In Dallas, Texas, property owners may need to be familiar with the Non-Homestead Affidavit and Designation of Homestead, as these legal documents play a crucial role in understanding and protecting property rights. Whether you are a homeowner, investor, or involved in real estate transactions, understanding these affidavits can be highly beneficial. The Non-Homestead Affidavit is a declaration made by property owners stating that the property they own is not their primary residence and therefore does not qualify for certain tax exemptions or protections provided to homestead properties. By filing this affidavit, property owners acknowledge that their property does not meet the criteria necessary for claiming homestead status. On the other hand, the Designation of Homestead is a document filed by property owners to declare that the property in question is their primary residence and qualifies for various benefits and protections granted by Texas law. It serves as a formal recognition of a property's homestead status, offering protection against certain creditors and potential tax increases. It is important to note that these documents are not mutually exclusive. Property owners have the option to file either the Non-Homestead Affidavit or the Designation of Homestead, depending on their current circumstances. There are a few different types of Non-Homestead Affidavits frequently used in Dallas, Texas, each addressing specific scenarios. These include: 1. Non-Homestead Affidavit for Investment Property: This affidavit is filed for properties that are solely used as investments and not intended as a primary residence. It acknowledges that the property owner does not reside on the premises and therefore cannot claim homestead status. 2. Non-Homestead Affidavit for Rental Property: This type of affidavit is applicable when the property is rented out to tenants, and the property owner does not live on-site. By filing this affidavit, the property owner recognizes that the property is not eligible for certain homestead protections or exemptions. 3. Non-Homestead Affidavit for Vacant Land: This affidavit is filed for undeveloped land that does not have any residential structures or buildings. It acknowledges that the property does not qualify for homestead status due to its non-residential nature. 4. Non-Homestead Affidavit for Secondary Residence: In cases where individuals own multiple properties but only designate one as their primary residence, they can file this affidavit to declare that the property in question is not their primary dwelling. Understanding the different types of Non-Homestead Affidavits and the Designation of Homestead is essential for property owners in Dallas, Texas. These affidavits allow individuals to accurately declare the status of their property, ensuring compliance with local laws and regulations while providing clarity for tax assessments, creditor protection, and other legal considerations.

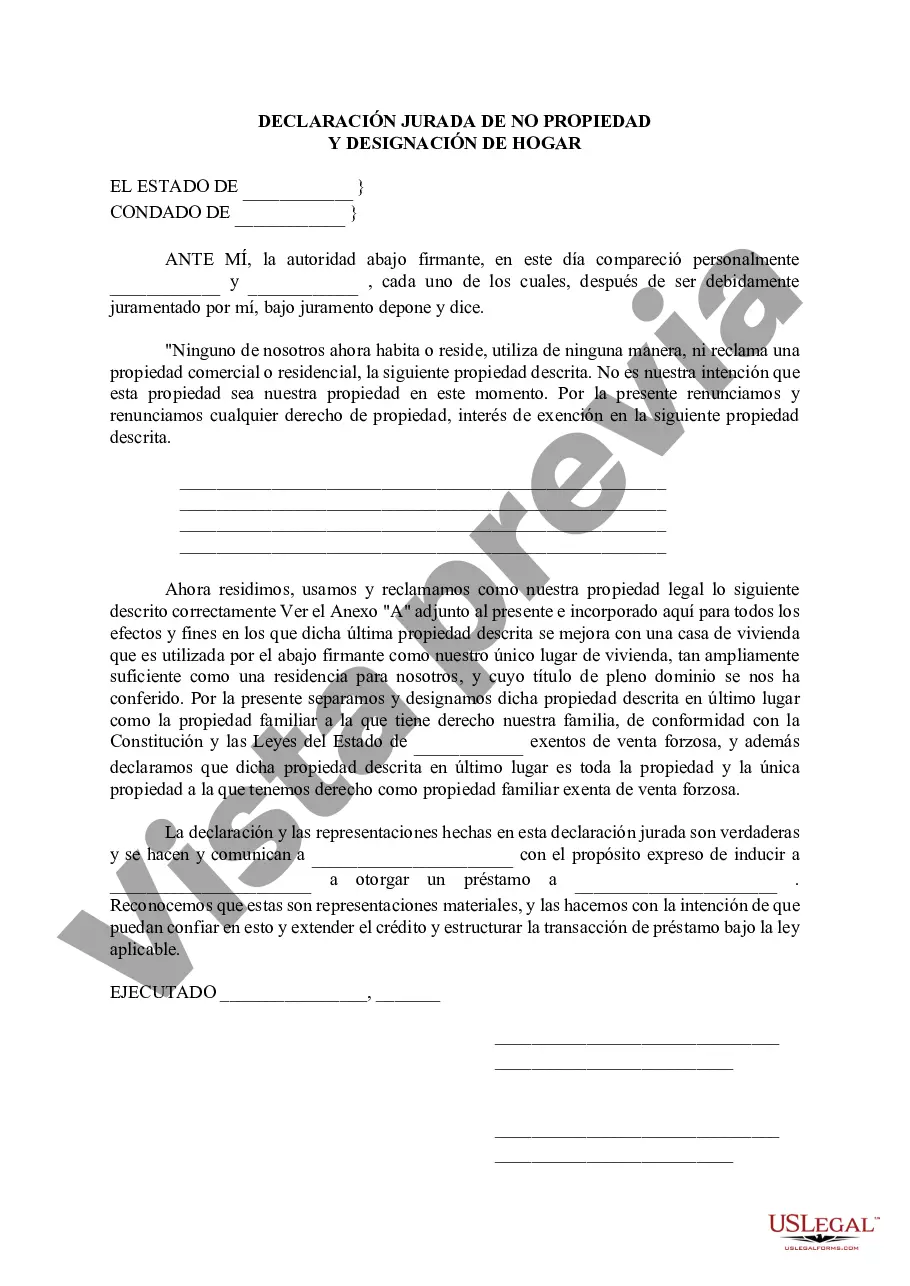

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Declaración jurada de no propiedad familiar y designación de propiedad familiar - Texas Non- Homestead Affidavit and Designation of Homestead

State:

Texas

County:

Dallas

Control #:

TX-LR042T

Format:

Word

Instant download

Description

This affidavit is used to notify a change in location of legal Homestead Property.

In Dallas, Texas, property owners may need to be familiar with the Non-Homestead Affidavit and Designation of Homestead, as these legal documents play a crucial role in understanding and protecting property rights. Whether you are a homeowner, investor, or involved in real estate transactions, understanding these affidavits can be highly beneficial. The Non-Homestead Affidavit is a declaration made by property owners stating that the property they own is not their primary residence and therefore does not qualify for certain tax exemptions or protections provided to homestead properties. By filing this affidavit, property owners acknowledge that their property does not meet the criteria necessary for claiming homestead status. On the other hand, the Designation of Homestead is a document filed by property owners to declare that the property in question is their primary residence and qualifies for various benefits and protections granted by Texas law. It serves as a formal recognition of a property's homestead status, offering protection against certain creditors and potential tax increases. It is important to note that these documents are not mutually exclusive. Property owners have the option to file either the Non-Homestead Affidavit or the Designation of Homestead, depending on their current circumstances. There are a few different types of Non-Homestead Affidavits frequently used in Dallas, Texas, each addressing specific scenarios. These include: 1. Non-Homestead Affidavit for Investment Property: This affidavit is filed for properties that are solely used as investments and not intended as a primary residence. It acknowledges that the property owner does not reside on the premises and therefore cannot claim homestead status. 2. Non-Homestead Affidavit for Rental Property: This type of affidavit is applicable when the property is rented out to tenants, and the property owner does not live on-site. By filing this affidavit, the property owner recognizes that the property is not eligible for certain homestead protections or exemptions. 3. Non-Homestead Affidavit for Vacant Land: This affidavit is filed for undeveloped land that does not have any residential structures or buildings. It acknowledges that the property does not qualify for homestead status due to its non-residential nature. 4. Non-Homestead Affidavit for Secondary Residence: In cases where individuals own multiple properties but only designate one as their primary residence, they can file this affidavit to declare that the property in question is not their primary dwelling. Understanding the different types of Non-Homestead Affidavits and the Designation of Homestead is essential for property owners in Dallas, Texas. These affidavits allow individuals to accurately declare the status of their property, ensuring compliance with local laws and regulations while providing clarity for tax assessments, creditor protection, and other legal considerations.

Free preview

How to fill out Dallas Texas Declaración Jurada De No Propiedad Familiar Y Designación De Propiedad Familiar?

If you’ve already utilized our service before, log in to your account and save the Dallas Texas Non- Homestead Affidavit and Designation of Homestead on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make certain you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Dallas Texas Non- Homestead Affidavit and Designation of Homestead. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!