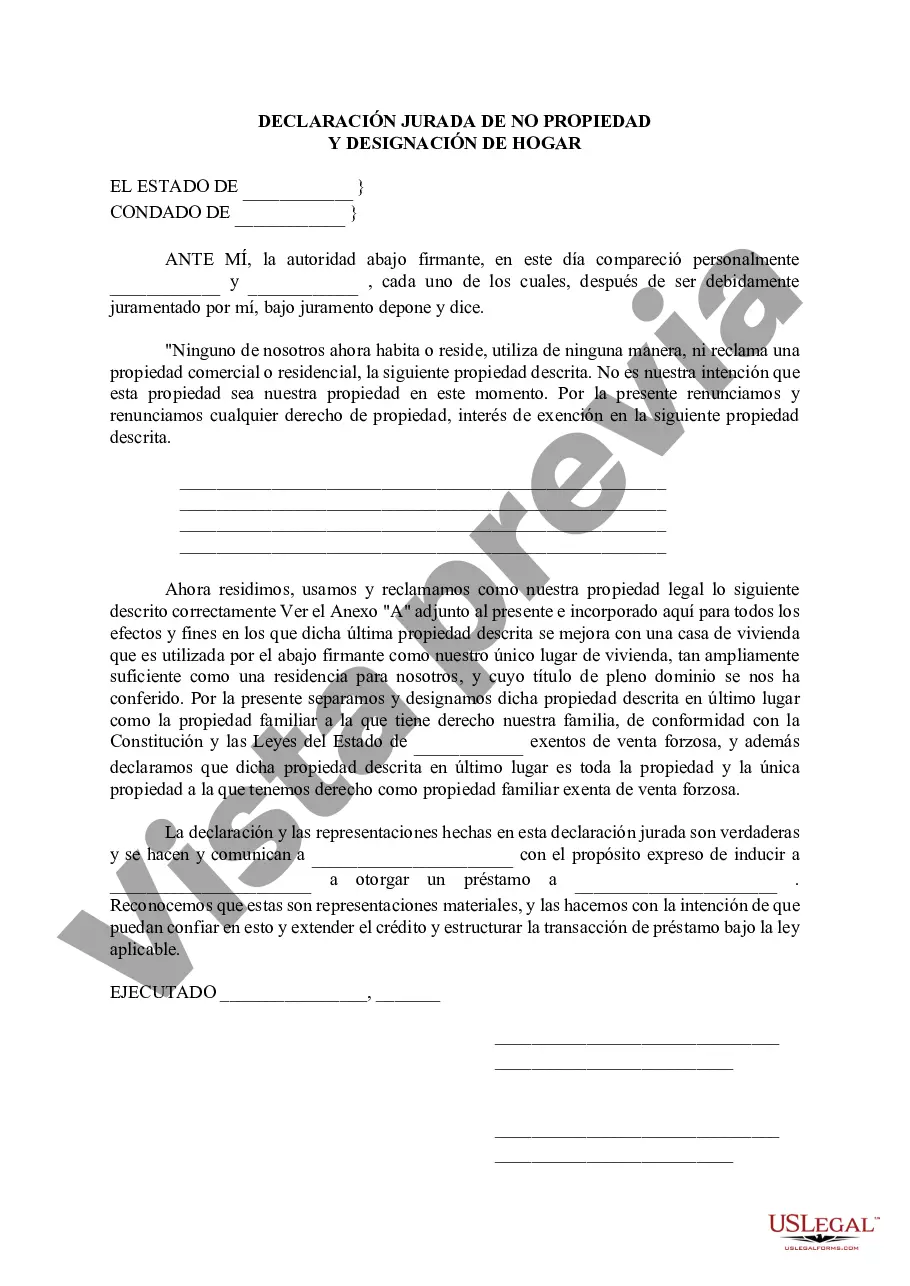

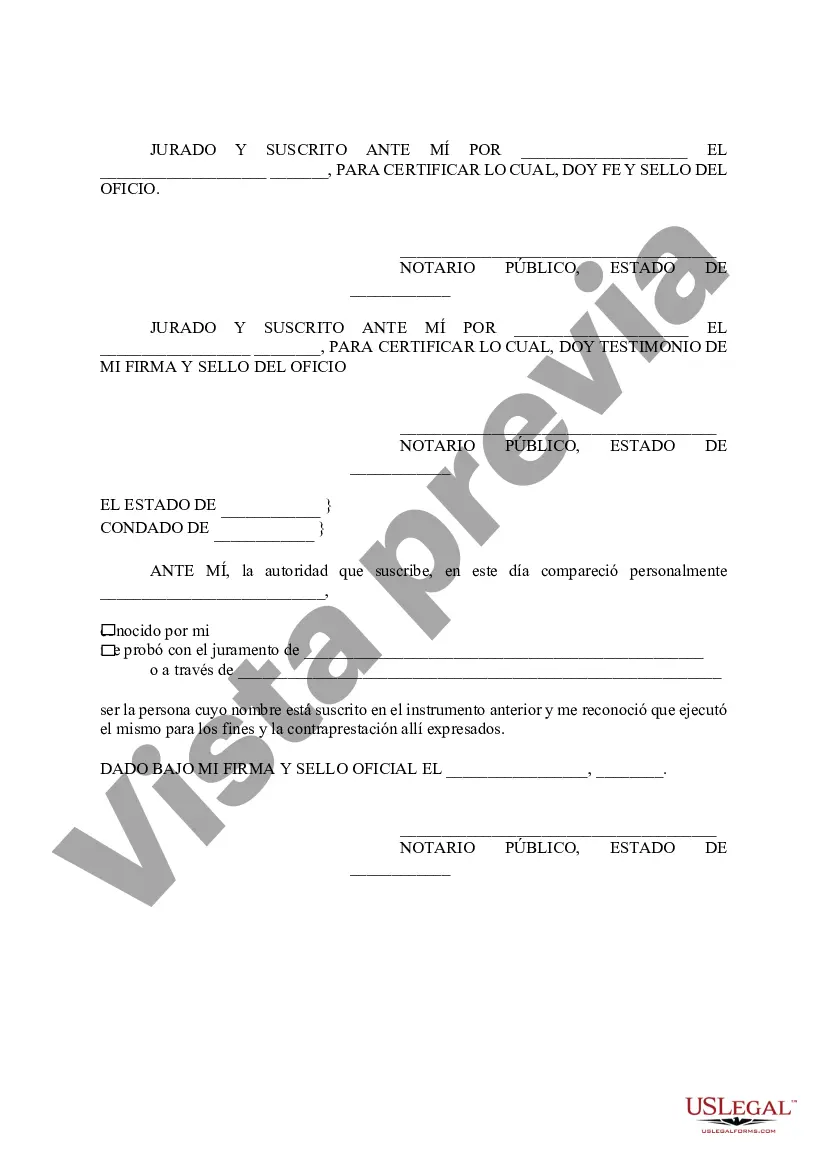

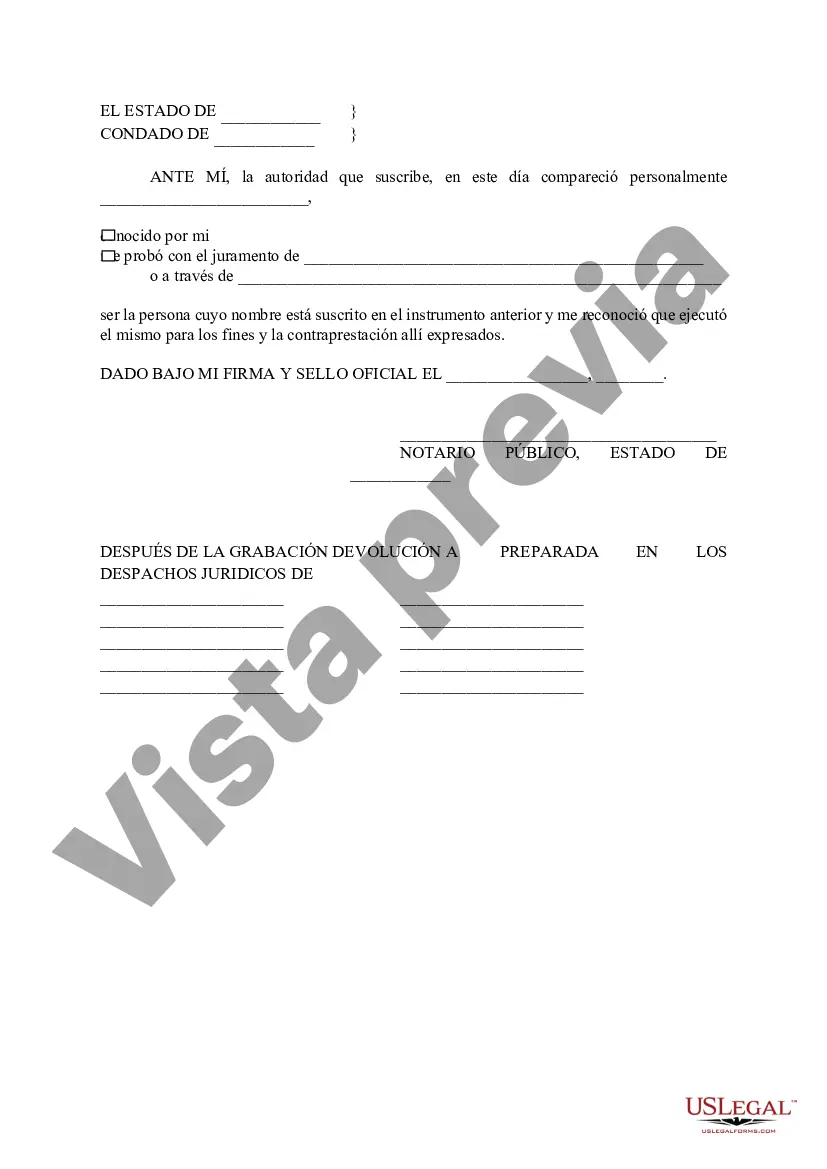

In San Antonio, Texas, a Non-Homestead Affidavit and Designation of Homestead are legal documents that pertain to property ownership and taxation. These documents play a crucial role in determining the classification of a property as either a homestead or non-homestead, which has implications for property tax assessments. A homestead refers to a primary residence that qualifies for certain legal protections, such as property tax exemptions and protection from creditors. On the other hand, a non-homestead property is considered any property that does not meet the criteria of a homestead. The Non-Homestead Affidavit is a form typically used by property owners to declare that a property does not qualify as a homestead. This document is essential as it allows the appropriate authorities to determine the property's tax status accurately. The Designation of Homestead, however, is a form used to establish a property as a homestead. It allows property owners to declare their primary residence as a homestead, which could potentially result in property tax savings and other protective benefits. In San Antonio, there are no specific different types of Non-Homestead Affidavit or Designation of Homestead forms, as the basic purpose of these documents remains the same. However, it is important to note that different jurisdictions within Texas may have specific forms or requirements, so it is advisable to consult with local authorities or attorneys to ensure compliance with local regulations. The Non-Homestead Affidavit typically requires the property owner's identification information, property address, and a statement confirming that the property does not meet the criteria to be classified as a homestead. The owner's signature is also required to validate the affidavit. On the other hand, the Designation of Homestead usually requires the property owner's identification information, property address, and a statement declaring the property as the primary residence of the owner. Additionally, the owner's signature is needed to confirm the accuracy of the designation. Submitting these forms allows the San Antonio taxing authorities to correctly determine the property type, ensuring fair and accurate taxation. It is important to complete and submit the appropriate form to prevent potential penalties and ensure the property receives accurate tax assessment based on its classification as a homestead or non-homestead.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Declaración jurada de no propiedad familiar y designación de propiedad familiar - Texas Non- Homestead Affidavit and Designation of Homestead

State:

Texas

City:

San Antonio

Control #:

TX-LR042T

Format:

Word

Instant download

Description

This affidavit is used to notify a change in location of legal Homestead Property.

In San Antonio, Texas, a Non-Homestead Affidavit and Designation of Homestead are legal documents that pertain to property ownership and taxation. These documents play a crucial role in determining the classification of a property as either a homestead or non-homestead, which has implications for property tax assessments. A homestead refers to a primary residence that qualifies for certain legal protections, such as property tax exemptions and protection from creditors. On the other hand, a non-homestead property is considered any property that does not meet the criteria of a homestead. The Non-Homestead Affidavit is a form typically used by property owners to declare that a property does not qualify as a homestead. This document is essential as it allows the appropriate authorities to determine the property's tax status accurately. The Designation of Homestead, however, is a form used to establish a property as a homestead. It allows property owners to declare their primary residence as a homestead, which could potentially result in property tax savings and other protective benefits. In San Antonio, there are no specific different types of Non-Homestead Affidavit or Designation of Homestead forms, as the basic purpose of these documents remains the same. However, it is important to note that different jurisdictions within Texas may have specific forms or requirements, so it is advisable to consult with local authorities or attorneys to ensure compliance with local regulations. The Non-Homestead Affidavit typically requires the property owner's identification information, property address, and a statement confirming that the property does not meet the criteria to be classified as a homestead. The owner's signature is also required to validate the affidavit. On the other hand, the Designation of Homestead usually requires the property owner's identification information, property address, and a statement declaring the property as the primary residence of the owner. Additionally, the owner's signature is needed to confirm the accuracy of the designation. Submitting these forms allows the San Antonio taxing authorities to correctly determine the property type, ensuring fair and accurate taxation. It is important to complete and submit the appropriate form to prevent potential penalties and ensure the property receives accurate tax assessment based on its classification as a homestead or non-homestead.

Free preview

How to fill out San Antonio Texas Declaración Jurada De No Propiedad Familiar Y Designación De Propiedad Familiar?

If you’ve already used our service before, log in to your account and save the San Antonio Texas Non- Homestead Affidavit and Designation of Homestead on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Ensure you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your San Antonio Texas Non- Homestead Affidavit and Designation of Homestead. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!