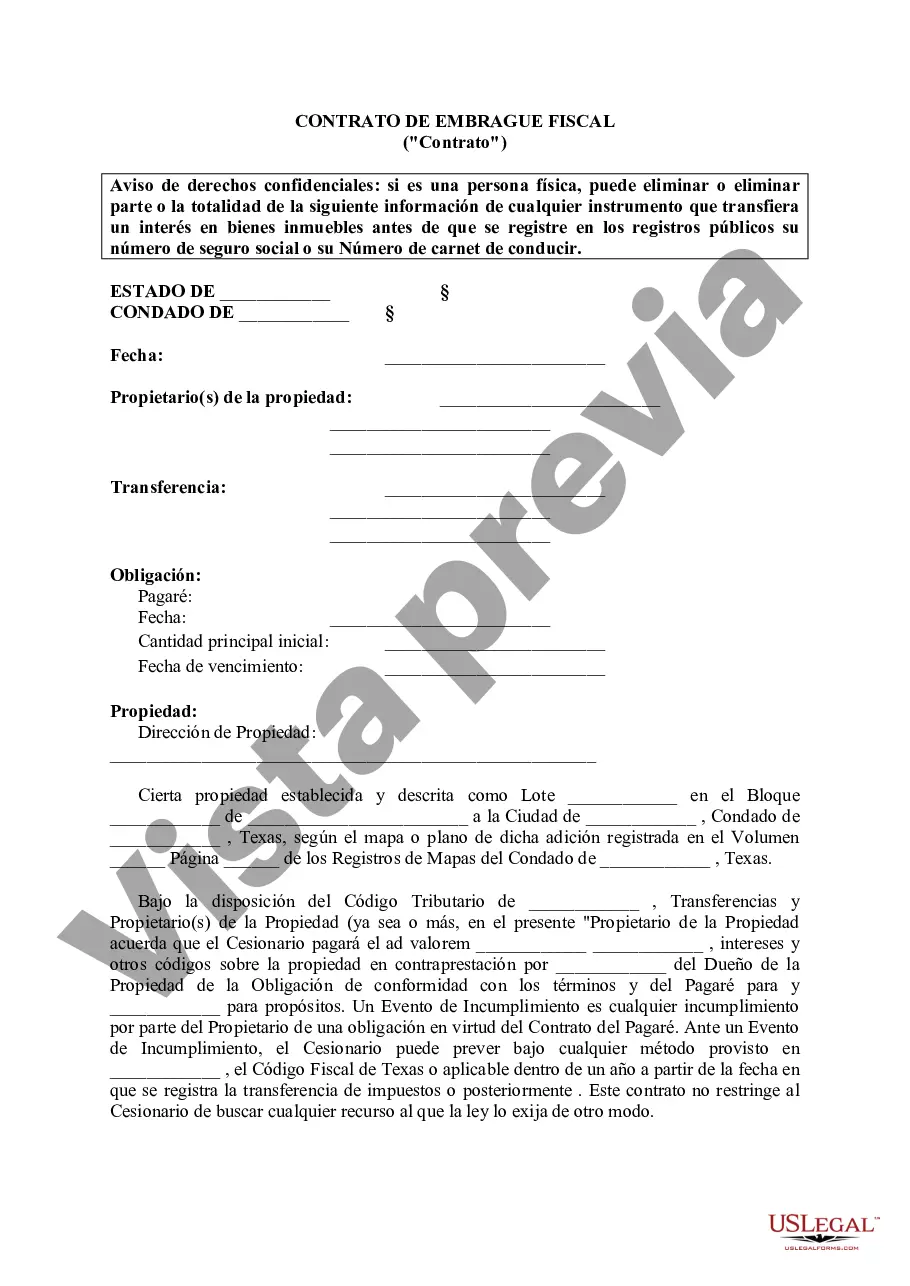

A Houston Texas Tax Lien Contract refers to an agreement between a property owner and the municipality government in Houston, Texas, regarding unpaid property taxes. When a property owner fails to pay their property taxes on time, the government has the right to place a lien on the property, which acts as a claim or encumbrance on the property's title until the owed taxes are paid. The tax lien contract serves as the legal documentation outlining the terms and conditions of the agreement between the property owner and the government entity responsible for collecting property taxes. It specifies the amount of unpaid taxes, any penalties or interest accrued, and the timeframe within which the property owner must fulfill their tax obligations to remove the lien. There are different types of tax lien contracts in Houston, Texas, based on the specific circumstances and regulations. These can include: 1. Regular tax lien contract: This type of contract is initiated when a property owner defaults on their property taxes, and the government places a lien on the property. It outlines the repayment terms, including the principal amount, penalties, interest, and any additional charges incurred during the process. 2. Redemption period tax lien contract: In cases of extreme delinquency, where the property owner has failed to pay their taxes for several years, the government may offer a redemption period tax lien contract. This contract allows the property owner a grace period to settle their outstanding tax debt, often with more favorable repayment terms. 3. Tax lien certificate contract: When a tax lien is placed on a property, the government may choose to sell the lien to a third-party investor through a tax lien certificate auction. This contract details the terms of the purchase and outlines the investor's rights and responsibilities regarding the lien, such as the ability to collect the outstanding debt or initiate foreclosure proceedings. Overall, a Houston Texas Tax Lien Contract is a legally binding agreement that ensures the property owner's compliance with their property tax obligations. It protects the government's interest in recovering the unpaid taxes while providing the property owner a structured path towards clearing the tax lien and regaining full control of their property.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Contrato de gravamen fiscal - Texas Tax Lien Contract

Category:

State:

Texas

City:

Houston

Control #:

TX-LR051T

Format:

Word

Instant download

Description

This Lien document state Property Owner agrees that Transferee shall pay Ad valorem taxes, interests and other codes within terms of Promissory Note.

A Houston Texas Tax Lien Contract refers to an agreement between a property owner and the municipality government in Houston, Texas, regarding unpaid property taxes. When a property owner fails to pay their property taxes on time, the government has the right to place a lien on the property, which acts as a claim or encumbrance on the property's title until the owed taxes are paid. The tax lien contract serves as the legal documentation outlining the terms and conditions of the agreement between the property owner and the government entity responsible for collecting property taxes. It specifies the amount of unpaid taxes, any penalties or interest accrued, and the timeframe within which the property owner must fulfill their tax obligations to remove the lien. There are different types of tax lien contracts in Houston, Texas, based on the specific circumstances and regulations. These can include: 1. Regular tax lien contract: This type of contract is initiated when a property owner defaults on their property taxes, and the government places a lien on the property. It outlines the repayment terms, including the principal amount, penalties, interest, and any additional charges incurred during the process. 2. Redemption period tax lien contract: In cases of extreme delinquency, where the property owner has failed to pay their taxes for several years, the government may offer a redemption period tax lien contract. This contract allows the property owner a grace period to settle their outstanding tax debt, often with more favorable repayment terms. 3. Tax lien certificate contract: When a tax lien is placed on a property, the government may choose to sell the lien to a third-party investor through a tax lien certificate auction. This contract details the terms of the purchase and outlines the investor's rights and responsibilities regarding the lien, such as the ability to collect the outstanding debt or initiate foreclosure proceedings. Overall, a Houston Texas Tax Lien Contract is a legally binding agreement that ensures the property owner's compliance with their property tax obligations. It protects the government's interest in recovering the unpaid taxes while providing the property owner a structured path towards clearing the tax lien and regaining full control of their property.

Free preview

How to fill out Houston Texas Contrato De Gravamen Fiscal?

If you’ve already utilized our service before, log in to your account and save the Houston Texas Tax Lien Contract on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Houston Texas Tax Lien Contract. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!