Austin Texas Tax Lien Contract

Description

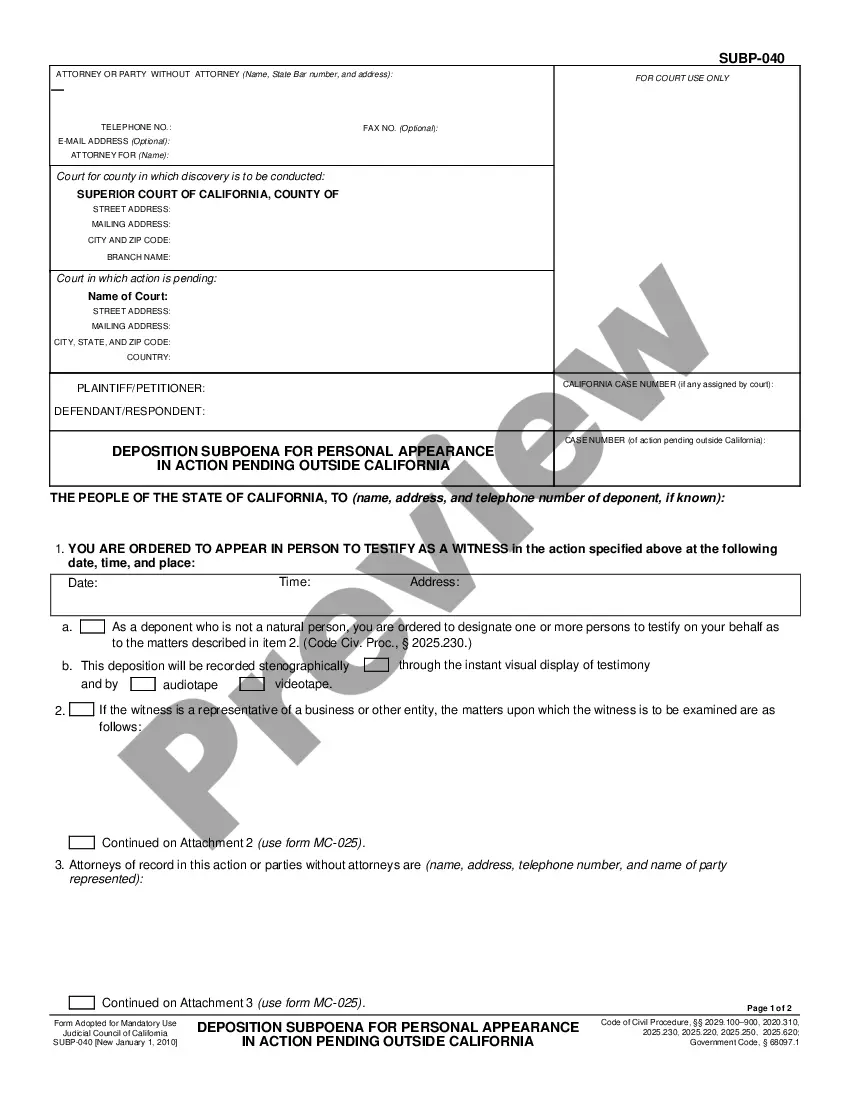

How to fill out Texas Tax Lien Contract?

Locating verified templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents catering to both personal and professional requirements, addressing various real-life situations.

All documents are neatly categorized by area of use and jurisdiction, making it simple and quick to find the Austin Texas Tax Lien Contract.

Maintaining organized paperwork that adheres to legal standards is crucial. Leverage the US Legal Forms library to always have important document templates readily available for your needs!

- Examine the Preview mode and form details.

- Ensure you have selected the right document that aligns with your needs and complies with your local jurisdiction standards.

- Look for an alternative template, if necessary.

- If you spot any discrepancies, utilize the Search tab above to find the correct document.

- If it meets your criteria, proceed to the next step.

Form popularity

FAQ

TAX LIEN. (a) On January 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for the year on the property, whether or not the taxes are imposed in the year the lien attaches.

In Texas, you cannot assume ownership of someone else's property by simply paying the balance of unpaid property taxes. However, you can purchase real estate, often at a discounted rate, at a tax foreclosure sale.

How Can I Invest in Tax Liens? Investors can purchase property tax liens the same way actual properties can be bought and sold at auctions. The auctions are held in a physical setting or online, and investors can either bid down on the interest rate on the lien or bid up a premium they will pay for it.

The tax office does not sell tax liens. Texas law allows the public to purchase properties from the county at a monthly tax foreclosure sale. The states sells the deed to the property. Note: The state does not sell tax lien certificates where a buyer becomes the lienholder for the back taxes.

Texas doesn't sell tax liens, but it does sell tax-delinquent properties at auction, with a redemption period during which the previous homeowner will have to pay a 25 to 50 percent penalty to recoup the home.

There are two kinds auctions at Texas property tax sales. The first is a tax lien sale; this gives you the right to collect the past due taxes, plus interest. Eventually, you can foreclose on the property and own it if the taxes are not paid.

Unless sealed by a court order or statute, property records in Texas are in the public domain and available upon request. Interested persons must visit the local county recorder or tax assessor-collector's office during business hours to request copies of property records.

Tax lien investing can be a good way to see a 12 to 18 percent return on your investment, but it is not without heavy competition and some degree of risk. Before you consider tax liens, find out what the guidelines are in your specific state, and attend an auction to get a feel of the process.

To check department records for tax liens, you may view homeownership records online or call our office at 1-800-500-7074, ext. 64471. Please be prepared to provide the complete serial number and HUD Label or Texas Seal number of the home.