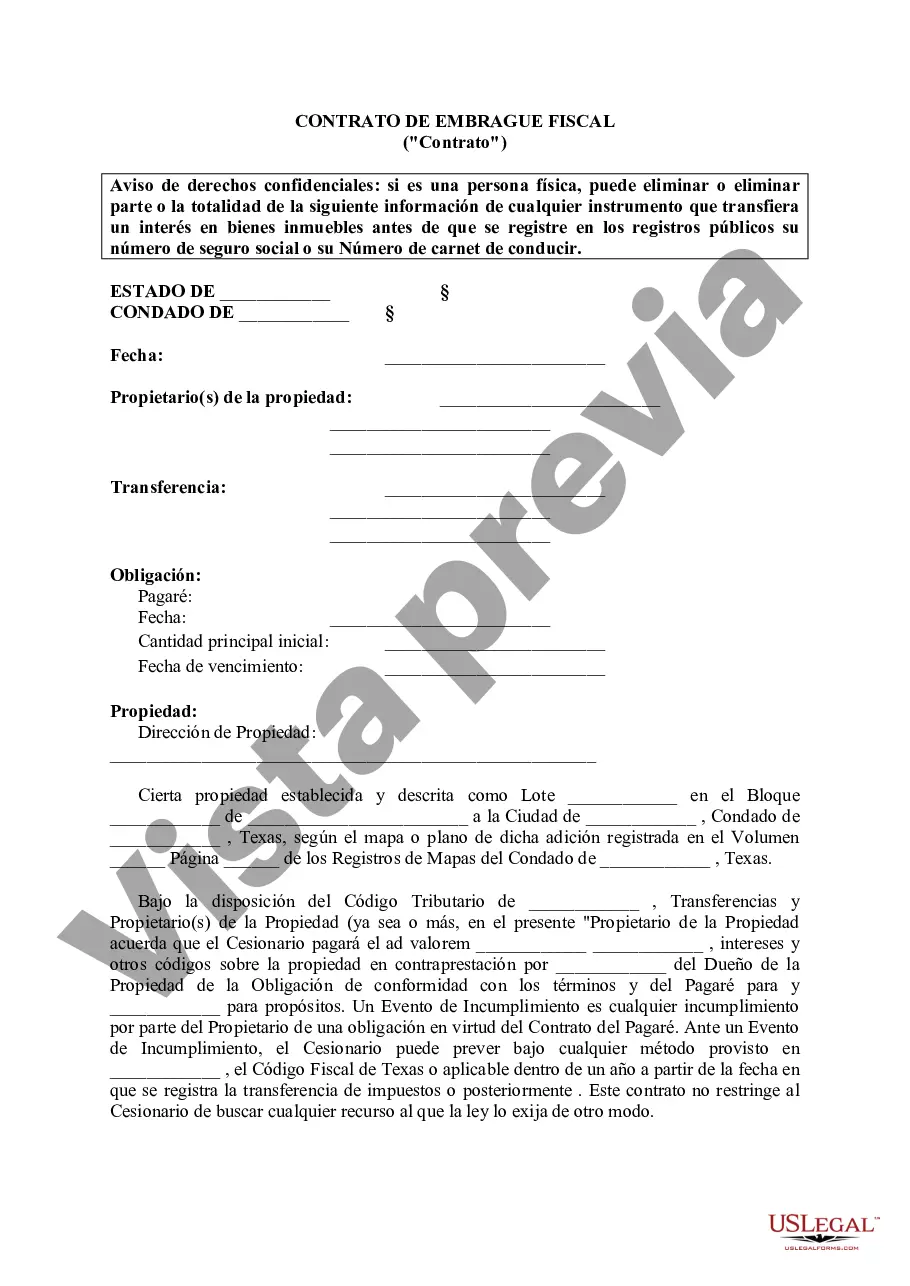

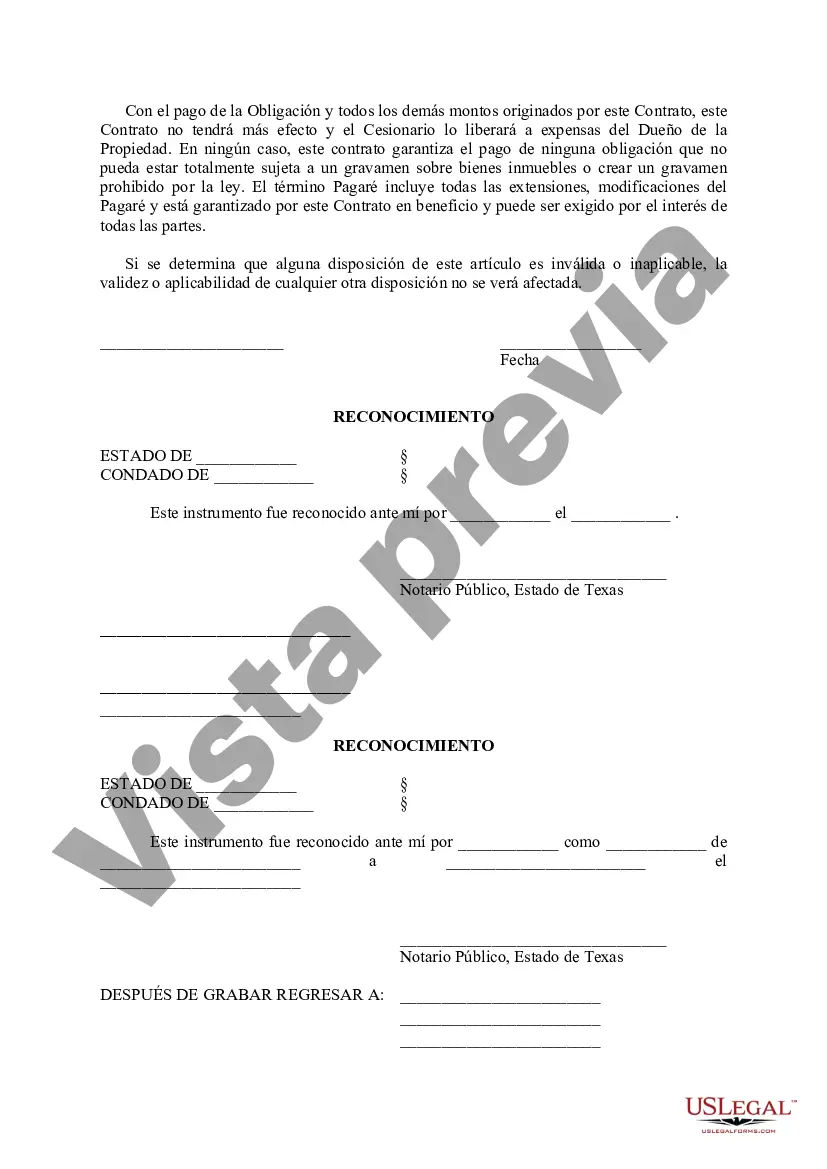

Arlington, Texas Tax Lien Contract is a legal agreement entered into between the government tax agency and a property owner in Arlington, Texas. It is designed to facilitate the collection of unpaid property taxes by allowing the taxing authority to place a lien on the property until the delinquent taxes are paid. The tax lien contract serves as a means for the government to recover the tax revenue owed to them, while ensuring that property owners are given an opportunity to rectify their tax delinquency. When a property owner fails to pay their property taxes on time, the taxing authority may initiate the tax lien process to secure their claim on the property. In Arlington, Texas, there are generally two types of tax lien contracts: the Purchase of Tax Lien Certificate and the Assignment of Tax Lien Certificate. 1. Purchase of Tax Lien Certificate: In this type of tax lien contract, the taxing authority auctions off the tax lien certificates to investors. These certificates represent the debt owed by the property owner, and investors have the opportunity to bid on them. The investor who wins the bid receives the certificate and becomes the lien holder on the property. The property owner is now responsible for paying the delinquent taxes plus any interest or penalties to the investor. If the owner fails to do so within a specified redemption period, the investor may foreclose on the property. 2. Assignment of Tax Lien Certificate: In this type of tax lien contract, the taxing authority assigns the tax lien certificate directly to a third-party purchaser. This means that the taxing authority sells the tax debt on the property to an investor without going through the auction process. The investor becomes the lien holder and has the same rights and responsibilities as mentioned in the Purchase of Tax Lien Certificate option. It is important for property owners to understand that tax lien contracts can have serious consequences if left unresolved. Failure to pay the delinquent taxes within the redemption period can lead to foreclosure and the loss of the property. Additionally, tax liens can negatively impact a property owner's creditworthiness and hinder future financing opportunities. Therefore, it is advisable for property owners in Arlington, Texas to promptly address any tax delinquencies and seek professional guidance if they find themselves in such a situation. Understanding the intricacies of the Arlington, Texas Tax Lien Contract and the different types available can help property owners navigate the process more effectively and potentially avoid the risk of losing their property.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arlington Texas Contrato de gravamen fiscal - Texas Tax Lien Contract

Description

How to fill out Arlington Texas Contrato De Gravamen Fiscal?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Arlington Texas Tax Lien Contract becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Arlington Texas Tax Lien Contract takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Arlington Texas Tax Lien Contract. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!