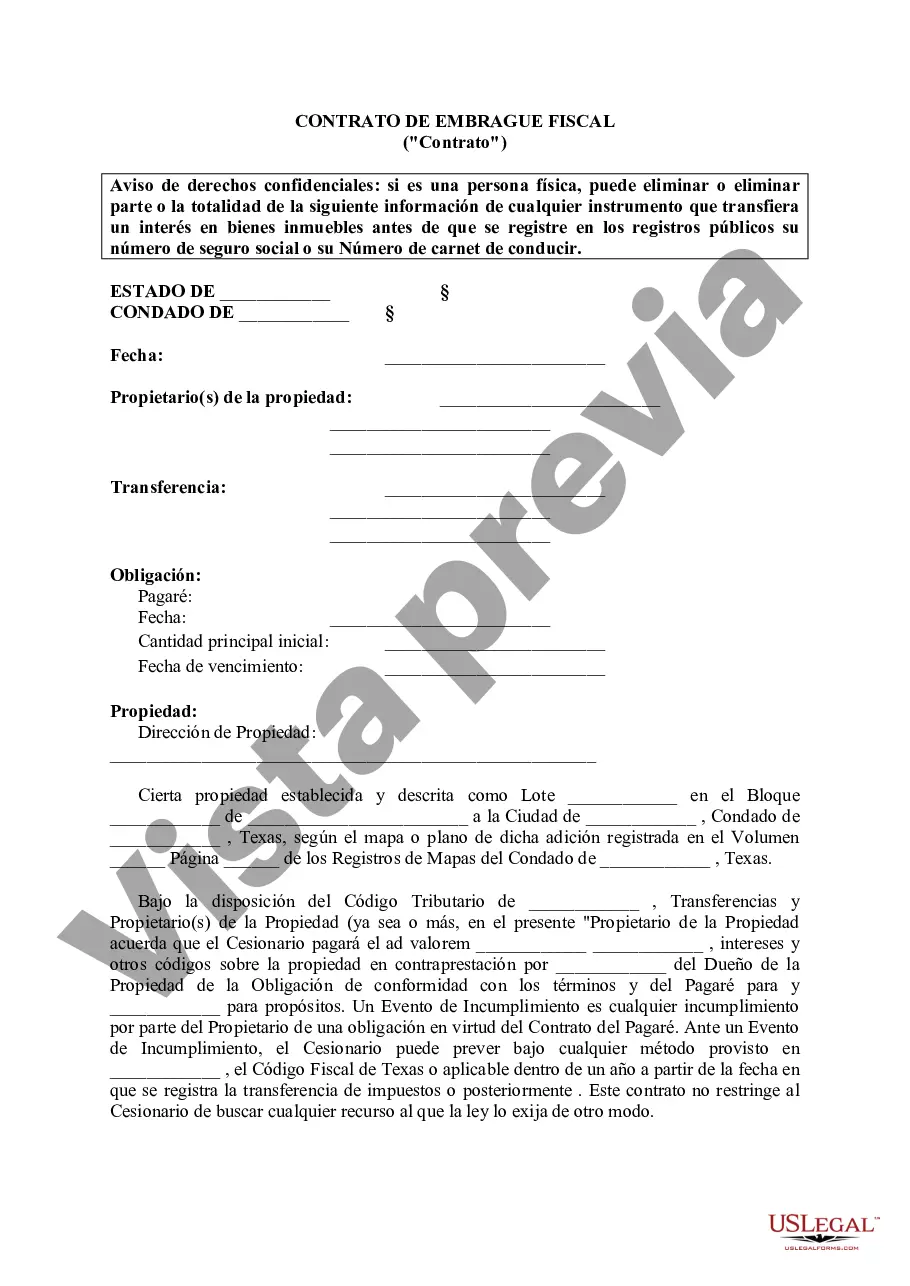

Grand Prairie, Texas Tax Lien Contracts: A Detailed Description In Grand Prairie, Texas, tax lien contracts serve as a means for the local government to recover unpaid property taxes. When property owners fail to pay their taxes, the county government may place a tax lien on the property, which can later be sold to investors through a tax lien auction. By purchasing these liens, investors have the opportunity to earn returns on their investment through interest payments made by the delinquent property owner. There are two primary types of tax lien contracts that exist in Grand Prairie, Texas: 1. Tax Lien Certificates: Tax lien certificates are issued to investors who successfully bid on a tax lien at the auction. These certificates represent the amount of taxes owed, including any penalties and interest accrued. The investor becomes the holder of the certificate and has the right to collect the delinquent amount from the property owner, along with interest specified by the state law. The interest rate can vary, usually ranging from 12% to 24% per annum, making tax liens an attractive investment opportunity. 2. Tax Deeds: If the property owner fails to fulfill their tax obligations within a specified redemption period, the tax lien certificate holder may apply for a tax deed. A tax deed grants the investor ownership of the property, extinguishing the property owner's rights. This option allows investors to acquire real estate at a fraction of its market value. However, the process of obtaining a tax deed can be complex, involving legal procedures and potentially competing interests. When investing in Grand Prairie tax lien contracts, potential investors should conduct thorough research on the property and its associated risks before bidding on tax liens. It is essential to consider factors such as the property's condition, market value, title status, and any outstanding mortgages or liens that may affect the investment. Furthermore, it is crucial to understand that investing in tax lien contracts carries both benefits and risks. On the one hand, tax liens can provide a relatively high return on investment compared to other investment options. On the other hand, there might be challenges in collecting the delinquent amounts from property owners or facing competing interests from other lien holders. To participate in the tax lien auctions in Grand Prairie, interested investors must typically register with the county's tax collector's office and meet any specified requirements or qualifications. These auctions are often held annually, providing opportunities to acquire tax liens on various properties throughout the area. In summary, Grand Prairie, Texas tax lien contracts are a mechanism used by the local government to recover unpaid property taxes. Investors can participate in tax lien auctions to purchase tax lien certificates, hopes to earn interest payments from the delinquent property owners. Additionally, investors may also pursue the acquisition of the property through a tax deed process. However, individuals considering tax lien investment should thoroughly evaluate risks and conduct due diligence before engaging in these ventures.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Grand Prairie Texas Contrato de gravamen fiscal - Texas Tax Lien Contract

Description

How to fill out Grand Prairie Texas Contrato De Gravamen Fiscal?

If you have previously utilized our service, sign in to your account and store the Grand Prairie Texas Tax Lien Contract on your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your file.

You have ongoing access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to access it again. Utilize the US Legal Forms service to quickly find and save any template for your personal or professional requirements!

- Confirm you’ve found a suitable document. Review the description and use the Preview feature, if available, to verify if it meets your requirements. If it doesn’t fit your needs, use the Search tab above to discover the right one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process the payment. Utilize your credit card information or the PayPal method to finalize the transaction.

- Obtain your Grand Prairie Texas Tax Lien Contract. Select the file format for your document and save it to your device.

- Prepare your sample. Print it or use professional online editors to complete and sign it electronically.

Form popularity

FAQ

Tax liens in Texas enable the government to secure debts owed by property owners. When taxes remain unpaid, the local taxing authority can place a lien against the property, which allows them to reclaim the owed amount through a tax sale. It’s important to understand that a Grand Prairie Texas Tax Lien Contract can provide you with a pathway to potentially earn returns on your investment. Doing your research and seeking professional advice can help you leverage tax liens effectively.

To obtain a tax lien in Texas, you typically need to participate in a tax sale auction. This involves bidding on properties with unpaid taxes and acquiring the lien for the amount owed. Once you secure a Grand Prairie Texas Tax Lien Contract, you can work towards collecting the tax debt plus interest. Ensure you're familiar with all legal procedures to protect your investment.

While several states offer tax lien certificates, Florida and Arizona are often regarded as some of the best. These states provide high interest rates and opportunities for real estate investors. However, Texas, with its Grand Prairie Texas Tax Lien Contract, also presents a solid investment opportunity, especially due to its predictable auction process. Always assess your options thoroughly before investing.

To find out if a lien exists on your house in Texas, check with your local county's appraisal district or tax assessor-collector office. They often have online search tools that allow you to view any recorded liens by entering your property details. It's crucial to stay informed, especially when considering a Grand Prairie Texas Tax Lien Contract.

You can look up a tax lien in Texas by visiting your county's appraisal district website. Most counties provide online databases where you can search for tax liens using property addresses or owner names. Alternatively, you can contact the county tax assessor-collector's office directly for assistance. Always keep in mind that understanding a Grand Prairie Texas Tax Lien Contract will help in comprehending the associated risks.

To look up a tax lien in Texas, you can start by visiting the county clerk's office or their website. Most counties provide online access to public records, including tax liens. For Grand Prairie, Texas, you can search for tax liens by entering specific details like the property address or owner's name. Additionally, consider using platforms like US Legal Forms to simplify this process and access comprehensive resources related to Grand Prairie Texas Tax Lien Contract.

A tax lien in Texas lasts for about 20 years if not resolved. This time frame emphasizes the importance of understanding your obligations as a property owner. If you encounter a tax lien situation, addressing it promptly will help protect your property investment. You may find assistance through uslegalforms for navigating the complexities of a Grand Prairie Texas tax lien contract.

Yes, residents can claim property tax exemptions in Texas under certain conditions. Qualifying homeowners may receive tax relief for various reasons, such as disability, age, or veteran status. These exemptions can significantly reduce tax burdens and help you manage finances better. Utilizing uslegalforms can guide you through the necessary steps to claim your property tax benefits.