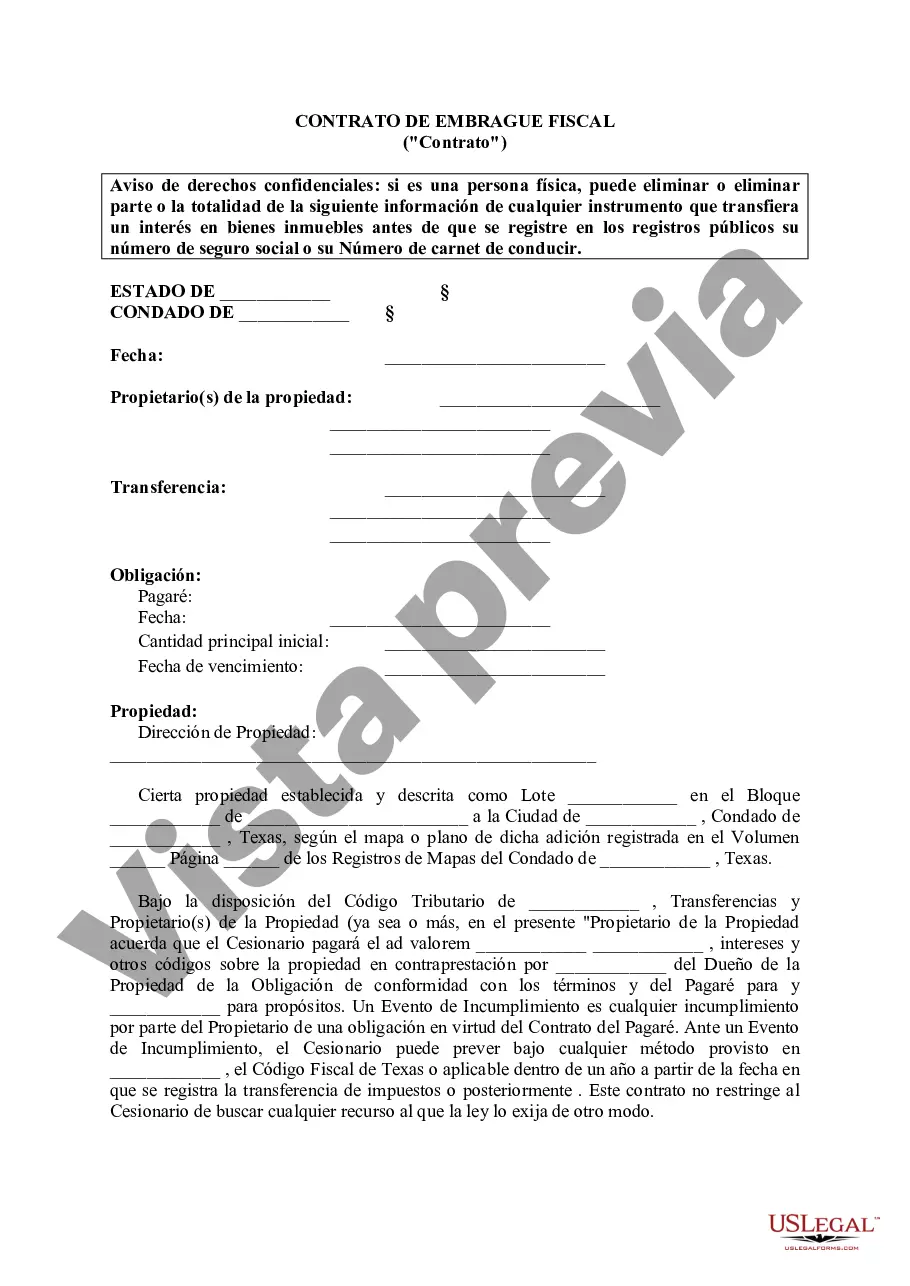

Frisco, Texas Tax Lien Contract: Understanding the Basics and Different Types In Frisco, Texas, the tax lien contract is a legal document that allows the local government to secure unpaid property taxes by placing a lien on the property. When property owners fail to pay their property taxes on time, the city government may decide to auction off these tax liens to investors who are willing to pay the outstanding tax debt on behalf of the property owner. This process ensures that the city recovers the unpaid taxes while investors have the opportunity to earn interest on their investment. Frisco, like many other cities in Texas, follows the Texas Property Tax Code, which outlines the rules and regulations for tax lien contracts. The city holds tax lien sales annually, typically in the month of July. During these auctions, investors bid on tax liens, and the winning bidder is then issued a tax lien certificate. This certificate grants the investor the right to collect the unpaid taxes, along with any accrued interest, from the property owner within a specified redemption period. It's important to note that there are different types of tax lien contracts in Frisco, Texas, based on the classification of the property being subject to the lien. Here are three types you should know: 1. Residential Tax Lien Contract: This type of tax lien contract applies to properties used for residential purposes, including single-family homes, townhouses, duplexes, and condos. Residential properties form a significant portion of the tax liens offered during the auction. 2. Commercial Tax Lien Contract: This category encompasses tax liens placed on commercial properties, such as office buildings, retail spaces, industrial facilities, and vacant land designated for commercial use. Commercial tax lien contracts can attract a diverse range of investors seeking opportunities in the business sector. 3. Vacant Land Tax Lien Contract: Frisco also offers tax liens for vacant land that may not fall into the residential or commercial property category. These tax liens can be particularly attractive to investors looking to develop or hold onto potential future properties. Investors who successfully acquire a tax lien certificate in Frisco, Texas, must ensure compliance with the redemption period specified in the certificate. During this period, property owners have the opportunity to redeem their tax lien by paying off their outstanding taxes, including any accrued interest. If the property owner fails to redeem the tax lien within the redemption period, the investor may proceed with foreclosure proceedings to acquire the property. To participate in the tax lien auction in Frisco, interested investors must register with the city and comply with any qualifications or requirements outlined by the local tax authority. Additionally, it is crucial for investors to conduct their due diligence before bidding on tax liens, thoroughly researching the property in question and assessing potential risks associated with the investment. In conclusion, the tax lien contract in Frisco, Texas, is a mechanism implemented by the local government to recover unpaid property taxes. With different types of tax lien contracts available for residential, commercial, and vacant land properties, investors have an array of opportunities to participate in the tax lien auction and potentially earn returns while assisting the city in maintaining its vital revenue stream.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Frisco Texas Contrato de gravamen fiscal - Texas Tax Lien Contract

Description

How to fill out Frisco Texas Contrato De Gravamen Fiscal?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person with no law education to draft this sort of papers cfrom the ground up, mainly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms can save the day. Our service offers a huge catalog with over 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you require the Frisco Texas Tax Lien Contract or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Frisco Texas Tax Lien Contract in minutes using our reliable service. If you are presently a subscriber, you can proceed to log in to your account to get the needed form.

Nevertheless, in case you are new to our platform, ensure that you follow these steps before downloading the Frisco Texas Tax Lien Contract:

- Ensure the form you have chosen is specific to your area because the regulations of one state or county do not work for another state or county.

- Preview the form and read a quick outline (if available) of cases the document can be used for.

- If the one you picked doesn’t suit your needs, you can start over and search for the necessary document.

- Click Buy now and pick the subscription option that suits you the best.

- utilizing your login information or register for one from scratch.

- Select the payment gateway and proceed to download the Frisco Texas Tax Lien Contract as soon as the payment is through.

You’re all set! Now you can proceed to print out the form or fill it out online. In case you have any issues locating your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.