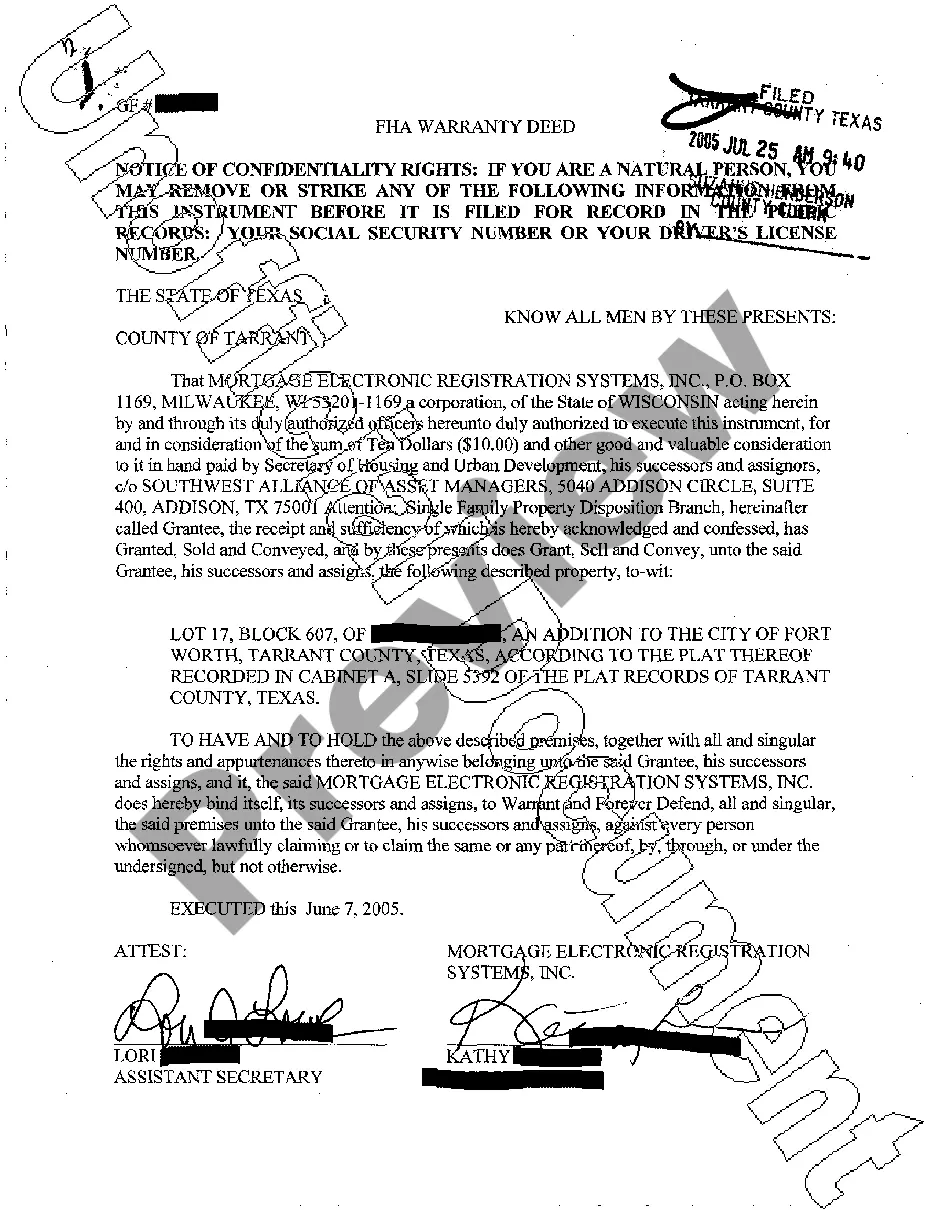

A FHA Warranty Deed, in the context of League City, Texas, refers to a legal document that is utilized in real estate transactions to transfer ownership of a property with certain assurances and guarantees. It provides protection to the buyer by guaranteeing that the property is free from any undisclosed encumbrances or defects in title. The keyword-optimized description of League City Texas FHA Warranty Deed is as follows: A League City Texas FHA Warranty Deed is a legally binding agreement commonly used during real estate transactions in League City, Texas. This document acts as a written guarantee to the buyer, assuring them that the property they are purchasing is free from any undisclosed liens, claims, or defects in title. It provides a sense of security to both parties involved in the transaction. Different types of League City Texas FHA Warranty Deeds include: 1. General Warranty Deed: This type of deed ensures the highest level of protection to the buyer, as it guarantees that the seller holds a clear and marketable title, and will defend it against any claims that may arise in the future. 2. Special Warranty Deed: With a special warranty deed, the seller guarantees that they have not caused any title defects during their ownership of the property. This means that the seller will only defend the title against claims that arise during their ownership period and will not be responsible for any defects that existed before. 3. Quitclaim Deed: Although not technically an FHA Warranty Deed, a quitclaim deed is often used in real estate transactions. It transfers the ownership interest of the seller to the buyer without providing any guarantees or warranties regarding the property's title. This means that the buyer assumes any risks associated with potential undisclosed liens or defects. In summary, when engaging in a real estate transaction in League City, Texas, a FHA Warranty Deed establishes a legal protection for the buyer, guaranteeing that the property's title is clear and free from any unforeseen issues. It is important for both parties involved to understand the type of deed being utilized to determine the level of protection and assurance offered.

League City Texas FHA Warranty Deed

Description

How to fill out League City Texas FHA Warranty Deed?

Do you need a reliable and affordable legal forms provider to get the League City Texas FHA Warranty Deed? US Legal Forms is your go-to choice.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of specific state and area.

To download the document, you need to log in account, find the required form, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the League City Texas FHA Warranty Deed conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to learn who and what the document is good for.

- Start the search over if the form isn’t good for your legal scenario.

Now you can register your account. Then select the subscription plan and proceed to payment. As soon as the payment is completed, download the League City Texas FHA Warranty Deed in any available format. You can get back to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal papers online for good.