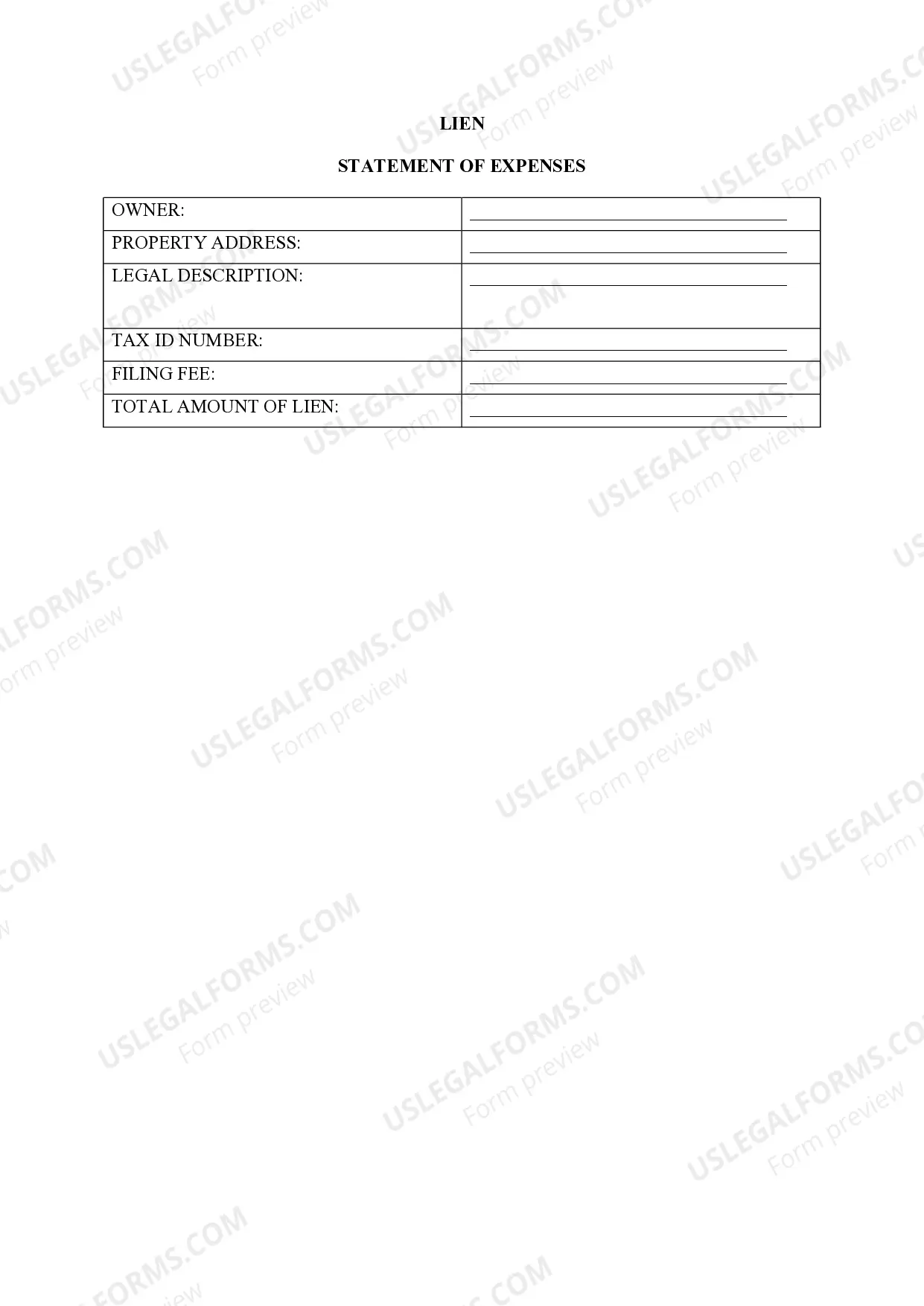

Sugar Land, Texas Lien-Property: A Detailed Description In the vibrant city of Sugar Land, Texas, a lien-property refers to a legal claim placed upon a property by a creditor to secure a debt payment. This ensures that the creditor has a right to the property, enabling them to recover the owed funds if the debtor fails to fulfill their financial obligations. A lien can be imposed by various entities, such as mortgage lenders, tax departments, contractors, or homeowners' associations. Here are a few types of lien-properties commonly encountered in Sugar Land, Texas: 1. Mortgage Lien: When an individual purchases a property using a mortgage loan, the lender typically places a mortgage lien on the property. This lien gives the lender the right to repossess and sell the property if the borrower defaults on the loan payments. 2. Tax Lien: The government, whether at the local, state, or federal level, can impose a tax lien on a property if the owner fails to pay property taxes. The tax lien enables the government to collect the unpaid taxes by selling the property through a tax foreclosure auction. 3. Mechanics Lien: Contractors, subcontractors, or material suppliers who have provided labor or materials for construction or improvement of a property can file a mechanics lien if they are not paid for their services. This lien grants them the legal right to force the sale of the property to recover the owed amount. 4. Homeowners' Association (HOA) Lien: In community developments or subdivisions with shared amenities and maintenance services, homeowners are typically required to pay dues to the HOA. Failure to pay these dues can result in the HOA placing a lien on the property, allowing them to collect the unpaid fees through foreclosure proceedings. 5. Judgment Lien: If an individual is involved in a legal dispute and is awarded a monetary judgment, they can place a judgment lien on the debtor's property. This type of lien ensures that the creditor can enforce the court's decision and collect the owed amount by forcing the sale of the property. 6. Federal Tax Lien: The Internal Revenue Service (IRS) can impose a federal tax lien if an individual or business owes unpaid federal taxes. This lien guarantees that the government has a legal claim on the debtor's property, providing a means to collect the outstanding tax debt. Understanding the various types of lien-properties in Sugar Land, Texas is vital for homeowners, real estate investors, and contractors alike. It is essential to ensure compliance with financial obligations and maintain a good credit record to prevent the possibility of a lien being placed on one's property.

Sugar Land Texas Lien -Property

Description

How to fill out Sugar Land Texas Lien -Property?

We always want to reduce or prevent legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we apply for attorney services that, usually, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of legal counsel. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Sugar Land Texas Lien -Property or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is just as effortless if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Sugar Land Texas Lien -Property adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Sugar Land Texas Lien -Property is proper for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!