Brownsville Texas Tax Lien Contract is a legal agreement that establishes a lien on a property in Brownsville, Texas, for unpaid taxes. When a property owner fails to pay their property taxes, the local government files a lien against the property to secure the payment of these taxes. The tax lien contract outlines the terms and conditions under which the government can collect the outstanding taxes, including interest and penalties, by selling the property or through other means. In Brownsville, Texas, there are primarily two types of tax lien contracts: 1. Brownsville Tax Lien Auctions: In this type of tax lien contract, the local government holds an auction where tax liens on properties with unpaid taxes are sold to interested buyers. Investors bid on the liens, offering to pay the outstanding taxes on the property in return for a lien on the property. The highest bidder wins the lien, and the property owner is then responsible for repaying the outstanding taxes, plus any interest or penalties, to the investor. 2. Brownsville County Redeemed Tax Liens: This type of tax lien contract occurs when the local government sells tax liens on properties, but the property owner eventually repays the outstanding taxes to clear the lien. In such cases, the investor who purchased the lien gets reimbursed the principal amount of the tax lien plus a fixed interest rate determined by the county. It is important to note that purchasing a tax lien contract in Brownsville, Texas can be a potentially profitable investment strategy. However, it is crucial for potential investors to thoroughly research the property and its market value before buying a tax lien. Additionally, investors should be aware of the risks involved, such as the property owner's ability to redeem the lien or potential legal issues with the property title. Overall, the Brownsville Texas Tax Lien Contract provides a mechanism for local government to collect unpaid property taxes while offering an opportunity for investors to potentially earn a return on their investment. Proper due diligence and understanding of the specific tax lien contract type are vital when engaging in such investments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Brownsville Texas Contrato de gravamen fiscal - Texas Tax Lien Contract

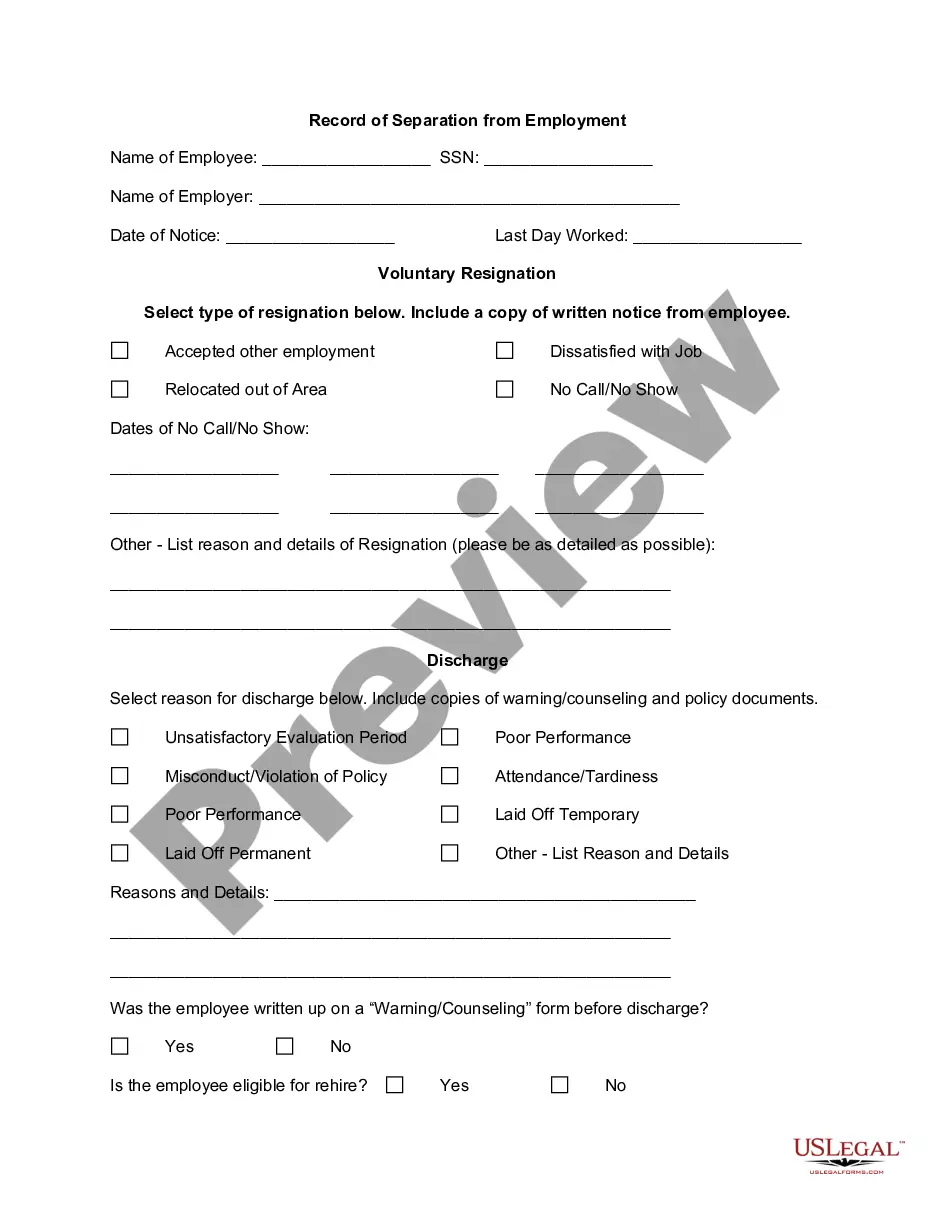

Description

How to fill out Brownsville Texas Contrato De Gravamen Fiscal?

We always strive to minimize or avoid legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for attorney solutions that, usually, are extremely costly. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of an attorney. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Brownsville Texas Tax Lien Contract or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is equally easy if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Brownsville Texas Tax Lien Contract adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Brownsville Texas Tax Lien Contract would work for you, you can choose the subscription option and proceed to payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!