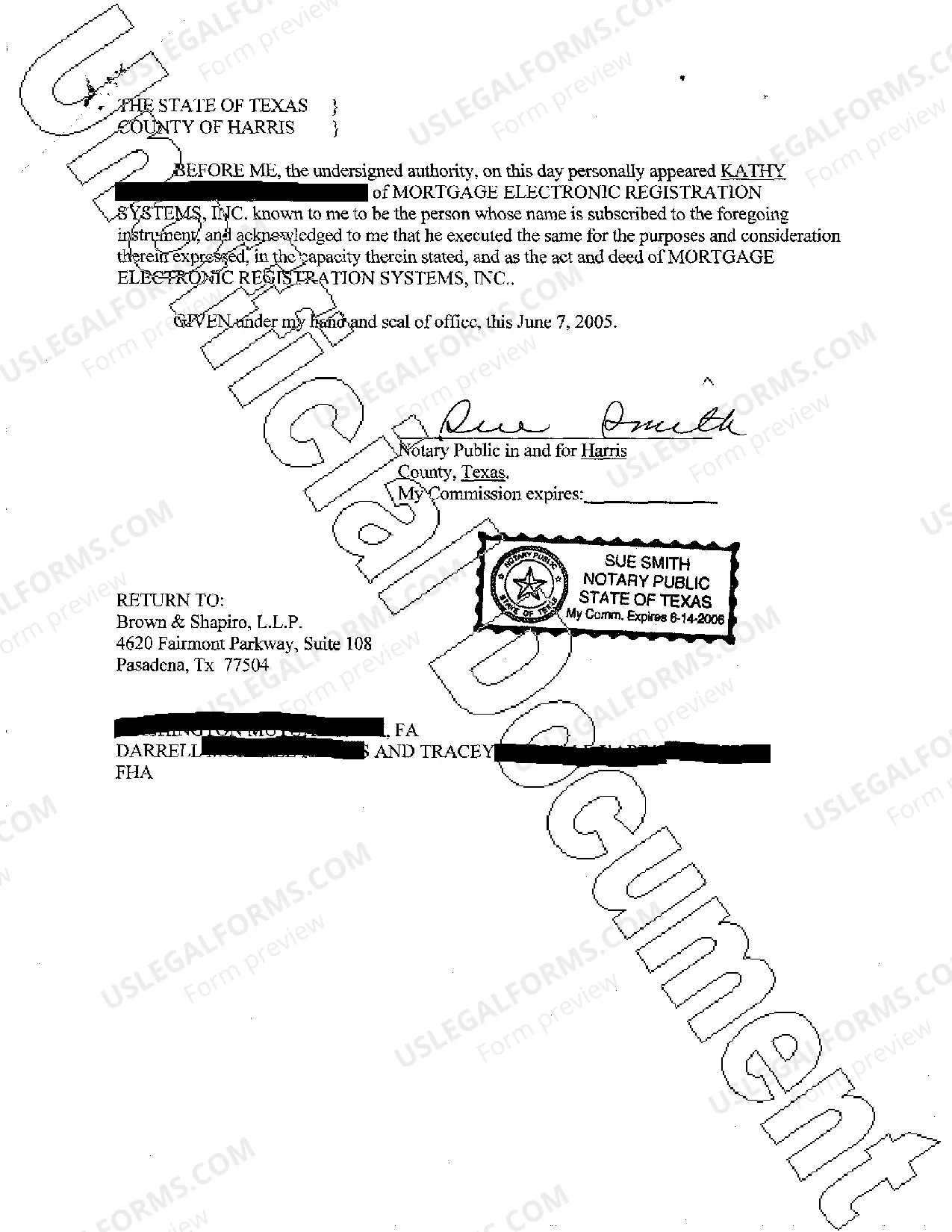

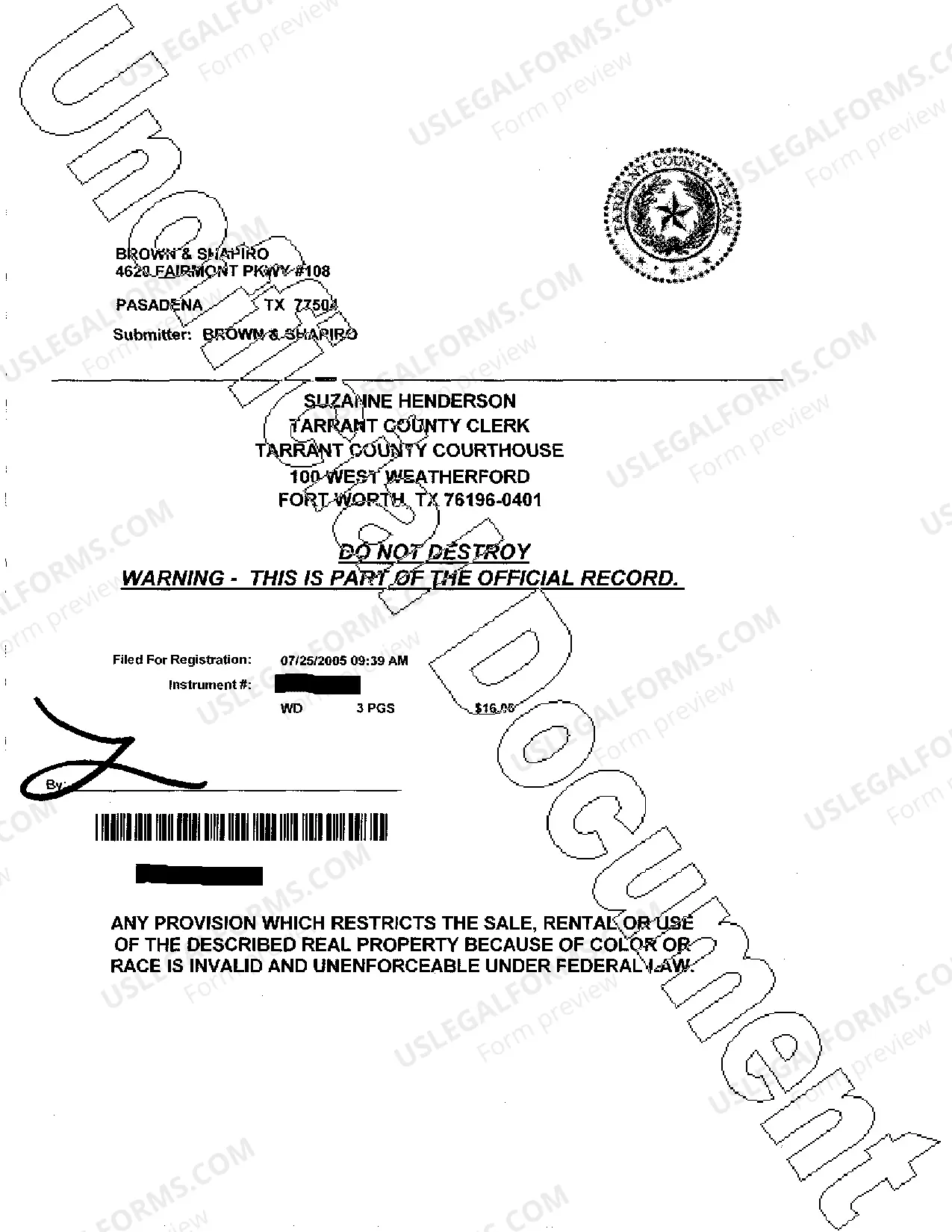

A Fort Worth Texas FHA Warranty Deed is a legal document that guarantees the title or ownership of a property. It is specific to the state of Texas and is regulated by the Federal Housing Administration (FHA). This type of deed is commonly used for real estate transactions involving loans insured by the FHA. The Fort Worth Texas FHA Warranty Deed provides protection to the buyer, ensuring that the property is free from any undisclosed liens or encumbrances. It guarantees that the seller has the legal right to transfer the title and that there are no outstanding claims against the property. There are different types of Fort Worth Texas FHA Warranty Deeds, including: 1. General Warranty Deed: This type of deed offers the highest level of protection to the buyer as it guarantees the title against any claims, even if they arose before the seller acquired the property. 2. Special Warranty Deed: With a special warranty deed, the seller guarantees the title only against claims that may have arisen during their ownership period. This means that any issues that existed before the seller acquired the property are not covered. 3. Quitclaim Deed: A quitclaim deed transfers the seller's rights or interest in the property to the buyer, but without any guarantees or warranties regarding the title. It is a less secure form of warranty deed, as it does not provide any assurances about the property's ownership status or potential liens. When using a Fort Worth Texas FHA Warranty Deed, it is essential to ensure that all necessary information, legal descriptions of the property, and signatures are accurately recorded. Additionally, it is highly recommended consulting with a real estate attorney or professional to ensure compliance with FHA regulations and to obtain proper legal advice.

Fort Worth Texas FHA Warranty Deed

Description

How to fill out Fort Worth Texas FHA Warranty Deed?

Do you need a trustworthy and affordable legal forms supplier to get the Fort Worth Texas FHA Warranty Deed? US Legal Forms is your go-to option.

Whether you require a basic arrangement to set regulations for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of specific state and area.

To download the form, you need to log in account, locate the needed form, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Fort Worth Texas FHA Warranty Deed conforms to the laws of your state and local area.

- Go through the form’s description (if available) to learn who and what the form is intended for.

- Start the search over if the form isn’t good for your legal situation.

Now you can create your account. Then pick the subscription option and proceed to payment. Once the payment is done, download the Fort Worth Texas FHA Warranty Deed in any available format. You can get back to the website at any time and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time learning about legal papers online for good.