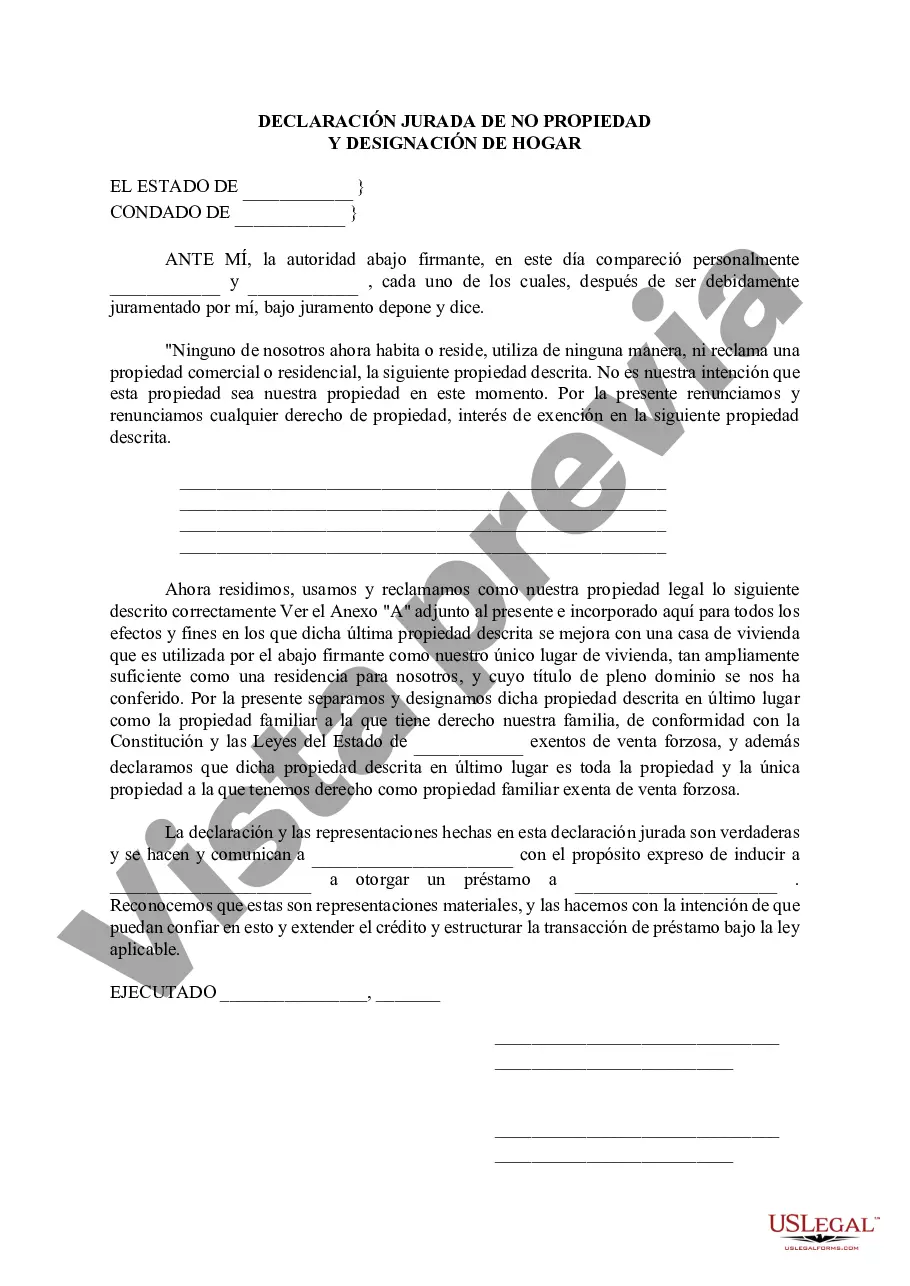

The Houston Texas Non-Homestead Affidavit and Designation of Homestead are legal documents used in the state of Texas to assert a homeowner's rights and protections related to homestead exemptions and property taxes. These documents are typically required when a homeowner is purchasing, refinancing, or transferring ownership of a residential property. The Homestead Affidavit serves as a declaration by the homeowner that the property being purchased or refinanced is or will be their primary residence. By designating a property as a homestead, homeowners become eligible for certain benefits and protections, such as property tax exemptions and protections against forced sale by creditors. This allows homeowners to enjoy a reduced tax burden and safeguards their primary residence from being seized to satisfy debts. The Non-Homestead Affidavit, on the other hand, is used when the property being purchased or refinanced will not be the homeowner's primary residence. Various types of properties fall under this category, including rental properties, vacation homes, and commercial properties. By signing this affidavit, the homeowner acknowledges that the property does not qualify for homestead exemptions and will be subject to different taxation rules and regulations. It is important to note that in Houston, Texas, there are additional types of Homestead Affidavit and Designation of Homestead documents depending on the specific circumstances. For instance, there may be separate affidavits for disabled or elderly homeowners, as they might be eligible for additional exemptions or protections. Additionally, homeowners who have recently suffered a loss due to a natural disaster, such as a hurricane or flood, may be required to submit a specific disaster-related homestead affidavit. These affidavits and designations are significant as they establish a legal framework for property tax assessments, exemptions, and protections. They ensure that homeowners receive the appropriate tax benefits or bear the rightful tax responsibilities based on the use and nature of their property. Failure to accurately complete and file these documents can result in the incorrect assessment of property taxes or the loss of qualifying exemptions. In summary, the Houston Texas Non-Homestead Affidavit and Designation of Homestead are crucial legal documents used to assert a homeowner's rights and protections related to homestead exemptions and property taxes. Homeowners must identify whether their property qualifies as a homestead or non-homestead and complete the relevant documentation accordingly to receive the appropriate benefits and comply with necessary taxation regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Declaración jurada de no propiedad familiar y designación de propiedad familiar - Texas Non- Homestead Affidavit and Designation of Homestead

Description

How to fill out Houston Texas Declaración Jurada De No Propiedad Familiar Y Designación De Propiedad Familiar?

Are you looking for a reliable and affordable provider of legal forms to obtain the Houston Texas Non-Homestead Affidavit and Homestead Designation? US Legal Forms is your ideal choice.

Whether you need a simple agreement to establish rules for living with your partner, or a collection of documents to facilitate your divorce through the legal system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and commercial purposes. All templates we offer are not generic and are tailored to meet the needs of different states and regions.

To acquire the document, you must Log In to your account, locate the required form, and click the Download button adjacent to it. Please remember that you can download your previously acquired form templates at any time from the My documents section.

Is this your first visit to our site? No problem. You can easily create an account, but firstly, be sure to do the following.

Now you can register your account. Next, select the subscription plan and proceed to payment. Once the payment is processed, download the Houston Texas Non-Homestead Affidavit and Homestead Designation in any available file format. Feel free to return to the website at any time and redownload the document at no additional cost.

Finding current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time trying to understand legal paperwork online for good.

- Verify that the Houston Texas Non-Homestead Affidavit and Homestead Designation complies with your state's and local area's regulations.

- Examine the form's description (if provided) to understand who and what the document is designed for.

- Repeat the search if the form does not suit your legal needs.

Form popularity

More info

In general, a residential homestead exemption is provided by the Texas Property Code. This is a property qualification that exempts a homestead from the Texas Homestead Exemption Law. This exemption does not apply to an inherited or inherited property. It applies to a homestead purchased by the surviving spouse or minor children. The qualification for residential homestead exemption is that the homestead is the first home owned by the surviving spouse or minor children. This residence homestead exemption is subject to the following three conditions: It must be on the surviving spouse's or minor children's residential lot. It must be within 10 miles of the surviving spouse or minor children's place of employment The homestead must be at least 25 years old on the date the surviving spouse or minor children acquire it. Qualification The Texas Property Code places two requirements on the residence homestead exemption. They are: Existing homesteads may be exempt homesteads.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.