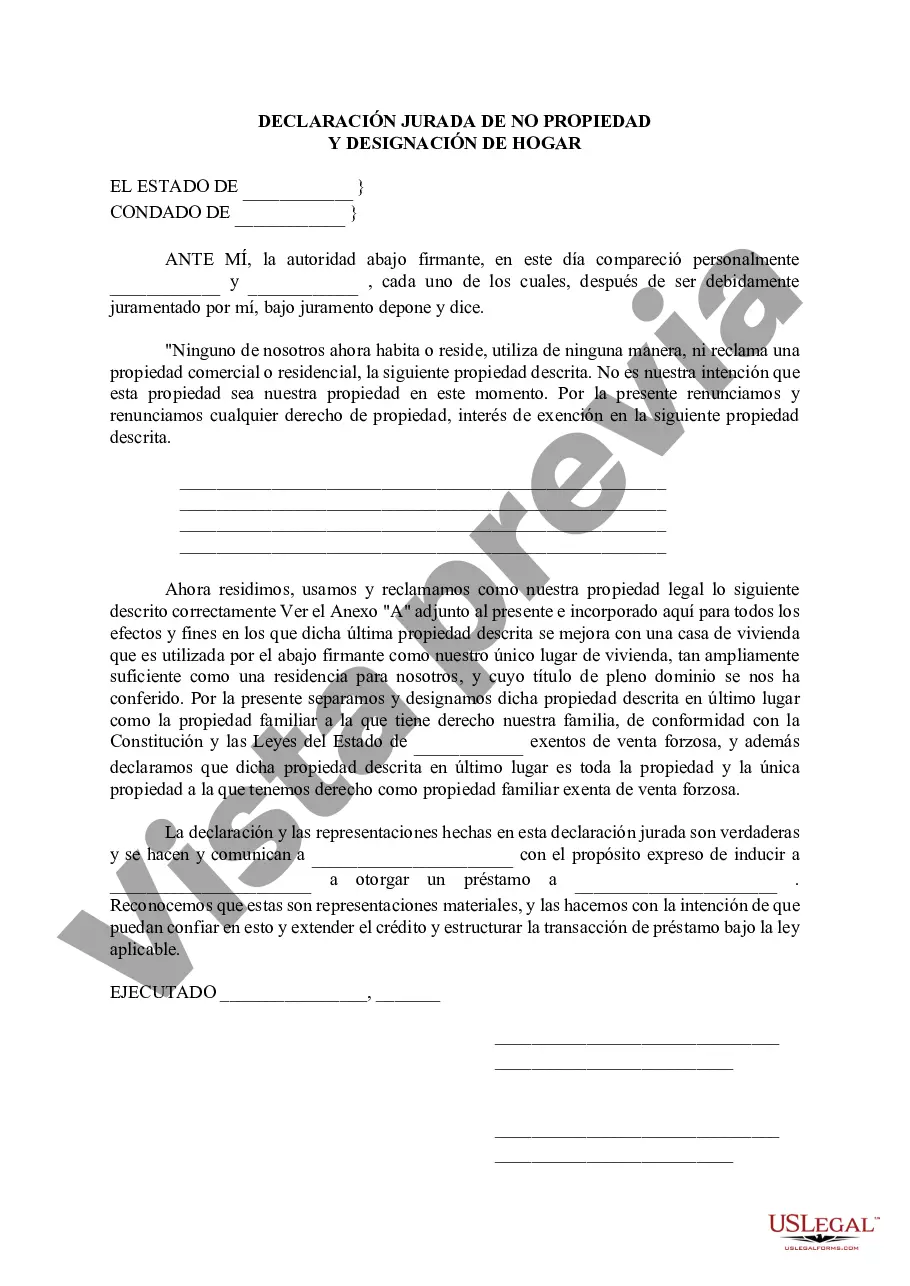

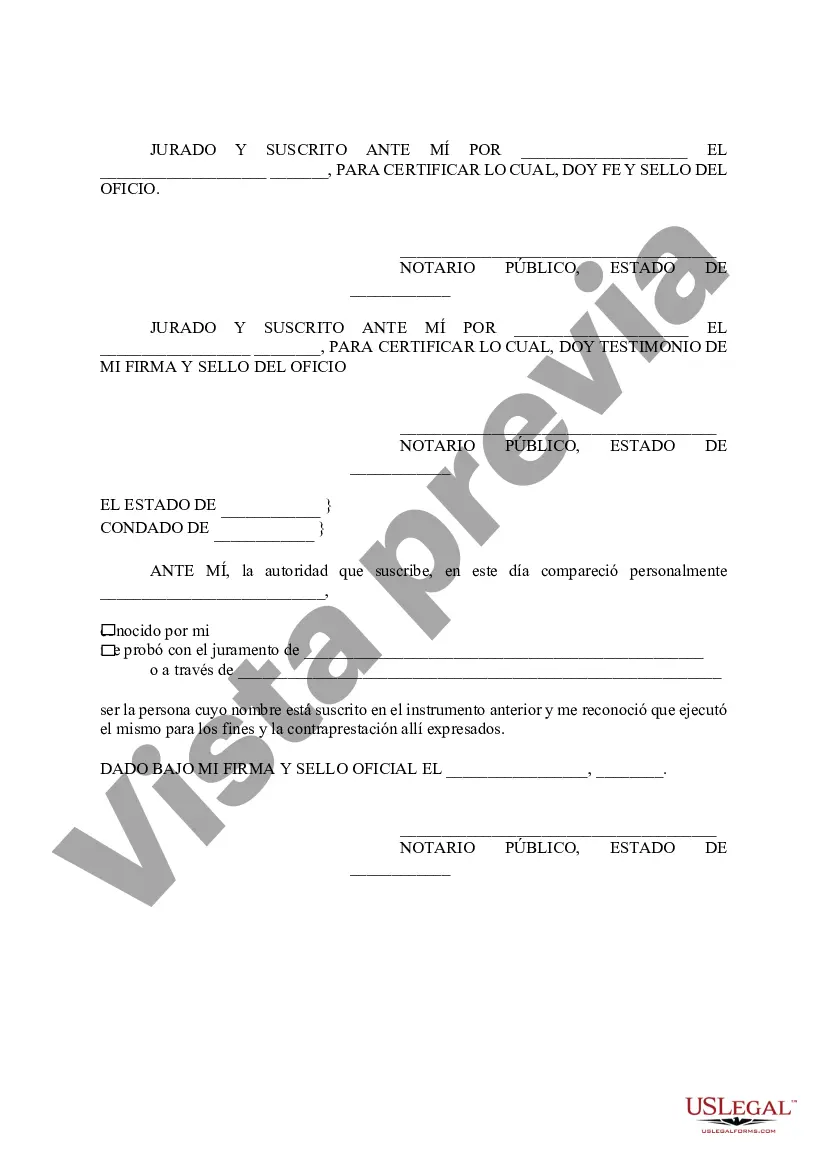

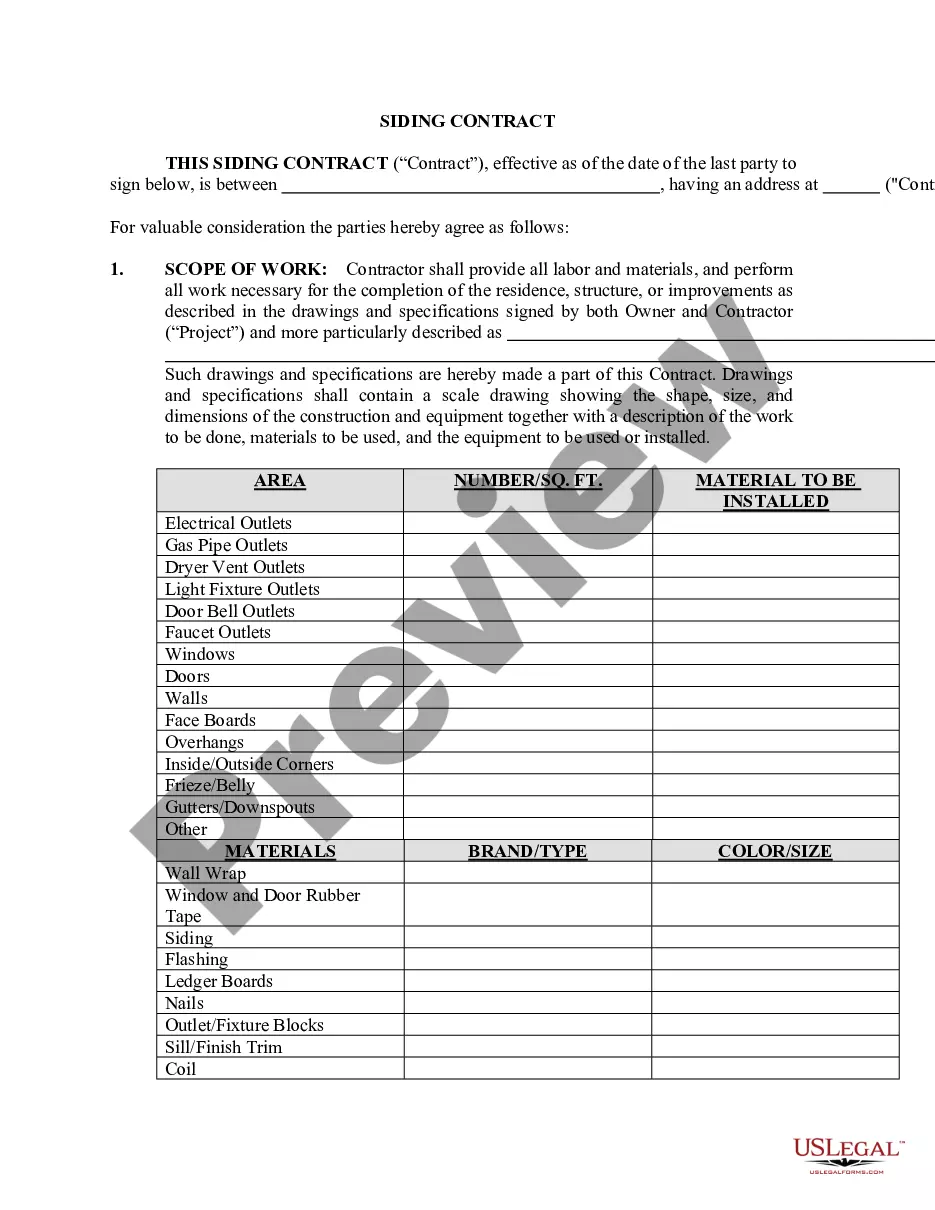

The Abilene Texas Non-Homestead Affidavit and Designation of Homestead are legal documents pertaining to the property ownership and taxation regulations in Abilene, Texas. These documents provide crucial information regarding the designation of a property as a homestead or non-homestead, which affects property taxes and legal protections. The Abilene Texas Non-Homestead Affidavit is a declaration made by a property owner stating that the property is not being used as their primary residence, hence making it non-homestead. This affidavit is required to establish the property's eligibility for non-homestead property tax rates, exemptions, and other relevant regulations. On the other hand, the Designation of Homestead is a document that confirms the property as a homestead. By designating their property as a homestead, the owner gains certain legal protections and benefits, including specific property tax exemptions and limitations on the amount of property taxes that can be increased annually. These documents are essential for property owners in Abilene to accurately declare the status of their properties, ensuring compliance with local taxation laws and regulations. The affidavits must be completed accurately and in accordance with state and county guidelines to avoid any legal complications. Different types of Abilene Texas Non-Homestead Affidavit and Designation of Homestead may include: 1. Non-Homestead Affidavit for Residential Property: This type of affidavit is used to declare a property as non-homestead if it is not the individual's primary residence. It may be a second home, rental property, or any property that the owner does not reside in full-time. 2. Non-Homestead Affidavit for Commercial Property: This affidavit is specific to declaring a commercial property as non-homestead. It confirms that the property is used for business purposes and not as a primary residence. 3. Individual Homestead Designation Affidavit: This designation is applicable for properties claimed by an individual as their primary residence, making them eligible for certain property tax exemptions and legal protections. 4. Family Homestead Designation Affidavit: This type of affidavit is utilized when multiple individuals, typically family members, jointly own and occupy a property as their primary residence. It confirms that the property is designated as a homestead for the purpose of property tax benefits and legal protection. In summary, the Abilene Texas Non-Homestead Affidavit and Designation of Homestead are essential legal documents that property owners in Abilene must complete to designate their properties correctly for property tax purposes. By carefully completing these documents and adhering to relevant guidelines, property owners can ensure accurate taxation and avail themselves of relevant exemptions and legal protections based on the designation of their properties as homestead or non-homestead.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Abilene Texas Declaración jurada de no propiedad familiar y designación de propiedad familiar - Texas Non- Homestead Affidavit and Designation of Homestead

Description

How to fill out Texas Declaración Jurada De No Propiedad Familiar Y Designación De Propiedad Familiar?

Are you seeking a trustworthy and affordable provider of legal forms to purchase the Abilene Texas Non-Homestead Affidavit and Homestead Designation? US Legal Forms is your top option.

Whether you require a simple arrangement to establish guidelines for living together with your partner or a collection of documents to facilitate your separation or divorce through the legal system, we have everything you need. Our platform features over 85,000 current legal document templates for personal and business use. All templates we offer are not generic and tailored based on the regulations of individual states and regions.

To obtain the document, you must sign in to your account, locate the desired template, and click the Download button adjacent to it. Please note that you can download your previously acquired document templates at any time from the My documents tab.

Is this your first visit to our website? No problem. You can create an account in a matter of minutes, but before you do, ensure you follow these steps.

Now you can establish your account. Then choose the subscription plan and move on to payment. Once the payment is finalized, download the Abilene Texas Non-Homestead Affidavit and Designation of Homestead in any provided format. You can revisit the website at any point and redownload the document without incurring any additional fees.

Obtaining current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to wasting hours researching legal papers online for good.

- Verify if the Abilene Texas Non-Homestead Affidavit and Designation of Homestead aligns with the laws of your state and locality.

- Review the form’s specifics (if accessible) to ascertain who and what the document is designed for.

- Reinitiate your search if the template isn’t suitable for your particular circumstances.