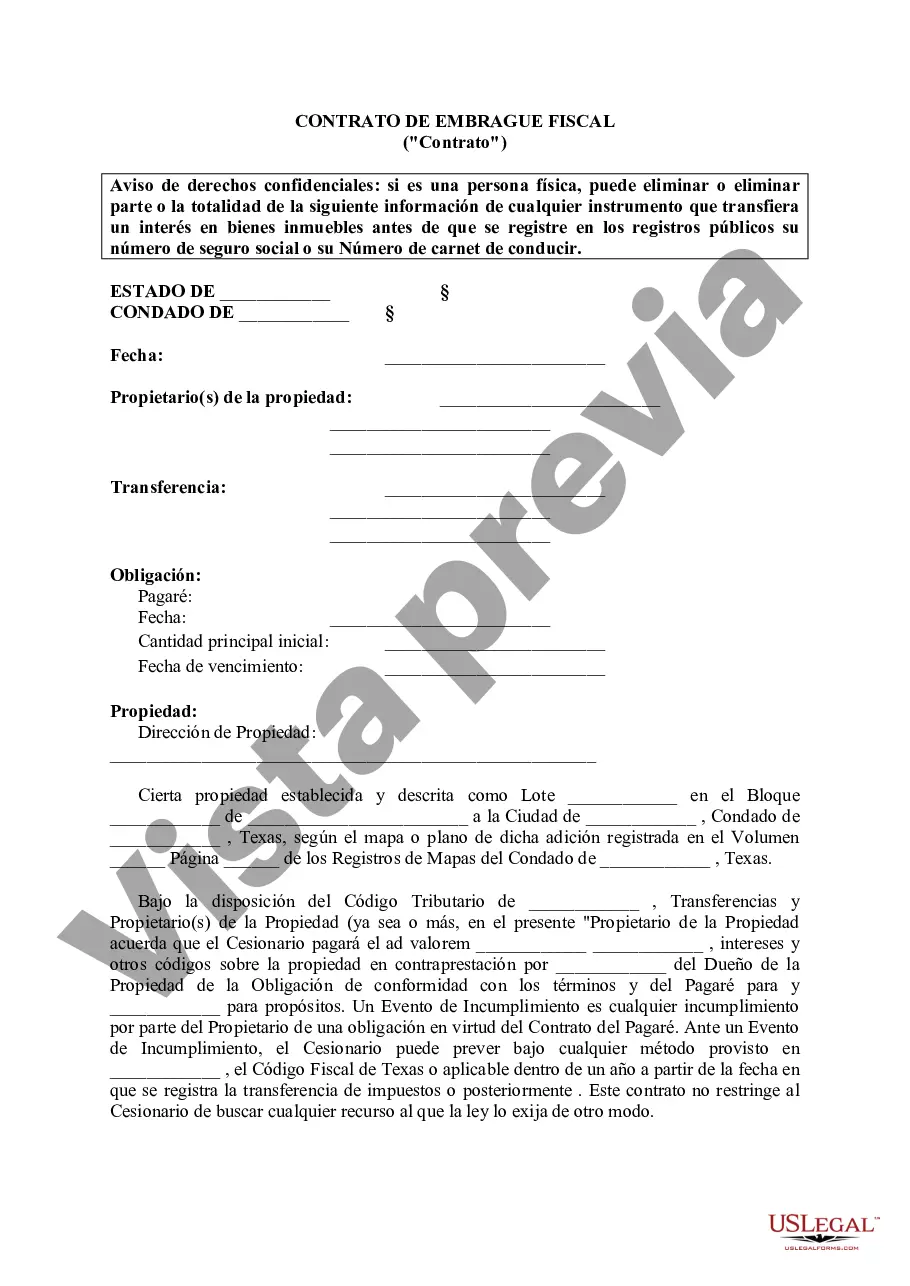

A Fort Worth Texas Tax Lien Contract is a legal agreement between the government and a property owner in Fort Worth, Texas, pertaining to unpaid property taxes. When an individual fails to pay their property taxes, the local tax authority places a lien on the property, allowing them to claim the outstanding amount by selling the property in a public auction. The tax lien contract is the contractual agreement formed between the government and a buyer who purchases the tax lien certificate at the auction. The tax lien contract outlines the terms and conditions of the financial agreement between the buyer and the local tax authority. It includes details such as the amount of the delinquent taxes owed, the interest rate that will accrue on the lien, the time period within which the property owner can redeem the taxes, and the consequences of non-payment. The contract also specifies the rights and responsibilities of both parties involved in the transaction. There are different types of tax lien contracts in Fort Worth, Texas, based on the specific tax lien investment method. Two common types are: 1. Tax Lien Certificate: This type of tax lien contract grants the investor the right to receive the unpaid taxes, along with any accumulated interests, once the property owner satisfies the debt. The investor effectively becomes a lien holder and is entitled to collect the outstanding amount from the property owner, including any applicable penalties or fees. 2. Tax Deed Certificate: In this type of tax lien contract, when the property owner fails to redeem the tax lien within the specified redemption period, the investor has the right to obtain the property through a tax deed. The investor becomes the owner of the property and can take possession or sell it to recover their investment. These are the main types of Fort Worth Texas Tax Lien Contracts. However, it's essential to note that specific terms, redemption periods, and procedures may vary depending on the local tax laws and regulations. It is advisable for individuals interested in tax lien investments to thoroughly research and consult with legal and financial professionals before participating in tax lien auctions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fort Worth Texas Contrato de gravamen fiscal - Texas Tax Lien Contract

Description

How to fill out Fort Worth Texas Contrato De Gravamen Fiscal?

Are you looking for a trustworthy and affordable legal forms provider to get the Fort Worth Texas Tax Lien Contract? US Legal Forms is your go-to choice.

No matter if you require a basic arrangement to set regulations for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed based on the requirements of specific state and county.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Fort Worth Texas Tax Lien Contract conforms to the laws of your state and local area.

- Go through the form’s description (if available) to learn who and what the form is good for.

- Restart the search in case the form isn’t suitable for your specific situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Fort Worth Texas Tax Lien Contract in any available file format. You can return to the website when you need and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal papers online once and for all.